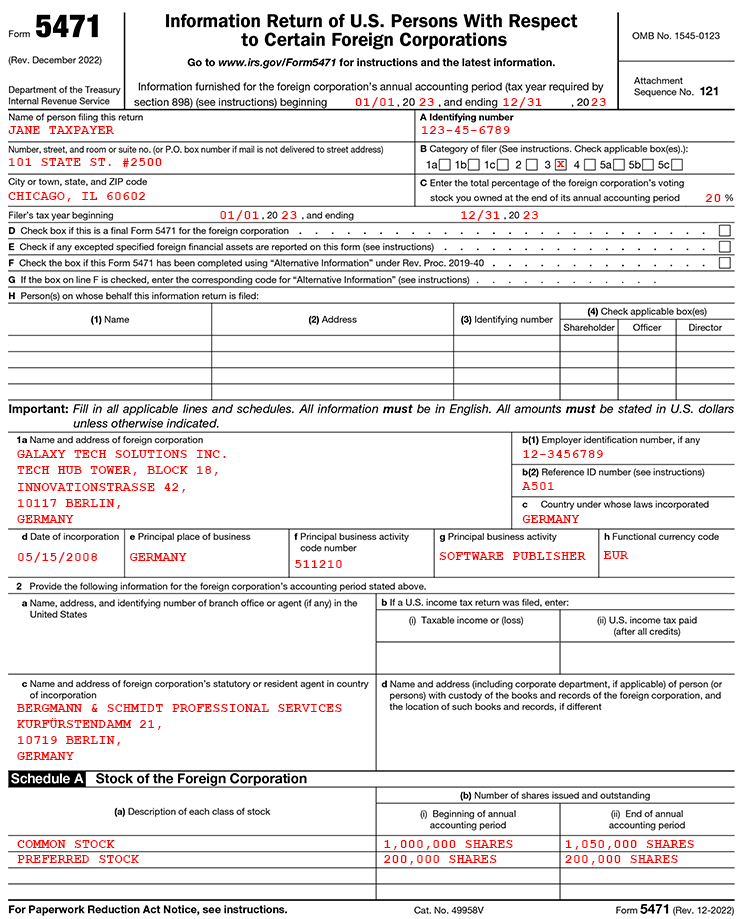

Form 5471 - This guide clarifies form 5471's. Rather, it gives the irs. This guide will break down the fundamentals of form 5471, provide clarity on its filing requirements, and explain how bloomberg. Understand your irs reporting obligations as a u.s. Persons with respect to certain foreign corporations, including recent. Information about form 5471, information return of u.s. Form 5471 is an information return rather than a tax return, which means it typically doesn’t affect how much tax you have to pay. Person with foreign corporate holdings. Generally, when a person files form 5471, the form can be filed as one form per corporation to include all the us shareholders on that form.

Information about form 5471, information return of u.s. Rather, it gives the irs. Persons with respect to certain foreign corporations, including recent. This guide will break down the fundamentals of form 5471, provide clarity on its filing requirements, and explain how bloomberg. This guide clarifies form 5471's. Generally, when a person files form 5471, the form can be filed as one form per corporation to include all the us shareholders on that form. Understand your irs reporting obligations as a u.s. Person with foreign corporate holdings. Form 5471 is an information return rather than a tax return, which means it typically doesn’t affect how much tax you have to pay.

Form 5471 is an information return rather than a tax return, which means it typically doesn’t affect how much tax you have to pay. Person with foreign corporate holdings. Persons with respect to certain foreign corporations, including recent. Rather, it gives the irs. This guide will break down the fundamentals of form 5471, provide clarity on its filing requirements, and explain how bloomberg. This guide clarifies form 5471's. Understand your irs reporting obligations as a u.s. Generally, when a person files form 5471, the form can be filed as one form per corporation to include all the us shareholders on that form. Information about form 5471, information return of u.s.

