Irs Form 3115 Instructions - Download irs tax form 3115 for financial flexibility. Master form 3115 filing requirements for accounting method changes with this comprehensive guide covering deadlines,. Learn how to change your business's accounting method using irs form 3115, covering accrual vs. Understanding how to complete form 3115 correctly is essential to ensure compliance with tax regulations and recover lost deductions. See the instructions for part i information for automatic change request, later, and the list of automatic changes in rev. Cash basis, filing procedures, and irs compliance.

Download irs tax form 3115 for financial flexibility. Cash basis, filing procedures, and irs compliance. See the instructions for part i information for automatic change request, later, and the list of automatic changes in rev. Learn how to change your business's accounting method using irs form 3115, covering accrual vs. Master form 3115 filing requirements for accounting method changes with this comprehensive guide covering deadlines,. Understanding how to complete form 3115 correctly is essential to ensure compliance with tax regulations and recover lost deductions.

Master form 3115 filing requirements for accounting method changes with this comprehensive guide covering deadlines,. Learn how to change your business's accounting method using irs form 3115, covering accrual vs. See the instructions for part i information for automatic change request, later, and the list of automatic changes in rev. Cash basis, filing procedures, and irs compliance. Download irs tax form 3115 for financial flexibility. Understanding how to complete form 3115 correctly is essential to ensure compliance with tax regulations and recover lost deductions.

