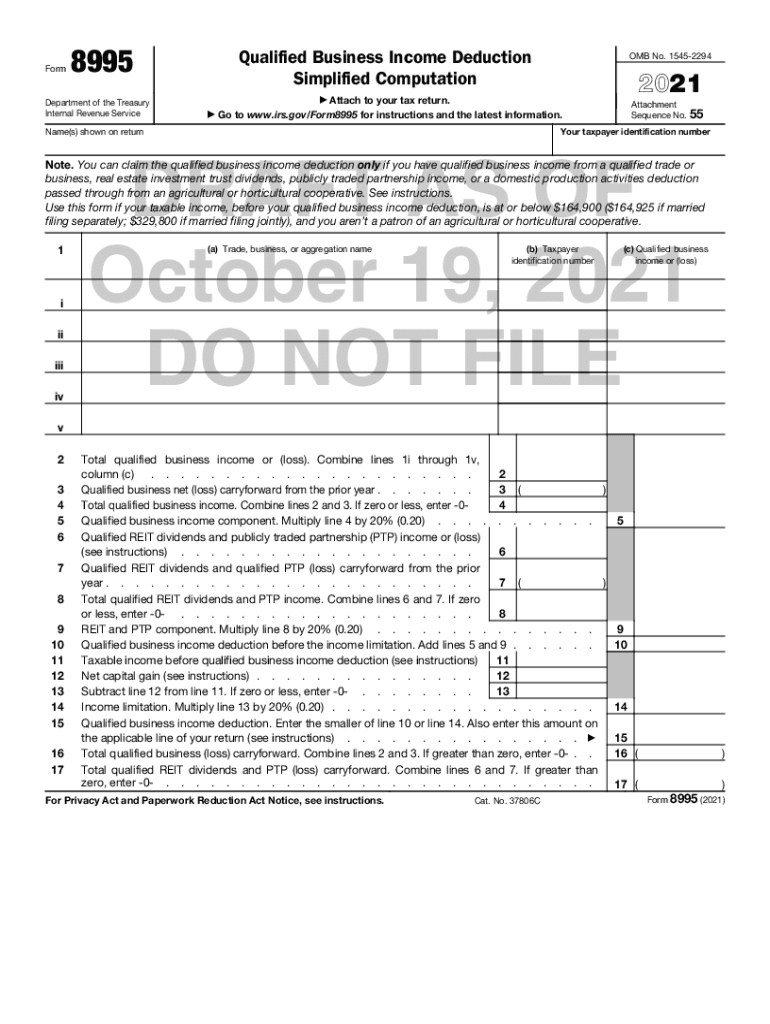

2021 Form 8995 - Information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and instructions on. In this guide, we’ll cover everything you need to know about form 8995—including its purpose, who is eligible, and how it differs from. Use this form if your taxable income, before your qualified business income deduction, is at or below $164,900 ($164,925 if married filing separately;. Deducting qualified business income on a tax return? Check out our irs form 8995 guide to see if you can use the simple form to calculate. The qbi deduction will flow to line.

In this guide, we’ll cover everything you need to know about form 8995—including its purpose, who is eligible, and how it differs from. Information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and instructions on. Deducting qualified business income on a tax return? The qbi deduction will flow to line. Use this form if your taxable income, before your qualified business income deduction, is at or below $164,900 ($164,925 if married filing separately;. Check out our irs form 8995 guide to see if you can use the simple form to calculate.

In this guide, we’ll cover everything you need to know about form 8995—including its purpose, who is eligible, and how it differs from. Check out our irs form 8995 guide to see if you can use the simple form to calculate. Deducting qualified business income on a tax return? The qbi deduction will flow to line. Use this form if your taxable income, before your qualified business income deduction, is at or below $164,900 ($164,925 if married filing separately;. Information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and instructions on.

