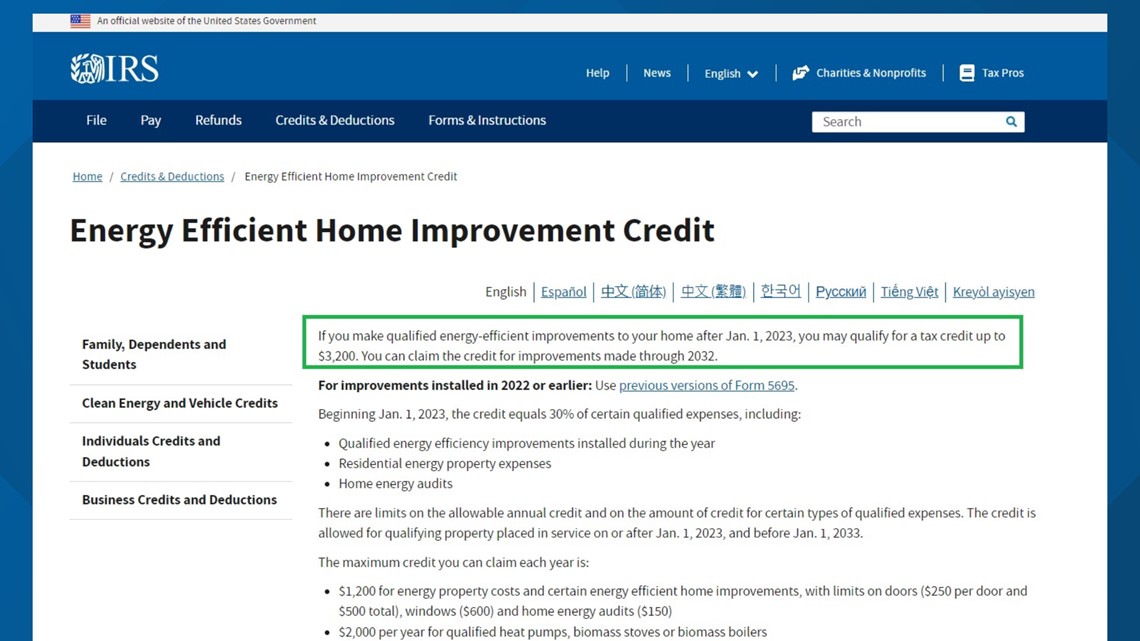

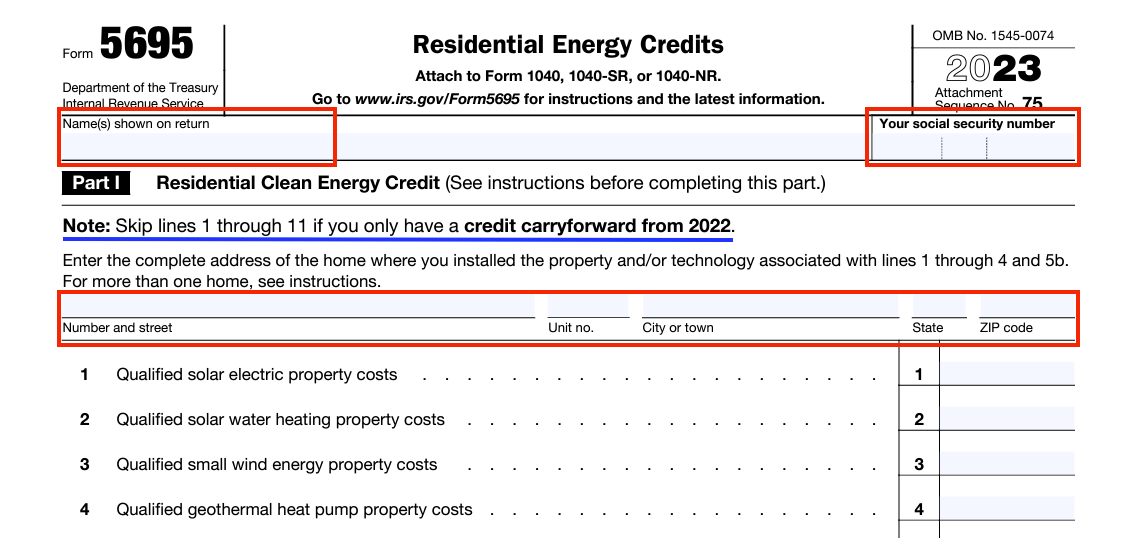

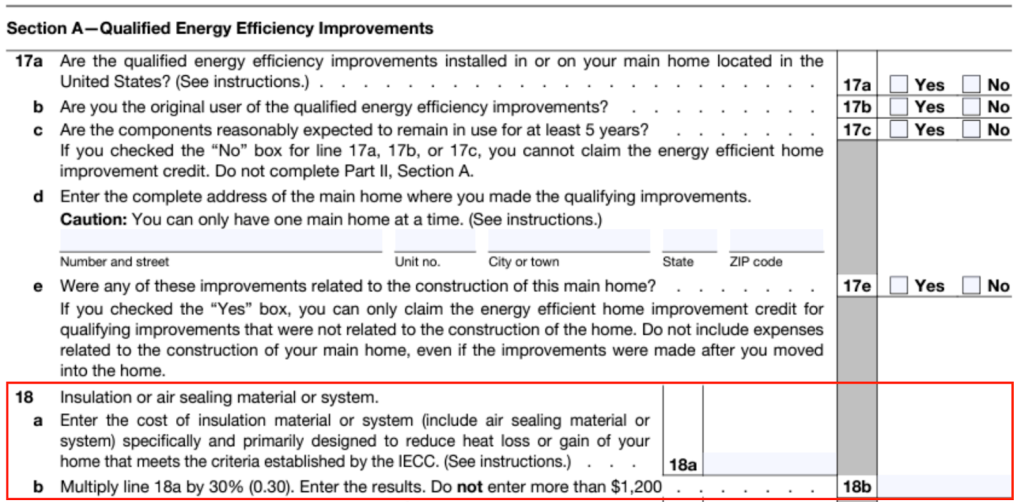

Energy Efficient Home Improvement Credit Form - Below are the steps to complete the form for tax year 2024. Here's how you can claim the 2025 energy efficient home improvement credit for heat pumps, windows, and hvac systems using irs. You can claim the credit. If you only have a credit carryforward from tax year 2023, you can skip. 1, 2023, you may qualify for a tax credit up to $3,200.

If you only have a credit carryforward from tax year 2023, you can skip. 1, 2023, you may qualify for a tax credit up to $3,200. Below are the steps to complete the form for tax year 2024. Here's how you can claim the 2025 energy efficient home improvement credit for heat pumps, windows, and hvac systems using irs. You can claim the credit.

Here's how you can claim the 2025 energy efficient home improvement credit for heat pumps, windows, and hvac systems using irs. Below are the steps to complete the form for tax year 2024. 1, 2023, you may qualify for a tax credit up to $3,200. You can claim the credit. If you only have a credit carryforward from tax year 2023, you can skip.

