8862 Form - Here's how to file form 8862 in turbotax. Irs form 8862 is used to claim the earned income tax credit (eitc), it the eitc was disallowed or reduced, for reasons other than. Asegúrate de seguir las instrucciones del irs si recibiste un aviso exigiendo que presentes el formulario 8862. Open or continue your return. What do i doyou would need to add a form 8862 to your taxes. I keep getting rejected because of a 8862 form. No es necesario que presentes.

What do i doyou would need to add a form 8862 to your taxes. Here's how to file form 8862 in turbotax. Asegúrate de seguir las instrucciones del irs si recibiste un aviso exigiendo que presentes el formulario 8862. No es necesario que presentes. Open or continue your return. Irs form 8862 is used to claim the earned income tax credit (eitc), it the eitc was disallowed or reduced, for reasons other than. I keep getting rejected because of a 8862 form.

No es necesario que presentes. I keep getting rejected because of a 8862 form. What do i doyou would need to add a form 8862 to your taxes. Irs form 8862 is used to claim the earned income tax credit (eitc), it the eitc was disallowed or reduced, for reasons other than. Here's how to file form 8862 in turbotax. Asegúrate de seguir las instrucciones del irs si recibiste un aviso exigiendo que presentes el formulario 8862. Open or continue your return.

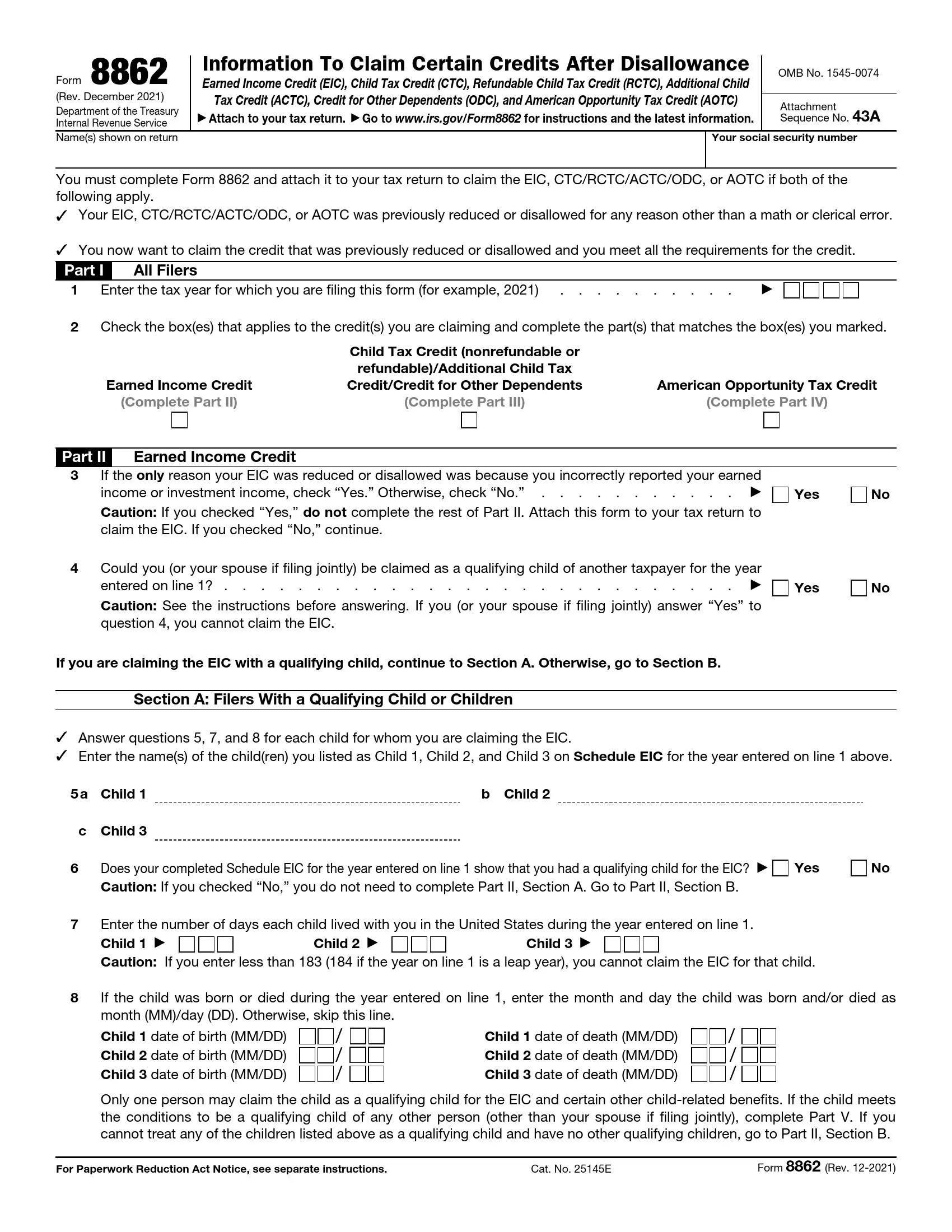

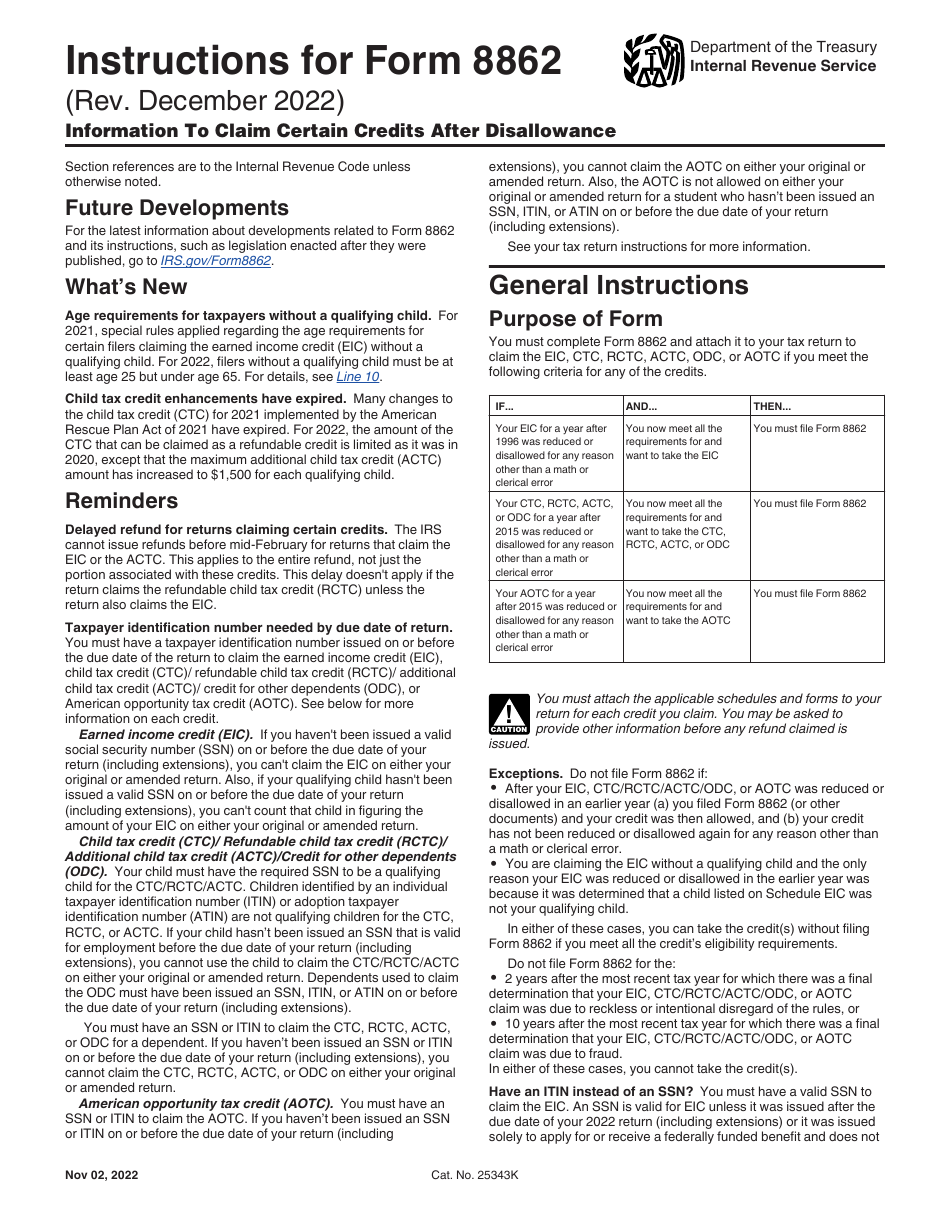

IRS Form 8862 Instructions

Asegúrate de seguir las instrucciones del irs si recibiste un aviso exigiendo que presentes el formulario 8862. I keep getting rejected because of a 8862 form. Irs form 8862 is used to claim the earned income tax credit (eitc), it the eitc was disallowed or reduced, for reasons other than. What do i doyou would need to add a form.

