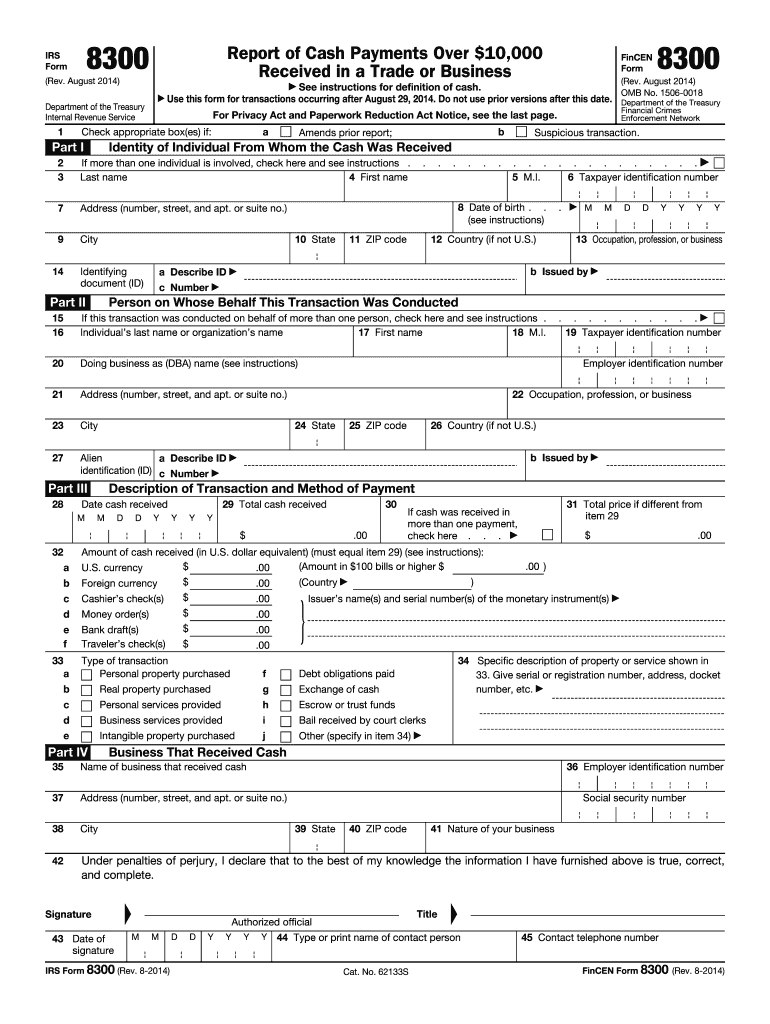

8300 Form Pdf - A suspicious transaction is a transaction in which it appears that a person is attempting to cause form 8300 not to be filed, or to file a false or incomplete. You must give a written or electronic statement to each person named on a required form 8300 on or before january 31 of the year following the. A suspicious transaction is a transaction in which it appears that a person is attempting to cause form 8300 not to be filed, or. Information about form 8300, report of cash payments over $10,000 received in a trade or business, including recent updates, related forms. Dollar equivalent) (must equal item 29) (see instructions): 8300 amount of cash received (in u.s.

Information about form 8300, report of cash payments over $10,000 received in a trade or business, including recent updates, related forms. You must give a written or electronic statement to each person named on a required form 8300 on or before january 31 of the year following the. Dollar equivalent) (must equal item 29) (see instructions): 8300 amount of cash received (in u.s. A suspicious transaction is a transaction in which it appears that a person is attempting to cause form 8300 not to be filed, or to file a false or incomplete. A suspicious transaction is a transaction in which it appears that a person is attempting to cause form 8300 not to be filed, or.

