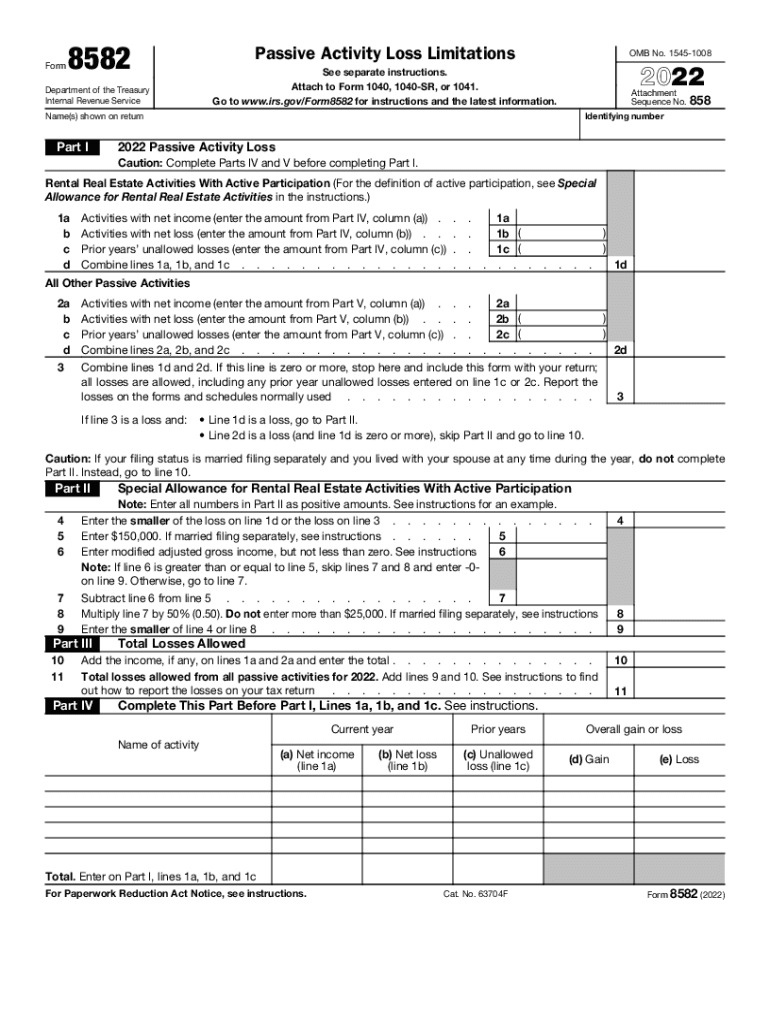

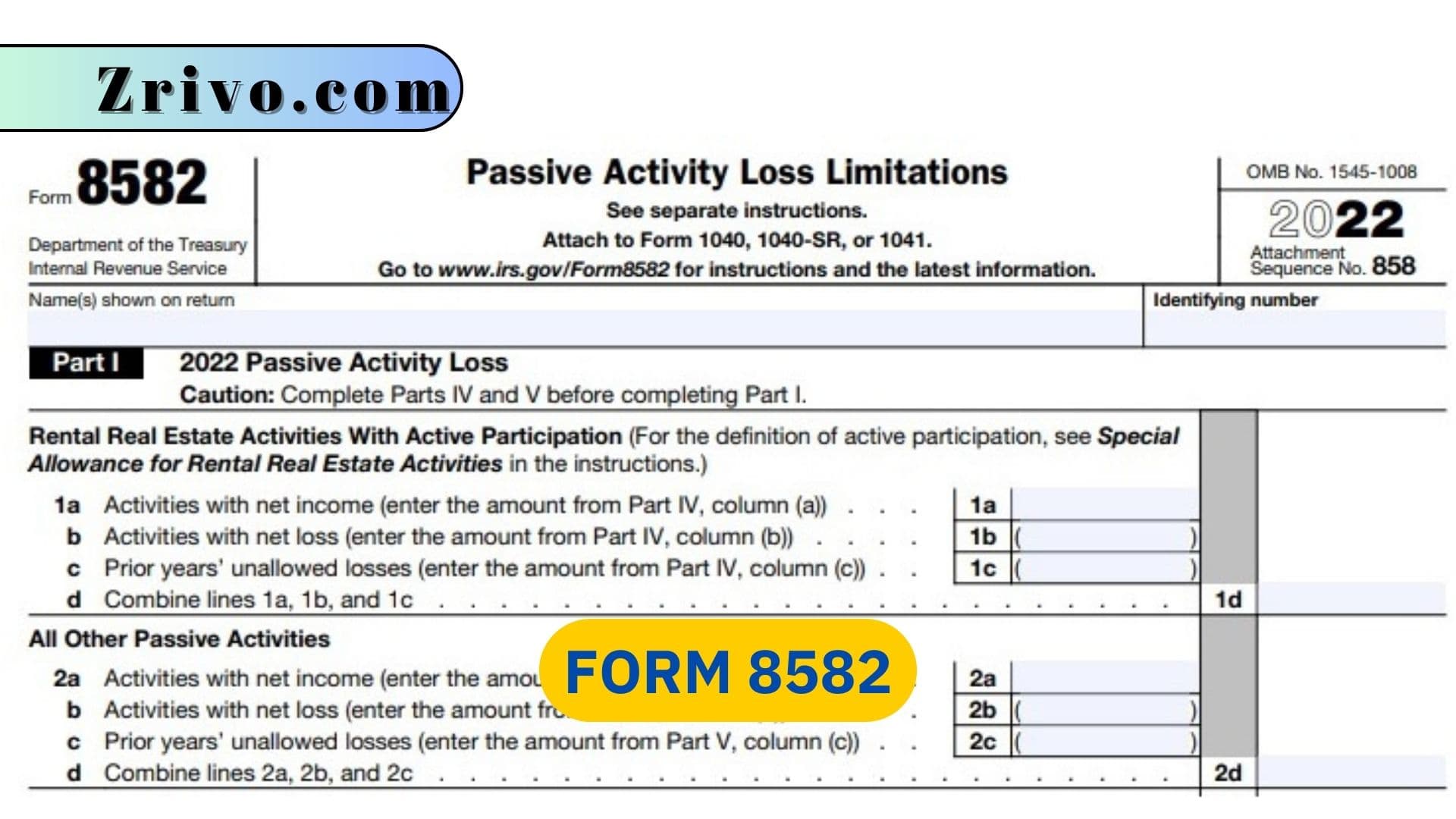

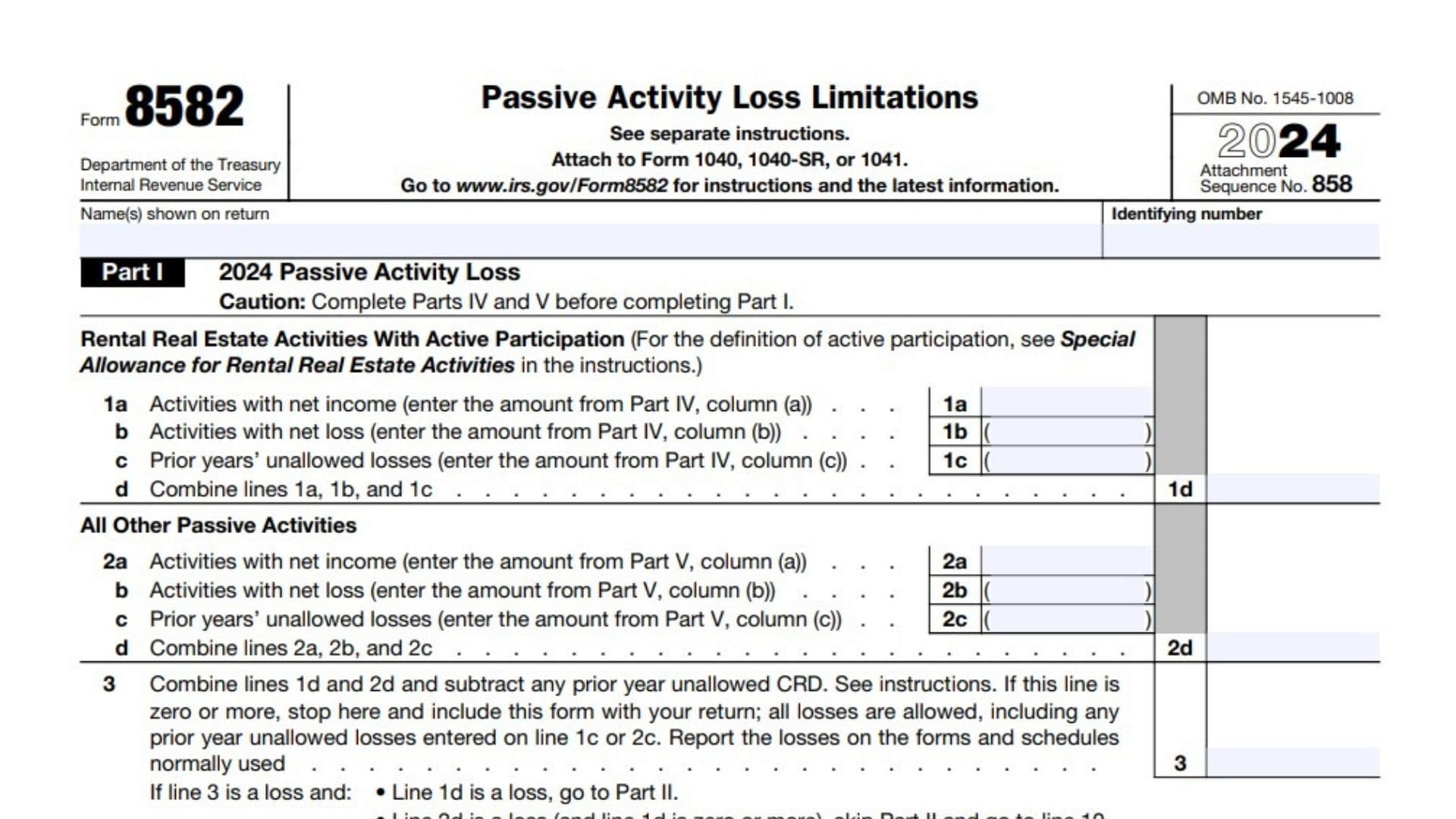

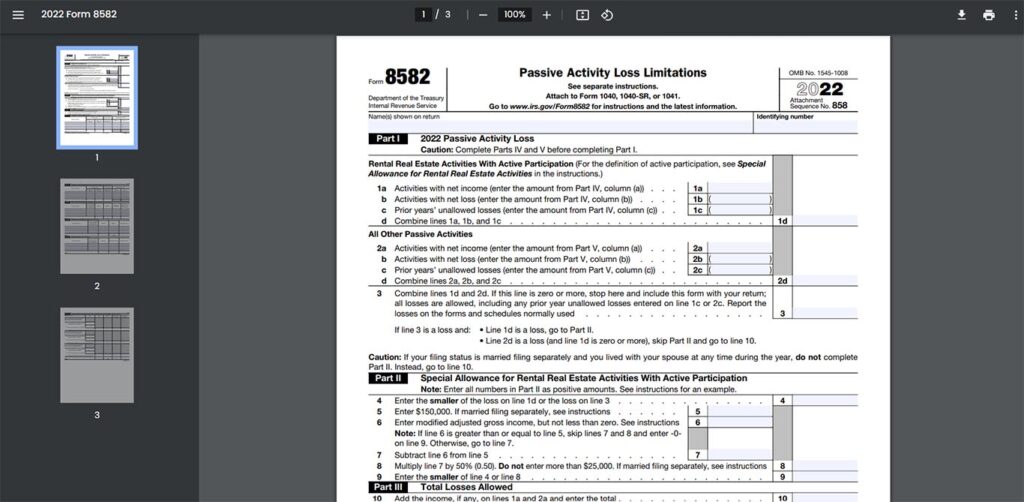

Form 8582 Instructions 2024 - (1) federal form 8582, passive activity loss limitations, is required and. Form 8582 is used by individuals, estates, and trusts with losses from passive activities to figure the amount of any passive. Use parts iv through ix of form 8582 and the related instructions to figure the unallowed loss to be carried forward and the allowed loss to report on. Use parts iv through ix of form 8582 and the related