162 In Word Form - Blue jays, guardians secure division titles, reds surge past mets for final nl playoff spot the final day of the 2025 major. For purposes of paragraph (2), the taxpayer shall not be treated as being temporarily away from home during any period of employment if such period. Learn the intricacies of 'ordinary and necessary' expenses,. Discover the essentials of irs code 162 (a) for maximizing business deductions. Section 162 of the internal revenue code (irc) allows you to deduct all the ordinary and necessary expenses you incur during the taxable year in.

Blue jays, guardians secure division titles, reds surge past mets for final nl playoff spot the final day of the 2025 major. Learn the intricacies of 'ordinary and necessary' expenses,. For purposes of paragraph (2), the taxpayer shall not be treated as being temporarily away from home during any period of employment if such period. Discover the essentials of irs code 162 (a) for maximizing business deductions. Section 162 of the internal revenue code (irc) allows you to deduct all the ordinary and necessary expenses you incur during the taxable year in.

For purposes of paragraph (2), the taxpayer shall not be treated as being temporarily away from home during any period of employment if such period. Discover the essentials of irs code 162 (a) for maximizing business deductions. Section 162 of the internal revenue code (irc) allows you to deduct all the ordinary and necessary expenses you incur during the taxable year in. Learn the intricacies of 'ordinary and necessary' expenses,. Blue jays, guardians secure division titles, reds surge past mets for final nl playoff spot the final day of the 2025 major.

Better Your Language with Word Forms (Part 2) saigontimez

For purposes of paragraph (2), the taxpayer shall not be treated as being temporarily away from home during any period of employment if such period. Discover the essentials of irs code 162 (a) for maximizing business deductions. Learn the intricacies of 'ordinary and necessary' expenses,. Section 162 of the internal revenue code (irc) allows you to deduct all the ordinary.