8300 amount of cash received (in u.s. Dollar equivalent) (must equal item 29) (see instructions): Information about form 8300, report of cash payments over $10,000 received in a trade or business, including recent updates, related forms. You must give a written or electronic statement to each person named on a required form 8300 on or before january 31 of the year following the. A suspicious transaction is a transaction in which it appears that a person is attempting to cause form 8300 not to be filed, or. A suspicious transaction is a transaction in which it appears that a person is attempting to cause form 8300 not to be filed, or to file a false or incomplete.

8300 PDF 20142025 Form Fill Out and Sign Printable PDF Template

A suspicious transaction is a transaction in which it appears that a person is attempting to cause form 8300 not to be filed, or to file a false or incomplete. A suspicious transaction is a transaction in which it appears that a person is attempting to cause form 8300 not to be filed, or. Information about form 8300, report of.

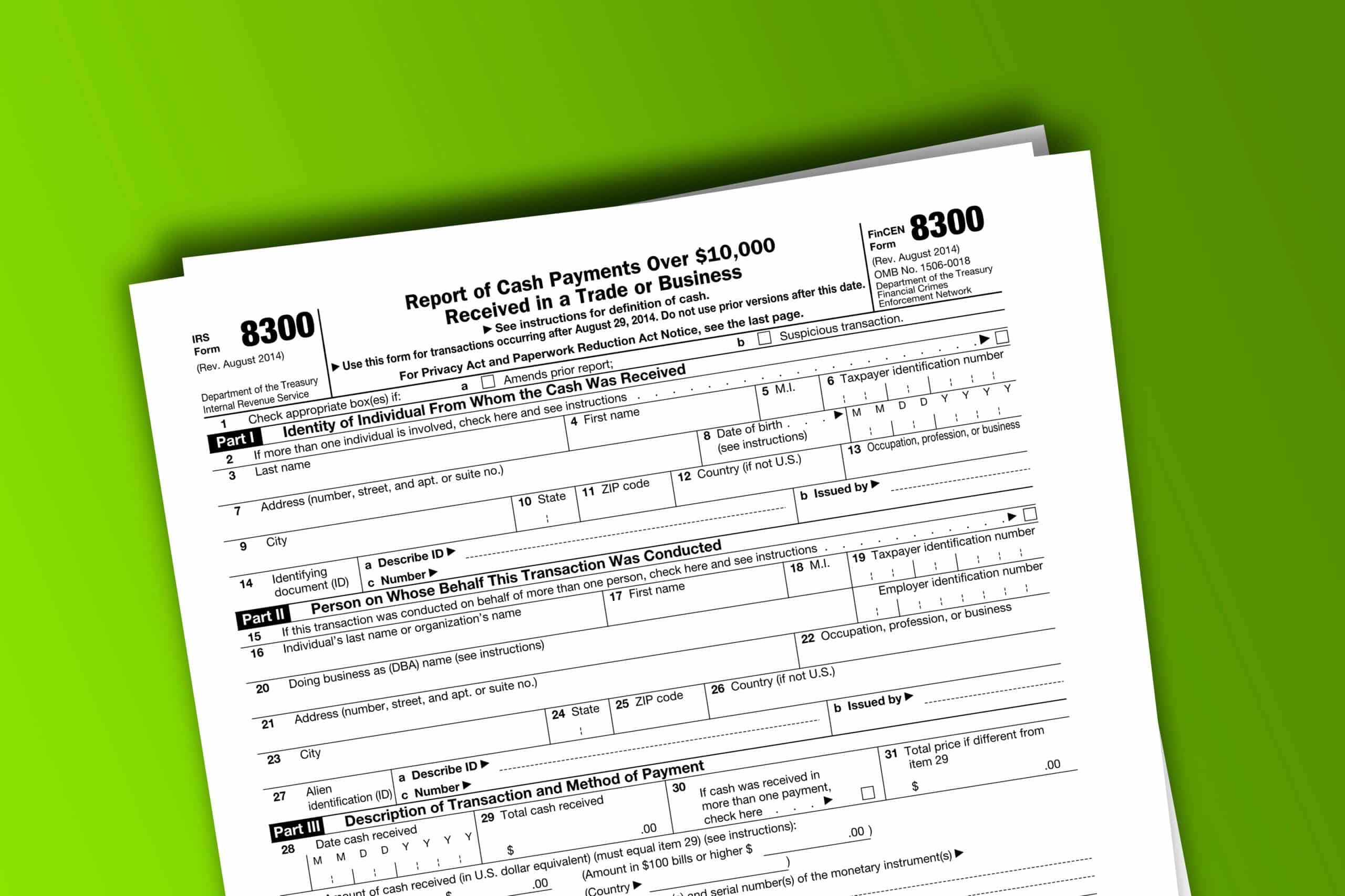

Report Cash Payments Over 10,000 on IRS Form 8300 for Expats

A suspicious transaction is a transaction in which it appears that a person is attempting to cause form 8300 not to be filed, or. You must give a written or electronic statement to each person named on a required form 8300 on or before january 31 of the year following the. Dollar equivalent) (must equal item 29) (see instructions): Information.