instructions to figure the unallowed loss to be carried forward and the allowed loss to report on. Begin by gathering all relevant documents that detail your income and losses from passive activities.

(1) federal form 8582, passive activity loss limitations, is required and. Use parts iv through ix of form 8582 and the related instructions to figure the unallowed loss to be carried forward and the allowed loss to report on. Use parts iv through ix of form 8582 and the related instructions to figure the unallowed loss to be carried forward and the allowed loss to report on. Form 8582 is used by individuals, estates, and trusts with losses from passive activities to figure the amount of any passive. Begin by gathering all relevant documents that detail your income and losses from passive activities.

Form 8582 is used by individuals, estates, and trusts with losses from passive activities to figure the amount of any passive. (1) federal form 8582, passive activity loss limitations, is required and. Begin by gathering all relevant documents that detail your income and losses from passive activities. Use parts iv through ix of form 8582 and the related instructions to figure the unallowed loss to be carried forward and the allowed loss to report on. Use parts iv through ix of form 8582 and the related instructions to figure the unallowed loss to be carried forward and the allowed loss to report on.

IRS Form 8582CR Instructions Passive Activity Credit Limits

Use parts iv through ix of form 8582 and the related instructions to figure the unallowed loss to be carried forward and the allowed loss to report on. Use parts iv through ix of form 8582 and the related instructions to figure the unallowed loss to be carried forward and the allowed loss to report on. (1) federal form 8582,.

