2553 Form - Understand the process for changing your business's tax classification. Learn how to accurately file irs form 2553 to elect s corporation status. A complete guide to irs form 2553, including eligibility requirements, filing instructions, and benefits of electing s corporation status. Instead, it allows the business to file taxes as an s corporation. This guide explains how to properly prepare and file irs form. Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. This guide covers eligibility, deadlines, late election relief, and filing. Filing this form does not change the structure of a company;

This guide explains how to properly prepare and file irs form. Understand the process for changing your business's tax classification. Instead, it allows the business to file taxes as an s corporation. This guide covers eligibility, deadlines, late election relief, and filing. A complete guide to irs form 2553, including eligibility requirements, filing instructions, and benefits of electing s corporation status. Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. Filing this form does not change the structure of a company; Learn how to accurately file irs form 2553 to elect s corporation status.

This guide covers eligibility, deadlines, late election relief, and filing. Instead, it allows the business to file taxes as an s corporation. Filing this form does not change the structure of a company; A complete guide to irs form 2553, including eligibility requirements, filing instructions, and benefits of electing s corporation status. Understand the process for changing your business's tax classification. Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. This guide explains how to properly prepare and file irs form. Learn how to accurately file irs form 2553 to elect s corporation status.

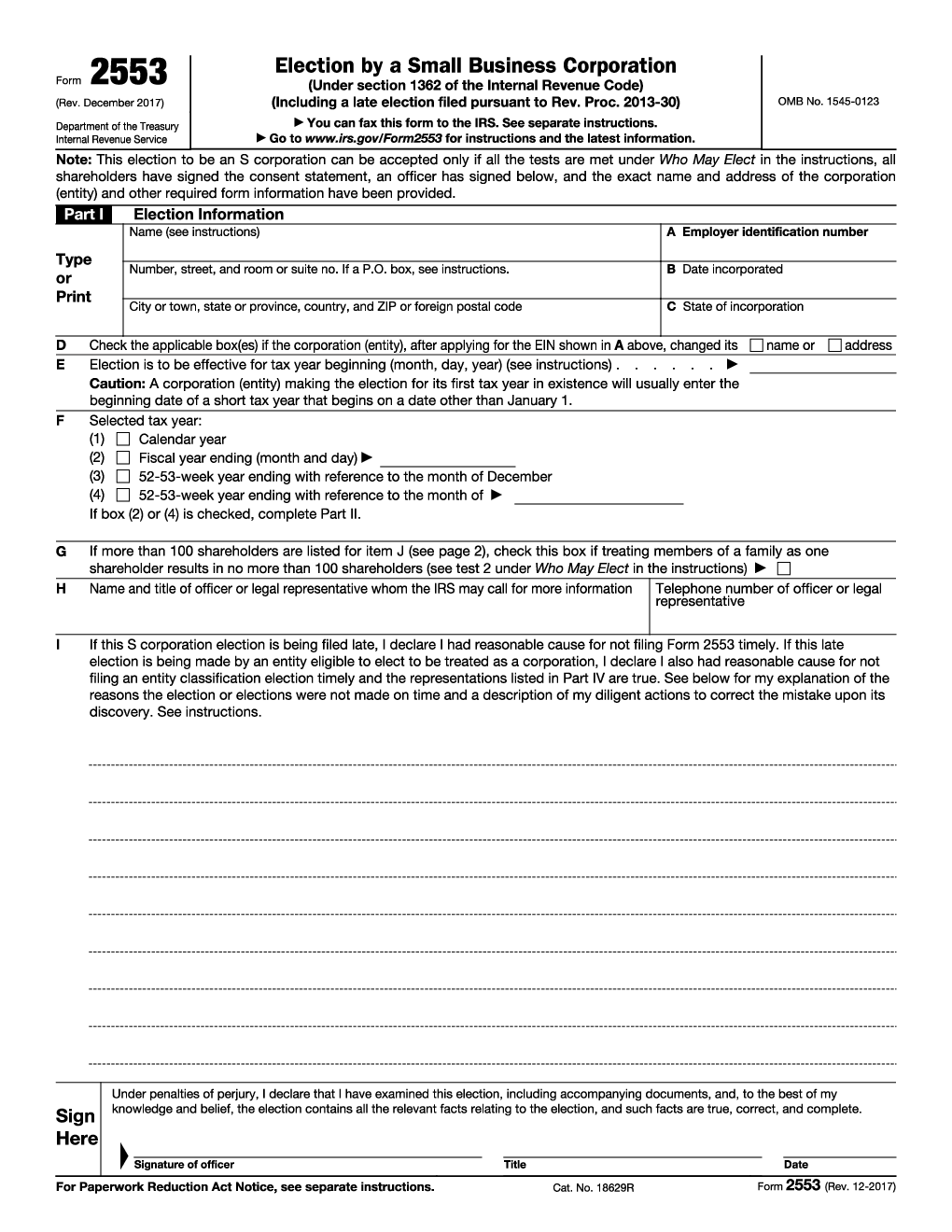