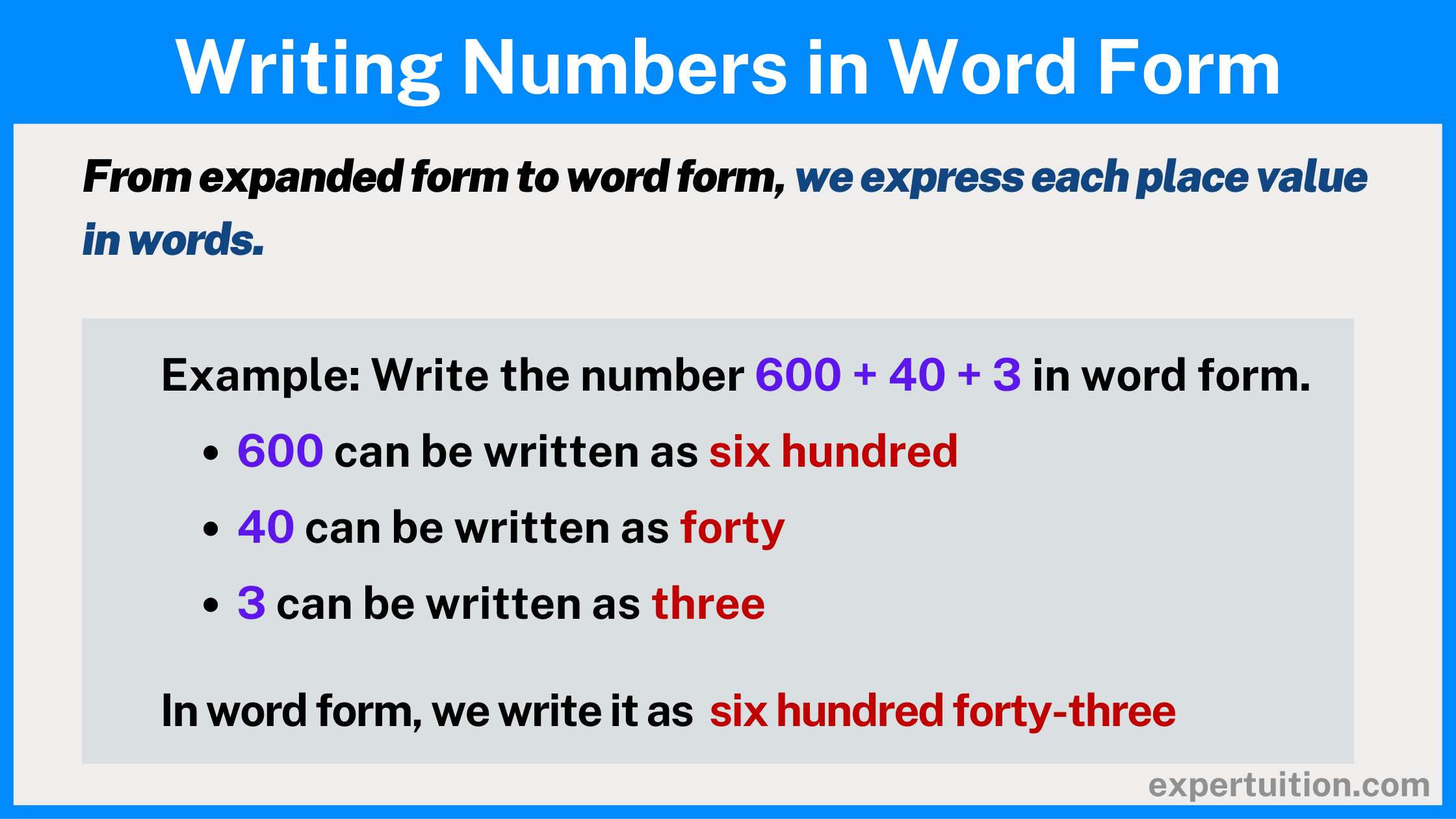

Writing Numbers in Standard, Word, and Expanded Forms ExperTuition

Section 162 of the internal revenue code (irc) allows you to deduct all the ordinary and necessary expenses you incur during the taxable year in. Blue jays, guardians secure division titles, reds surge past mets for final nl playoff spot the final day of the 2025 major. For purposes of paragraph (2), the taxpayer shall not be treated as being.

How to Write Numbers in Word Form DoodleLearning

Discover the essentials of irs code 162 (a) for maximizing business deductions. For purposes of paragraph (2), the taxpayer shall not be treated as being temporarily away from home during any period of employment if such period. Learn the intricacies of 'ordinary and necessary' expenses,. Section 162 of the internal revenue code (irc) allows you to deduct all the ordinary.

Writing Numbers in Standard, Word, and Expanded Forms ExperTuition

Learn the intricacies of 'ordinary and necessary' expenses,. For purposes of paragraph (2), the taxpayer shall not be treated as being temporarily away from home during any period of employment if such period. Blue jays, guardians secure division titles, reds surge past mets for final nl playoff spot the final day of the 2025 major. Section 162 of the internal.

