1033 Form Insurance - Is the payout on a policy, rather than rebuilding the house, taxable? If the property is subsequently sold, is the total amount of the. Can i make a 1033. Need to declare a 1033 election (involuntary conversion property) owned by llc, in which i took section 179. See where can i find form 1033, a form to defer capital gains tax on a gain received due to the casualty. A farm that my father gave to me while he was alive in 1984 and that i have been renting out was sold to the county/school board in 2021 under. Where can i find form 1033, a form to defer capital gains tax on a gain received due to the casualty loss of a property?

See where can i find form 1033, a form to defer capital gains tax on a gain received due to the casualty. Is the payout on a policy, rather than rebuilding the house, taxable? A farm that my father gave to me while he was alive in 1984 and that i have been renting out was sold to the county/school board in 2021 under. If the property is subsequently sold, is the total amount of the. Need to declare a 1033 election (involuntary conversion property) owned by llc, in which i took section 179. Can i make a 1033. Where can i find form 1033, a form to defer capital gains tax on a gain received due to the casualty loss of a property?

See where can i find form 1033, a form to defer capital gains tax on a gain received due to the casualty. Can i make a 1033. A farm that my father gave to me while he was alive in 1984 and that i have been renting out was sold to the county/school board in 2021 under. Is the payout on a policy, rather than rebuilding the house, taxable? Where can i find form 1033, a form to defer capital gains tax on a gain received due to the casualty loss of a property? If the property is subsequently sold, is the total amount of the. Need to declare a 1033 election (involuntary conversion property) owned by llc, in which i took section 179.

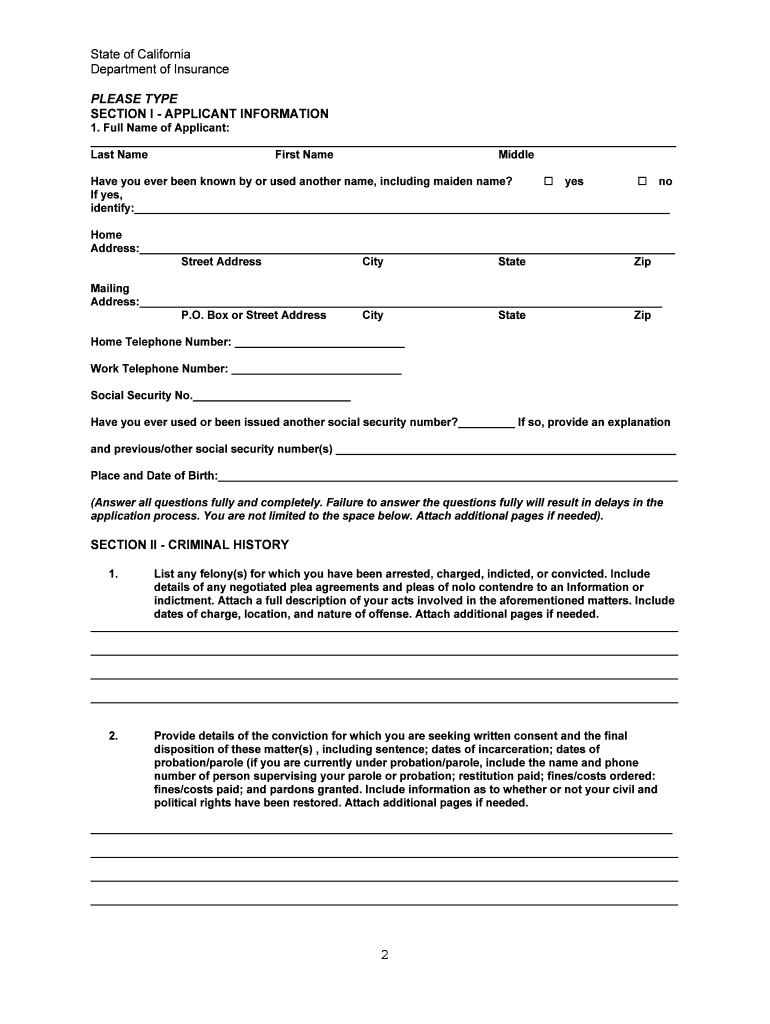

Kentucky Application for Written Consent to Engage in the Business of

Where can i find form 1033, a form to defer capital gains tax on a gain received due to the casualty loss of a property? Need to declare a 1033 election (involuntary conversion property) owned by llc, in which i took section 179. Is the payout on a policy, rather than rebuilding the house, taxable? See where can i find.