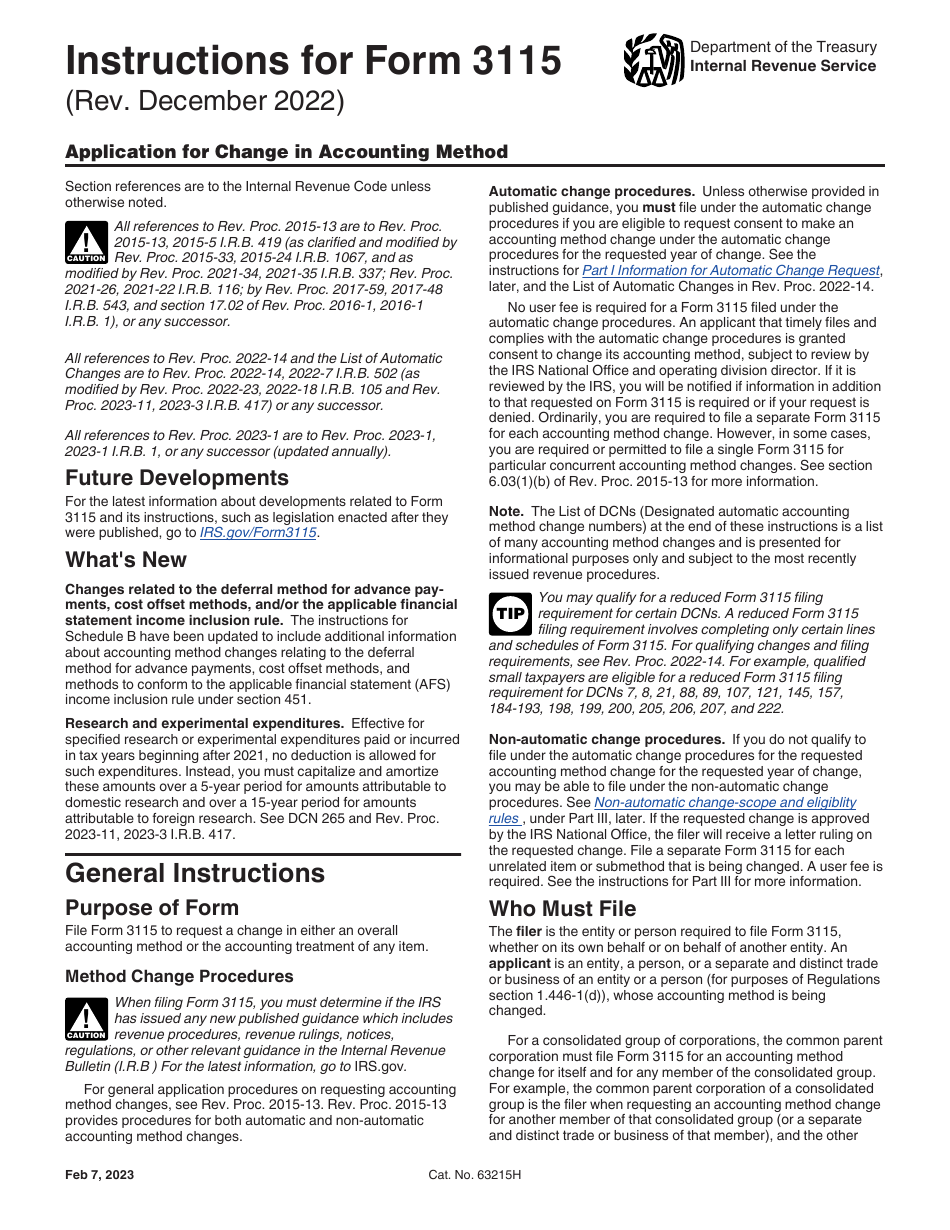

Download Instructions for IRS Form 3115 Application for Change in

Understanding how to complete form 3115 correctly is essential to ensure compliance with tax regulations and recover lost deductions. See the instructions for part i information for automatic change request, later, and the list of automatic changes in rev. Master form 3115 filing requirements for accounting method changes with this comprehensive guide covering deadlines,. Download irs tax form 3115 for.

