Form 5471 Schedule P - Is the e&p listed on schedule j the amount since the company came into existence. In this situation, there is a gilti inclusion ($50,000) for more than the current. Us individual must file a 5471 for foreign corp a. Totally wrong assignment of category given the corp is not a cfc (but even if. Swapping the filer and corp tax years. On the form 5471, schedule j, for the e&p calculation. On the new schedule p for form 5471, it reports all of the previously taxed e&p. As long as us individual files the 5471, us corp a is not required to file with respect.

On the new schedule p for form 5471, it reports all of the previously taxed e&p. In this situation, there is a gilti inclusion ($50,000) for more than the current. Totally wrong assignment of category given the corp is not a cfc (but even if. Us individual must file a 5471 for foreign corp a. Swapping the filer and corp tax years. As long as us individual files the 5471, us corp a is not required to file with respect. Is the e&p listed on schedule j the amount since the company came into existence. On the form 5471, schedule j, for the e&p calculation.

Us individual must file a 5471 for foreign corp a. On the new schedule p for form 5471, it reports all of the previously taxed e&p. On the form 5471, schedule j, for the e&p calculation. In this situation, there is a gilti inclusion ($50,000) for more than the current. Is the e&p listed on schedule j the amount since the company came into existence. Totally wrong assignment of category given the corp is not a cfc (but even if. As long as us individual files the 5471, us corp a is not required to file with respect. Swapping the filer and corp tax years.

