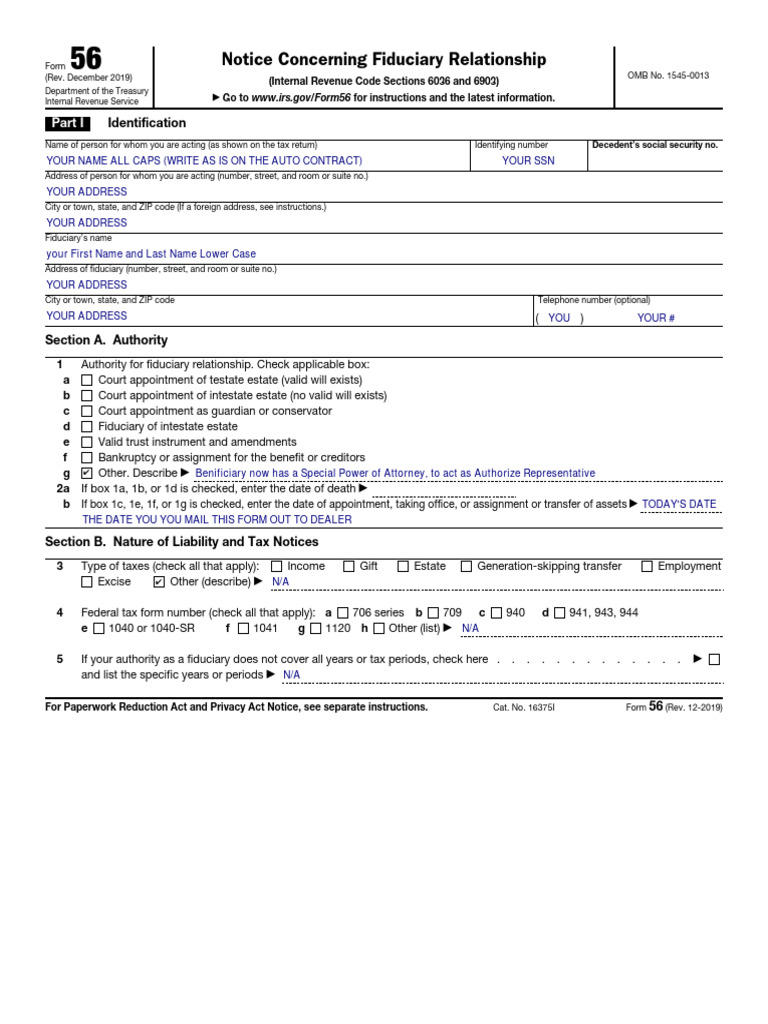

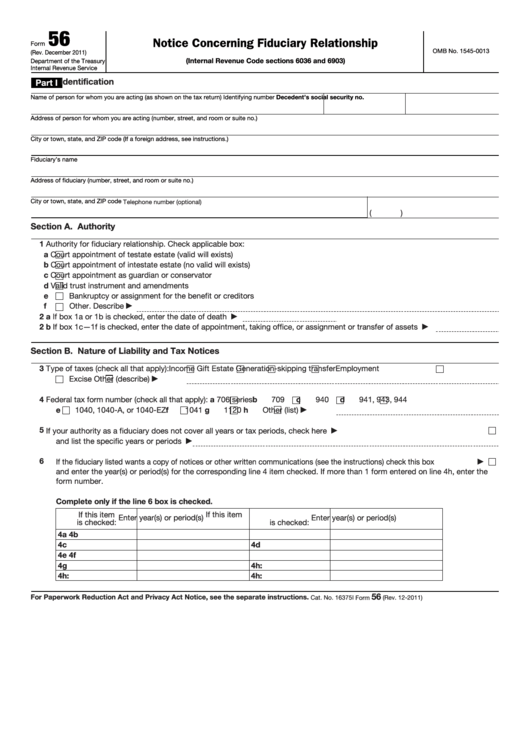

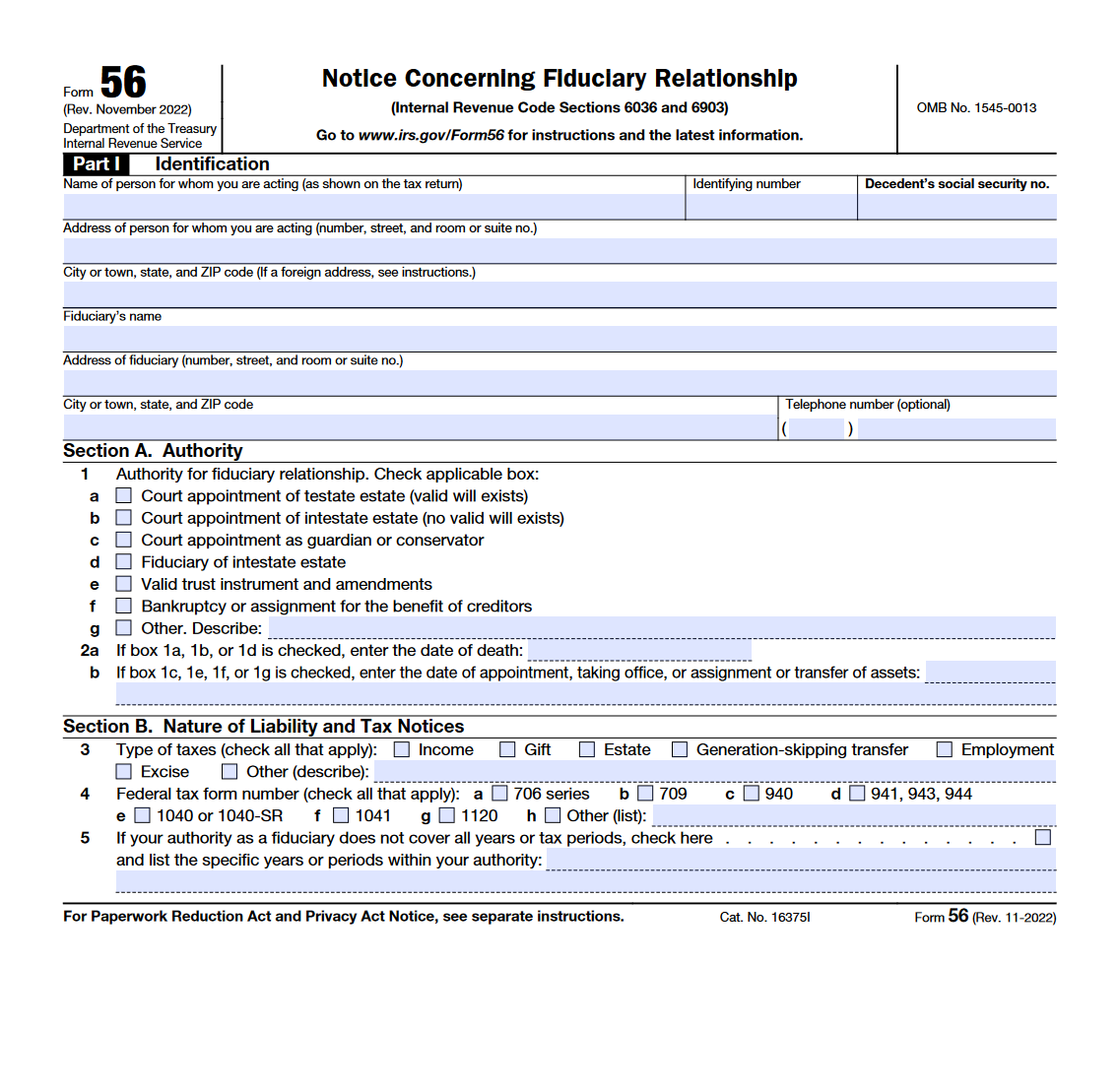

Form 56 - Generally, you should file form 56 when you create (or terminate) a fiduciary relationship. You haven't mentioned form where you are transferring the money. In international wire transfer to a small. However, they're also asking for the fractional form of the routing number, which is not provided by my bank, and which i can't look up on a check. How do i fill out irs form 1310, as a successor trustee? Reissue a check from the irs? Ask question asked 6 years, 3 months ago.