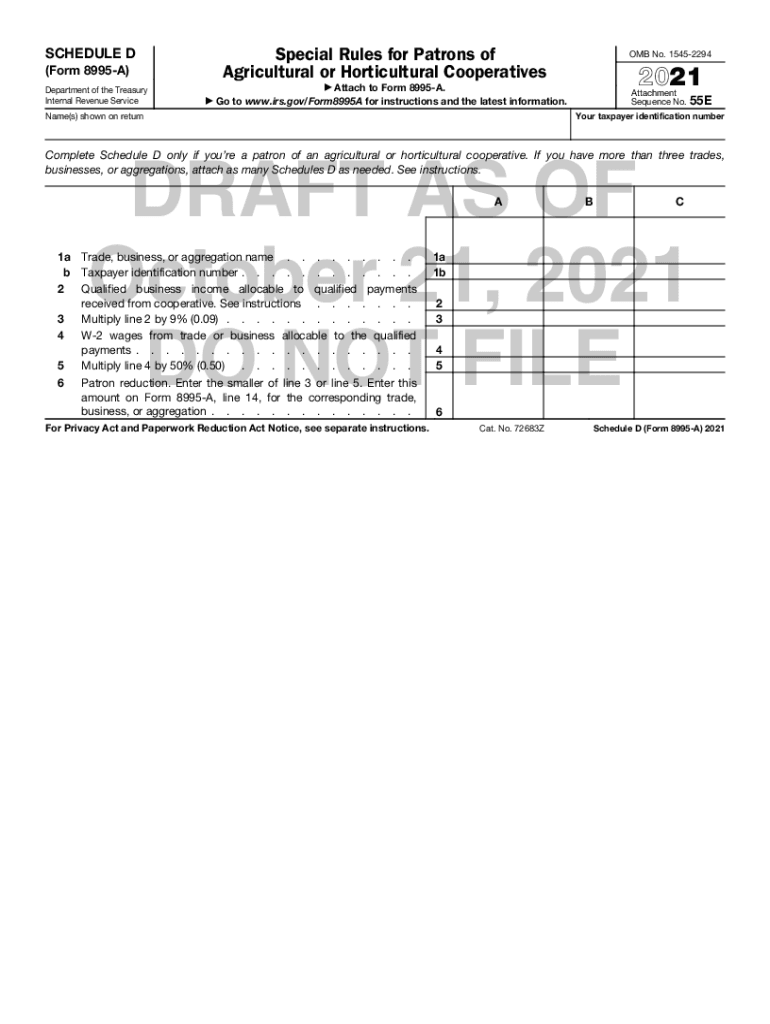

Fillable Online 2021 Schedule B (Form 8995A). Aggregation of Business

Information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and instructions on. Deducting qualified business income on a tax return? In this guide, we’ll cover everything you need to know about form 8995—including its purpose, who is eligible, and how it differs from. The qbi deduction will flow to line. Use this form if.

