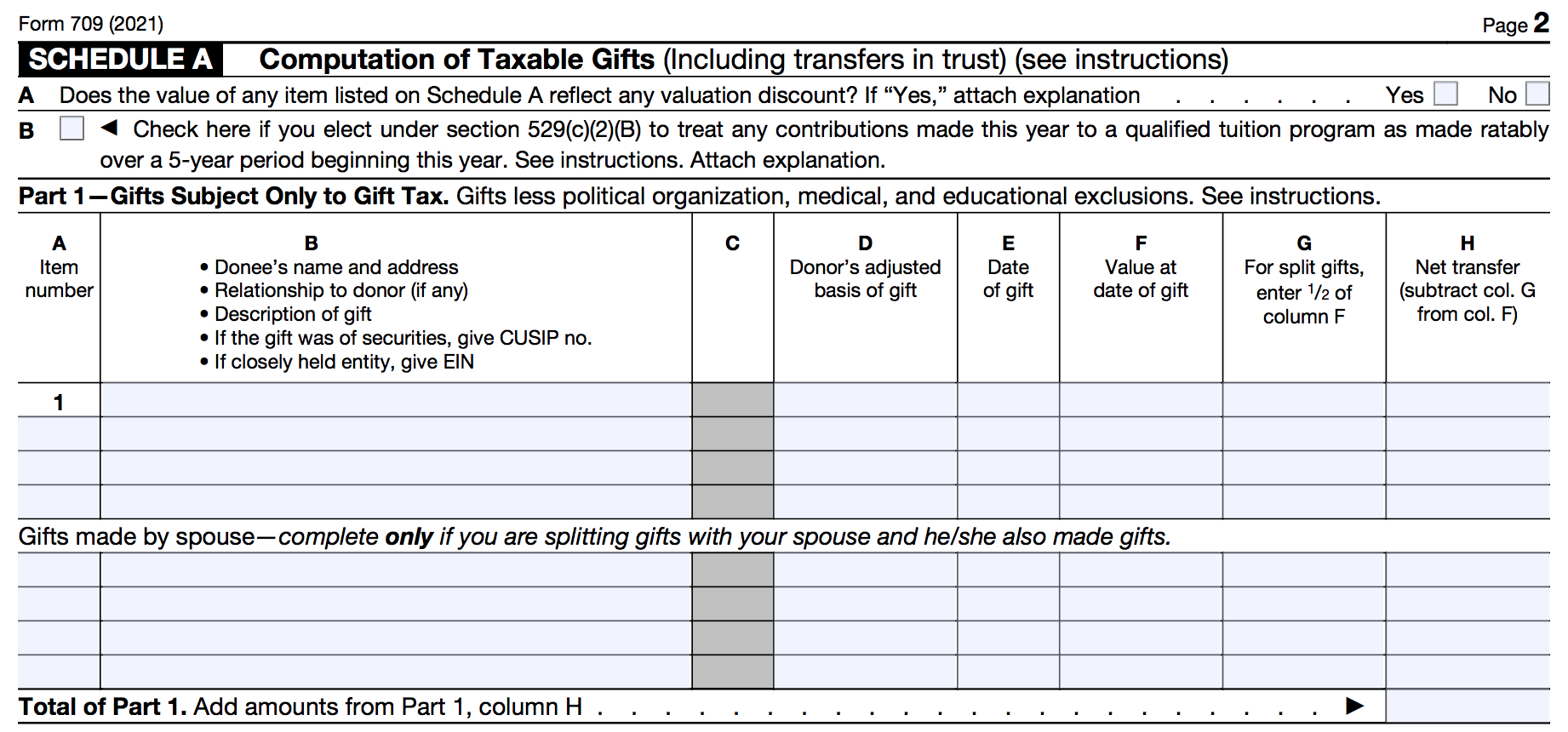

Form 709 - If you made substantial gifts this year, you may need to fill out form 709. Form 709 is used to report gifts you give that exceed the annual gift tax exclusion, which is $18,000 per person for 2025. For couples splitting gifts, if either spouse makes a gift that exceeds the couple’s combined annual gift tax exclusion, or if each. With the irs closely monitoring gifts that exceed annual exclusion limits, you need to understand when and how to file form 709. This guide breaks down the steps for reporting gift taxes and how to.