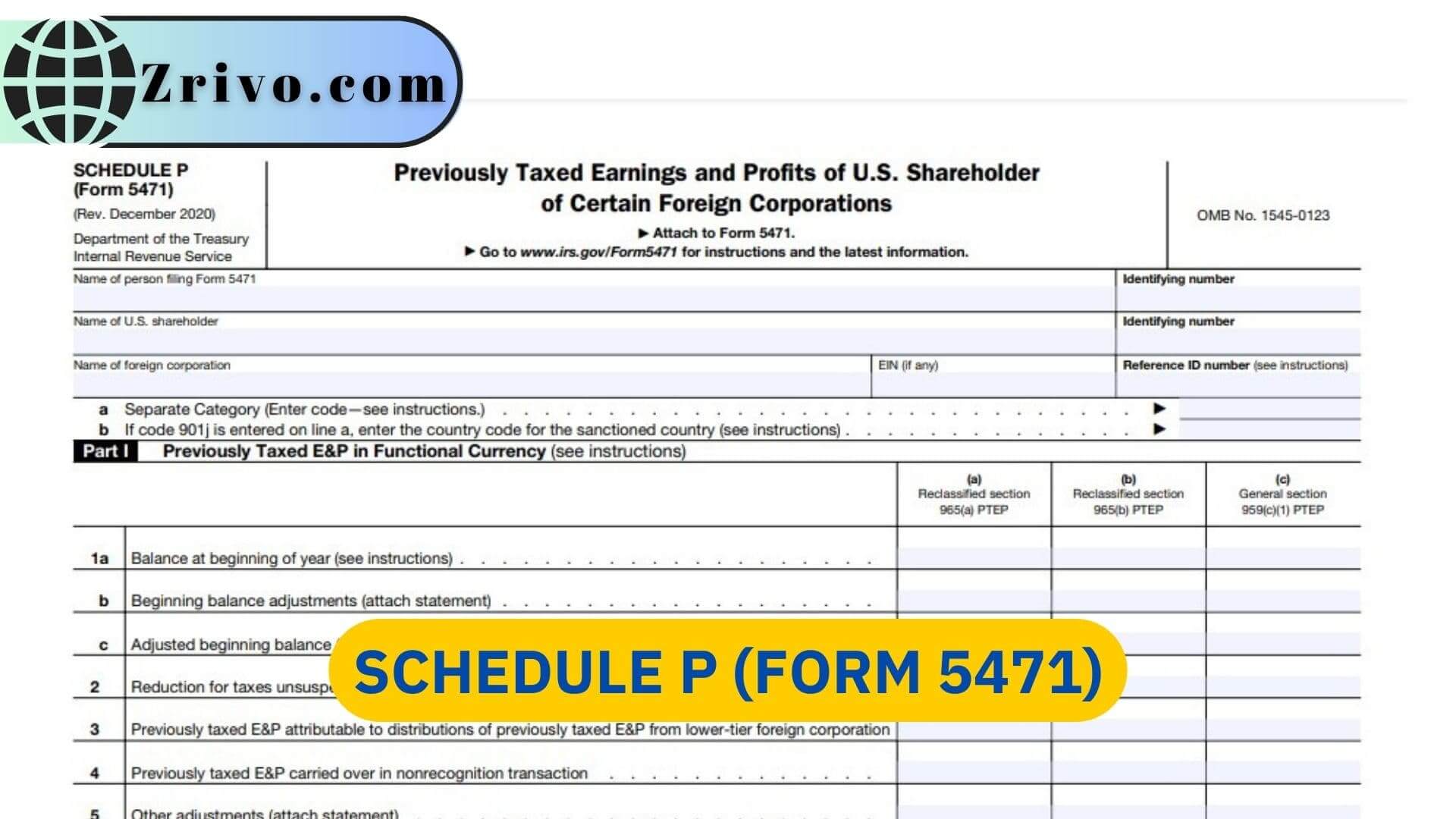

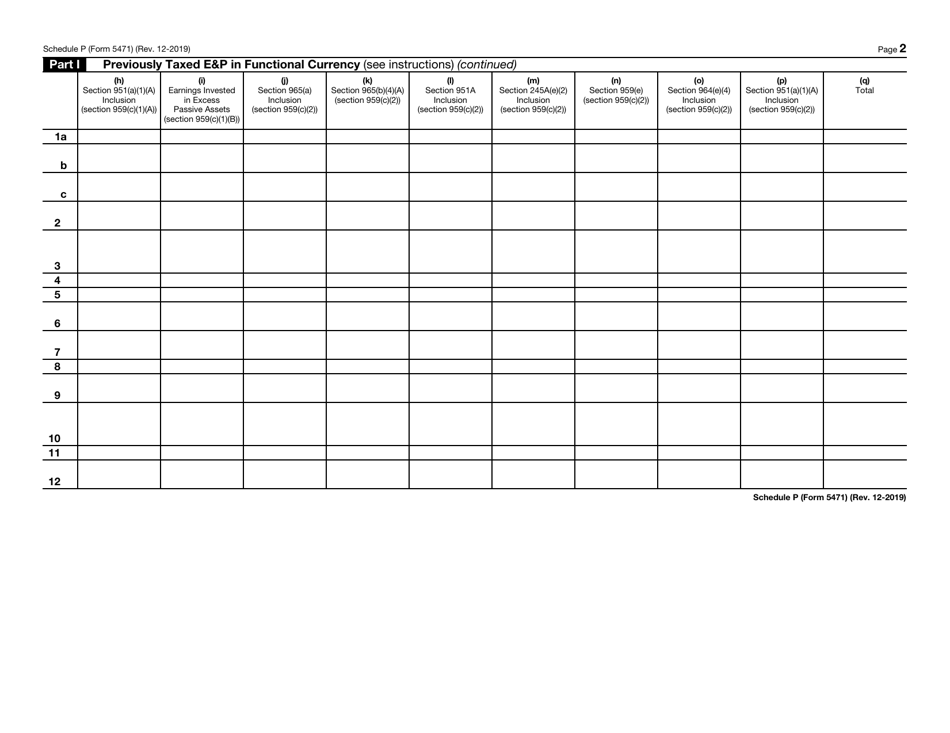

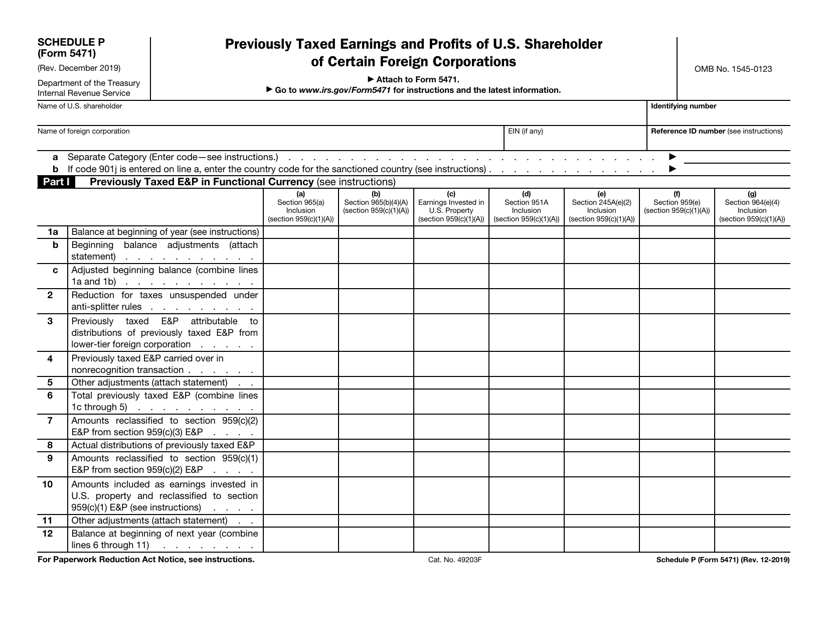

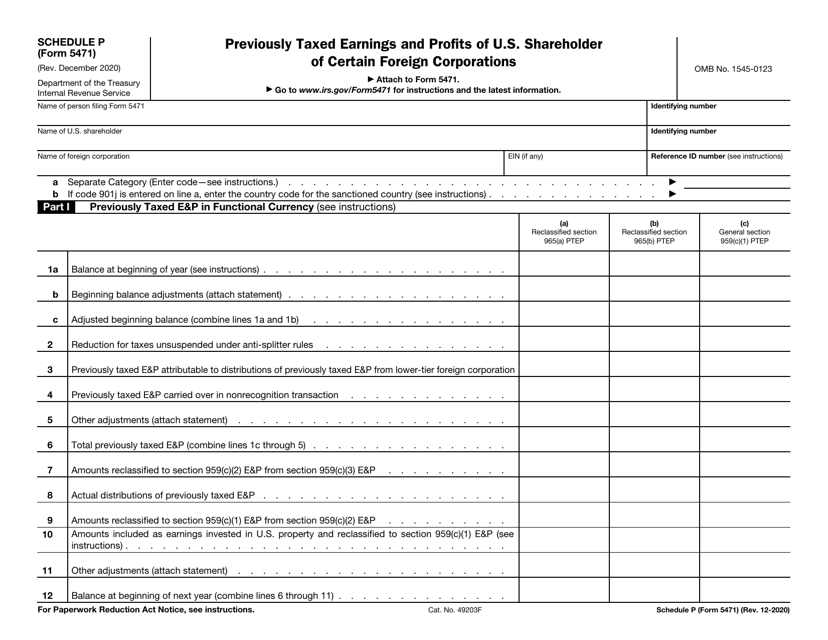

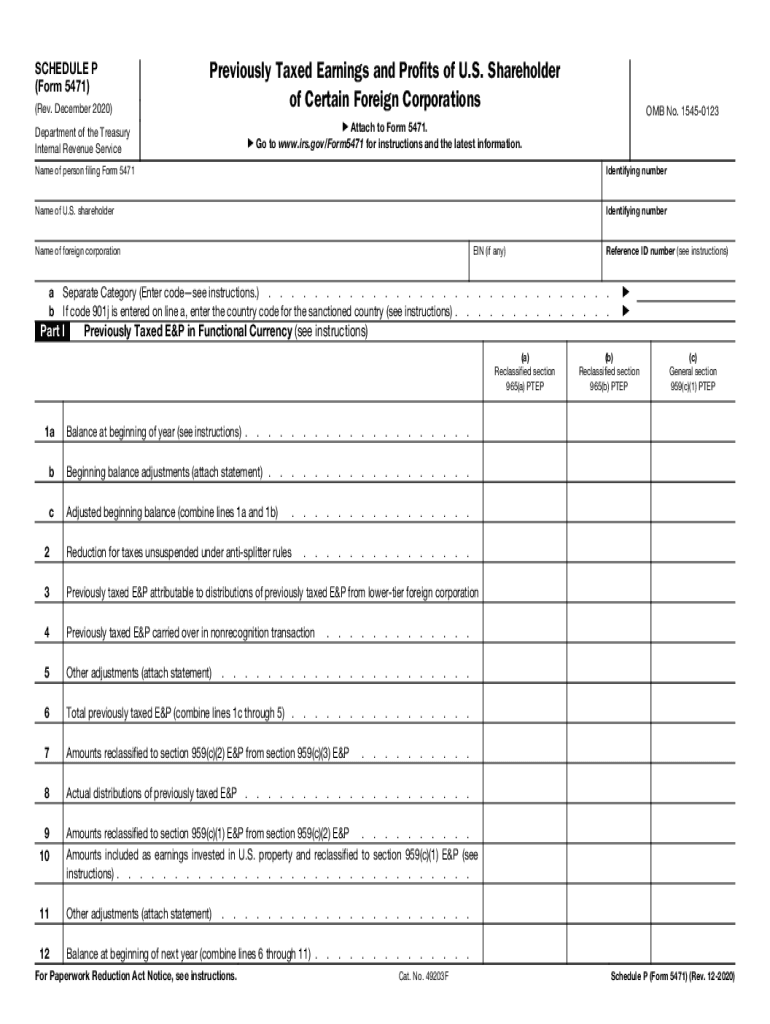