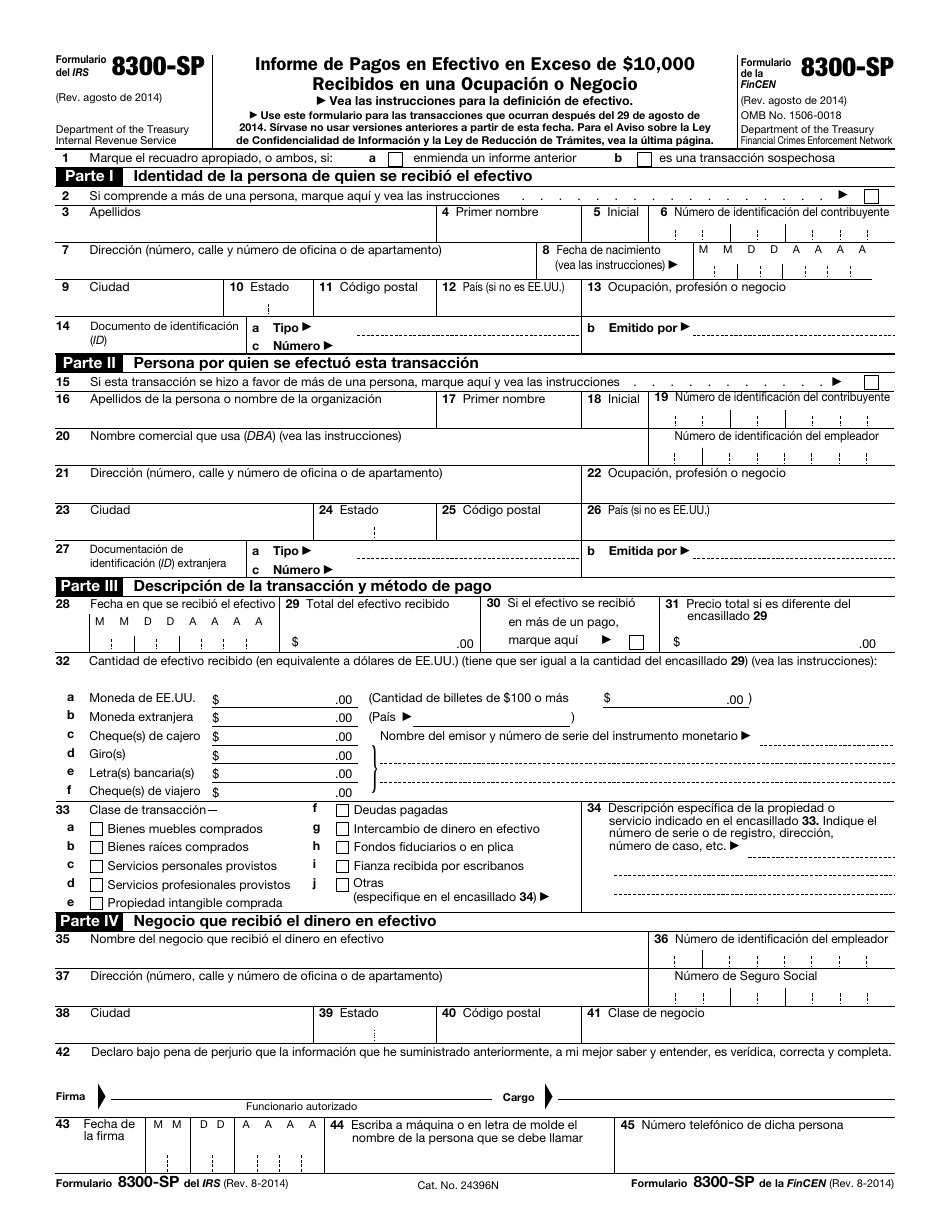

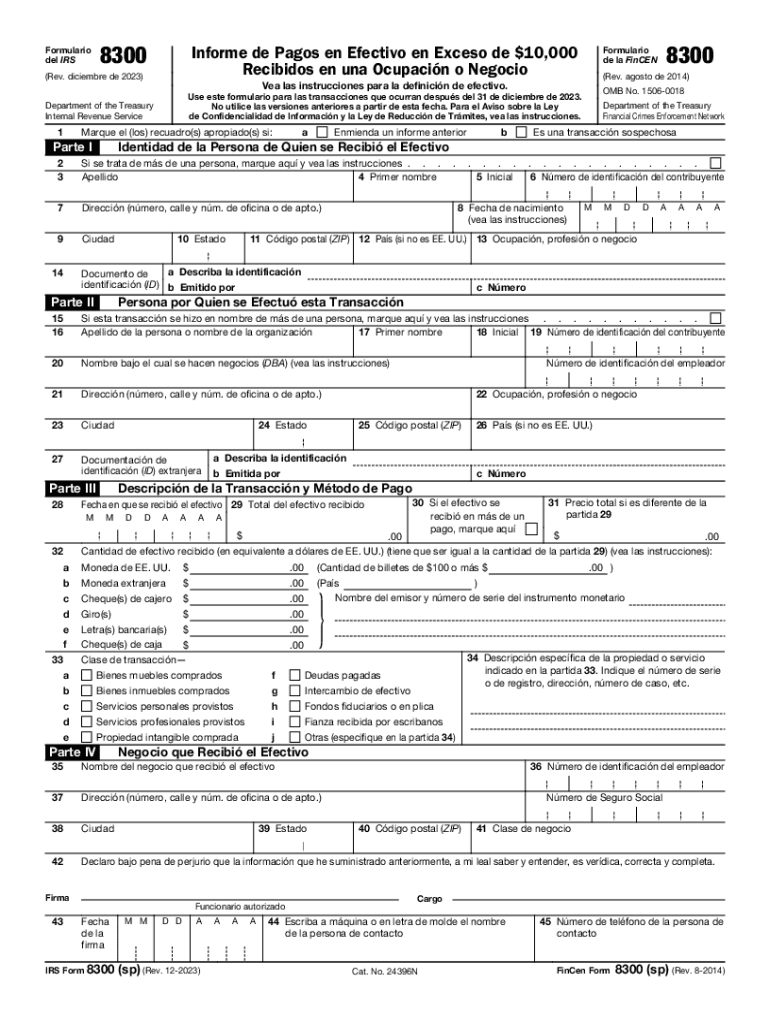

IRS Formulario 8300SP (FinCEN Form 8300SP) Fill Out, Sign Online

A suspicious transaction is a transaction in which it appears that a person is attempting to cause form 8300 not to be filed, or. 8300 amount of cash received (in u.s. You must give a written or electronic statement to each person named on a required form 8300 on or before january 31 of the year following the. A suspicious.