This guide breaks down the steps for reporting gift taxes and how to. If you made substantial gifts this year, you may need to fill out form 709. With the irs closely monitoring gifts that exceed annual exclusion limits, you need to understand when and how to file form 709. Form 709 is used to report gifts you give that exceed the annual gift tax exclusion, which is $18,000 per person for 2025. For couples splitting gifts, if either spouse makes a gift that exceeds the couple’s combined annual gift tax exclusion, or if each.

Form 709 is used to report gifts you give that exceed the annual gift tax exclusion, which is $18,000 per person for 2025. This guide breaks down the steps for reporting gift taxes and how to. For couples splitting gifts, if either spouse makes a gift that exceeds the couple’s combined annual gift tax exclusion, or if each. If you made substantial gifts this year, you may need to fill out form 709. With the irs closely monitoring gifts that exceed annual exclusion limits, you need to understand when and how to file form 709.

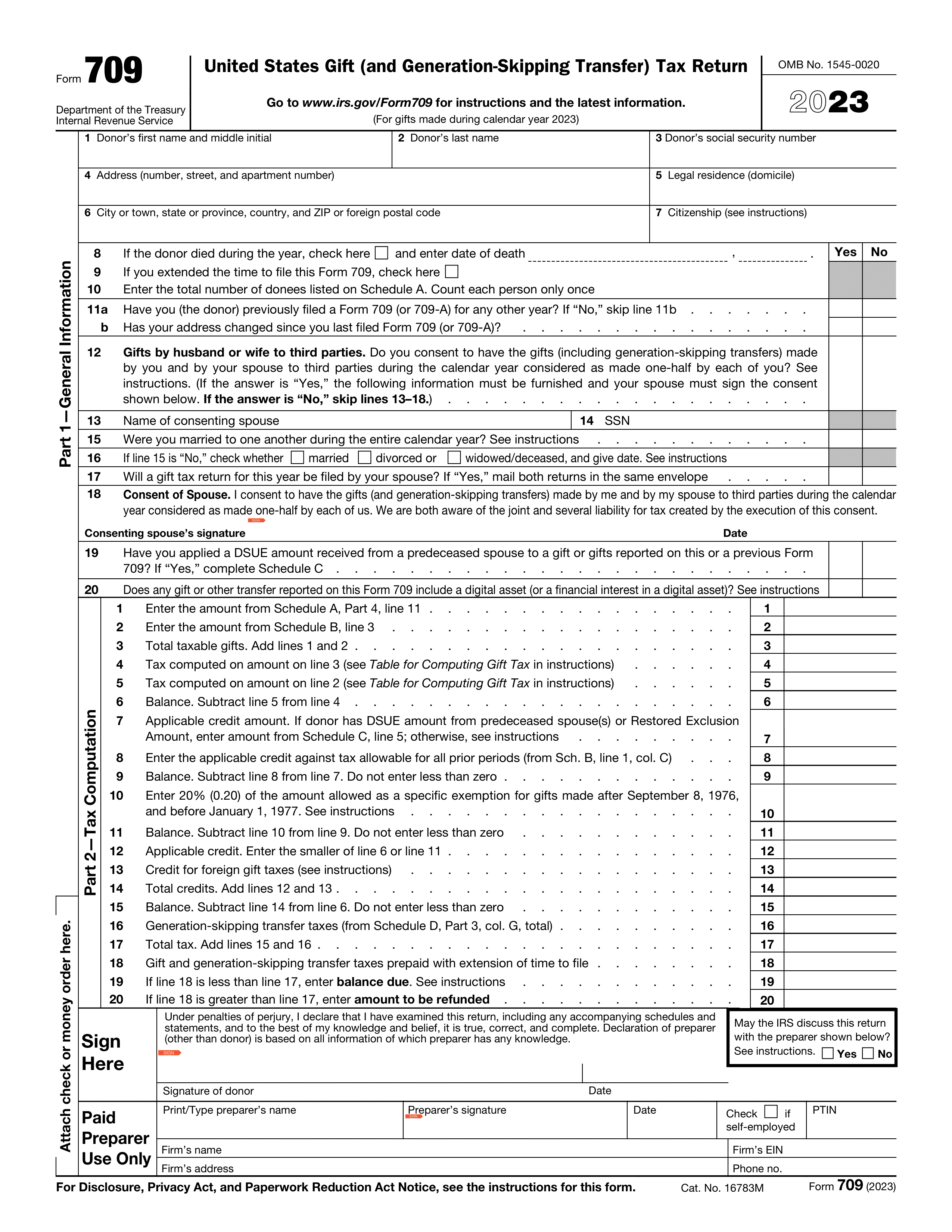

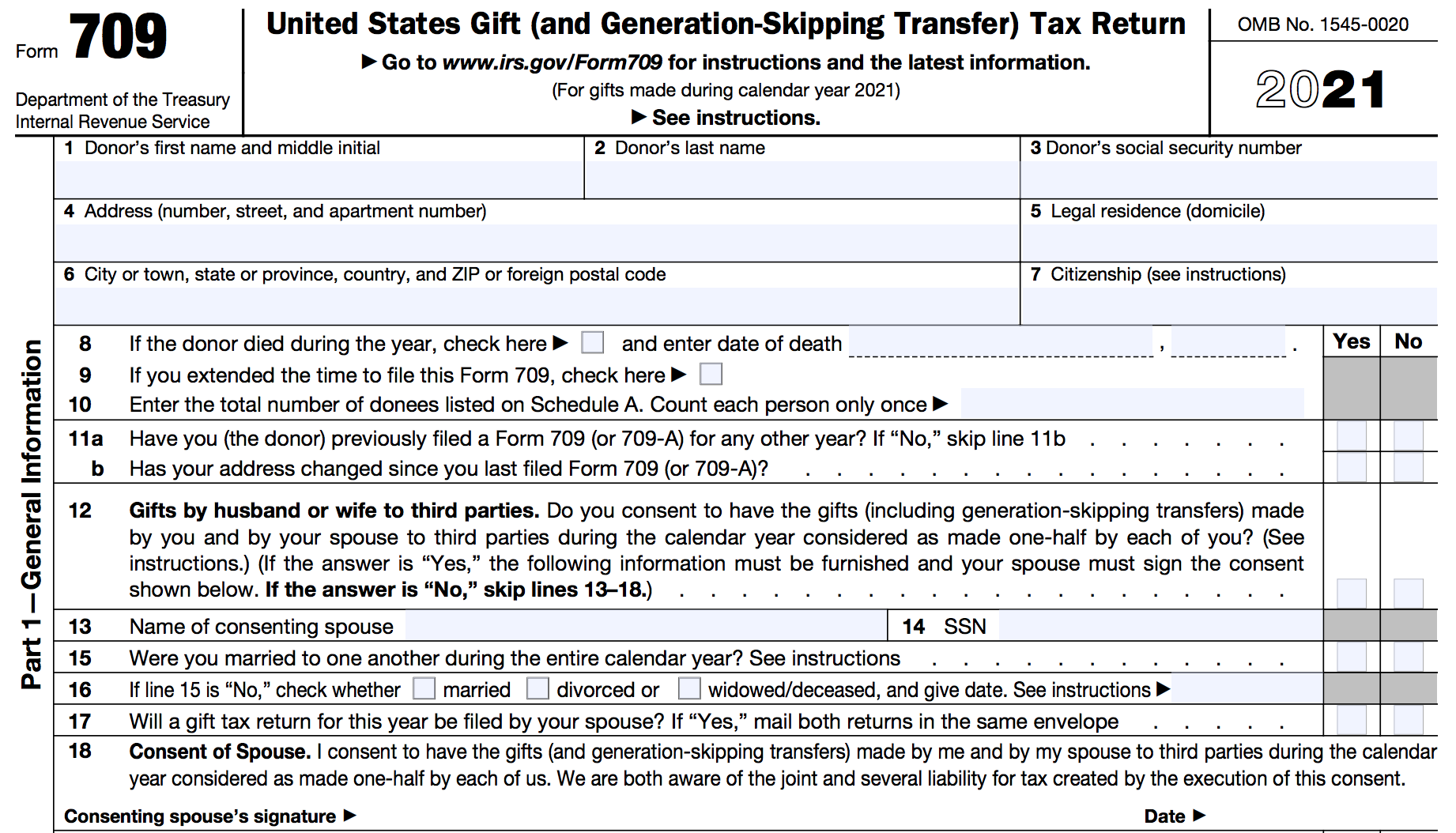

IRS Form 709 Download Fillable PDF or Fill Online United States Gift

With the irs closely monitoring gifts that exceed annual exclusion limits, you need to understand when and how to file form 709. If you made substantial gifts this year, you may need to fill out form 709. Form 709 is used to report gifts you give that exceed the annual gift tax exclusion, which is $18,000 per person for 2025..