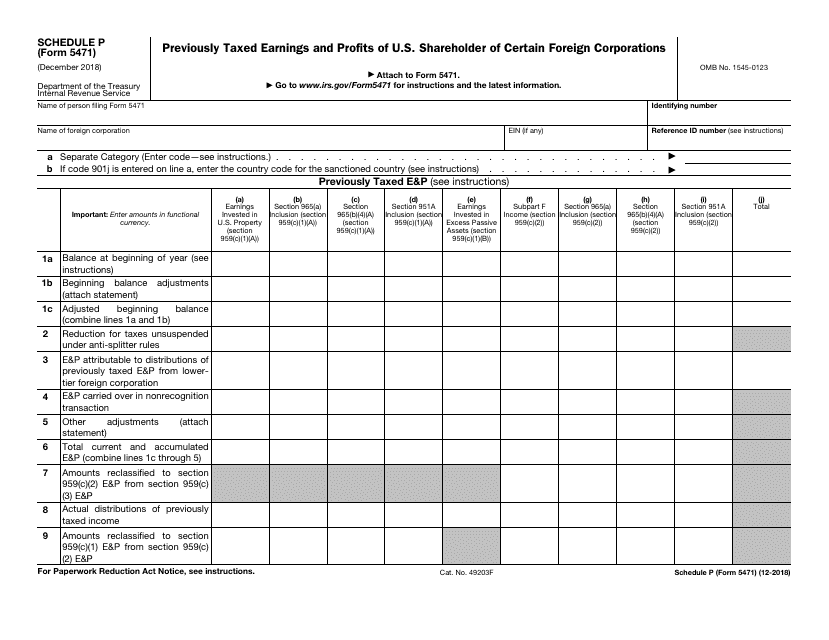

Schedule P Previously Taxed E&P of US Shareholder IRS Form 5471

As long as us individual files the 5471, us corp a is not required to file with respect. Us individual must file a 5471 for foreign corp a. In this situation, there is a gilti inclusion ($50,000) for more than the current. Totally wrong assignment of category given the corp is not a cfc (but even if. On the form.