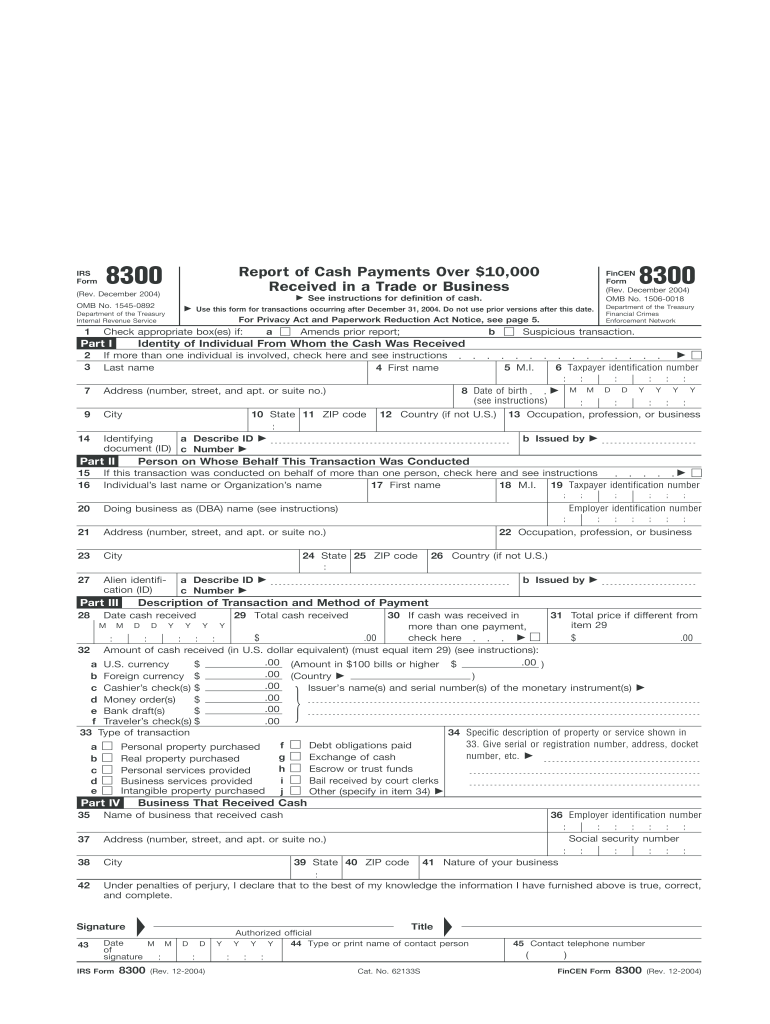

8300 form pdf Fill out & sign online DocHub

You must give a written or electronic statement to each person named on a required form 8300 on or before january 31 of the year following the. A suspicious transaction is a transaction in which it appears that a person is attempting to cause form 8300 not to be filed, or to file a false or incomplete. 8300 amount of.

Preenchendo o Formulário 8300 do IRS de maneira inteligente

You must give a written or electronic statement to each person named on a required form 8300 on or before january 31 of the year following the. Dollar equivalent) (must equal item 29) (see instructions): 8300 amount of cash received (in u.s. A suspicious transaction is a transaction in which it appears that a person is attempting to cause form.