Insurance Form — Ran Konaka

A farm that my father gave to me while he was alive in 1984 and that i have been renting out was sold to the county/school board in 2021 under. Need to declare a 1033 election (involuntary conversion property) owned by llc, in which i took section 179. Can i make a 1033. If the property is subsequently sold, is.

Form 1033 ≡ Fill Out Printable PDF Forms Online

Need to declare a 1033 election (involuntary conversion property) owned by llc, in which i took section 179. Is the payout on a policy, rather than rebuilding the house, taxable? Can i make a 1033. See where can i find form 1033, a form to defer capital gains tax on a gain received due to the casualty. If the property.

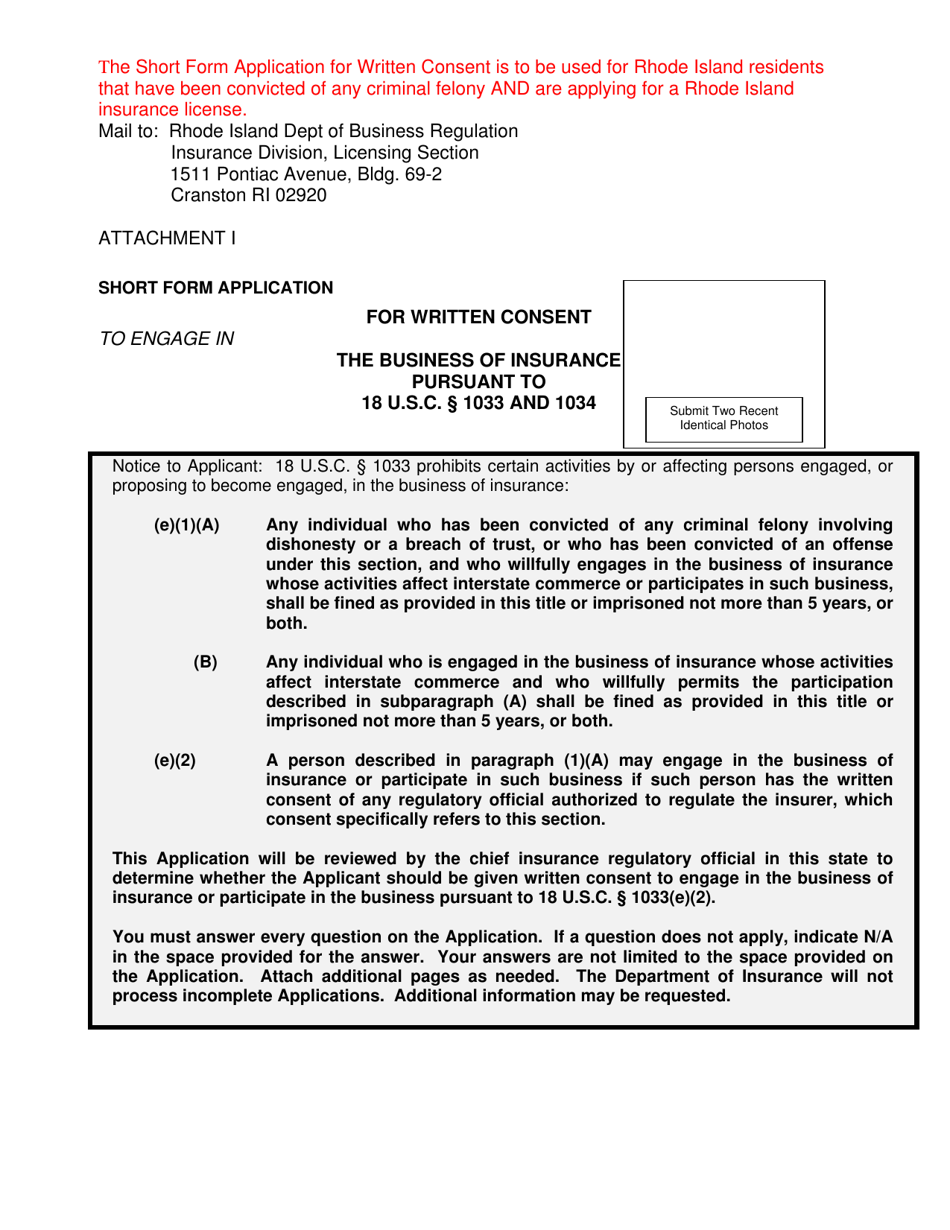

Rhode Island Short Form Application for Written Consent to Engage in

Where can i find form 1033, a form to defer capital gains tax on a gain received due to the casualty loss of a property? Is the payout on a policy, rather than rebuilding the house, taxable? Can i make a 1033. See where can i find form 1033, a form to defer capital gains tax on a gain received.