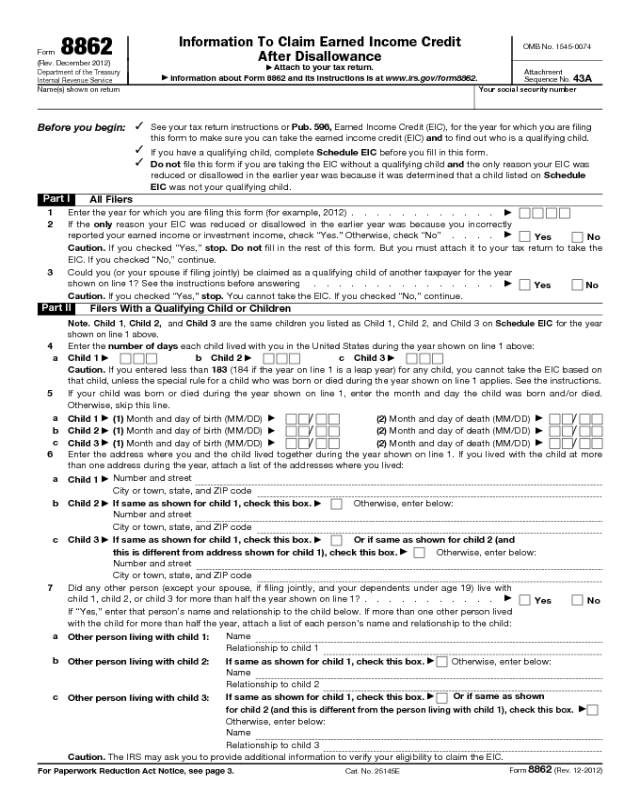

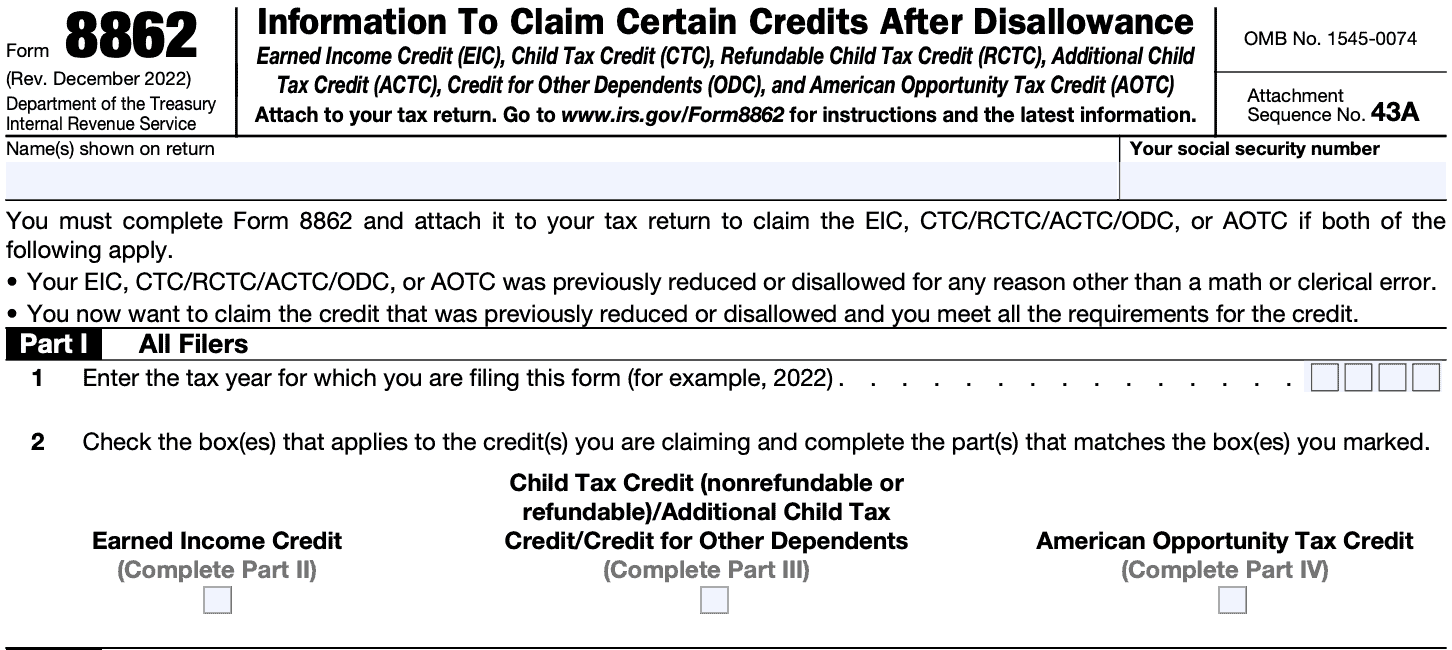

Form 8862Information to Claim Earned Credit for Disallowance

Open or continue your return. What do i doyou would need to add a form 8862 to your taxes. Asegúrate de seguir las instrucciones del irs si recibiste un aviso exigiendo que presentes el formulario 8862. I keep getting rejected because of a 8862 form. Here's how to file form 8862 in turbotax.