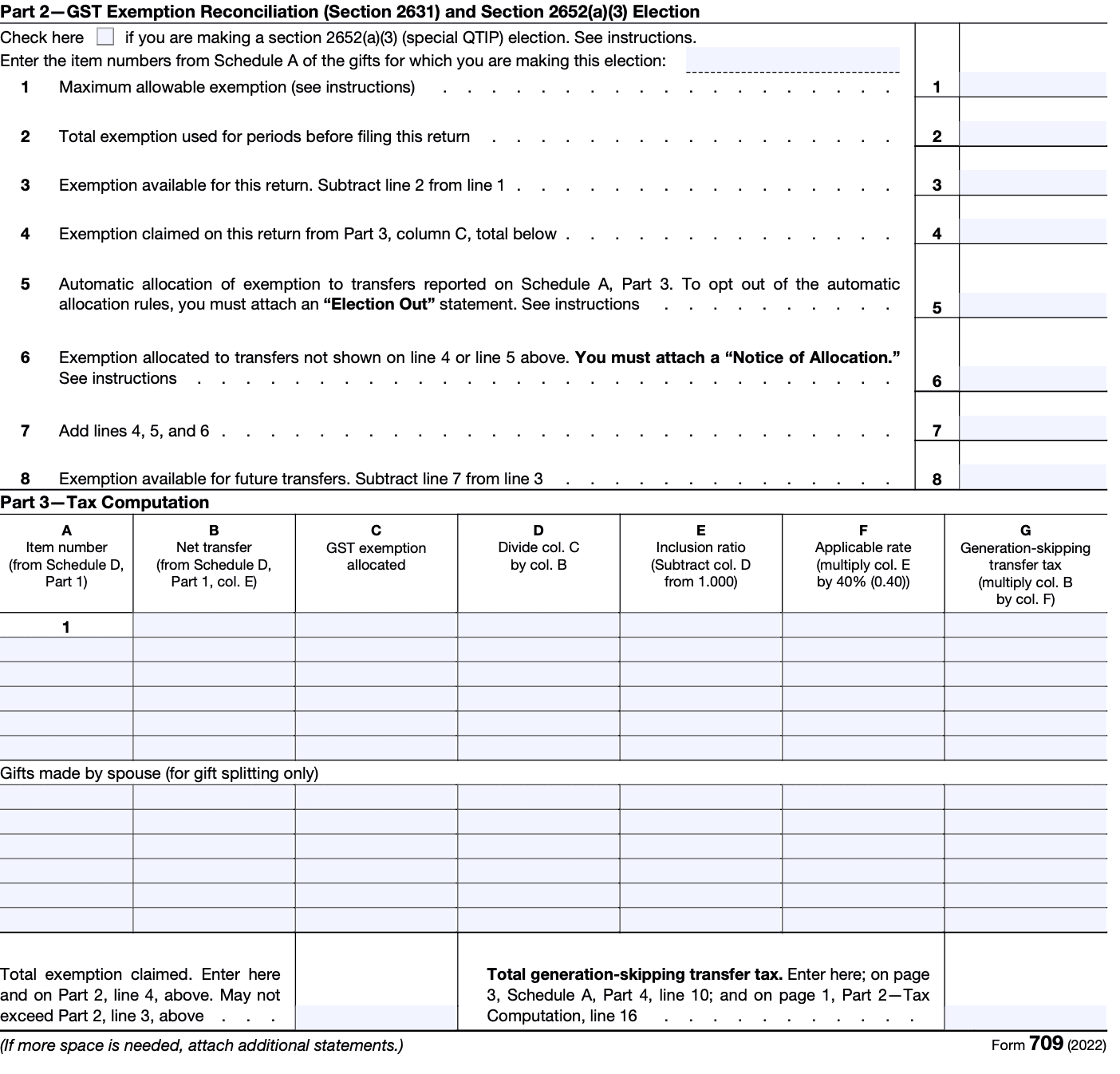

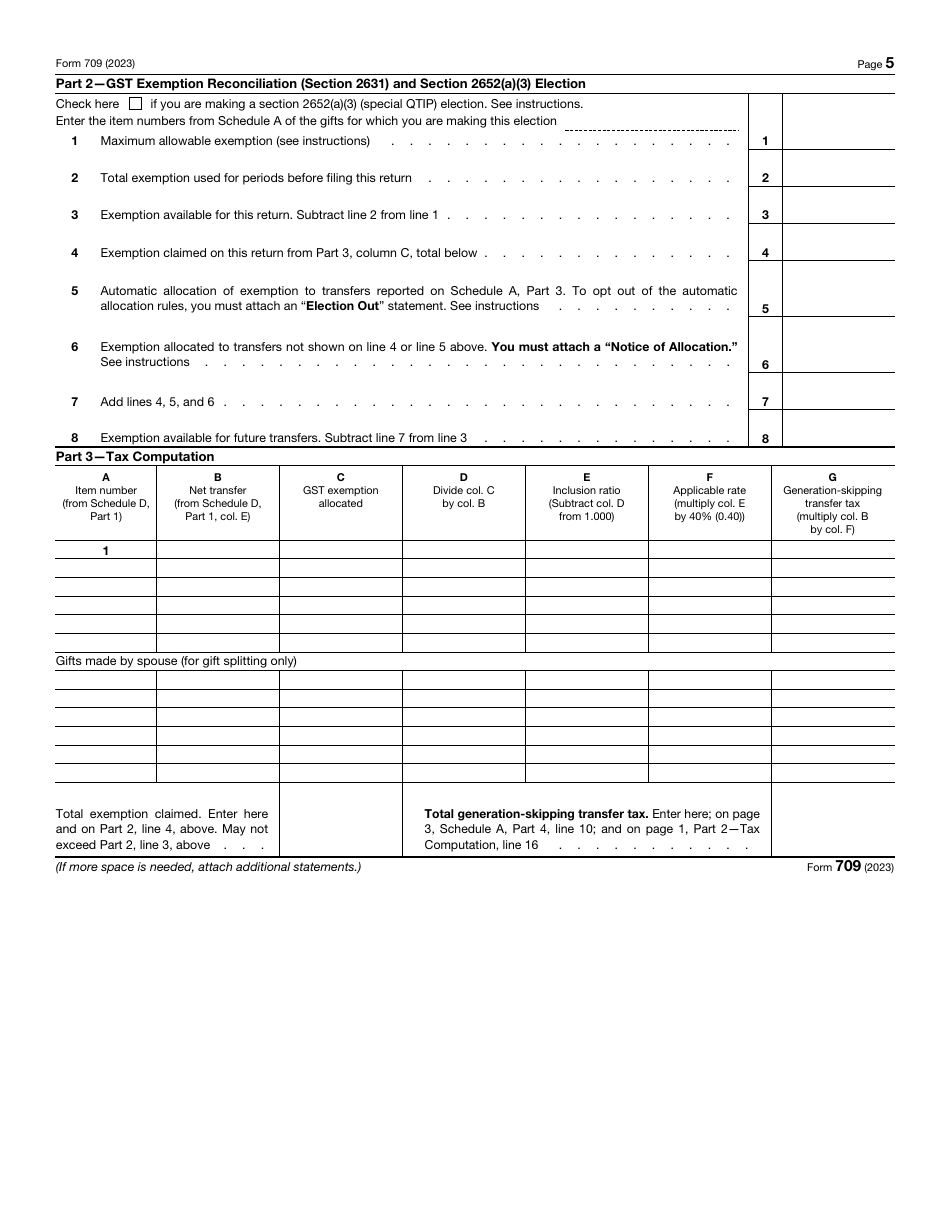

Calculating Gift and GenerationSkipping Transfer Taxes An Analysis of

If you made substantial gifts this year, you may need to fill out form 709. With the irs closely monitoring gifts that exceed annual exclusion limits, you need to understand when and how to file form 709. Form 709 is used to report gifts you give that exceed the annual gift tax exclusion, which is $18,000 per person for 2025..

Fillable PDF Form Templates by PDF Guru

With the irs closely monitoring gifts that exceed annual exclusion limits, you need to understand when and how to file form 709. For couples splitting gifts, if either spouse makes a gift that exceeds the couple’s combined annual gift tax exclusion, or if each. This guide breaks down the steps for reporting gift taxes and how to. Form 709 is.

How to Fill Out Form 709 StepbyStep Guide to Report Gift Tax

This guide breaks down the steps for reporting gift taxes and how to. With the irs closely monitoring gifts that exceed annual exclusion limits, you need to understand when and how to file form 709. Form 709 is used to report gifts you give that exceed the annual gift tax exclusion, which is $18,000 per person for 2025. If you.

Foreign Gift Tax Reporting Rules & Exemptions Explained

