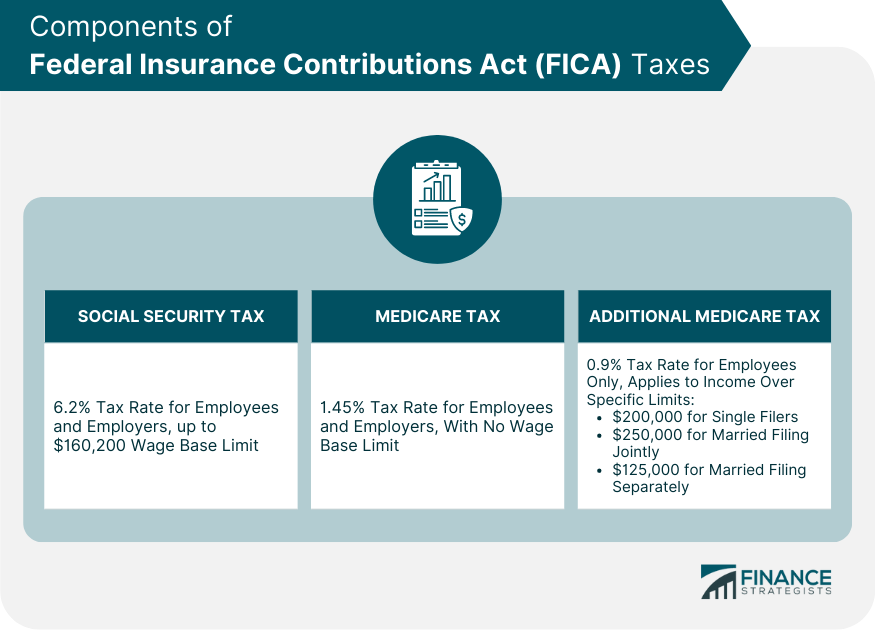

Fica Form - The fica taxes consist of a 6.2% social security tax, 1.45% medicare tax, and potentially a 0.9% medicare surtax, depending on your income. Partnerships and s corporations must file this form to claim the credit. It stands for the federal insurance contributions act and is deducted from each paycheck. Learn about fica, the u.s. Essential info for employees and. Fica tax is a u.s. Payroll tax funding social security and medicare, who pays it, rates, and limits. Federal payroll tax shared by employees and employers to fund social security and medicare. All other taxpayers are not required to complete or file this form if their only.

Partnerships and s corporations must file this form to claim the credit. The fica taxes consist of a 6.2% social security tax, 1.45% medicare tax, and potentially a 0.9% medicare surtax, depending on your income. Payroll tax funding social security and medicare, who pays it, rates, and limits. Fica tax is a u.s. All other taxpayers are not required to complete or file this form if their only. Learn about fica, the u.s. It stands for the federal insurance contributions act and is deducted from each paycheck. Essential info for employees and. Federal payroll tax shared by employees and employers to fund social security and medicare.

Essential info for employees and. Partnerships and s corporations must file this form to claim the credit. Federal payroll tax shared by employees and employers to fund social security and medicare. All other taxpayers are not required to complete or file this form if their only. The fica taxes consist of a 6.2% social security tax, 1.45% medicare tax, and potentially a 0.9% medicare surtax, depending on your income. Payroll tax funding social security and medicare, who pays it, rates, and limits. It stands for the federal insurance contributions act and is deducted from each paycheck. Learn about fica, the u.s. Fica tax is a u.s.

W2 Form Overview LinebyLine Guide to Form W2 AwesomeFinTech Blog

It stands for the federal insurance contributions act and is deducted from each paycheck. Essential info for employees and. Fica tax is a u.s. Learn about fica, the u.s. Payroll tax funding social security and medicare, who pays it, rates, and limits.