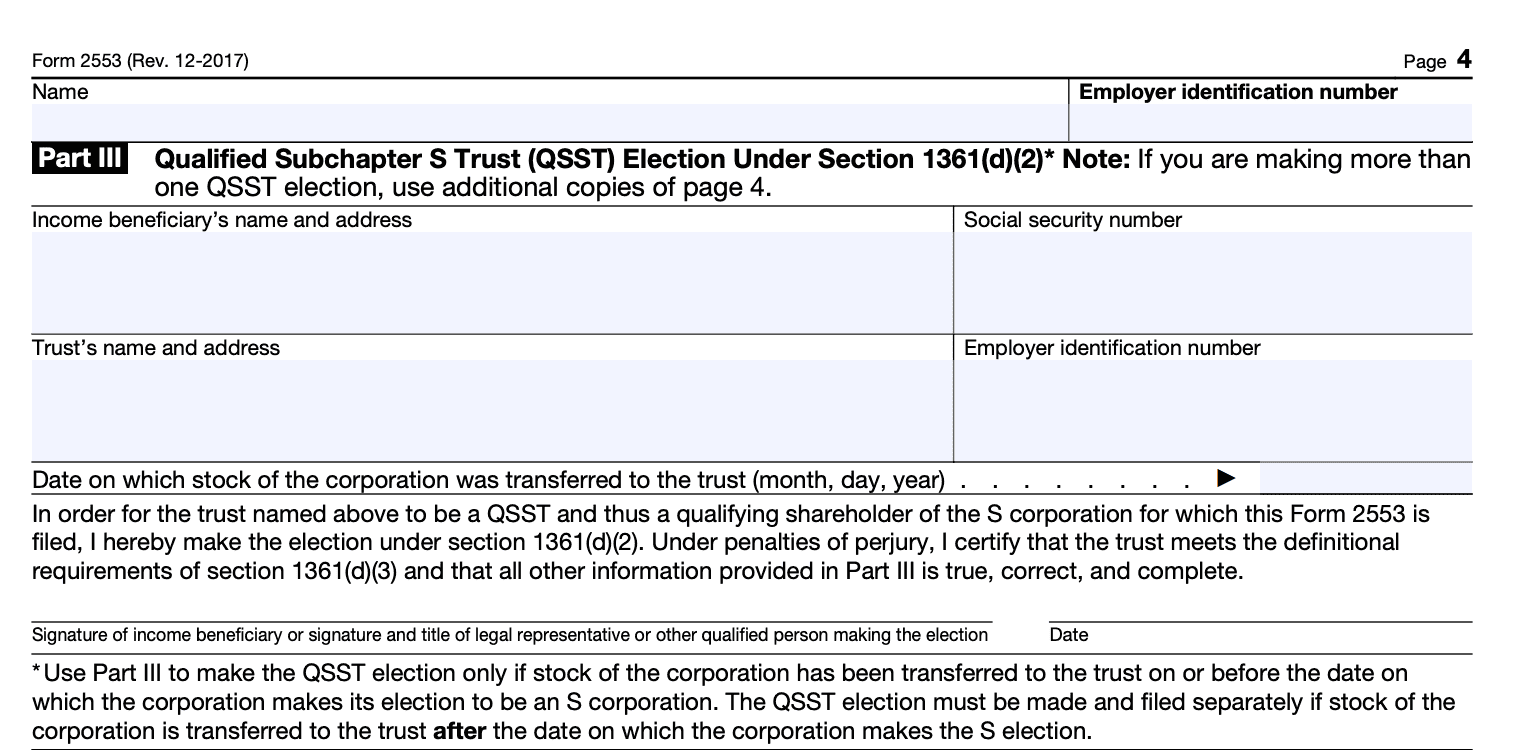

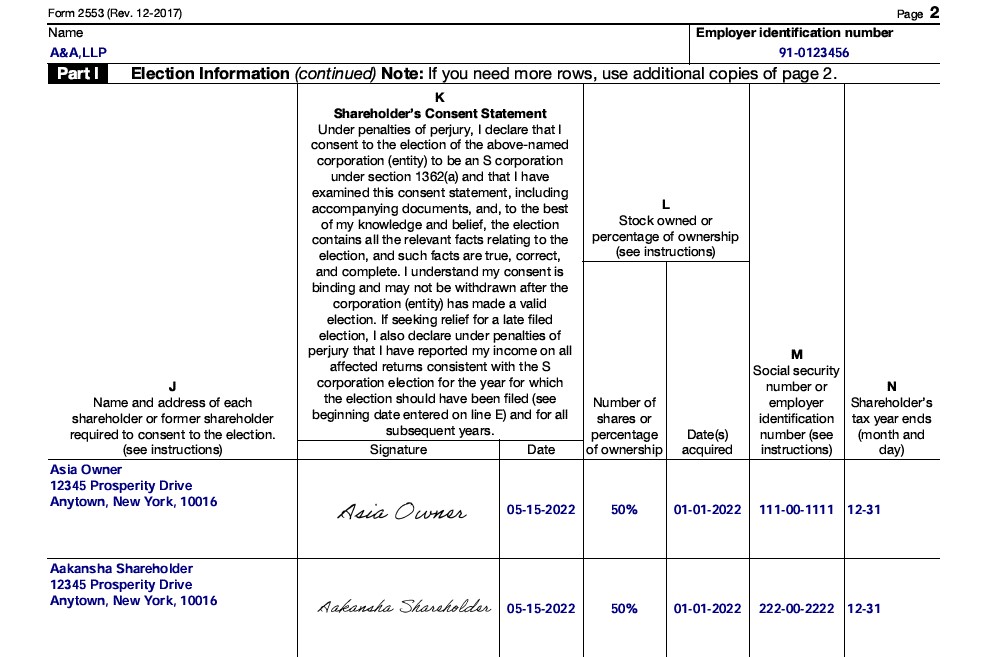

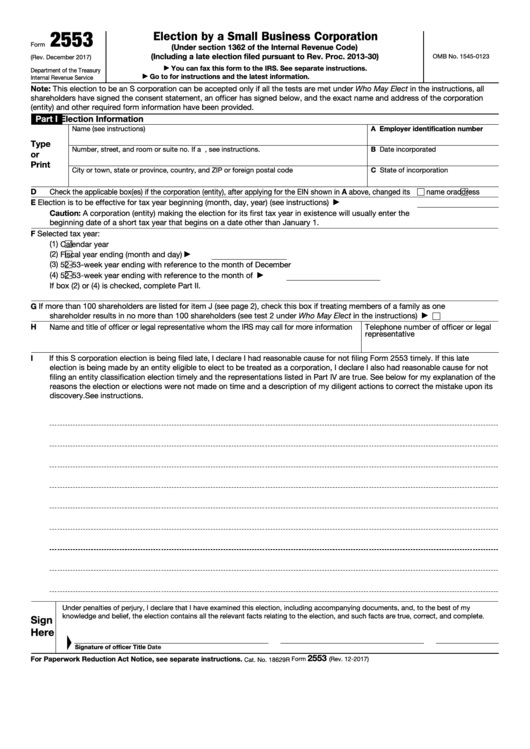

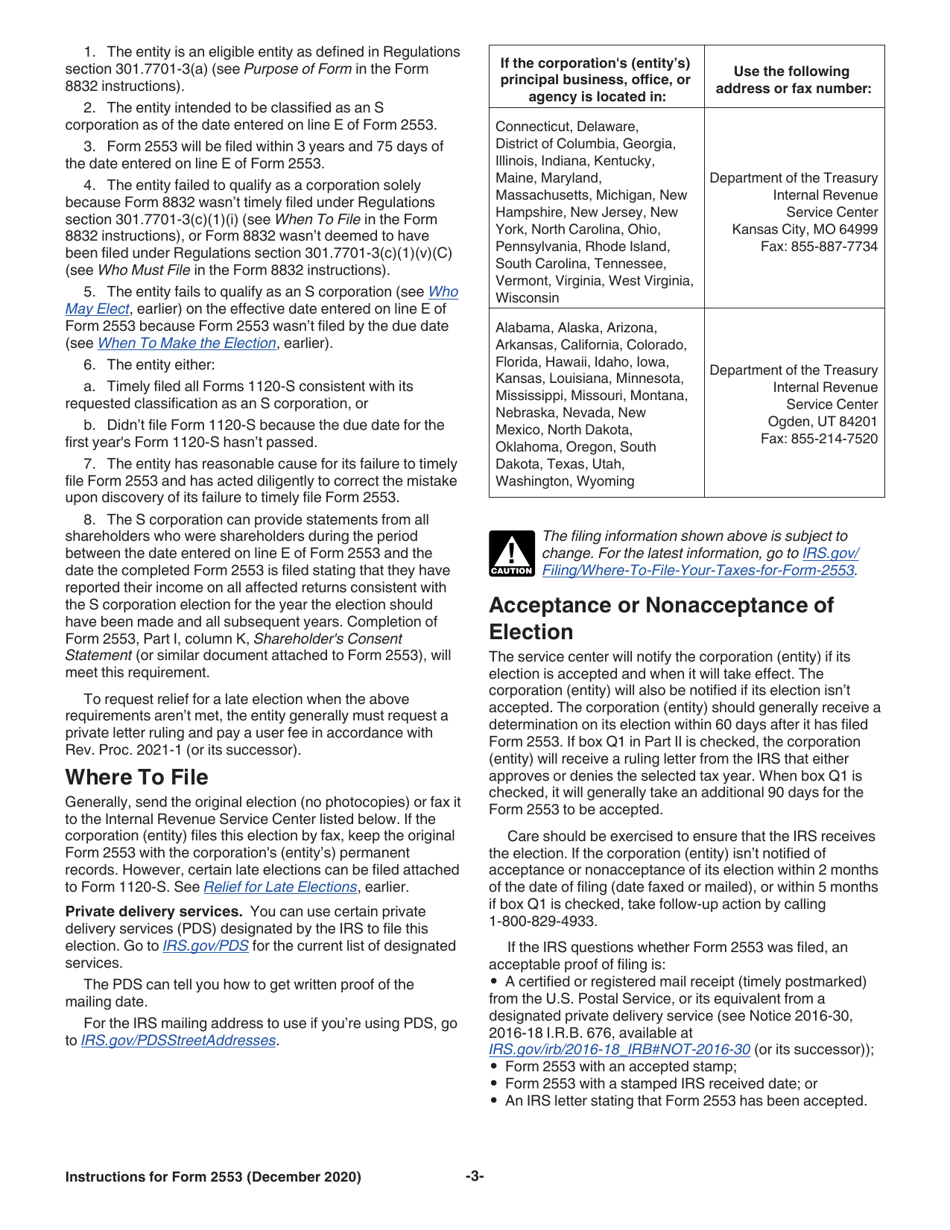

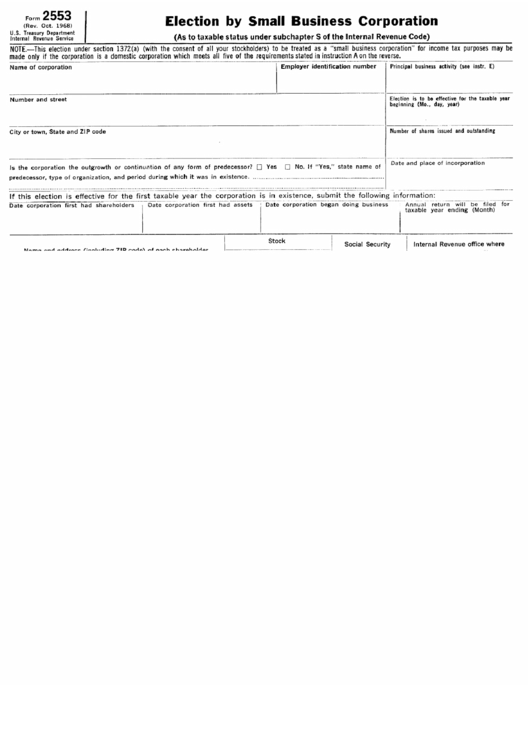

IRS Form 2553. Election by a Small Business Corporation Forms Docs

Understand the process for changing your business's tax classification. This guide explains how to properly prepare and file irs form. Instead, it allows the business to file taxes as an s corporation. Learn how to accurately file irs form 2553 to elect s corporation status. This guide covers eligibility, deadlines, late election relief, and filing.

