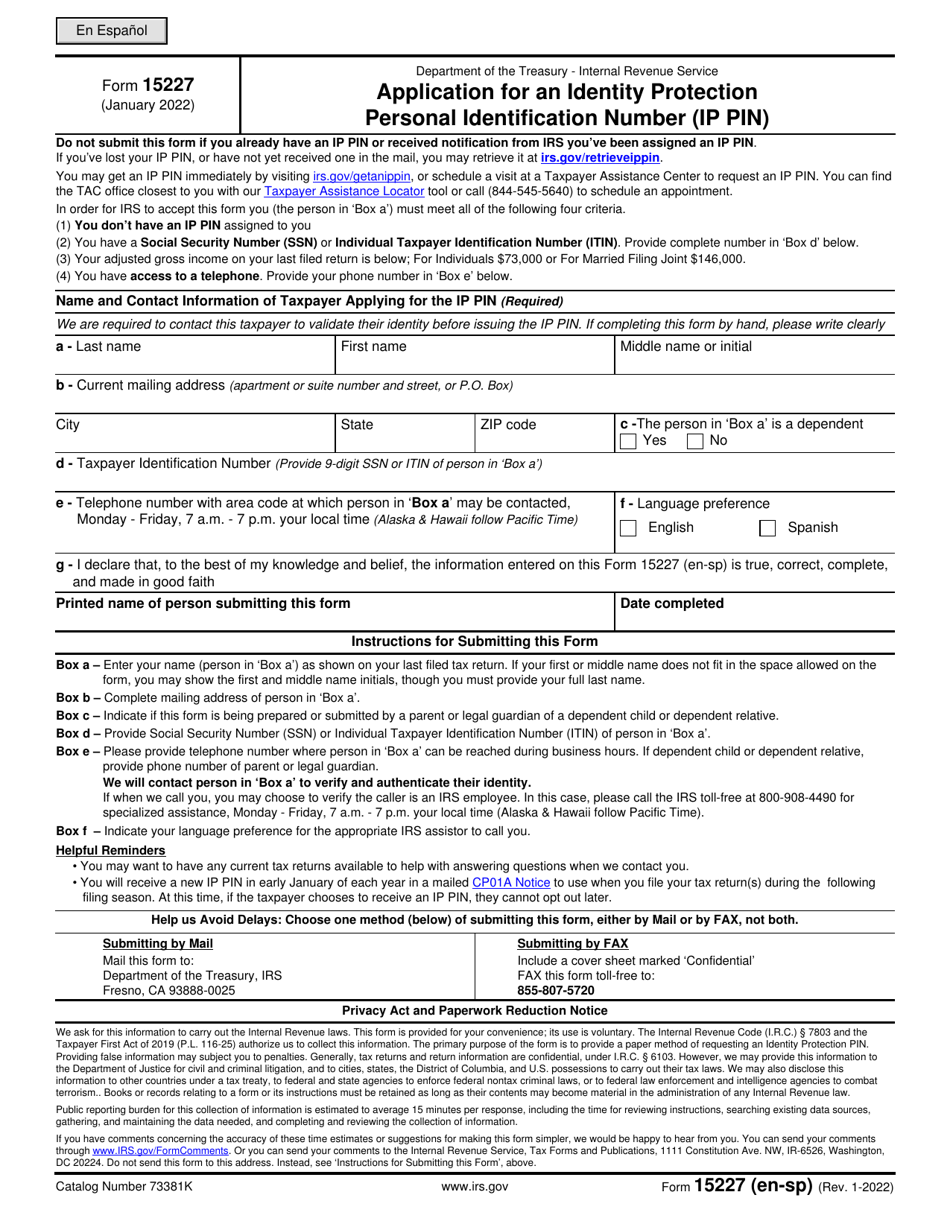

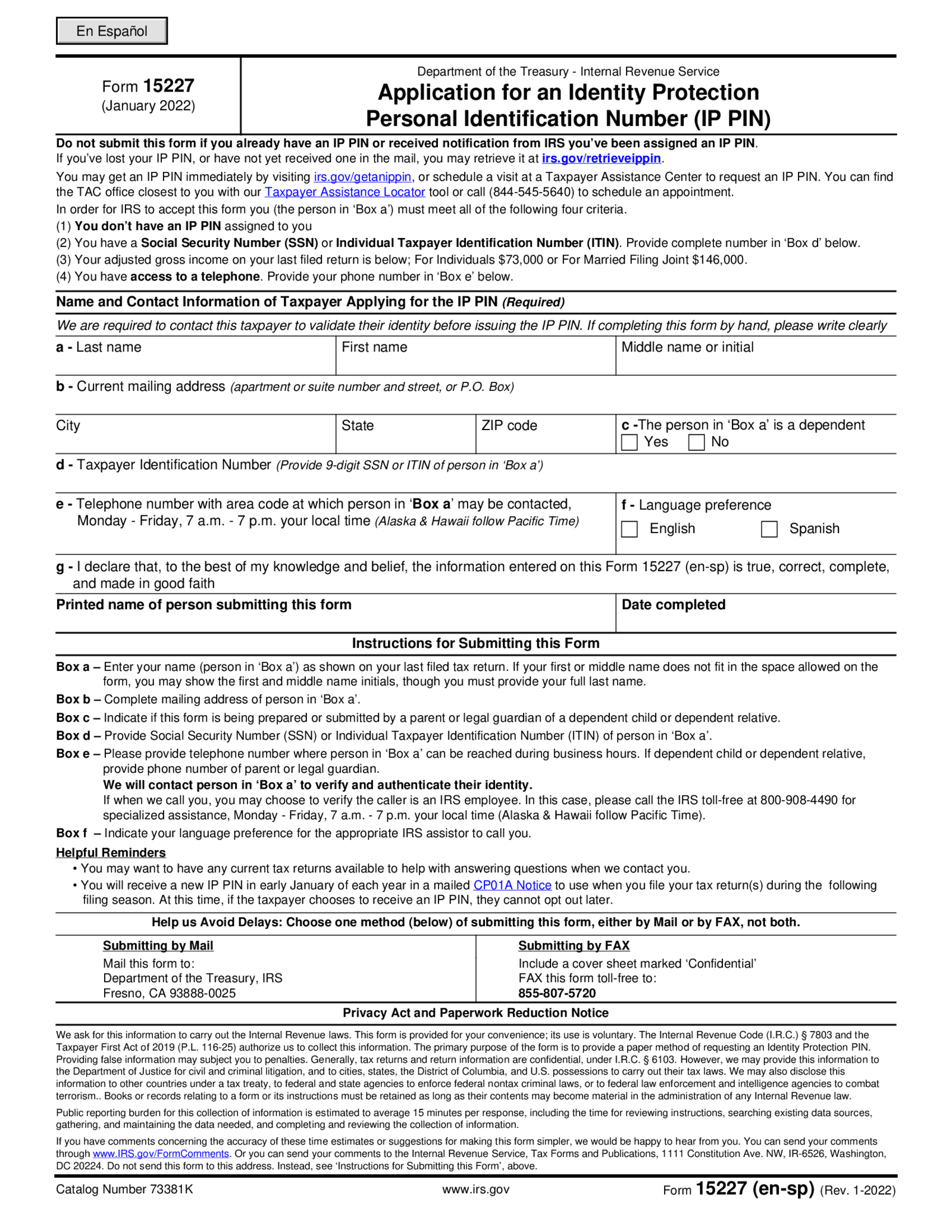

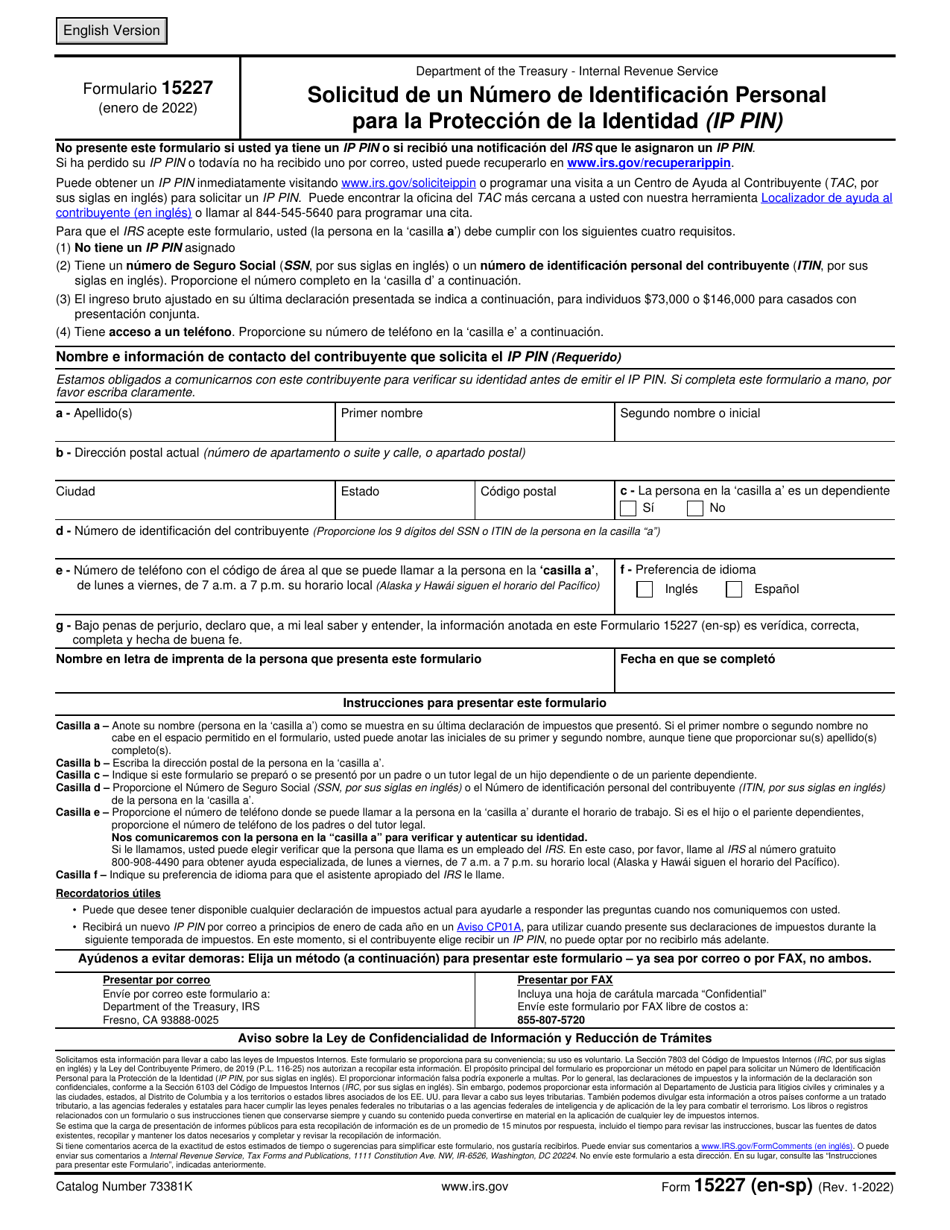

Form 15227 - Irs form 15227, application for an identity protection personal identification number (ip pin), is a formal document used by taxpayers to request. Understand how certain separated taxpayers in community property states can request to be. Providing false information may subject you. Form 15227 is typically completed by individuals who have been victims of identity theft or who are at risk of it. This form is essential for obtaining an. The primary purpose of the form is to provide a paper method of requesting an identity protection pin. To lower the chances of a fraudulent return, victims of identity theft can participate in the irs identity protection pin program, known as the. What is form 15227 and how do you file it?

