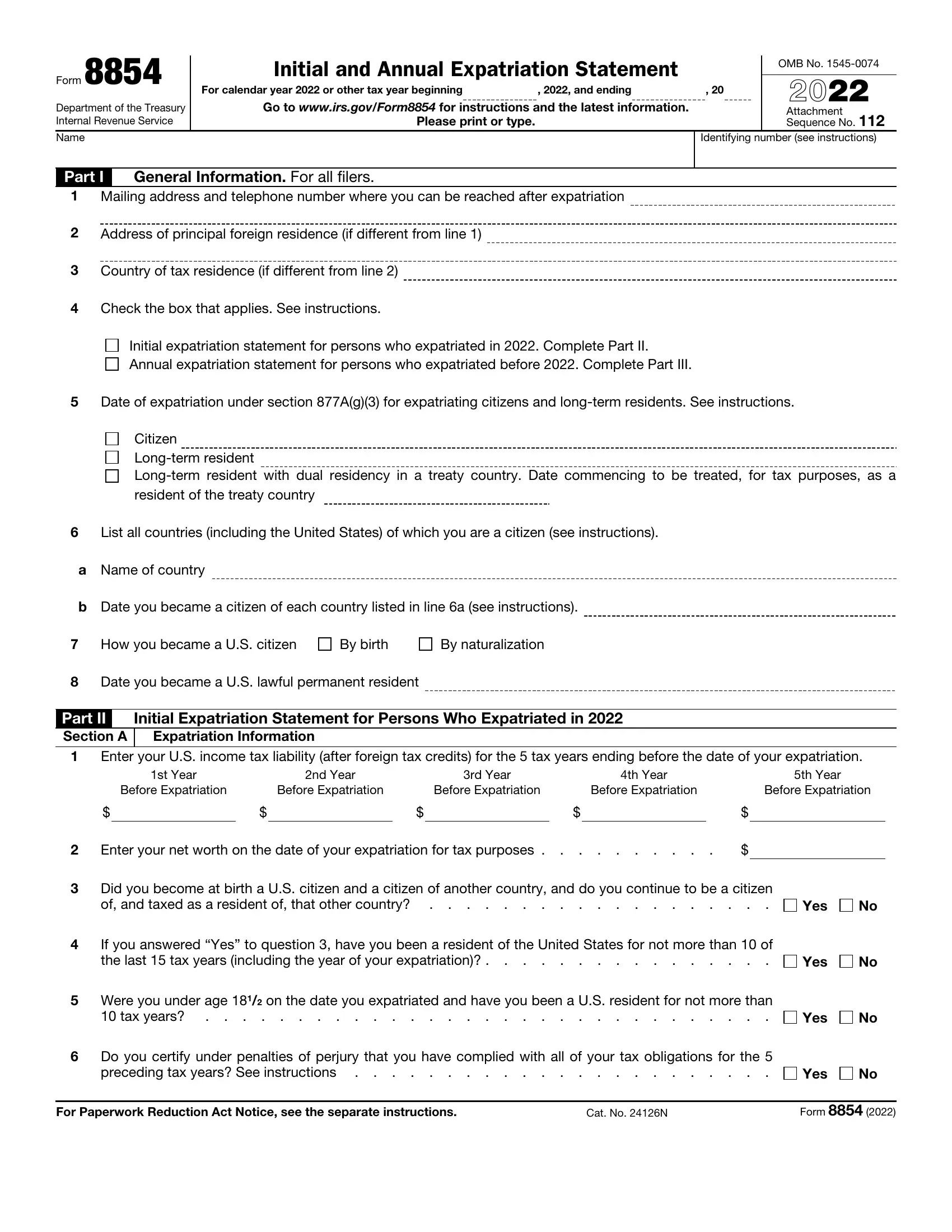

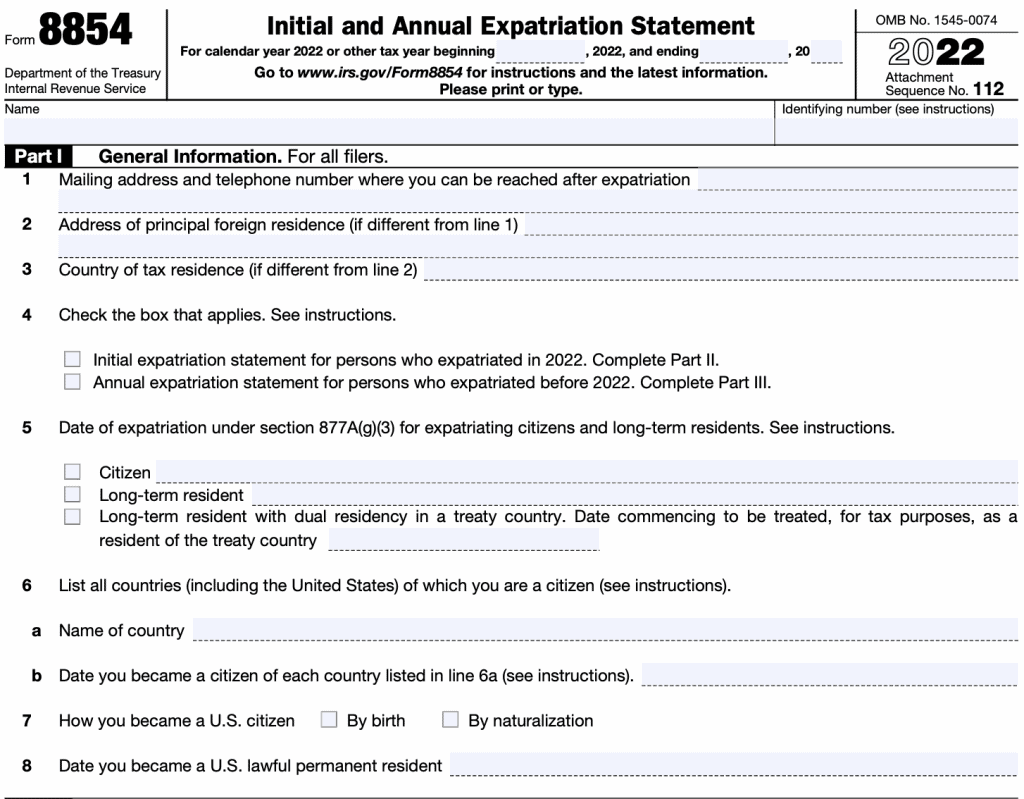

Irs Form 8854 - Form 8854 is usually due when you file your final form 1040 for the year you expatriated. This form is critical for ensuring compliance with u.s. Information about form 8854, initial and annual expatriation statement, including recent updates, related forms, and instructions on how to. Discover how form 8854 finalizes your exit from u.s. If you’re not filing a 1040 that year, you still need. Taxes, ensuring a smooth transition for expats. Your guide to a clean break. Among these is the requirement to file irs form 8854 for expatriation and exit tax calculations.

Information about form 8854, initial and annual expatriation statement, including recent updates, related forms, and instructions on how to. Form 8854 is usually due when you file your final form 1040 for the year you expatriated. Discover how form 8854 finalizes your exit from u.s. If you’re not filing a 1040 that year, you still need. Taxes, ensuring a smooth transition for expats. Among these is the requirement to file irs form 8854 for expatriation and exit tax calculations. This form is critical for ensuring compliance with u.s. Your guide to a clean break.

Form 8854 is usually due when you file your final form 1040 for the year you expatriated. If you’re not filing a 1040 that year, you still need. Your guide to a clean break. Discover how form 8854 finalizes your exit from u.s. This form is critical for ensuring compliance with u.s. Among these is the requirement to file irs form 8854 for expatriation and exit tax calculations. Taxes, ensuring a smooth transition for expats. Information about form 8854, initial and annual expatriation statement, including recent updates, related forms, and instructions on how to.