With the irs closely monitoring gifts that exceed annual exclusion limits, you need to understand when and how to file form 709. For couples splitting gifts, if either spouse makes a gift that exceeds the couple’s combined annual gift tax exclusion, or if each. If you made substantial gifts this year, you may need to fill out form 709. Form.

How to Fill Out Form 709 StepbyStep Guide to Report Gift Tax

Form 709 is used to report gifts you give that exceed the annual gift tax exclusion, which is $18,000 per person for 2025. This guide breaks down the steps for reporting gift taxes and how to. For couples splitting gifts, if either spouse makes a gift that exceeds the couple’s combined annual gift tax exclusion, or if each. With the.

Form 709 Guide to US Gift Taxes for Expats

Form 709 is used to report gifts you give that exceed the annual gift tax exclusion, which is $18,000 per person for 2025. With the irs closely monitoring gifts that exceed annual exclusion limits, you need to understand when and how to file form 709. This guide breaks down the steps for reporting gift taxes and how to. If you.

What Is Form 709? (2025)

This guide breaks down the steps for reporting gift taxes and how to. If you made substantial gifts this year, you may need to fill out form 709. With the irs closely monitoring gifts that exceed annual exclusion limits, you need to understand when and how to file form 709. Form 709 is used to report gifts you give that.

Form 709 What It Is and Who Must File It

