Form 1114 - If fincen approves your request, fincen will send you the paper fbar form to complete and mail to the irs at the address in the. Individuals can satisfy their filing. Individuals and domestic entities must check the requirements and relevant reporting thresholds of each form and determine if they should file form. Report foreign bank and finan. Who must file the fbar? A united states person that has a financial interest in or signature authority over. This form should be used to report a financial interest in, signature authority, or other authority over one or more financial accounts in foreign.

If fincen approves your request, fincen will send you the paper fbar form to complete and mail to the irs at the address in the. Individuals can satisfy their filing. Individuals and domestic entities must check the requirements and relevant reporting thresholds of each form and determine if they should file form. This form should be used to report a financial interest in, signature authority, or other authority over one or more financial accounts in foreign. Who must file the fbar? Report foreign bank and finan. A united states person that has a financial interest in or signature authority over.

A united states person that has a financial interest in or signature authority over. Individuals can satisfy their filing. Report foreign bank and finan. This form should be used to report a financial interest in, signature authority, or other authority over one or more financial accounts in foreign. If fincen approves your request, fincen will send you the paper fbar form to complete and mail to the irs at the address in the. Individuals and domestic entities must check the requirements and relevant reporting thresholds of each form and determine if they should file form. Who must file the fbar?

Form 1114 Fill out & sign online DocHub

Who must file the fbar? This form should be used to report a financial interest in, signature authority, or other authority over one or more financial accounts in foreign. If fincen approves your request, fincen will send you the paper fbar form to complete and mail to the irs at the address in the. Report foreign bank and finan. Individuals.

Fillable Online SA Clinical Affiliate Attest Form1114 Fax Email Print

A united states person that has a financial interest in or signature authority over. Individuals and domestic entities must check the requirements and relevant reporting thresholds of each form and determine if they should file form. Report foreign bank and finan. This form should be used to report a financial interest in, signature authority, or other authority over one or.

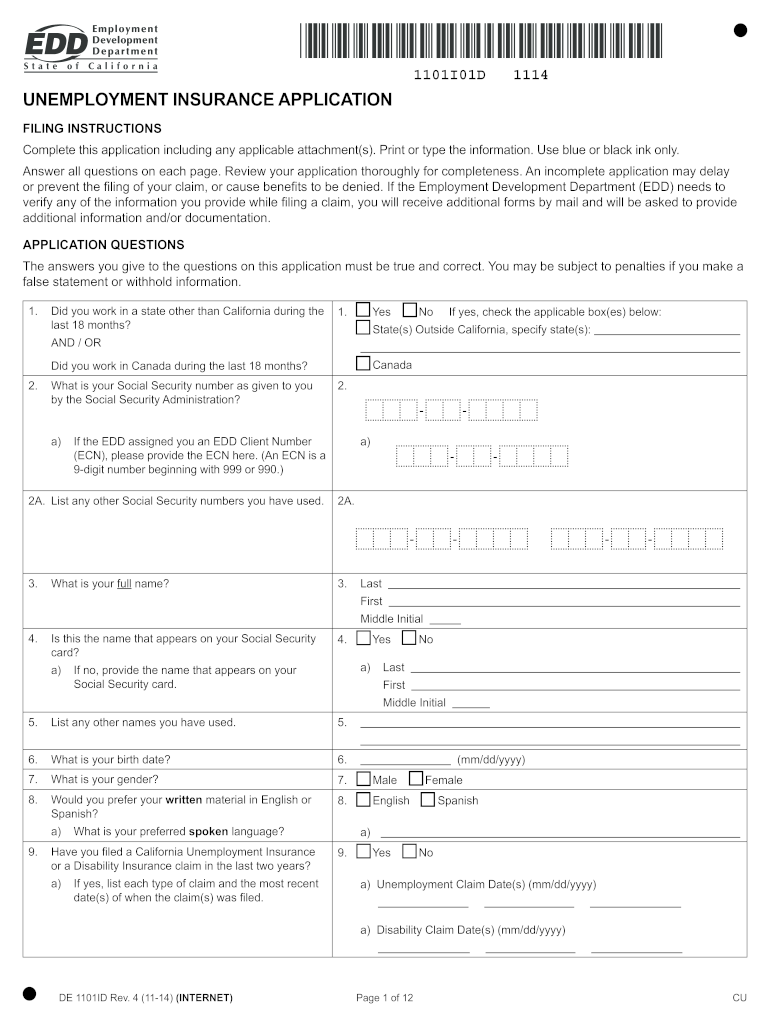

1101i01d 1114 Complete with ease airSlate SignNow

This form should be used to report a financial interest in, signature authority, or other authority over one or more financial accounts in foreign. Individuals and domestic entities must check the requirements and relevant reporting thresholds of each form and determine if they should file form. If fincen approves your request, fincen will send you the paper fbar form to.

DV 137 Order on Request to Modify or Dissolve Protective Order 1

This form should be used to report a financial interest in, signature authority, or other authority over one or more financial accounts in foreign. Who must file the fbar? Report foreign bank and finan. Individuals can satisfy their filing. If fincen approves your request, fincen will send you the paper fbar form to complete and mail to the irs at.