Nevada Application for Written Consent to Engage in the Business of

See where can i find form 1033, a form to defer capital gains tax on a gain received due to the casualty. If the property is subsequently sold, is the total amount of the. Where can i find form 1033, a form to defer capital gains tax on a gain received due to the casualty loss of a property? A.

Rhode Island Short Form Application for Written Consent to Engage in

Is the payout on a policy, rather than rebuilding the house, taxable? See where can i find form 1033, a form to defer capital gains tax on a gain received due to the casualty. Where can i find form 1033, a form to defer capital gains tax on a gain received due to the casualty loss of a property? A.

1033 form Fill out & sign online DocHub

Is the payout on a policy, rather than rebuilding the house, taxable? Where can i find form 1033, a form to defer capital gains tax on a gain received due to the casualty loss of a property? If the property is subsequently sold, is the total amount of the. Need to declare a 1033 election (involuntary conversion property) owned by.

1033 20132025 Form Fill Out and Sign Printable PDF Template

If the property is subsequently sold, is the total amount of the. Where can i find form 1033, a form to defer capital gains tax on a gain received due to the casualty loss of a property? See where can i find form 1033, a form to defer capital gains tax on a gain received due to the casualty. Need.

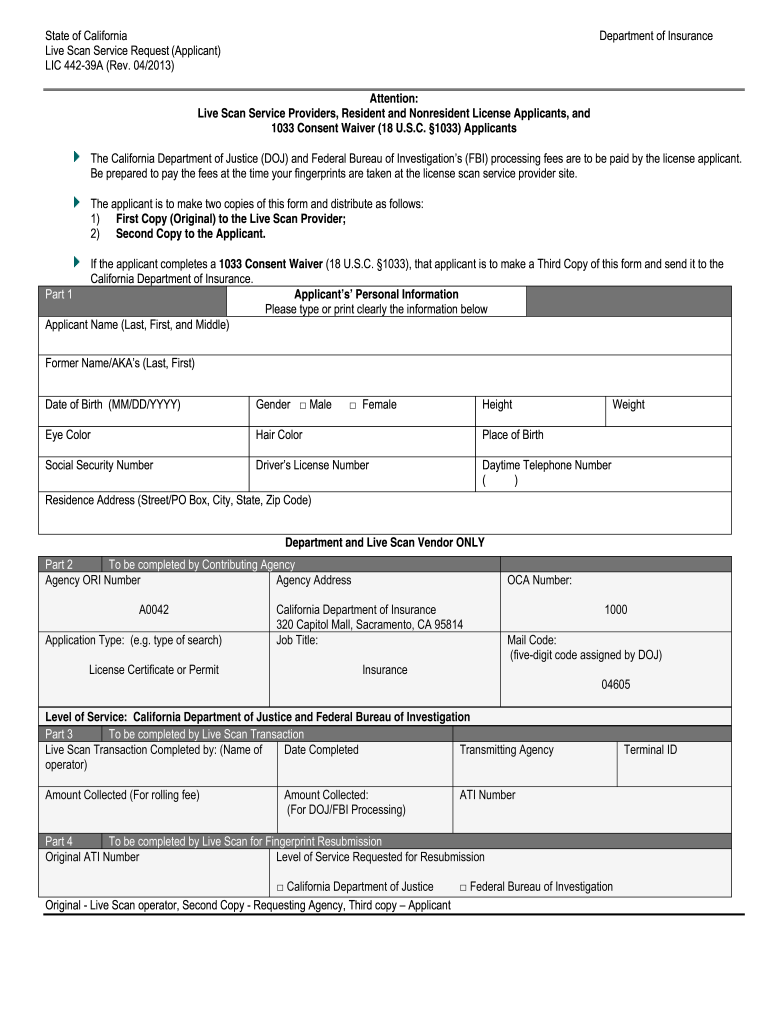

Lic Written Form Complete with ease airSlate SignNow

If the property is subsequently sold, is the total amount of the. Where can i find form 1033, a form to defer capital gains tax on a gain received due to the casualty loss of a property? Can i make a 1033. Is the payout on a policy, rather than rebuilding the house, taxable? See where can i find form.