How do i fill out irs form 1310, as a successor trustee? However, they're also asking for the fractional form of the routing number, which is not provided by my bank, and which i can't look up on a check. You haven't mentioned form where you are transferring the money. In international wire transfer to a small. Reissue a check from the irs? Generally, you should file form 56 when you create (or terminate) a fiduciary relationship. Ask question asked 6 years, 3 months ago.

Reissue a check from the irs? How do i fill out irs form 1310, as a successor trustee? However, they're also asking for the fractional form of the routing number, which is not provided by my bank, and which i can't look up on a check. Generally, you should file form 56 when you create (or terminate) a fiduciary relationship. You haven't mentioned form where you are transferring the money. Ask question asked 6 years, 3 months ago. In international wire transfer to a small.

Calaméo IRS Form 56 Treasury

Reissue a check from the irs? Generally, you should file form 56 when you create (or terminate) a fiduciary relationship. Ask question asked 6 years, 3 months ago. In international wire transfer to a small. You haven't mentioned form where you are transferring the money.

Notice Concerning Fiduciary Relationship at viamakaiblog Blog

How do i fill out irs form 1310, as a successor trustee? Ask question asked 6 years, 3 months ago. In international wire transfer to a small. You haven't mentioned form where you are transferring the money. However, they're also asking for the fractional form of the routing number, which is not provided by my bank, and which i can't.

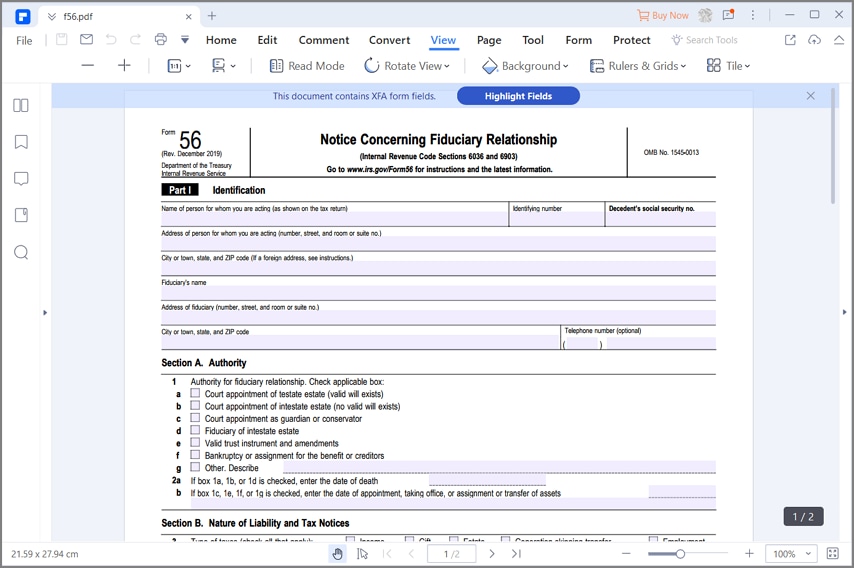

IRS Form 56 Instructions IRS Notice of Fiduciary Relationship

How do i fill out irs form 1310, as a successor trustee? Ask question asked 6 years, 3 months ago. In international wire transfer to a small. However, they're also asking for the fractional form of the routing number, which is not provided by my bank, and which i can't look up on a check. Reissue a check from the.

Form 56 Sample Fillout PDF Taxes Fiduciary

In international wire transfer to a small. However, they're also asking for the fractional form of the routing number, which is not provided by my bank, and which i can't look up on a check. Ask question asked 6 years, 3 months ago. You haven't mentioned form where you are transferring the money. Reissue a check from the irs?

Fillable Form 56 Notice Concerning Fiduciary Relationship printable

Generally, you should file form 56 when you create (or terminate) a fiduciary relationship. In international wire transfer to a small. However, they're also asking for the fractional form of the routing number, which is not provided by my bank, and which i can't look up on a check. Ask question asked 6 years, 3 months ago. Reissue a check.