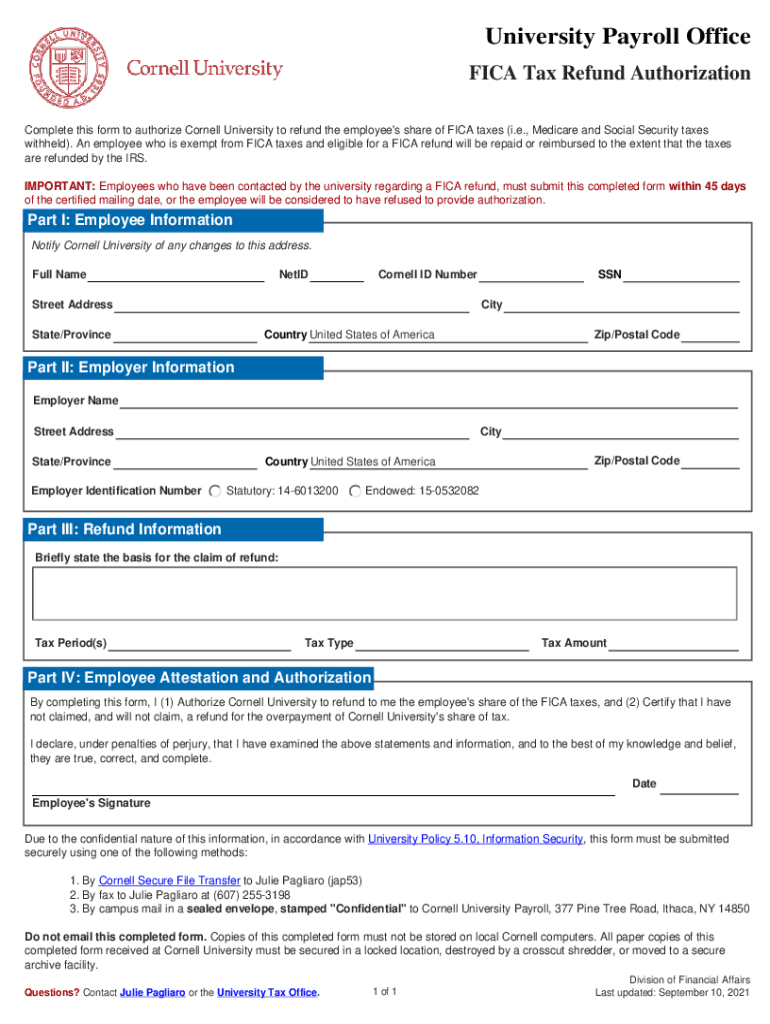

Fillable Online FICA Tax Refund Authorization Division of Financial

Partnerships and s corporations must file this form to claim the credit. All other taxpayers are not required to complete or file this form if their only. It stands for the federal insurance contributions act and is deducted from each paycheck. Fica tax is a u.s. Federal payroll tax shared by employees and employers to fund social security and medicare.