Form 15227 is typically completed by individuals who have been victims of identity theft or who are at risk of it. Providing false information may subject you. To lower the chances of a fraudulent return, victims of identity theft can participate in the irs identity protection pin program, known as the. The primary purpose of the form is to provide a paper method of requesting an identity protection pin. What is form 15227 and how do you file it? Irs form 15227, application for an identity protection personal identification number (ip pin), is a formal document used by taxpayers to request. Understand how certain separated taxpayers in community property states can request to be. This form is essential for obtaining an.

Irs form 15227, application for an identity protection personal identification number (ip pin), is a formal document used by taxpayers to request. This form is essential for obtaining an. Providing false information may subject you. Understand how certain separated taxpayers in community property states can request to be. To lower the chances of a fraudulent return, victims of identity theft can participate in the irs identity protection pin program, known as the. Form 15227 is typically completed by individuals who have been victims of identity theft or who are at risk of it. The primary purpose of the form is to provide a paper method of requesting an identity protection pin. What is form 15227 and how do you file it?

Form 15227

This form is essential for obtaining an. The primary purpose of the form is to provide a paper method of requesting an identity protection pin. Providing false information may subject you. Understand how certain separated taxpayers in community property states can request to be. Form 15227 is typically completed by individuals who have been victims of identity theft or who.

How to Get Pin for Taxes Tax Calculator USA

Providing false information may subject you. This form is essential for obtaining an. Understand how certain separated taxpayers in community property states can request to be. The primary purpose of the form is to provide a paper method of requesting an identity protection pin. Form 15227 is typically completed by individuals who have been victims of identity theft or who.