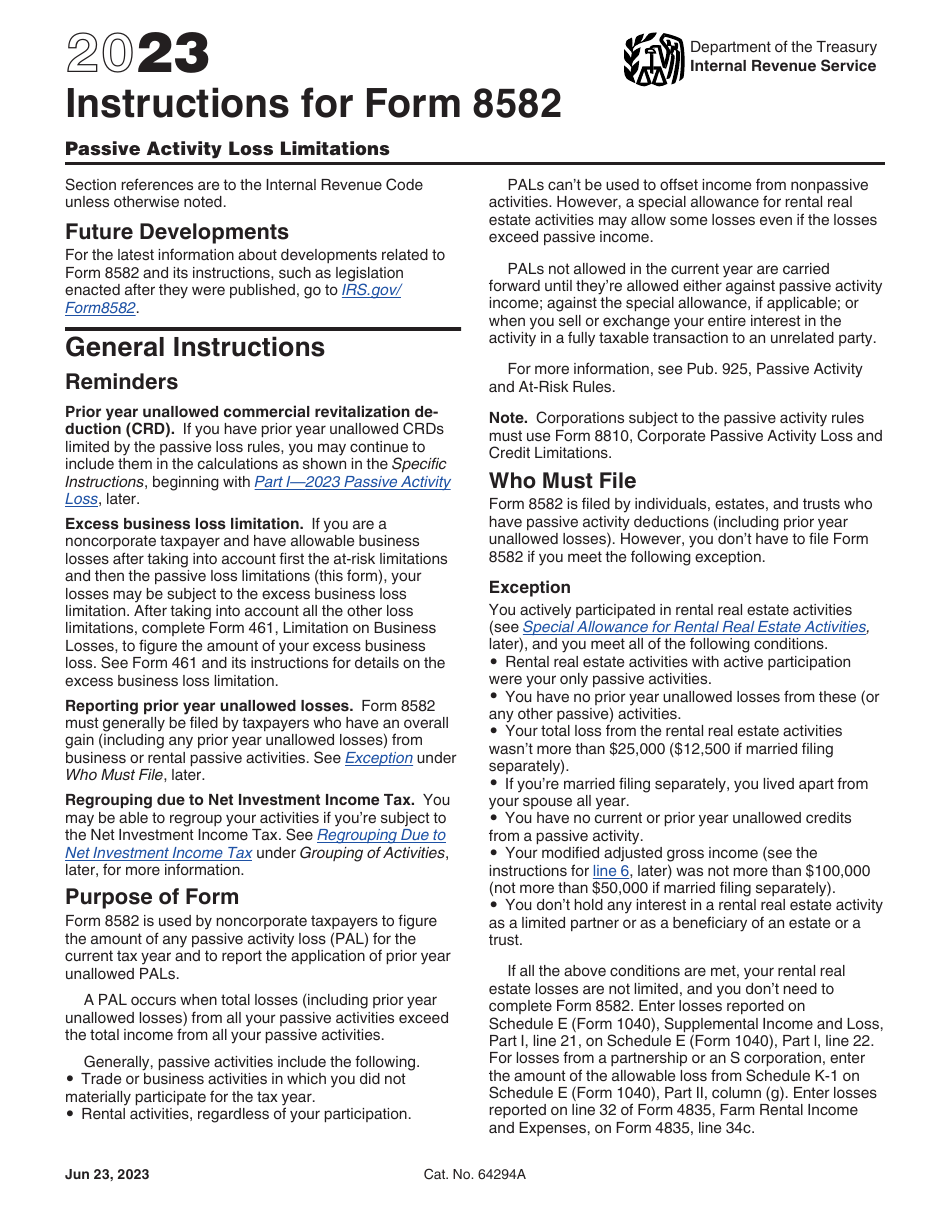

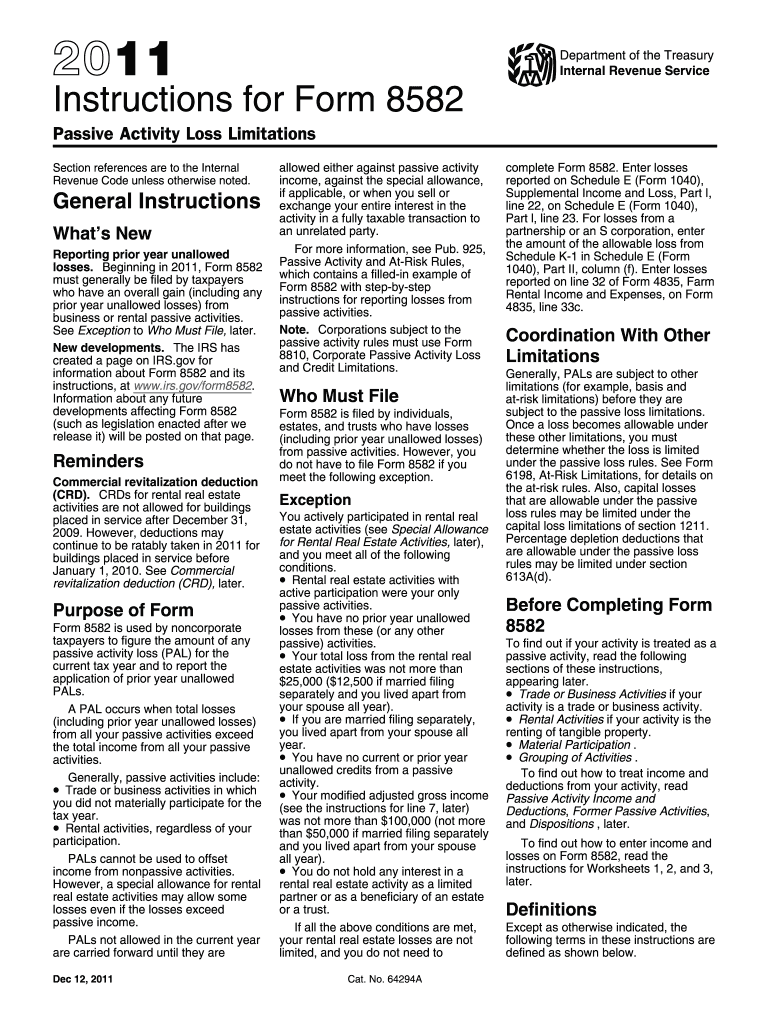

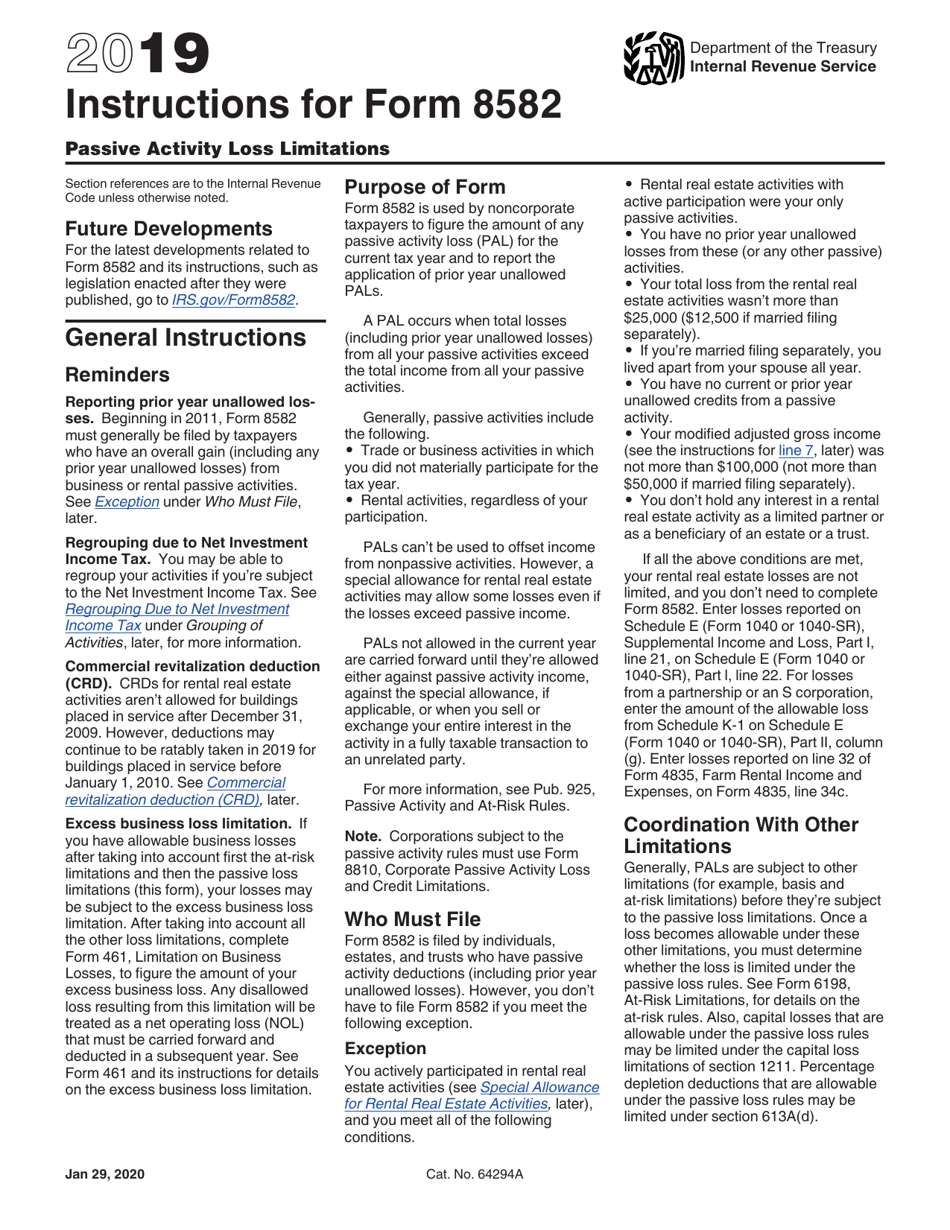

Download Instructions for IRS Form 8582 Passive Activity Loss

Form 8582 is used by individuals, estates, and trusts with losses from passive activities to figure the amount of any passive. Begin by gathering all relevant documents that detail your income and losses from passive activities. Use parts iv through ix of form 8582 and the related instructions to figure the unallowed loss to be carried forward and the allowed.

Download Instructions for IRS Form 8582 Passive Activity Loss

Begin by gathering all relevant documents that detail your income and losses from passive activities. (1) federal form 8582, passive activity loss limitations, is required and. Form 8582 is used by individuals, estates, and trusts with losses from passive activities to figure the amount of any passive. Use parts iv through ix of form 8582 and the related instructions to.

8582 Instructions Complete with ease airSlate SignNow

Begin by gathering all relevant documents that detail your income and losses from passive activities. Use parts iv through ix of form 8582 and the related instructions to figure the unallowed loss to be carried forward and the allowed loss to report on. Use parts iv through ix of form 8582 and the related instructions to figure the unallowed loss.

Passive Latest 20222025 Form Fill Out and Sign Printable PDF