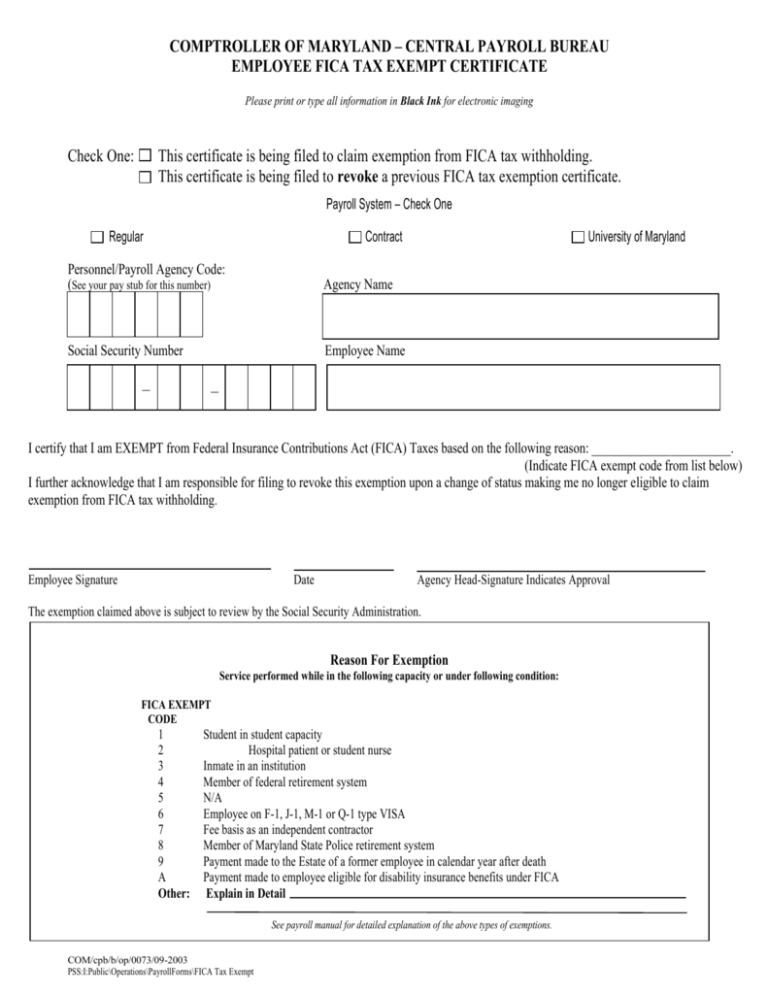

EMPLOYEE FICA TAX EXEMPT CERTIFICATE

Learn about fica, the u.s. Federal payroll tax shared by employees and employers to fund social security and medicare. The fica taxes consist of a 6.2% social security tax, 1.45% medicare tax, and potentially a 0.9% medicare surtax, depending on your income. It stands for the federal insurance contributions act and is deducted from each paycheck. Partnerships and s corporations.

Federal Insurance Contributions Act (FICA) Finance Strategists

Federal payroll tax shared by employees and employers to fund social security and medicare. Learn about fica, the u.s. Partnerships and s corporations must file this form to claim the credit. It stands for the federal insurance contributions act and is deducted from each paycheck. Essential info for employees and.

How To Pay Medicare Withholding Fica Withholding

It stands for the federal insurance contributions act and is deducted from each paycheck. All other taxpayers are not required to complete or file this form if their only. Learn about fica, the u.s. Fica tax is a u.s. Essential info for employees and.

What Is Fica On My Paycheck? How it Works in 2024

Learn about fica, the u.s. All other taxpayers are not required to complete or file this form if their only. Federal payroll tax shared by employees and employers to fund social security and medicare. It stands for the federal insurance contributions act and is deducted from each paycheck. Fica tax is a u.s.