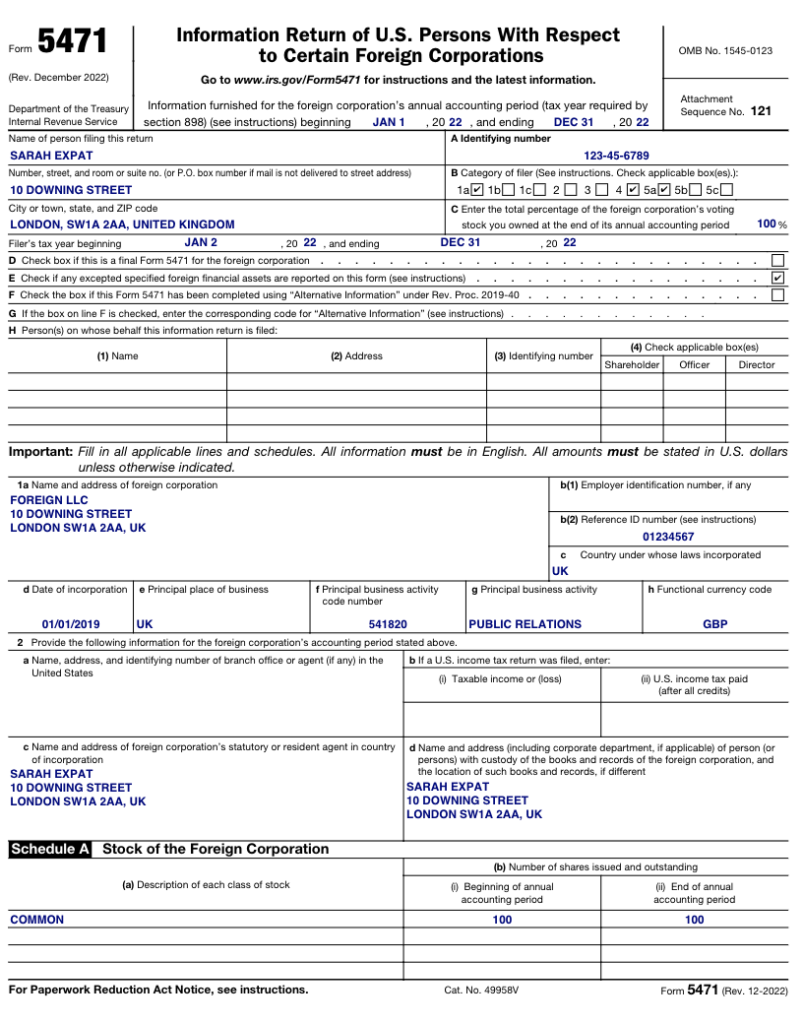

Form 5471 Filing Requirements with Your Expat Taxes

Generally, when a person files form 5471, the form can be filed as one form per corporation to include all the us shareholders on that form. Rather, it gives the irs. Information about form 5471, information return of u.s. Form 5471 is an information return rather than a tax return, which means it typically doesn’t affect how much tax you.

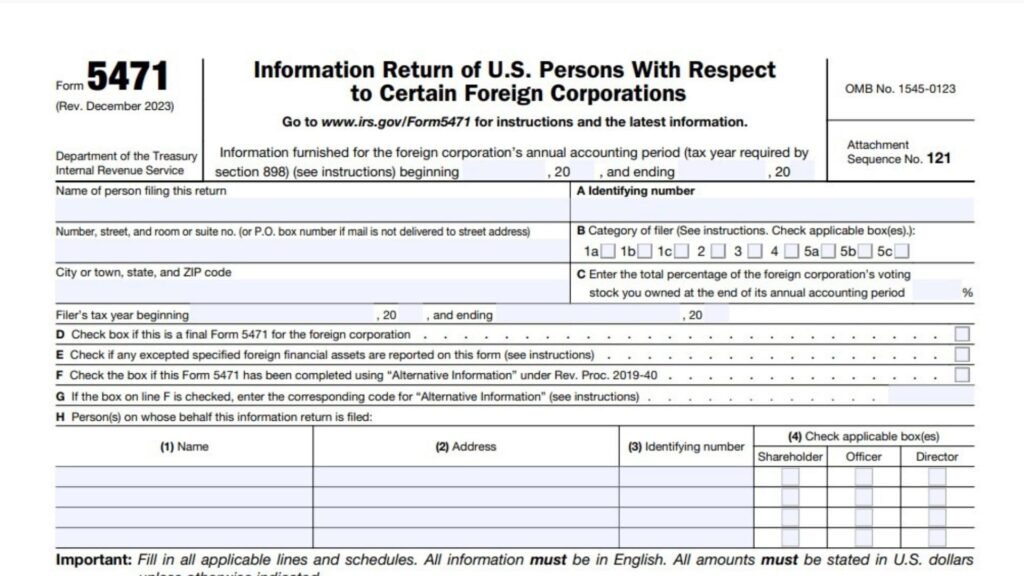

Form 5471 Instructions 2025 2026

Generally, when a person files form 5471, the form can be filed as one form per corporation to include all the us shareholders on that form. Persons with respect to certain foreign corporations, including recent. Rather, it gives the irs. Form 5471 is an information return rather than a tax return, which means it typically doesn’t affect how much tax.