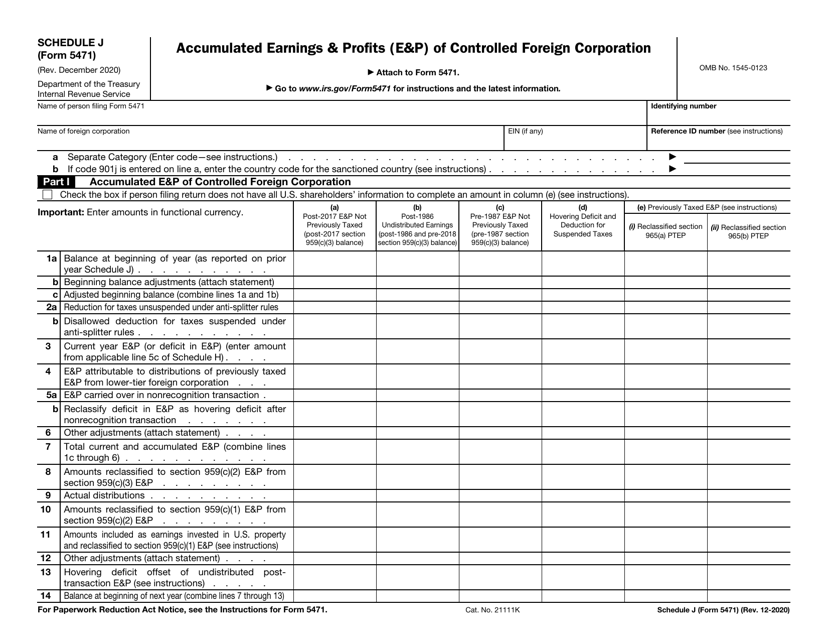

IRS Form 5471 Schedule J Download Fillable PDF or Fill Online

On the new schedule p for form 5471, it reports all of the previously taxed e&p. Is the e&p listed on schedule j the amount since the company came into existence. As long as us individual files the 5471, us corp a is not required to file with respect. Swapping the filer and corp tax years. On the form 5471,.