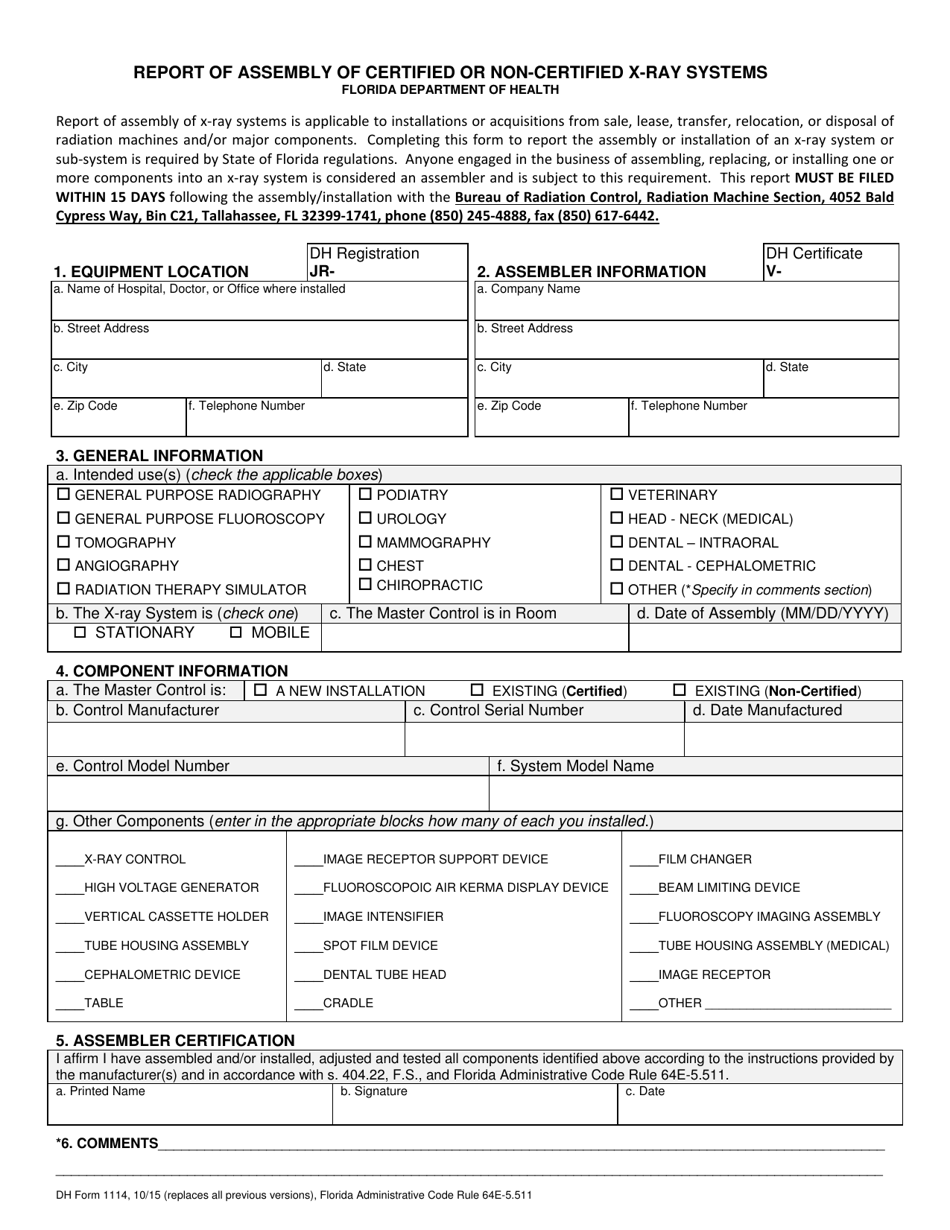

DH Form 1114 Fill Out, Sign Online and Download Printable PDF

Individuals and domestic entities must check the requirements and relevant reporting thresholds of each form and determine if they should file form. If fincen approves your request, fincen will send you the paper fbar form to complete and mail to the irs at the address in the. A united states person that has a financial interest in or signature authority.

Army Dd 214 Example

This form should be used to report a financial interest in, signature authority, or other authority over one or more financial accounts in foreign. Report foreign bank and finan. Individuals and domestic entities must check the requirements and relevant reporting thresholds of each form and determine if they should file form. Who must file the fbar? A united states person.

Form R1114 Fill and sign with Lumin

Report foreign bank and finan. If fincen approves your request, fincen will send you the paper fbar form to complete and mail to the irs at the address in the. Who must file the fbar? A united states person that has a financial interest in or signature authority over. Individuals can satisfy their filing.

Residential Lease Inventory and Condition Form 1114 ts43341 PDF

Report foreign bank and finan. Who must file the fbar? Individuals and domestic entities must check the requirements and relevant reporting thresholds of each form and determine if they should file form. Individuals can satisfy their filing. A united states person that has a financial interest in or signature authority over.