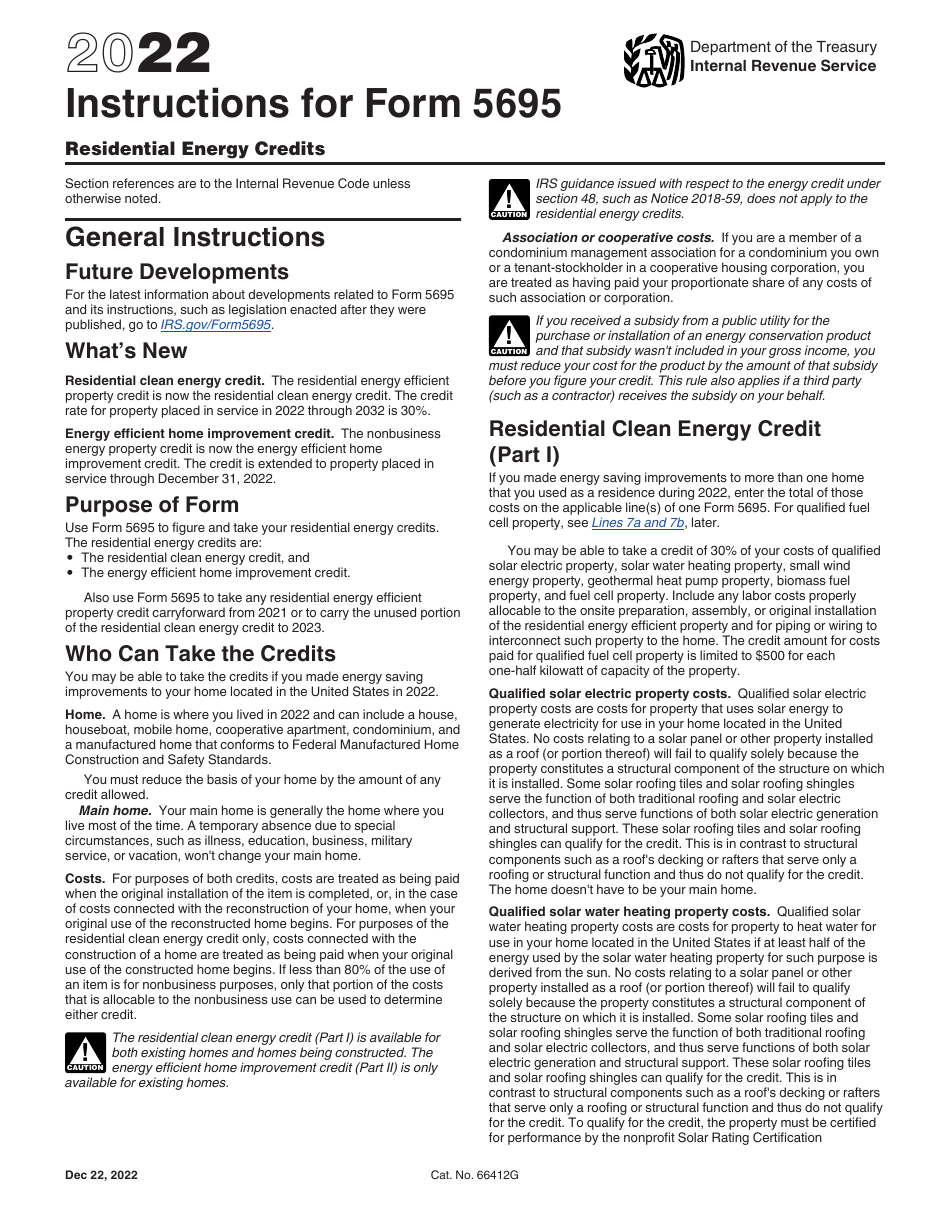

Download Instructions for IRS Form 5695 Residential Energy Credits PDF

If you only have a credit carryforward from tax year 2023, you can skip. 1, 2023, you may qualify for a tax credit up to $3,200. Below are the steps to complete the form for tax year 2024. You can claim the credit. Here's how you can claim the 2025 energy efficient home improvement credit for heat pumps, windows, and.

Energy Efficient Home Improvement Credit Limit Worksheet walkthrough

Here's how you can claim the 2025 energy efficient home improvement credit for heat pumps, windows, and hvac systems using irs. 1, 2023, you may qualify for a tax credit up to $3,200. You can claim the credit. If you only have a credit carryforward from tax year 2023, you can skip. Below are the steps to complete the form.

Expanded tax credits for energy efficient home improvements

You can claim the credit. Below are the steps to complete the form for tax year 2024. If you only have a credit carryforward from tax year 2023, you can skip. Here's how you can claim the 2025 energy efficient home improvement credit for heat pumps, windows, and hvac systems using irs. 1, 2023, you may qualify for a tax.

How to File Your Federal Heat Pump Tax Credit (25C Energy Efficient

Below are the steps to complete the form for tax year 2024. 1, 2023, you may qualify for a tax credit up to $3,200. Here's how you can claim the 2025 energy efficient home improvement credit for heat pumps, windows, and hvac systems using irs. If you only have a credit carryforward from tax year 2023, you can skip. You.

Energy Efficient Improvements

Below are the steps to complete the form for tax year 2024. 1, 2023, you may qualify for a tax credit up to $3,200. If you only have a credit carryforward from tax year 2023, you can skip. Here's how you can claim the 2025 energy efficient home improvement credit for heat pumps, windows, and hvac systems using irs. You.

What is the Energy Efficient Home Improvement Credit & How to Apply?