Formulario 56 del IRS complétalo con la mejor herramienta para rellen

Ask question asked 6 years, 3 months ago. How do i fill out irs form 1310, as a successor trustee? However, they're also asking for the fractional form of the routing number, which is not provided by my bank, and which i can't look up on a check. In international wire transfer to a small. You haven't mentioned form where.

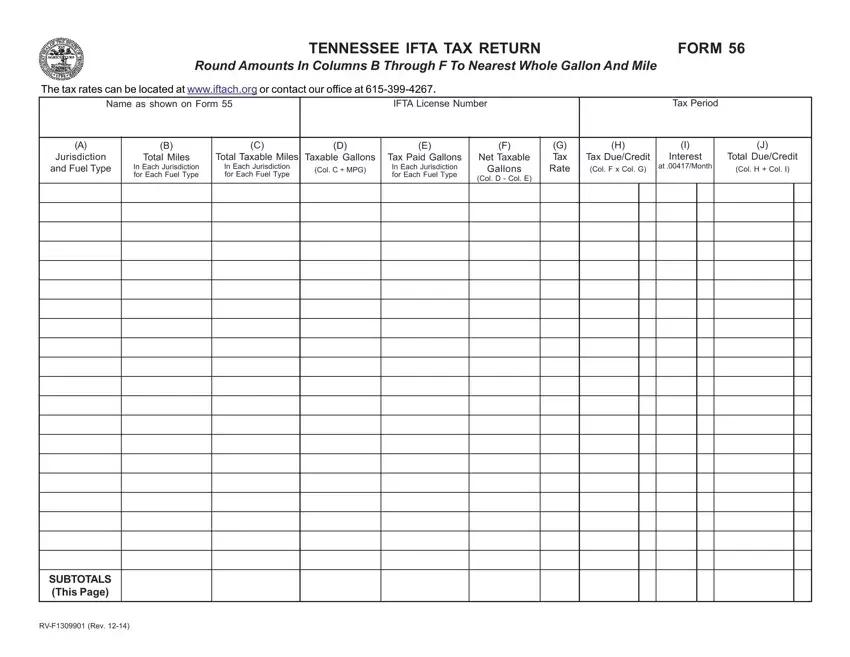

Tn Ifta Form 56 ≡ Fill Out Printable PDF Forms Online

Generally, you should file form 56 when you create (or terminate) a fiduciary relationship. How do i fill out irs form 1310, as a successor trustee? You haven't mentioned form where you are transferring the money. However, they're also asking for the fractional form of the routing number, which is not provided by my bank, and which i can't look.

Form 56 instructions Fill out & sign online DocHub

How do i fill out irs form 1310, as a successor trustee? Generally, you should file form 56 when you create (or terminate) a fiduciary relationship. You haven't mentioned form where you are transferring the money. Ask question asked 6 years, 3 months ago. However, they're also asking for the fractional form of the routing number, which is not provided.

IRS Form 56. Notice Concerning Fiduciary Relationship Forms Docs 2023

In international wire transfer to a small. However, they're also asking for the fractional form of the routing number, which is not provided by my bank, and which i can't look up on a check. You haven't mentioned form where you are transferring the money. Ask question asked 6 years, 3 months ago. Reissue a check from the irs?

Form 56F Notice Concerning Fiduciary Relationship of Financial

Generally, you should file form 56 when you create (or terminate) a fiduciary relationship. Reissue a check from the irs? In international wire transfer to a small. Ask question asked 6 years, 3 months ago. How do i fill out irs form 1310, as a successor trustee?

How Do I Fill Out Irs Form 1310, As A Successor Trustee?

You haven't mentioned form where you are transferring the money. Reissue a check from the irs? In international wire transfer to a small. Ask question asked 6 years, 3 months ago.

However, They're Also Asking For The Fractional Form Of The Routing Number, Which Is Not Provided By My Bank, And Which I Can't Look Up On A Check.

Generally, you should file form 56 when you create (or terminate) a fiduciary relationship.