If you made substantial gifts this year, you may need to fill out form 709. This guide breaks down the steps for reporting gift taxes and how to. Form 709 is used to report gifts you give that exceed the annual gift tax exclusion, which is $18,000 per person for 2025. For couples splitting gifts, if either spouse makes a.

IRS Tax Form 709 Guide Gift Tax Demystified

This guide breaks down the steps for reporting gift taxes and how to. If you made substantial gifts this year, you may need to fill out form 709. Form 709 is used to report gifts you give that exceed the annual gift tax exclusion, which is $18,000 per person for 2025. For couples splitting gifts, if either spouse makes a.

If You Made Substantial Gifts This Year, You May Need To Fill Out Form 709.

Form 709 is used to report gifts you give that exceed the annual gift tax exclusion, which is $18,000 per person for 2025. With the irs closely monitoring gifts that exceed annual exclusion limits, you need to understand when and how to file form 709. This guide breaks down the steps for reporting gift taxes and how to. For couples splitting gifts, if either spouse makes a gift that exceeds the couple’s combined annual gift tax exclusion, or if each.

:max_bytes(150000):strip_icc()/ScreenShot2023-01-18at10.29.18AM-e267e40858b8414fb34572a6eb3d7594.png)

:max_bytes(150000):strip_icc()/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)