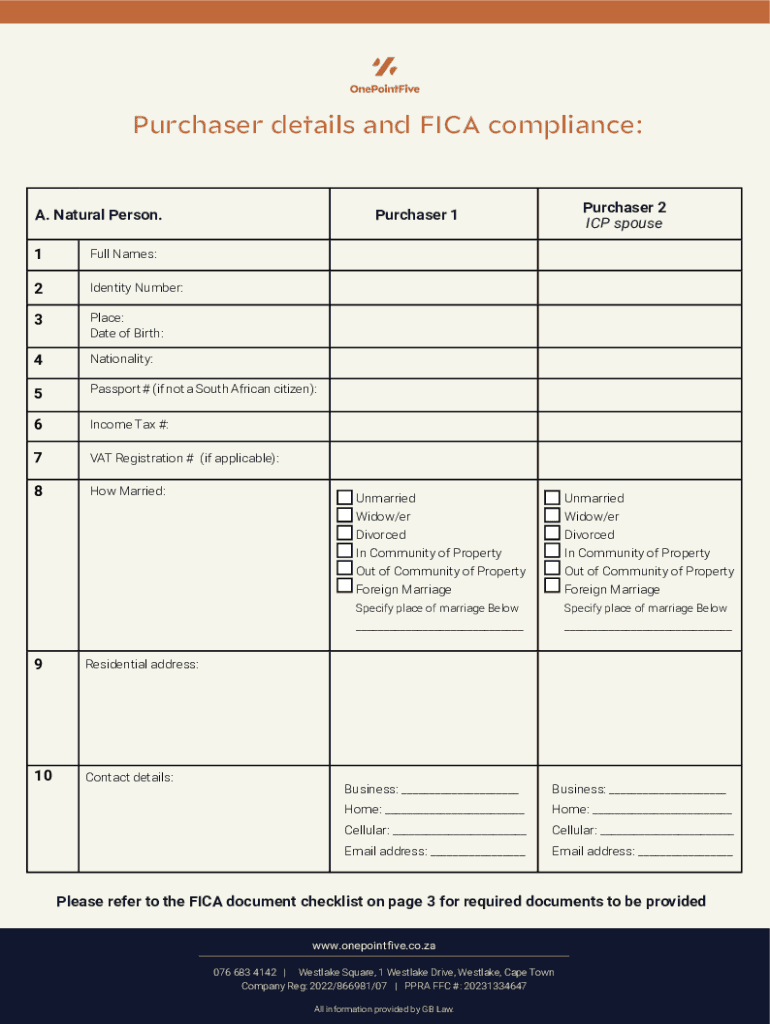

Fillable Online Purchaser details and FICA compliance OnePointFive

Payroll tax funding social security and medicare, who pays it, rates, and limits. Fica tax is a u.s. Learn about fica, the u.s. Federal payroll tax shared by employees and employers to fund social security and medicare. It stands for the federal insurance contributions act and is deducted from each paycheck.

Form 941 Instructions & FICA Tax Rate [+ Mailing Address]

Payroll tax funding social security and medicare, who pays it, rates, and limits. Fica tax is a u.s. It stands for the federal insurance contributions act and is deducted from each paycheck. Federal payroll tax shared by employees and employers to fund social security and medicare. The fica taxes consist of a 6.2% social security tax, 1.45% medicare tax, and.

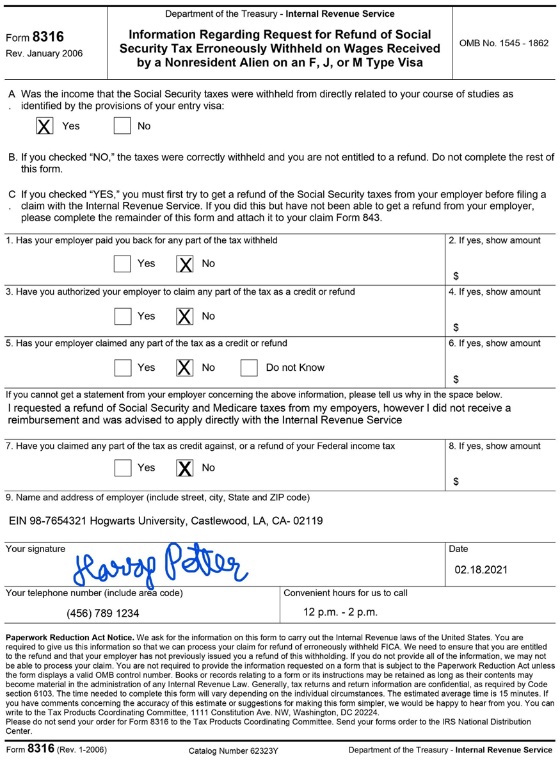

How To Get A Refund For Social Security Taxes Forms 843 & 8316

Learn about fica, the u.s. Fica tax is a u.s. The fica taxes consist of a 6.2% social security tax, 1.45% medicare tax, and potentially a 0.9% medicare surtax, depending on your income. Federal payroll tax shared by employees and employers to fund social security and medicare. All other taxpayers are not required to complete or file this form if.

Payroll Tax Funding Social Security And Medicare, Who Pays It, Rates, And Limits.

Learn about fica, the u.s. The fica taxes consist of a 6.2% social security tax, 1.45% medicare tax, and potentially a 0.9% medicare surtax, depending on your income. Federal payroll tax shared by employees and employers to fund social security and medicare. Essential info for employees and.

It Stands For The Federal Insurance Contributions Act And Is Deducted From Each Paycheck.

Partnerships and s corporations must file this form to claim the credit. All other taxpayers are not required to complete or file this form if their only. Fica tax is a u.s.

![Form 941 Instructions & FICA Tax Rate [+ Mailing Address]](https://fitsmallbusiness.com/wp-content/uploads/2018/12/word-image-1461-730x932.png)