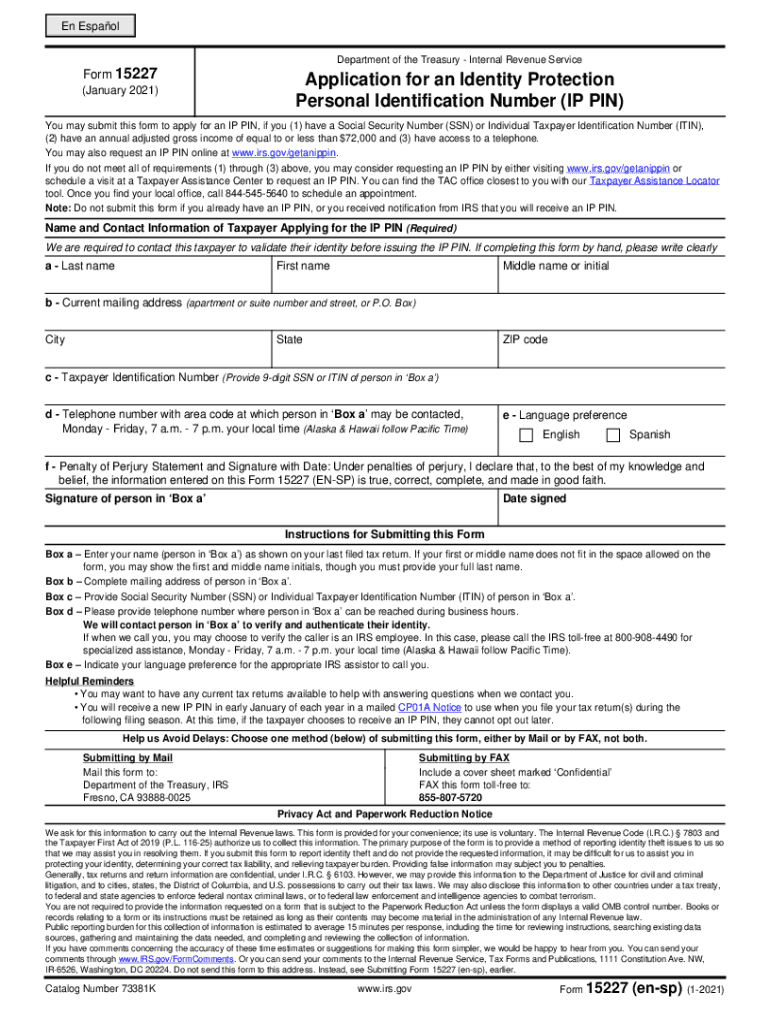

IRS Form 15227 Download Fillable PDF or Fill Online Application for an

Understand how certain separated taxpayers in community property states can request to be. Irs form 15227, application for an identity protection personal identification number (ip pin), is a formal document used by taxpayers to request. Providing false information may subject you. This form is essential for obtaining an. Form 15227 is typically completed by individuals who have been victims of.