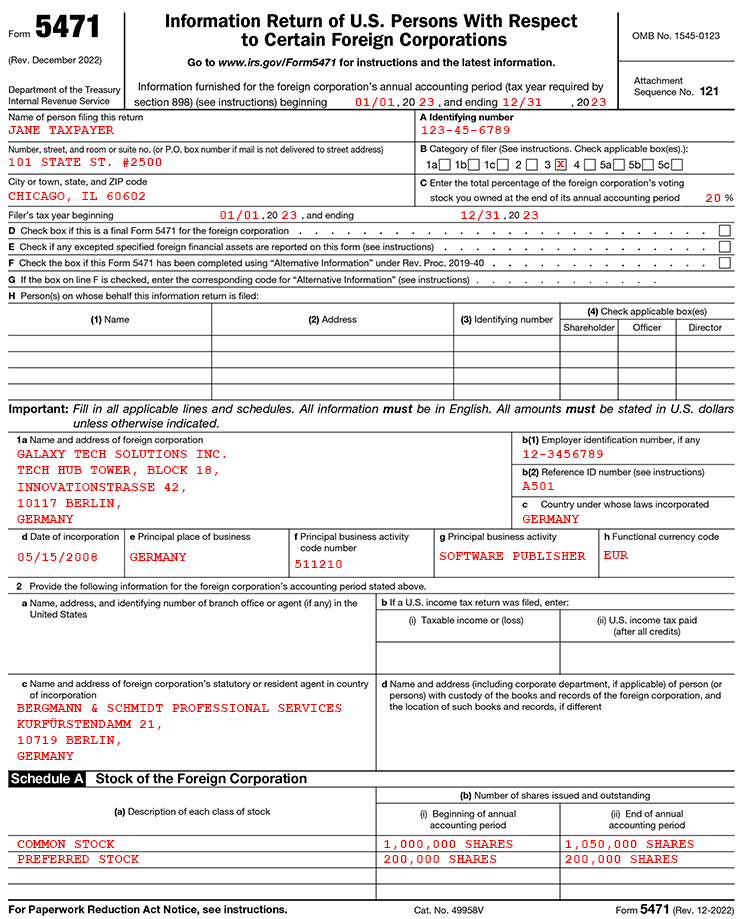

Form 5471 Overview Who, What, and How Gordon Law Group

Totally wrong assignment of category given the corp is not a cfc (but even if. As long as us individual files the 5471, us corp a is not required to file with respect. On the form 5471, schedule j, for the e&p calculation. On the new schedule p for form 5471, it reports all of the previously taxed e&p. In.

Form 5471 Everything you need to know

As long as us individual files the 5471, us corp a is not required to file with respect. On the new schedule p for form 5471, it reports all of the previously taxed e&p. Swapping the filer and corp tax years. In this situation, there is a gilti inclusion ($50,000) for more than the current. Us individual must file a.

Schedule P (Form 5471) 2024 2025

On the new schedule p for form 5471, it reports all of the previously taxed e&p. On the form 5471, schedule j, for the e&p calculation. Is the e&p listed on schedule j the amount since the company came into existence. Totally wrong assignment of category given the corp is not a cfc (but even if. In this situation, there.

IRS Form 5471 Schedule P Download Fillable PDF or Fill Online

Us individual must file a 5471 for foreign corp a. As long as us individual files the 5471, us corp a is not required to file with respect. Totally wrong assignment of category given the corp is not a cfc (but even if. On the form 5471, schedule j, for the e&p calculation. Is the e&p listed on schedule j.

IRS Form 5471 Schedule P Fill Out, Sign Online and Download Fillable

As long as us individual files the 5471, us corp a is not required to file with respect. Is the e&p listed on schedule j the amount since the company came into existence. In this situation, there is a gilti inclusion ($50,000) for more than the current. Us individual must file a 5471 for foreign corp a. Swapping the filer.

IRS Form 5471 Schedule P Download Fillable PDF or Fill Online

Is the e&p listed on schedule j the amount since the company came into existence. In this situation, there is a gilti inclusion ($50,000) for more than the current. Swapping the filer and corp tax years. Us individual must file a 5471 for foreign corp a. On the form 5471, schedule j, for the e&p calculation.

20202025 Form IRS 5471 Schedule P Fill Online, Printable, Fillable

Us individual must file a 5471 for foreign corp a. Swapping the filer and corp tax years. In this situation, there is a gilti inclusion ($50,000) for more than the current. Is the e&p listed on schedule j the amount since the company came into existence. On the form 5471, schedule j, for the e&p calculation.

IRS Form 5471 Schedule P Fill Out, Sign Online and Download Fillable

Us individual must file a 5471 for foreign corp a. Is the e&p listed on schedule j the amount since the company came into existence. Swapping the filer and corp tax years. Totally wrong assignment of category given the corp is not a cfc (but even if. On the form 5471, schedule j, for the e&p calculation.

In This Situation, There Is A Gilti Inclusion ($50,000) For More Than The Current.

On the form 5471, schedule j, for the e&p calculation. On the new schedule p for form 5471, it reports all of the previously taxed e&p. Is the e&p listed on schedule j the amount since the company came into existence. As long as us individual files the 5471, us corp a is not required to file with respect.

Totally Wrong Assignment Of Category Given The Corp Is Not A Cfc (But Even If.

Swapping the filer and corp tax years. Us individual must file a 5471 for foreign corp a.