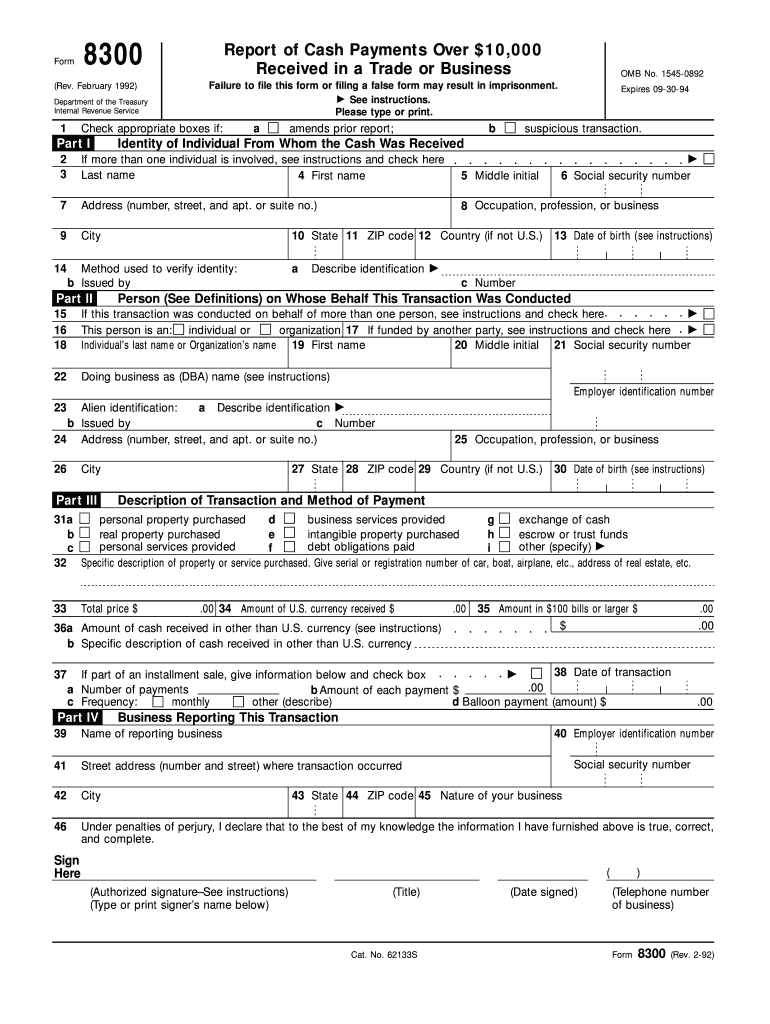

Fillable Online ftp irs Form 8300 (Rev ftp irs Fax Email Print

Information about form 8300, report of cash payments over $10,000 received in a trade or business, including recent updates, related forms. A suspicious transaction is a transaction in which it appears that a person is attempting to cause form 8300 not to be filed, or to file a false or incomplete. Dollar equivalent) (must equal item 29) (see instructions): You.

Form 8300 20242025 Complete, Edit, and Download PDF Guru

A suspicious transaction is a transaction in which it appears that a person is attempting to cause form 8300 not to be filed, or to file a false or incomplete. A suspicious transaction is a transaction in which it appears that a person is attempting to cause form 8300 not to be filed, or. You must give a written or.