Download Instructions for IRS Form 8862 Information to Claim Certain

What do i doyou would need to add a form 8862 to your taxes. Asegúrate de seguir las instrucciones del irs si recibiste un aviso exigiendo que presentes el formulario 8862. Open or continue your return. Here's how to file form 8862 in turbotax. Irs form 8862 is used to claim the earned income tax credit (eitc), it the eitc.

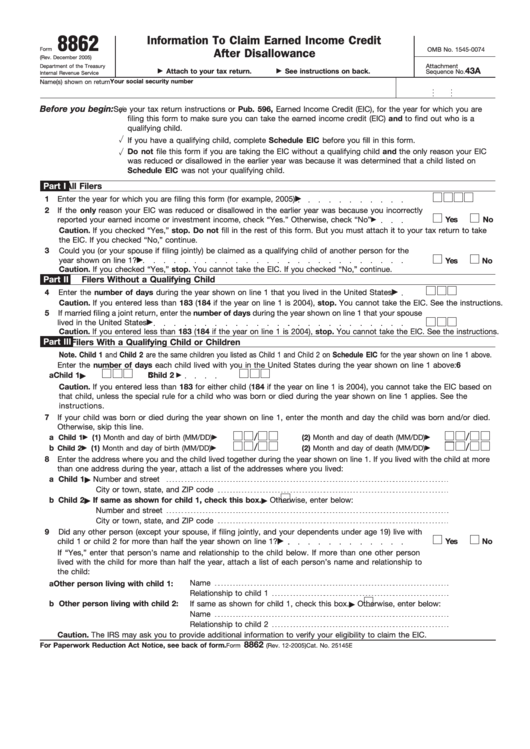

Irs Form 8862 Printable Printable Forms Free Online

Asegúrate de seguir las instrucciones del irs si recibiste un aviso exigiendo que presentes el formulario 8862. Open or continue your return. I keep getting rejected because of a 8862 form. What do i doyou would need to add a form 8862 to your taxes. Here's how to file form 8862 in turbotax.

What Is IRS Form 8862?

Here's how to file form 8862 in turbotax. No es necesario que presentes. I keep getting rejected because of a 8862 form. Open or continue your return. What do i doyou would need to add a form 8862 to your taxes.

Irs Form 8862 Printable Master of Documents

What do i doyou would need to add a form 8862 to your taxes. I keep getting rejected because of a 8862 form. No es necesario que presentes. Irs form 8862 is used to claim the earned income tax credit (eitc), it the eitc was disallowed or reduced, for reasons other than. Open or continue your return.

Printable Irs Form 8862 Printable Forms Free Online

Open or continue your return. What do i doyou would need to add a form 8862 to your taxes. I keep getting rejected because of a 8862 form. Irs form 8862 is used to claim the earned income tax credit (eitc), it the eitc was disallowed or reduced, for reasons other than. No es necesario que presentes.