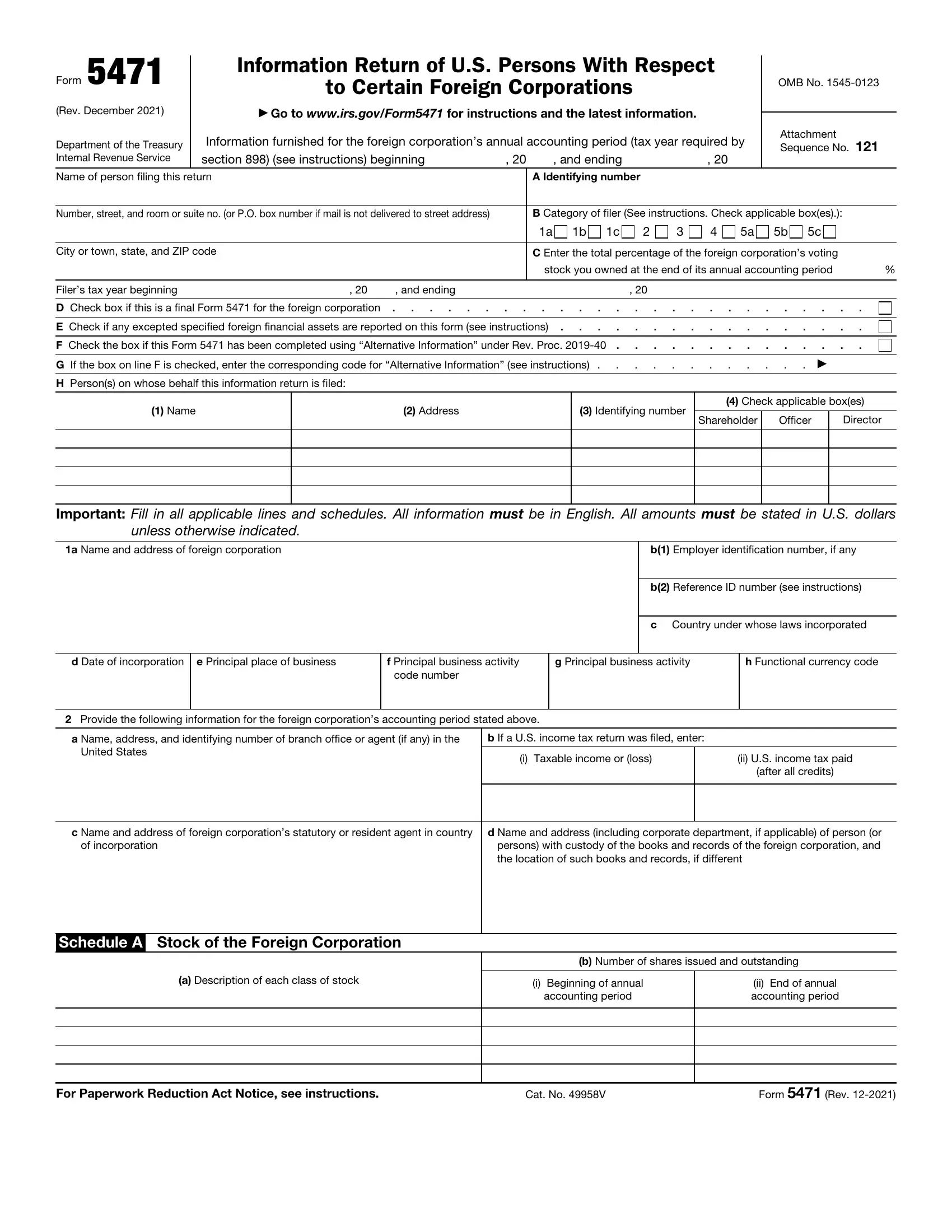

Form 5471 ≡ Fill Out Printable PDF Forms Online

Person with foreign corporate holdings. Generally, when a person files form 5471, the form can be filed as one form per corporation to include all the us shareholders on that form. Information about form 5471, information return of u.s. Rather, it gives the irs. Form 5471 is an information return rather than a tax return, which means it typically doesn’t.

Form 5471 Filing Requirements with Your Expat Taxes

Generally, when a person files form 5471, the form can be filed as one form per corporation to include all the us shareholders on that form. Person with foreign corporate holdings. Form 5471 is an information return rather than a tax return, which means it typically doesn’t affect how much tax you have to pay. Rather, it gives the irs..