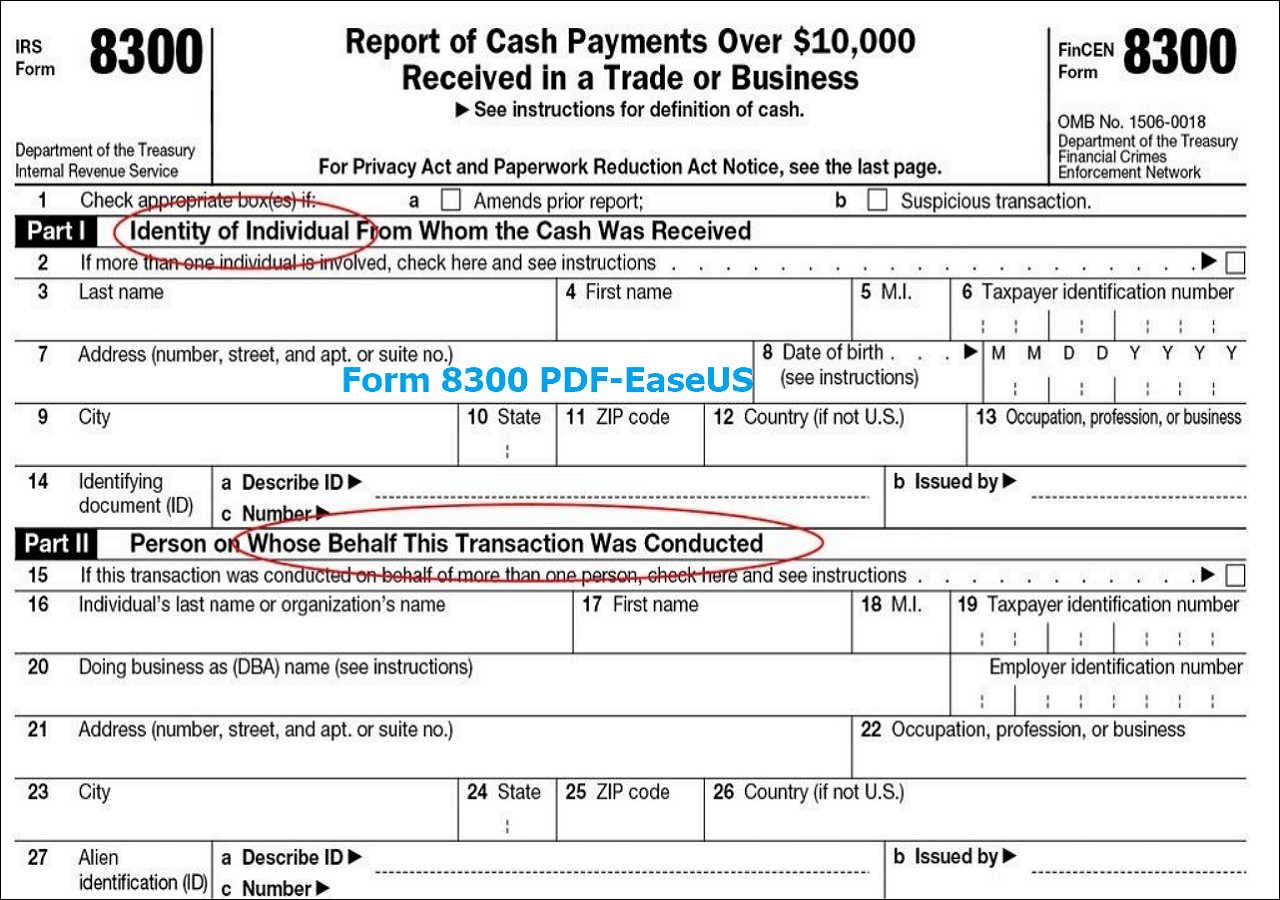

How to Fill Out Form 8300 PDF Document EaseUS

You must give a written or electronic statement to each person named on a required form 8300 on or before january 31 of the year following the. A suspicious transaction is a transaction in which it appears that a person is attempting to cause form 8300 not to be filed, or. A suspicious transaction is a transaction in which it.

Irs 8300 Form 2024 Pdf Danit Anneliese

Information about form 8300, report of cash payments over $10,000 received in a trade or business, including recent updates, related forms. Dollar equivalent) (must equal item 29) (see instructions): A suspicious transaction is a transaction in which it appears that a person is attempting to cause form 8300 not to be filed, or to file a false or incomplete. A.

20232025 Form IRS 8300SP Fill Online, Printable, Fillable, Blank

Dollar equivalent) (must equal item 29) (see instructions): A suspicious transaction is a transaction in which it appears that a person is attempting to cause form 8300 not to be filed, or. A suspicious transaction is a transaction in which it appears that a person is attempting to cause form 8300 not to be filed, or to file a false.

Information About Form 8300, Report Of Cash Payments Over $10,000 Received In A Trade Or Business, Including Recent Updates, Related Forms.

A suspicious transaction is a transaction in which it appears that a person is attempting to cause form 8300 not to be filed, or to file a false or incomplete. A suspicious transaction is a transaction in which it appears that a person is attempting to cause form 8300 not to be filed, or. 8300 amount of cash received (in u.s. You must give a written or electronic statement to each person named on a required form 8300 on or before january 31 of the year following the.