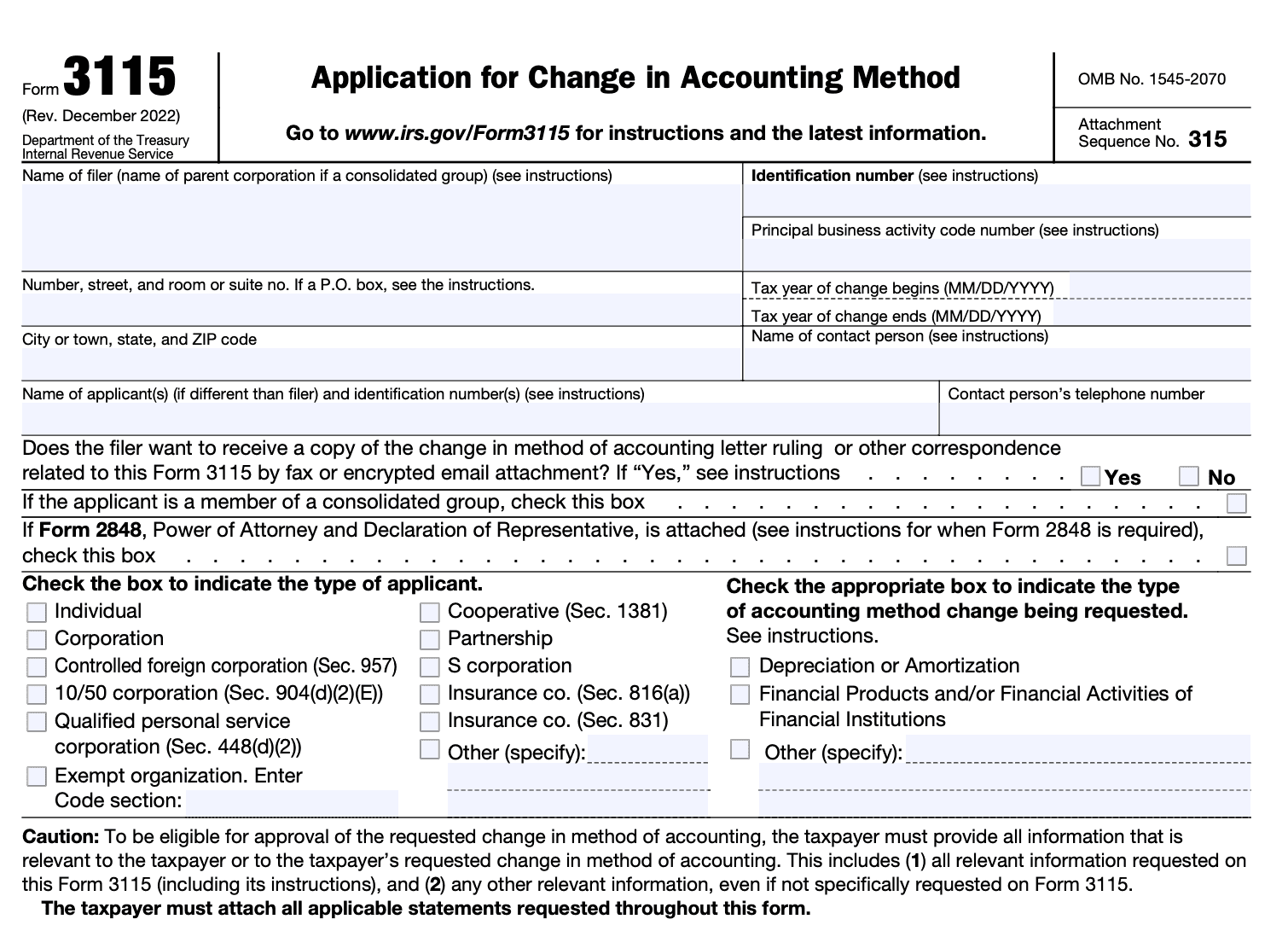

IRS Tax Form 3115 Filing Guide Change Accounting Methods

Understanding how to complete form 3115 correctly is essential to ensure compliance with tax regulations and recover lost deductions. Cash basis, filing procedures, and irs compliance. Download irs tax form 3115 for financial flexibility. Master form 3115 filing requirements for accounting method changes with this comprehensive guide covering deadlines,. See the instructions for part i information for automatic change request,.

Tax Accounting Methods Recent Developments and Trends ppt download

Learn how to change your business's accounting method using irs form 3115, covering accrual vs. Download irs tax form 3115 for financial flexibility. Master form 3115 filing requirements for accounting method changes with this comprehensive guide covering deadlines,. See the instructions for part i information for automatic change request, later, and the list of automatic changes in rev. Understanding how.