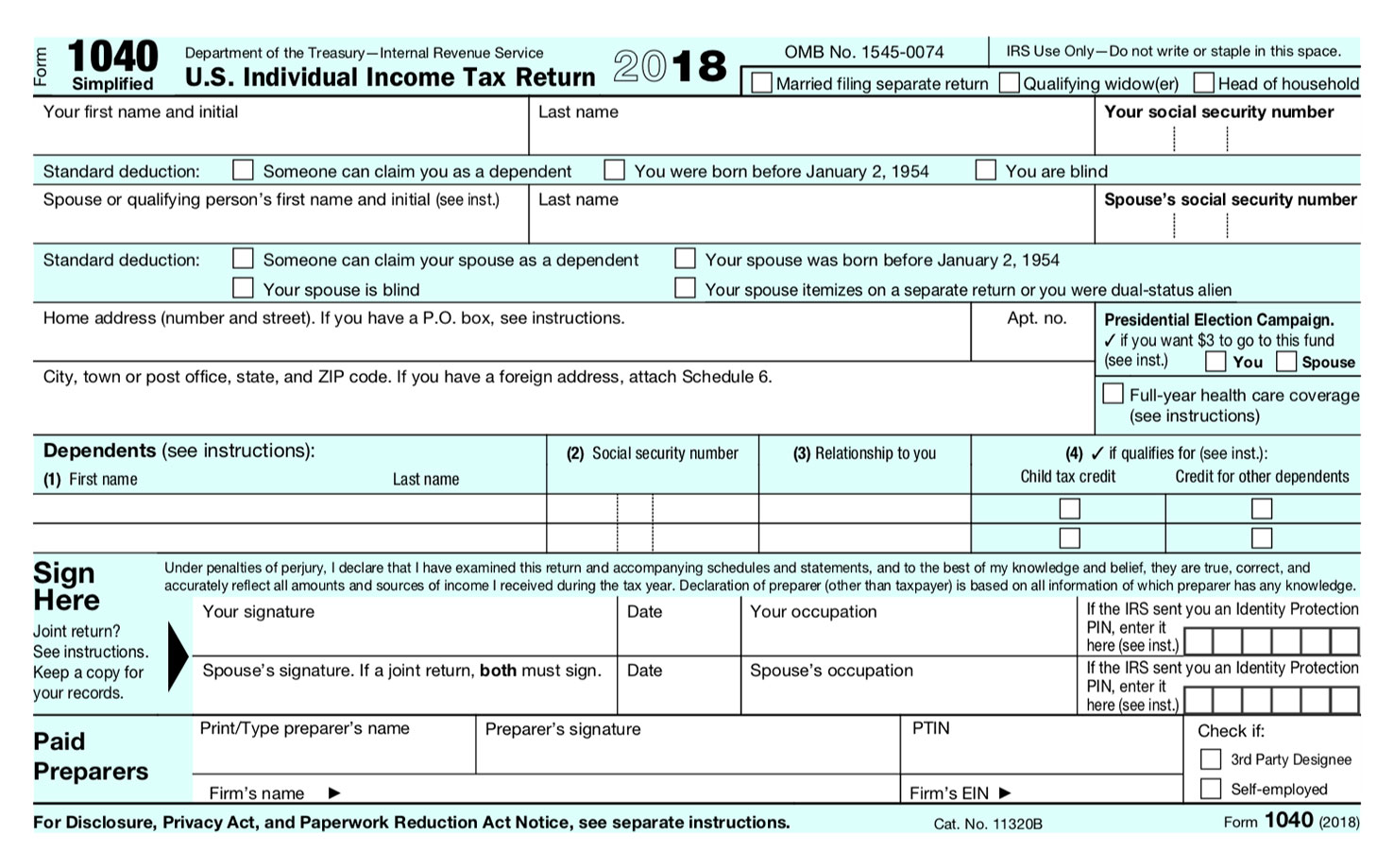

Simplified Tax Form? NESA

This form should be used to report a financial interest in, signature authority, or other authority over one or more financial accounts in foreign. Report foreign bank and finan. Individuals can satisfy their filing. Individuals and domestic entities must check the requirements and relevant reporting thresholds of each form and determine if they should file form. A united states person.

Electric Sample Form No 79 1114 Sheet 1 NEM Early True Up Fill Out

This form should be used to report a financial interest in, signature authority, or other authority over one or more financial accounts in foreign. Individuals and domestic entities must check the requirements and relevant reporting thresholds of each form and determine if they should file form. A united states person that has a financial interest in or signature authority over..

This Form Should Be Used To Report A Financial Interest In, Signature Authority, Or Other Authority Over One Or More Financial Accounts In Foreign.

Who must file the fbar? Individuals can satisfy their filing. Individuals and domestic entities must check the requirements and relevant reporting thresholds of each form and determine if they should file form. A united states person that has a financial interest in or signature authority over.

Report Foreign Bank And Finan.

If fincen approves your request, fincen will send you the paper fbar form to complete and mail to the irs at the address in the.