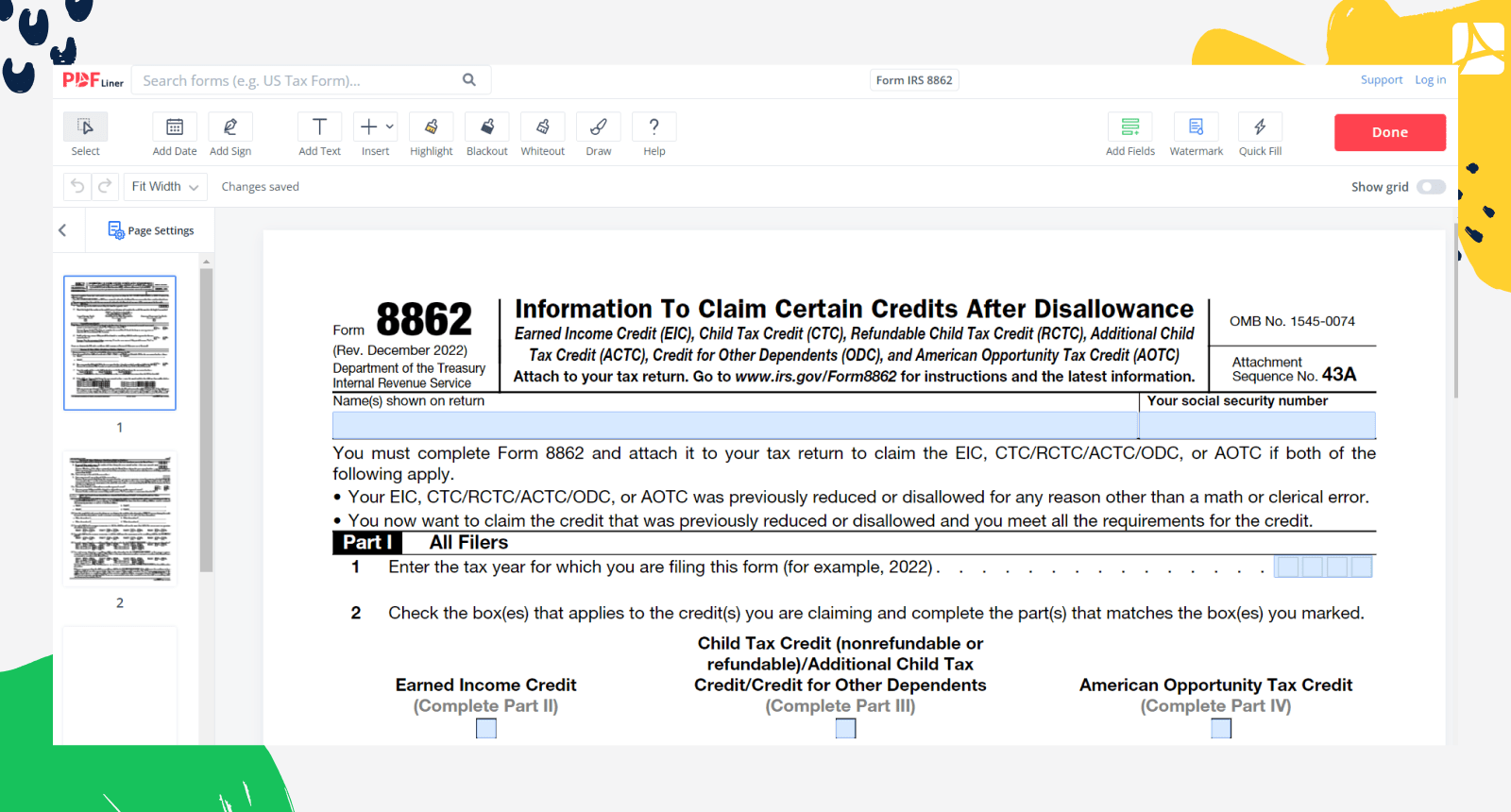

IRS Form 8862 ≡ Fill Out Printable PDF Forms Online

Irs form 8862 is used to claim the earned income tax credit (eitc), it the eitc was disallowed or reduced, for reasons other than. Asegúrate de seguir las instrucciones del irs si recibiste un aviso exigiendo que presentes el formulario 8862. I keep getting rejected because of a 8862 form. Here's how to file form 8862 in turbotax. Open or.

Form IRS 8862 Printable and Fillable forms online — PDFliner

No es necesario que presentes. Open or continue your return. What do i doyou would need to add a form 8862 to your taxes. I keep getting rejected because of a 8862 form. Irs form 8862 is used to claim the earned income tax credit (eitc), it the eitc was disallowed or reduced, for reasons other than.

8862 Tax Form Fill and Sign Printable Template Online US Legal Forms

Asegúrate de seguir las instrucciones del irs si recibiste un aviso exigiendo que presentes el formulario 8862. Here's how to file form 8862 in turbotax. Open or continue your return. Irs form 8862 is used to claim the earned income tax credit (eitc), it the eitc was disallowed or reduced, for reasons other than. I keep getting rejected because of.

What Do I Doyou Would Need To Add A Form 8862 To Your Taxes.

Asegúrate de seguir las instrucciones del irs si recibiste un aviso exigiendo que presentes el formulario 8862. Irs form 8862 is used to claim the earned income tax credit (eitc), it the eitc was disallowed or reduced, for reasons other than. I keep getting rejected because of a 8862 form. No es necesario que presentes.

Open Or Continue Your Return.

Here's how to file form 8862 in turbotax.

:max_bytes(150000):strip_icc()/2022-01-1111_48_02-Form8862Rev.December2021-f23f0eab085a467eb521f33bd3758904.jpg)