FORM 5471 TOP 6 REPORTING CHALLENGES Expat Tax Professionals

Rather, it gives the irs. Generally, when a person files form 5471, the form can be filed as one form per corporation to include all the us shareholders on that form. Person with foreign corporate holdings. Form 5471 is an information return rather than a tax return, which means it typically doesn’t affect how much tax you have to pay..

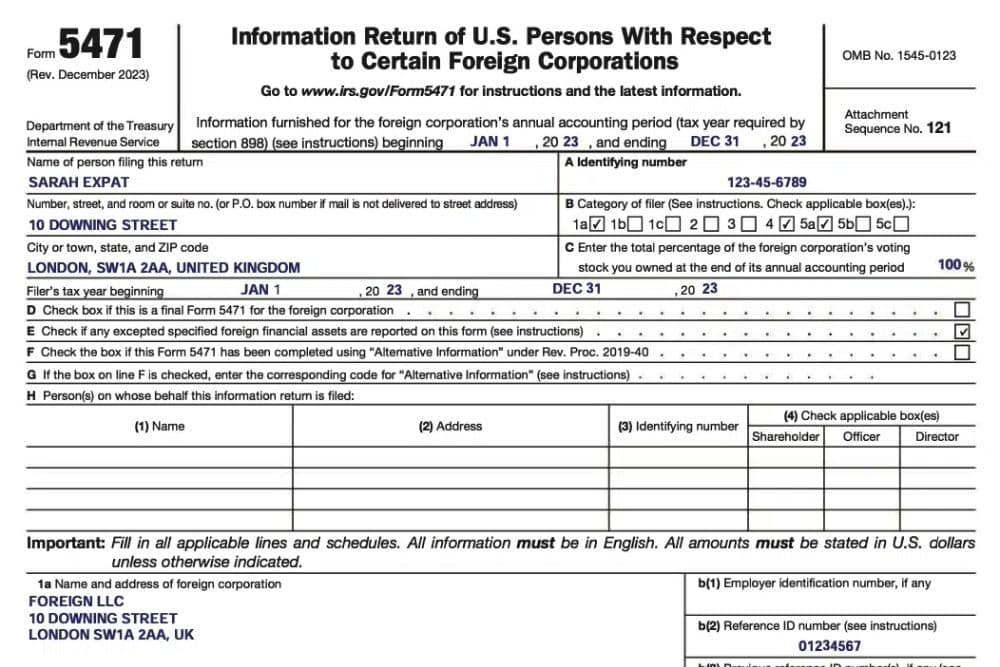

Form 5471 2024 2025

Form 5471 is an information return rather than a tax return, which means it typically doesn’t affect how much tax you have to pay. Persons with respect to certain foreign corporations, including recent. Rather, it gives the irs. This guide clarifies form 5471's. This guide will break down the fundamentals of form 5471, provide clarity on its filing requirements, and.

Substantial Compliance Form 5471 HTJ Tax

Form 5471 is an information return rather than a tax return, which means it typically doesn’t affect how much tax you have to pay. Persons with respect to certain foreign corporations, including recent. Rather, it gives the irs. Information about form 5471, information return of u.s. Generally, when a person files form 5471, the form can be filed as one.

Form 5471 Filing Requirements with Your Expat Taxes

Persons with respect to certain foreign corporations, including recent. Rather, it gives the irs. Form 5471 is an information return rather than a tax return, which means it typically doesn’t affect how much tax you have to pay. Person with foreign corporate holdings. Understand your irs reporting obligations as a u.s.

Form 5471 2023 2024

Persons with respect to certain foreign corporations, including recent. This guide clarifies form 5471's. Person with foreign corporate holdings. Information about form 5471, information return of u.s. Form 5471 is an information return rather than a tax return, which means it typically doesn’t affect how much tax you have to pay.

Form 5471 Overview Who, What, and How Gordon Law Group Experienced

Information about form 5471, information return of u.s. Understand your irs reporting obligations as a u.s. Persons with respect to certain foreign corporations, including recent. Person with foreign corporate holdings. This guide clarifies form 5471's.

Generally, When A Person Files Form 5471, The Form Can Be Filed As One Form Per Corporation To Include All The Us Shareholders On That Form.

Information about form 5471, information return of u.s. This guide clarifies form 5471's. Understand your irs reporting obligations as a u.s. Persons with respect to certain foreign corporations, including recent.

Form 5471 Is An Information Return Rather Than A Tax Return, Which Means It Typically Doesn’t Affect How Much Tax You Have To Pay.

Person with foreign corporate holdings. Rather, it gives the irs. This guide will break down the fundamentals of form 5471, provide clarity on its filing requirements, and explain how bloomberg.