If you only have a credit carryforward from tax year 2023, you can skip. Below are the steps to complete the form for tax year 2024. Here's how you can claim the 2025 energy efficient home improvement credit for heat pumps, windows, and hvac systems using irs. You can claim the credit. 1, 2023, you may qualify for a tax.

Energy Efficient Home Improvement Tax Credit

Here's how you can claim the 2025 energy efficient home improvement credit for heat pumps, windows, and hvac systems using irs. If you only have a credit carryforward from tax year 2023, you can skip. Below are the steps to complete the form for tax year 2024. You can claim the credit. 1, 2023, you may qualify for a tax.

How to File Your Federal Heat Pump Tax Credit (25C Energy Efficient

If you only have a credit carryforward from tax year 2023, you can skip. Here's how you can claim the 2025 energy efficient home improvement credit for heat pumps, windows, and hvac systems using irs. Below are the steps to complete the form for tax year 2024. You can claim the credit. 1, 2023, you may qualify for a tax.

Residential Energy Credits Instructions for Claiming the Residential

If you only have a credit carryforward from tax year 2023, you can skip. You can claim the credit. 1, 2023, you may qualify for a tax credit up to $3,200. Here's how you can claim the 2025 energy efficient home improvement credit for heat pumps, windows, and hvac systems using irs. Below are the steps to complete the form.

Energy Efficient Home Improvement Credit TAS

If you only have a credit carryforward from tax year 2023, you can skip. You can claim the credit. Here's how you can claim the 2025 energy efficient home improvement credit for heat pumps, windows, and hvac systems using irs. Below are the steps to complete the form for tax year 2024. 1, 2023, you may qualify for a tax.

If You Only Have A Credit Carryforward From Tax Year 2023, You Can Skip.

1, 2023, you may qualify for a tax credit up to $3,200. Below are the steps to complete the form for tax year 2024. Here's how you can claim the 2025 energy efficient home improvement credit for heat pumps, windows, and hvac systems using irs. You can claim the credit.