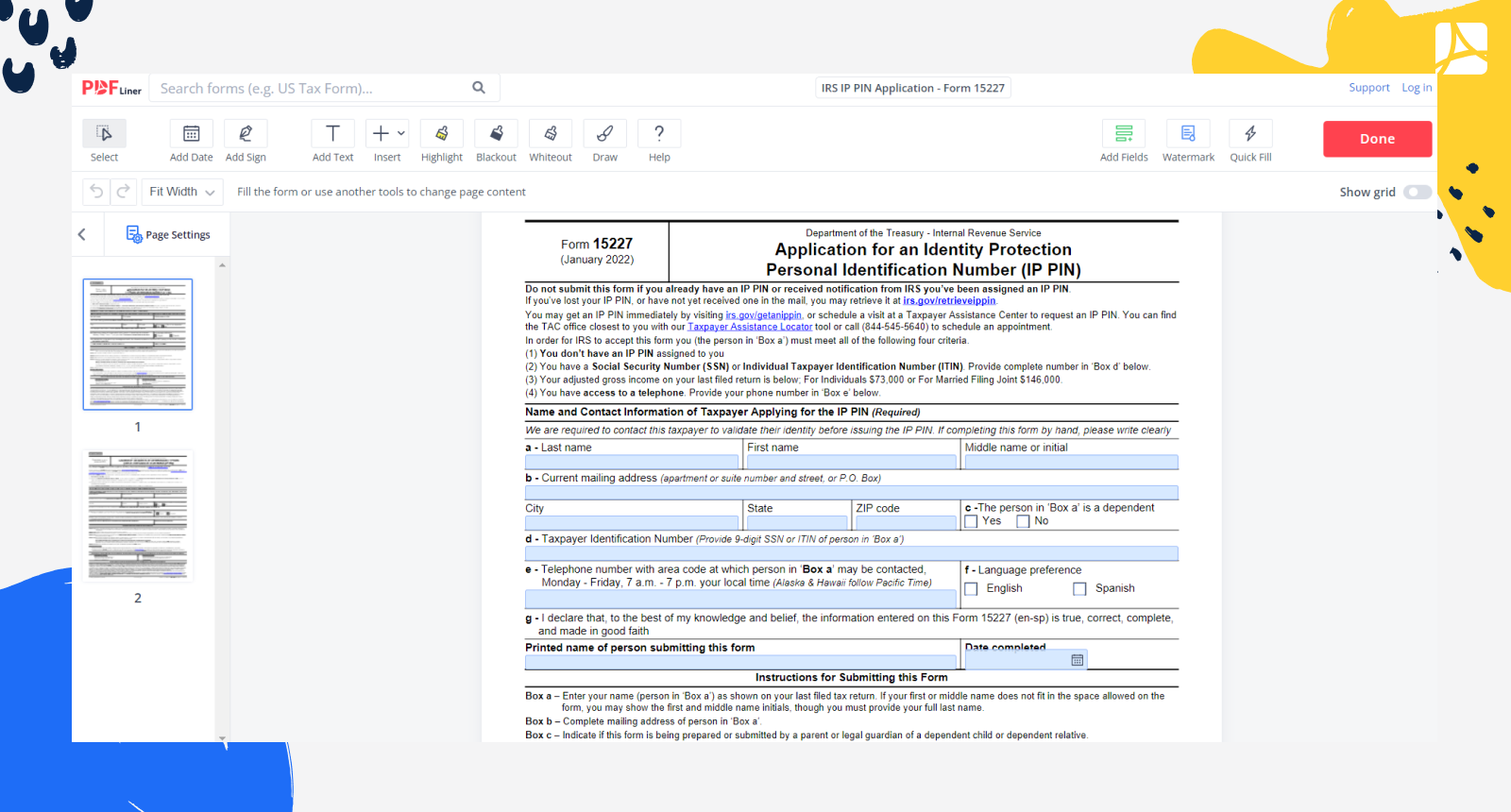

Form 15227, Fillable IRS IP PIN Application PDFliner

This form is essential for obtaining an. Irs form 15227, application for an identity protection personal identification number (ip pin), is a formal document used by taxpayers to request. Form 15227 is typically completed by individuals who have been victims of identity theft or who are at risk of it. Providing false information may subject you. The primary purpose of.

IRS Form 15227 Download Fillable PDF or Fill Online Application for an

Understand how certain separated taxpayers in community property states can request to be. The primary purpose of the form is to provide a paper method of requesting an identity protection pin. Providing false information may subject you. Irs form 15227, application for an identity protection personal identification number (ip pin), is a formal document used by taxpayers to request. What.

EN 152272020/prA12022 Railway applications Crashworthiness

What is form 15227 and how do you file it? Form 15227 is typically completed by individuals who have been victims of identity theft or who are at risk of it. To lower the chances of a fraudulent return, victims of identity theft can participate in the irs identity protection pin program, known as the. Irs form 15227, application for.

IRS Form 15227 walkthrough (Request for IP PIN) YouTube

The primary purpose of the form is to provide a paper method of requesting an identity protection pin. Form 15227 is typically completed by individuals who have been victims of identity theft or who are at risk of it. Providing false information may subject you. This form is essential for obtaining an. Understand how certain separated taxpayers in community property.

Form 15227, Fillable IRS IP PIN Application PDFliner

Form 15227 is typically completed by individuals who have been victims of identity theft or who are at risk of it. Irs form 15227, application for an identity protection personal identification number (ip pin), is a formal document used by taxpayers to request. Understand how certain separated taxpayers in community property states can request to be. This form is essential.

Form 15227 Ensp Papers Application Identity Stock Illustration

Understand how certain separated taxpayers in community property states can request to be. Irs form 15227, application for an identity protection personal identification number (ip pin), is a formal document used by taxpayers to request. Form 15227 is typically completed by individuals who have been victims of identity theft or who are at risk of it. The primary purpose of.

Form 15227 Fill and Sign Printable Template Online US Legal Forms

What is form 15227 and how do you file it? Understand how certain separated taxpayers in community property states can request to be. To lower the chances of a fraudulent return, victims of identity theft can participate in the irs identity protection pin program, known as the. The primary purpose of the form is to provide a paper method of.

What Is Form 15227 And How Do You File It?

Irs form 15227, application for an identity protection personal identification number (ip pin), is a formal document used by taxpayers to request. This form is essential for obtaining an. Providing false information may subject you. Form 15227 is typically completed by individuals who have been victims of identity theft or who are at risk of it.

Understand How Certain Separated Taxpayers In Community Property States Can Request To Be.

To lower the chances of a fraudulent return, victims of identity theft can participate in the irs identity protection pin program, known as the. The primary purpose of the form is to provide a paper method of requesting an identity protection pin.