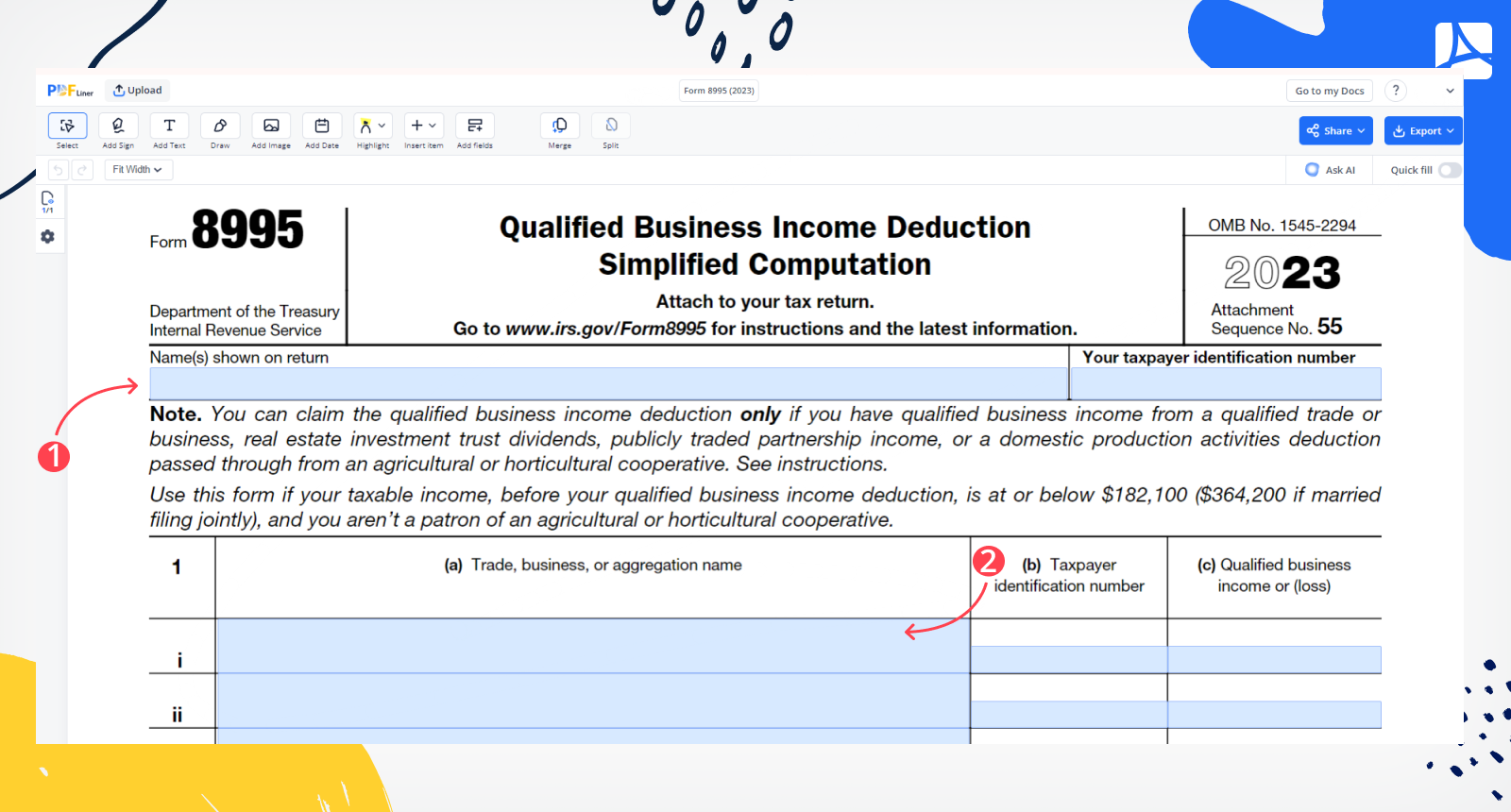

8995 Form 📝 IRS Form 8995 for Instructions Printable Sample With PDF

The qbi deduction will flow to line. Deducting qualified business income on a tax return? In this guide, we’ll cover everything you need to know about form 8995—including its purpose, who is eligible, and how it differs from. Use this form if your taxable income, before your qualified business income deduction, is at or below $164,900 ($164,925 if married filing.

Federal Tax Form 8995 Simplify Tax Filing with Expert Guidance

Use this form if your taxable income, before your qualified business income deduction, is at or below $164,900 ($164,925 if married filing separately;. Check out our irs form 8995 guide to see if you can use the simple form to calculate. Deducting qualified business income on a tax return? Information about form 8995, qualified business income deduction simplified computation, including.

Fillable Online 2021 Form 8995. Qualified Business Deduction

Check out our irs form 8995 guide to see if you can use the simple form to calculate. The qbi deduction will flow to line. Use this form if your taxable income, before your qualified business income deduction, is at or below $164,900 ($164,925 if married filing separately;. In this guide, we’ll cover everything you need to know about form.

Schedule C (Form 8995A) Fill and sign online with Lumin

Information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and instructions on. Deducting qualified business income on a tax return? Use this form if your taxable income, before your qualified business income deduction, is at or below $164,900 ($164,925 if married filing separately;. In this guide, we’ll cover everything you need to know about.