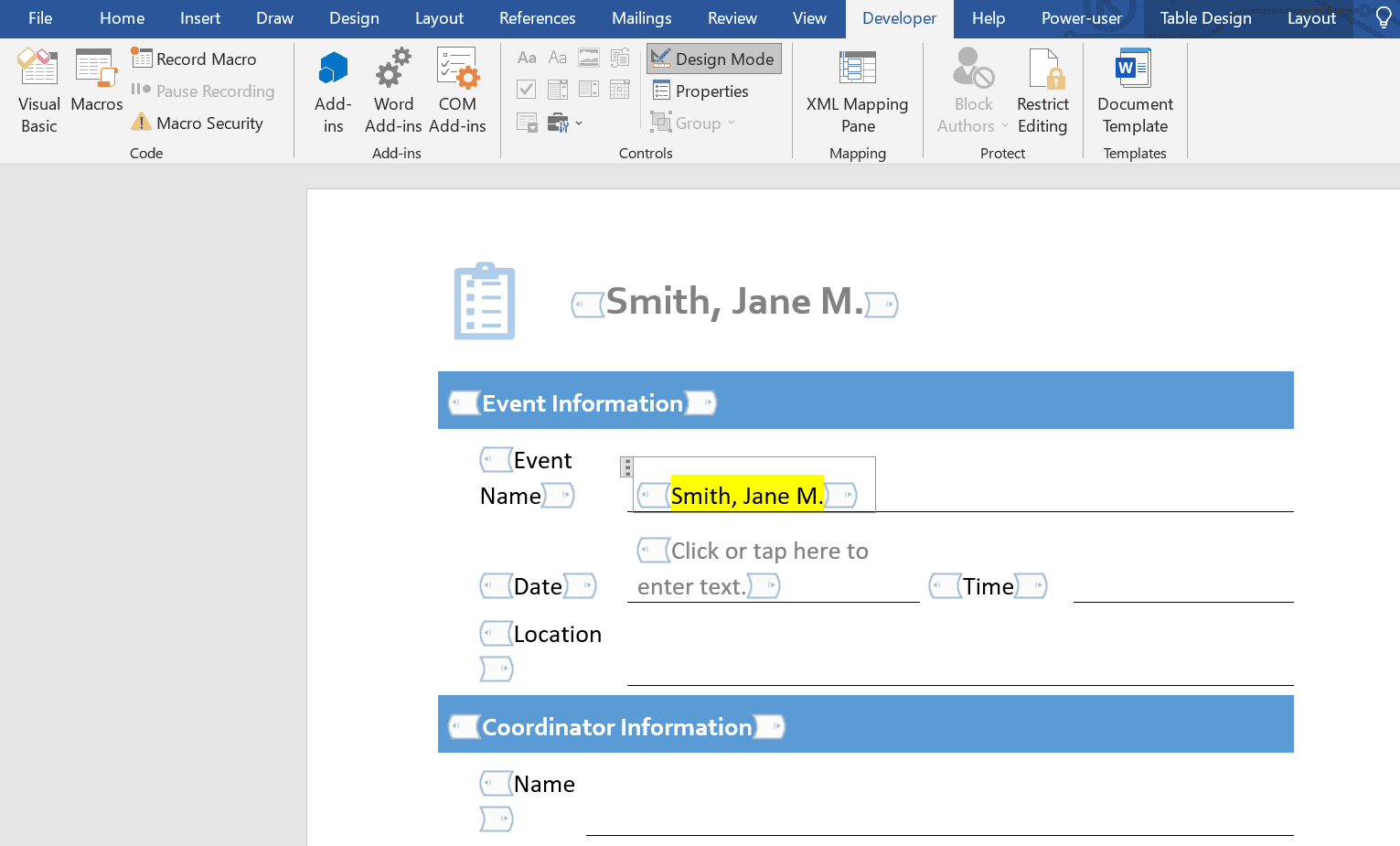

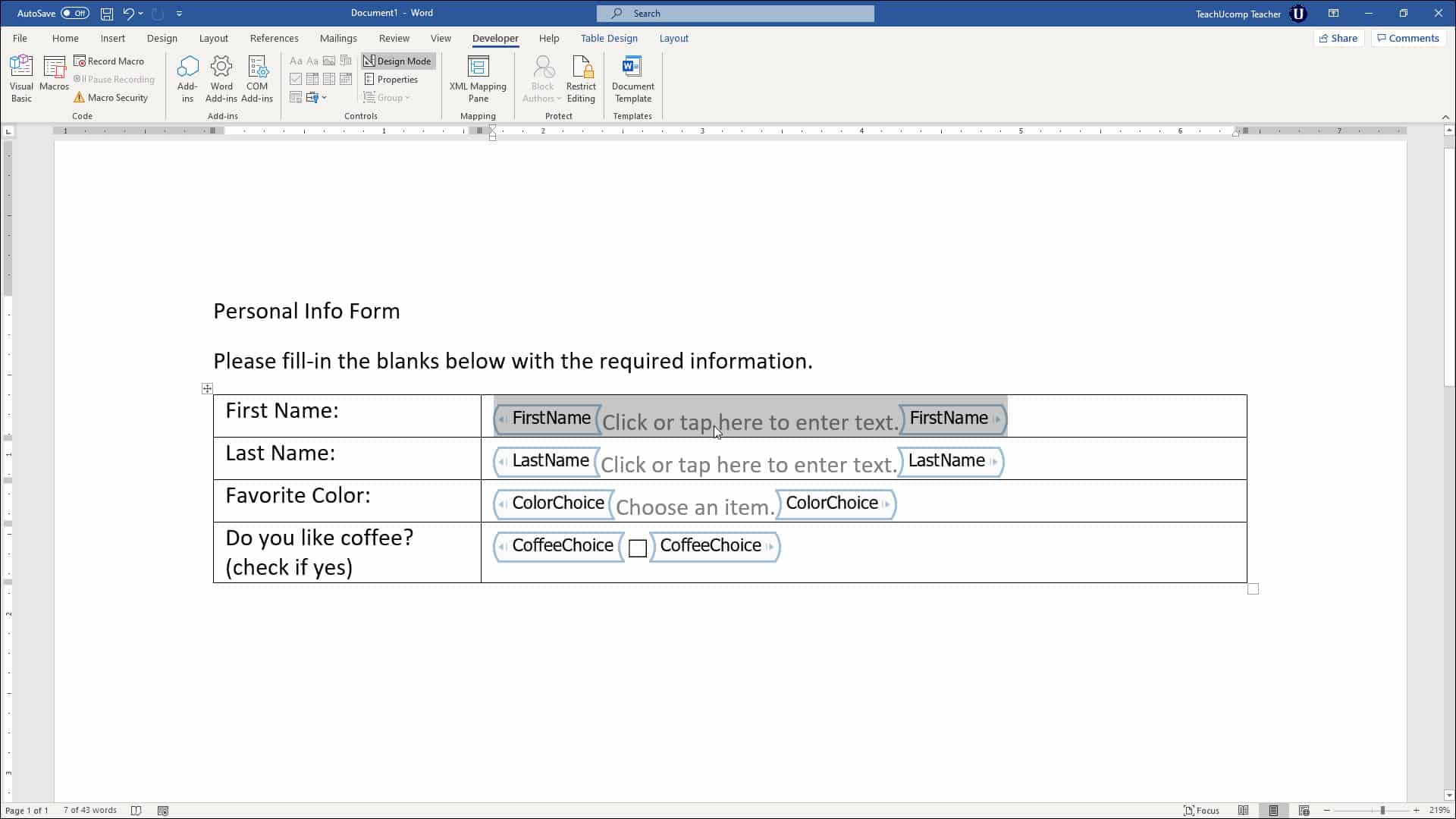

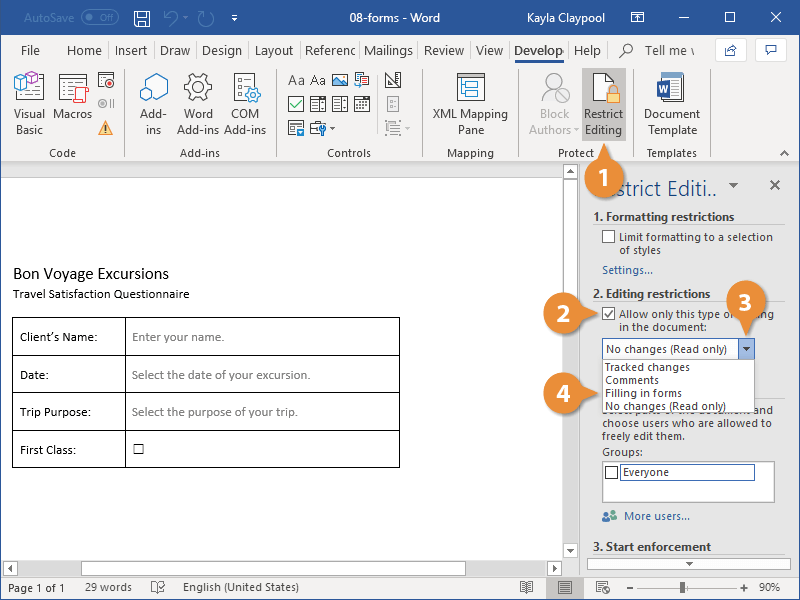

How to Create Fillable Forms in Word 7 Easy Steps

For purposes of paragraph (2), the taxpayer shall not be treated as being temporarily away from home during any period of employment if such period. Section 162 of the internal revenue code (irc) allows you to deduct all the ordinary and necessary expenses you incur during the taxable year in. Blue jays, guardians secure division titles, reds surge past mets.

How to build a form in word kobo building

For purposes of paragraph (2), the taxpayer shall not be treated as being temporarily away from home during any period of employment if such period. Discover the essentials of irs code 162 (a) for maximizing business deductions. Learn the intricacies of 'ordinary and necessary' expenses,. Section 162 of the internal revenue code (irc) allows you to deduct all the ordinary.

Number in Word Form Chart Word form, Words, Math fact fluency

For purposes of paragraph (2), the taxpayer shall not be treated as being temporarily away from home during any period of employment if such period. Section 162 of the internal revenue code (irc) allows you to deduct all the ordinary and necessary expenses you incur during the taxable year in. Blue jays, guardians secure division titles, reds surge past mets.

Easy Way to Enter Forms in Word MacAdie Grealwas