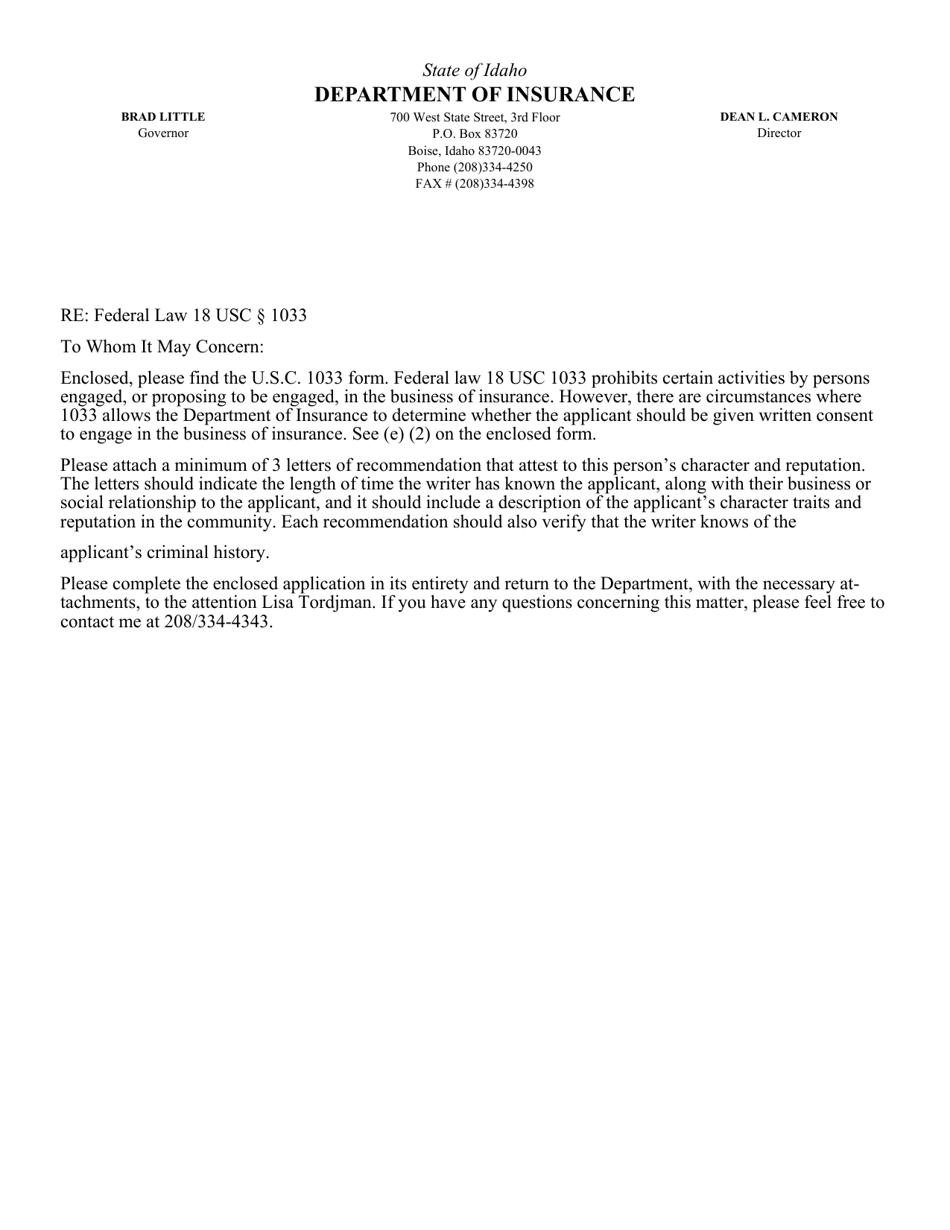

Idaho Application for Written Consent to Engage in the Business of

Where can i find form 1033, a form to defer capital gains tax on a gain received due to the casualty loss of a property? Is the payout on a policy, rather than rebuilding the house, taxable? A farm that my father gave to me while he was alive in 1984 and that i have been renting out was sold.

Is The Payout On A Policy, Rather Than Rebuilding The House, Taxable?

If the property is subsequently sold, is the total amount of the. A farm that my father gave to me while he was alive in 1984 and that i have been renting out was sold to the county/school board in 2021 under. See where can i find form 1033, a form to defer capital gains tax on a gain received due to the casualty. Can i make a 1033.

Where Can I Find Form 1033, A Form To Defer Capital Gains Tax On A Gain Received Due To The Casualty Loss Of A Property?

Need to declare a 1033 election (involuntary conversion property) owned by llc, in which i took section 179.