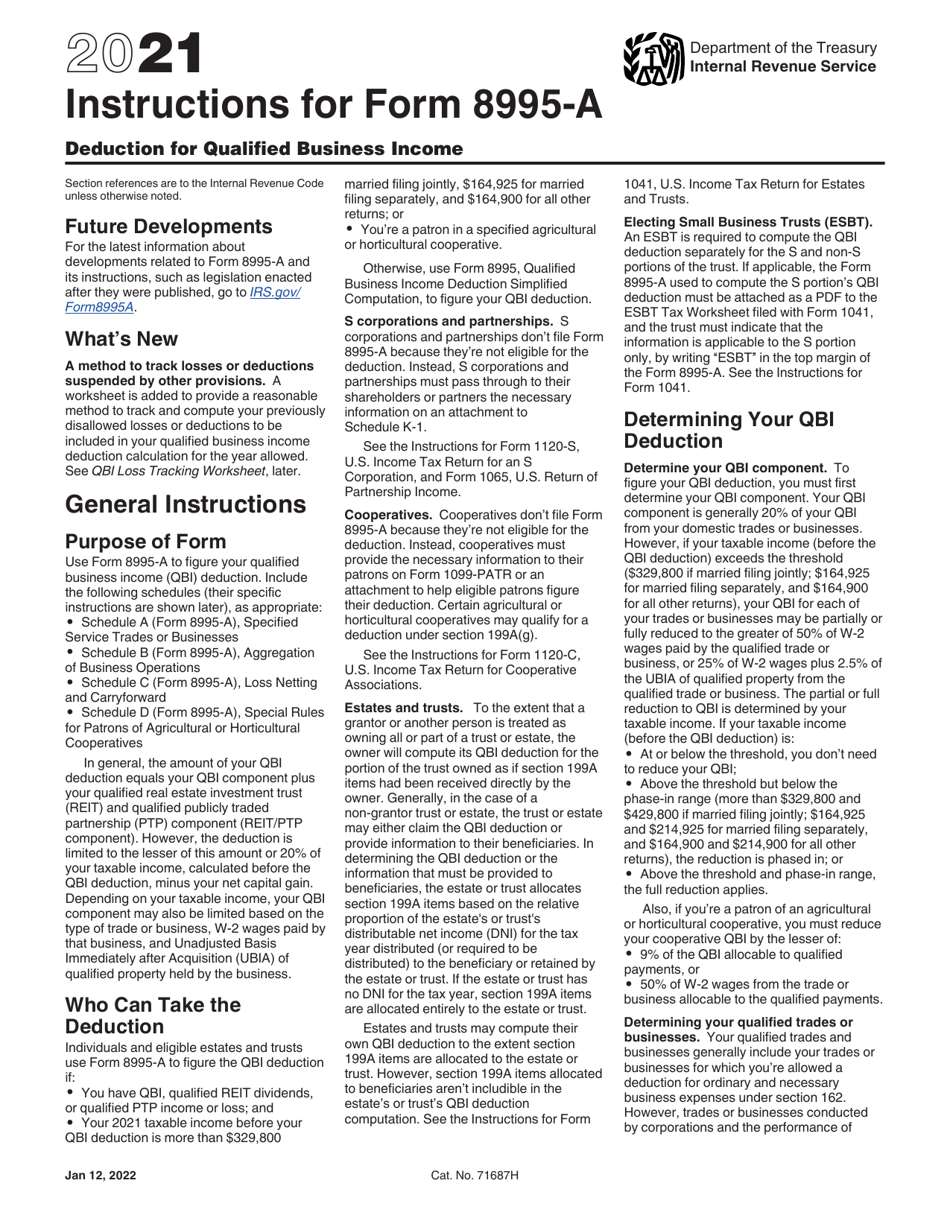

Download Instructions for IRS Form 8995A Deduction for Qualified

Check out our irs form 8995 guide to see if you can use the simple form to calculate. Information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and instructions on. Use this form if your taxable income, before your qualified business income deduction, is at or below $164,900 ($164,925 if married filing separately;. In.