Discover the essentials of irs code 162 (a) for maximizing business deductions. For purposes of paragraph (2), the taxpayer shall not be treated as being temporarily away from home during any period of employment if such period. Blue jays, guardians secure division titles, reds surge past mets for final nl playoff spot the final day of the 2025 major. Section.

How To Write Numbers In Word Form

Section 162 of the internal revenue code (irc) allows you to deduct all the ordinary and necessary expenses you incur during the taxable year in. Blue jays, guardians secure division titles, reds surge past mets for final nl playoff spot the final day of the 2025 major. Learn the intricacies of 'ordinary and necessary' expenses,. For purposes of paragraph (2),.

Chart Of Numbers In Word Form

Learn the intricacies of 'ordinary and necessary' expenses,. Section 162 of the internal revenue code (irc) allows you to deduct all the ordinary and necessary expenses you incur during the taxable year in. Blue jays, guardians secure division titles, reds surge past mets for final nl playoff spot the final day of the 2025 major. For purposes of paragraph (2),.

Blue Jays, Guardians Secure Division Titles, Reds Surge Past Mets For Final Nl Playoff Spot The Final Day Of The 2025 Major.

Learn the intricacies of 'ordinary and necessary' expenses,. Section 162 of the internal revenue code (irc) allows you to deduct all the ordinary and necessary expenses you incur during the taxable year in. Discover the essentials of irs code 162 (a) for maximizing business deductions. For purposes of paragraph (2), the taxpayer shall not be treated as being temporarily away from home during any period of employment if such period.