Begin by gathering all relevant documents that detail your income and losses from passive activities. Use parts iv through ix of form 8582 and the related instructions to figure the unallowed loss to be carried forward and the allowed loss to report on. Form 8582 is used by individuals, estates, and trusts with losses from passive activities to figure the.

Download Instructions for IRS Form 8582 Passive Activity Loss

Use parts iv through ix of form 8582 and the related instructions to figure the unallowed loss to be carried forward and the allowed loss to report on. Use parts iv through ix of form 8582 and the related instructions to figure the unallowed loss to be carried forward and the allowed loss to report on. Form 8582 is used.

Form 8582 2024 2025

Use parts iv through ix of form 8582 and the related instructions to figure the unallowed loss to be carried forward and the allowed loss to report on. (1) federal form 8582, passive activity loss limitations, is required and. Use parts iv through ix of form 8582 and the related instructions to figure the unallowed loss to be carried forward.

Form 8582 Instructions 2024 2025

Use parts iv through ix of form 8582 and the related instructions to figure the unallowed loss to be carried forward and the allowed loss to report on. Form 8582 is used by individuals, estates, and trusts with losses from passive activities to figure the amount of any passive. Use parts iv through ix of form 8582 and the related.

How to Report a Foreclosed Rental House on Your Taxes S'witty Kiwi

Form 8582 is used by individuals, estates, and trusts with losses from passive activities to figure the amount of any passive. Use parts iv through ix of form 8582 and the related instructions to figure the unallowed loss to be carried forward and the allowed loss to report on. (1) federal form 8582, passive activity loss limitations, is required and..

IRS Form 8582 Instructions A Guide to Passive Activity Losses

Use parts iv through ix of form 8582 and the related instructions to figure the unallowed loss to be carried forward and the allowed loss to report on. (1) federal form 8582, passive activity loss limitations, is required and. Form 8582 is used by individuals, estates, and trusts with losses from passive activities to figure the amount of any passive..

Use Parts Iv Through Ix Of Form 8582 And The Related Instructions To Figure The Unallowed Loss To Be Carried Forward And The Allowed Loss To Report On.

Form 8582 is used by individuals, estates, and trusts with losses from passive activities to figure the amount of any passive. Begin by gathering all relevant documents that detail your income and losses from passive activities. (1) federal form 8582, passive activity loss limitations, is required and. Use parts iv through ix of form 8582 and the related instructions to figure the unallowed loss to be carried forward and the allowed loss to report on.