Fillable Online 2021 Schedule D (Form 8995A). Special Rules for

Information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and instructions on. Check out our irs form 8995 guide to see if you can use the simple form to calculate. The qbi deduction will flow to line. Use this form if your taxable income, before your qualified business income deduction, is at or below.

What Is Form 8995 And 8995a Ethel Hernandez's Templates

Information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and instructions on. Use this form if your taxable income, before your qualified business income deduction, is at or below $164,900 ($164,925 if married filing separately;. Deducting qualified business income on a tax return? The qbi deduction will flow to line. In this guide, we’ll.

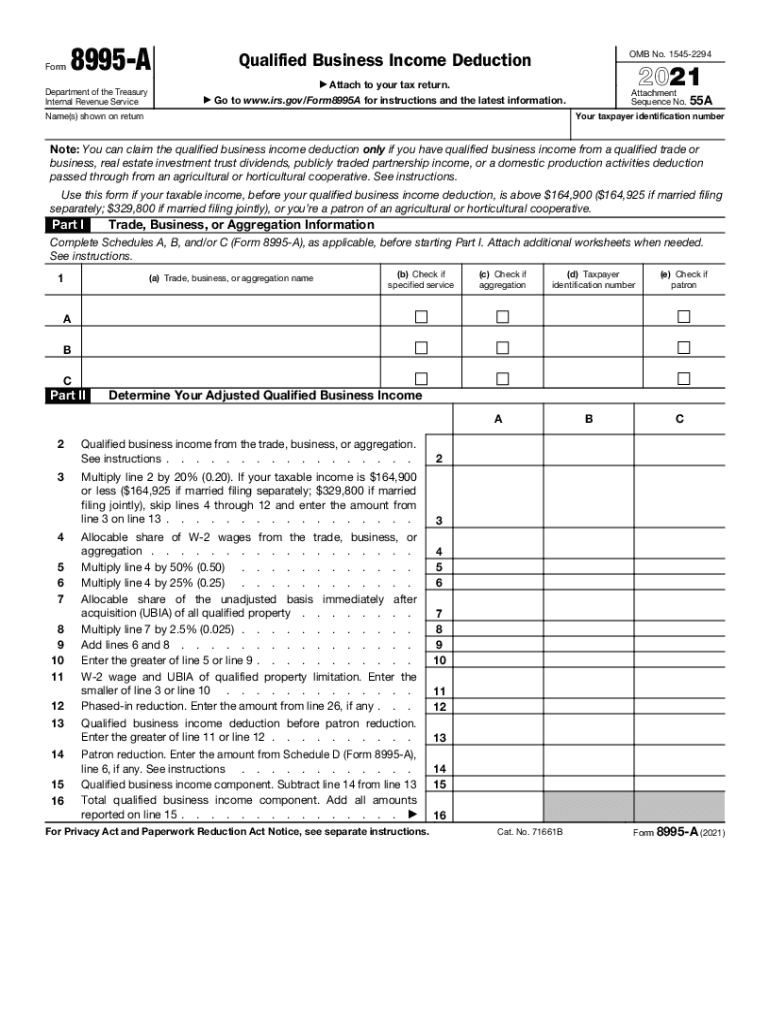

2021 Form IRS 8995A Fill Online, Printable, Fillable, Blank pdfFiller

Information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and instructions on. Use this form if your taxable income, before your qualified business income deduction, is at or below $164,900 ($164,925 if married filing separately;. The qbi deduction will flow to line. Deducting qualified business income on a tax return? Check out our irs.

PDFLiner Form 8995 Online Blank Template

The qbi deduction will flow to line. In this guide, we’ll cover everything you need to know about form 8995—including its purpose, who is eligible, and how it differs from. Use this form if your taxable income, before your qualified business income deduction, is at or below $164,900 ($164,925 if married filing separately;. Deducting qualified business income on a tax.

Deducting Qualified Business Income On A Tax Return?

Use this form if your taxable income, before your qualified business income deduction, is at or below $164,900 ($164,925 if married filing separately;. Check out our irs form 8995 guide to see if you can use the simple form to calculate. Information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and instructions on. The qbi deduction will flow to line.