Form 2553 Election by a Small Business Corporation

Instead, it allows the business to file taxes as an s corporation. Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. Understand the process for changing your business's tax classification. Learn how to accurately file irs form 2553 to elect s corporation status. Filing this form does not change.

Learn How to Fill the Form 2553 Election by a Small Business

A complete guide to irs form 2553, including eligibility requirements, filing instructions, and benefits of electing s corporation status. Instead, it allows the business to file taxes as an s corporation. Understand the process for changing your business's tax classification. Learn how to accurately file irs form 2553 to elect s corporation status. Form 2553 is used by qualifying small.

How to Fill out IRS Form 2553 EasytoFollow Instructions YouTube

A complete guide to irs form 2553, including eligibility requirements, filing instructions, and benefits of electing s corporation status. This guide covers eligibility, deadlines, late election relief, and filing. Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. Instead, it allows the business to file taxes as an s.

Form 2553 template ONLYOFFICE

This guide explains how to properly prepare and file irs form. This guide covers eligibility, deadlines, late election relief, and filing. Understand the process for changing your business's tax classification. Instead, it allows the business to file taxes as an s corporation. Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed.

How To Fill Out Form 2553 for Scorps and LLCs

Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. A complete guide to irs form 2553, including eligibility requirements, filing instructions, and benefits of electing s corporation status. Instead, it allows the business to file taxes as an s corporation. Understand the process for changing your business's tax classification..

Top 10 Form 2553 Templates free to download in PDF format

Learn how to accurately file irs form 2553 to elect s corporation status. Filing this form does not change the structure of a company; This guide covers eligibility, deadlines, late election relief, and filing. Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. A complete guide to irs form.

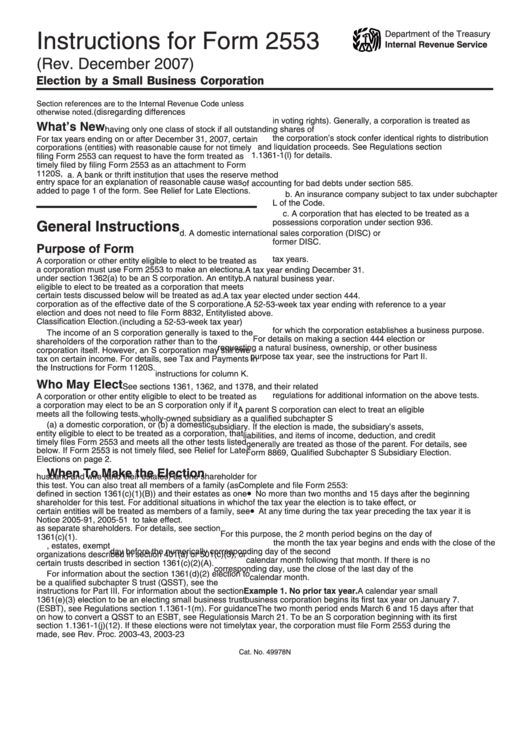

Download Instructions for IRS Form 2553 Election by a Small Business

This guide covers eligibility, deadlines, late election relief, and filing. Filing this form does not change the structure of a company; A complete guide to irs form 2553, including eligibility requirements, filing instructions, and benefits of electing s corporation status. Learn how to accurately file irs form 2553 to elect s corporation status. Understand the process for changing your business's.

Form 2553 Election By Small Business Corporation printable pdf download

Filing this form does not change the structure of a company; A complete guide to irs form 2553, including eligibility requirements, filing instructions, and benefits of electing s corporation status. Instead, it allows the business to file taxes as an s corporation. Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed.

Instructions For Form 2553 (Rev. December 2007) Election By A Small

This guide covers eligibility, deadlines, late election relief, and filing. This guide explains how to properly prepare and file irs form. Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. A complete guide to irs form 2553, including eligibility requirements, filing instructions, and benefits of electing s corporation status..

Understand The Process For Changing Your Business's Tax Classification.

Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. A complete guide to irs form 2553, including eligibility requirements, filing instructions, and benefits of electing s corporation status. This guide covers eligibility, deadlines, late election relief, and filing. Instead, it allows the business to file taxes as an s corporation.

This Guide Explains How To Properly Prepare And File Irs Form.

Learn how to accurately file irs form 2553 to elect s corporation status. Filing this form does not change the structure of a company;