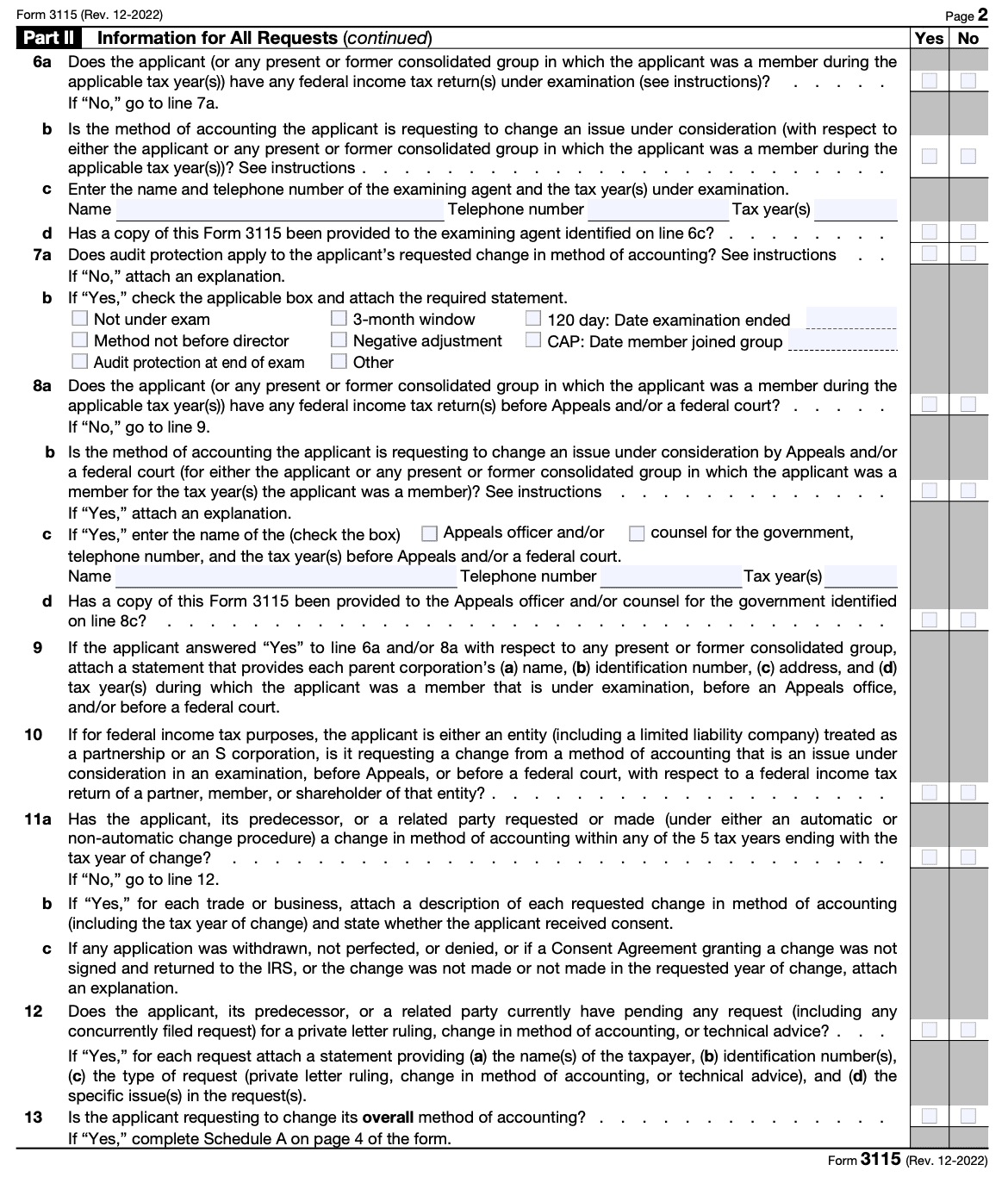

Form 3115 Instructions (Application for Change in Accounting Method)

Master form 3115 filing requirements for accounting method changes with this comprehensive guide covering deadlines,. Download irs tax form 3115 for financial flexibility. Learn how to change your business's accounting method using irs form 3115, covering accrual vs. Understanding how to complete form 3115 correctly is essential to ensure compliance with tax regulations and recover lost deductions. Cash basis, filing.

IRS Tax Form 3115 Filing Guide Change Accounting Methods

See the instructions for part i information for automatic change request, later, and the list of automatic changes in rev. Understanding how to complete form 3115 correctly is essential to ensure compliance with tax regulations and recover lost deductions. Learn how to change your business's accounting method using irs form 3115, covering accrual vs. Master form 3115 filing requirements for.

Accounting Method Changes Post Tax Reform ppt download

Download irs tax form 3115 for financial flexibility. Cash basis, filing procedures, and irs compliance. See the instructions for part i information for automatic change request, later, and the list of automatic changes in rev. Master form 3115 filing requirements for accounting method changes with this comprehensive guide covering deadlines,. Understanding how to complete form 3115 correctly is essential to.

What is IRS Form 3115?

Understanding how to complete form 3115 correctly is essential to ensure compliance with tax regulations and recover lost deductions. Master form 3115 filing requirements for accounting method changes with this comprehensive guide covering deadlines,. Learn how to change your business's accounting method using irs form 3115, covering accrual vs. Cash basis, filing procedures, and irs compliance. See the instructions for.

Form 3115 Example Return (2024) IRS Form 3115 What It Is, How to

See the instructions for part i information for automatic change request, later, and the list of automatic changes in rev. Download irs tax form 3115 for financial flexibility. Master form 3115 filing requirements for accounting method changes with this comprehensive guide covering deadlines,. Understanding how to complete form 3115 correctly is essential to ensure compliance with tax regulations and recover.

Download Instructions for IRS Form 3115 Application for Change in

Learn how to change your business's accounting method using irs form 3115, covering accrual vs. See the instructions for part i information for automatic change request, later, and the list of automatic changes in rev. Master form 3115 filing requirements for accounting method changes with this comprehensive guide covering deadlines,. Download irs tax form 3115 for financial flexibility. Cash basis,.

IRS Tax Form 3115 Filing Guide Change Accounting Methods

Learn how to change your business's accounting method using irs form 3115, covering accrual vs. Understanding how to complete form 3115 correctly is essential to ensure compliance with tax regulations and recover lost deductions. Download irs tax form 3115 for financial flexibility. Master form 3115 filing requirements for accounting method changes with this comprehensive guide covering deadlines,. See the instructions.

Understanding How To Complete Form 3115 Correctly Is Essential To Ensure Compliance With Tax Regulations And Recover Lost Deductions.

Download irs tax form 3115 for financial flexibility. Master form 3115 filing requirements for accounting method changes with this comprehensive guide covering deadlines,. See the instructions for part i information for automatic change request, later, and the list of automatic changes in rev. Cash basis, filing procedures, and irs compliance.