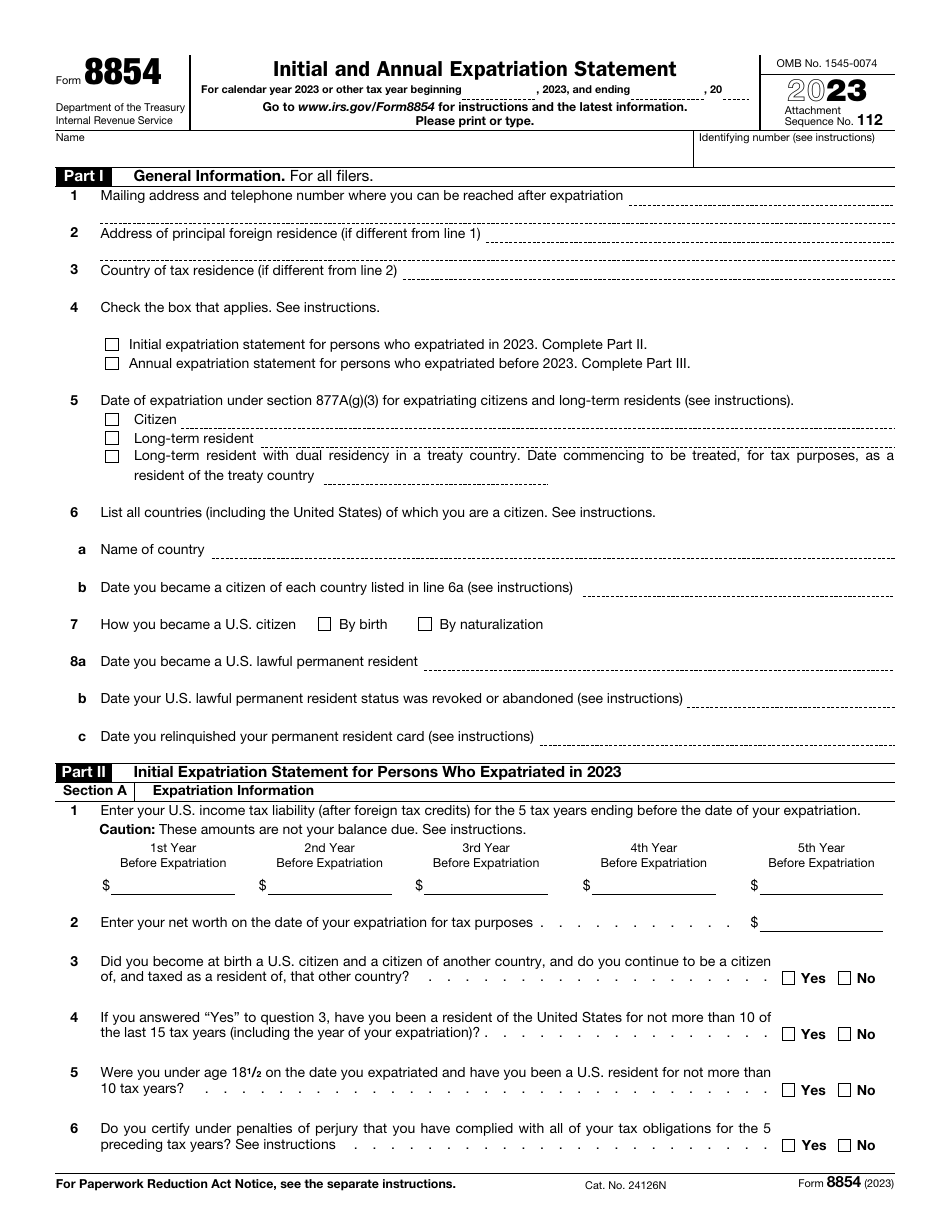

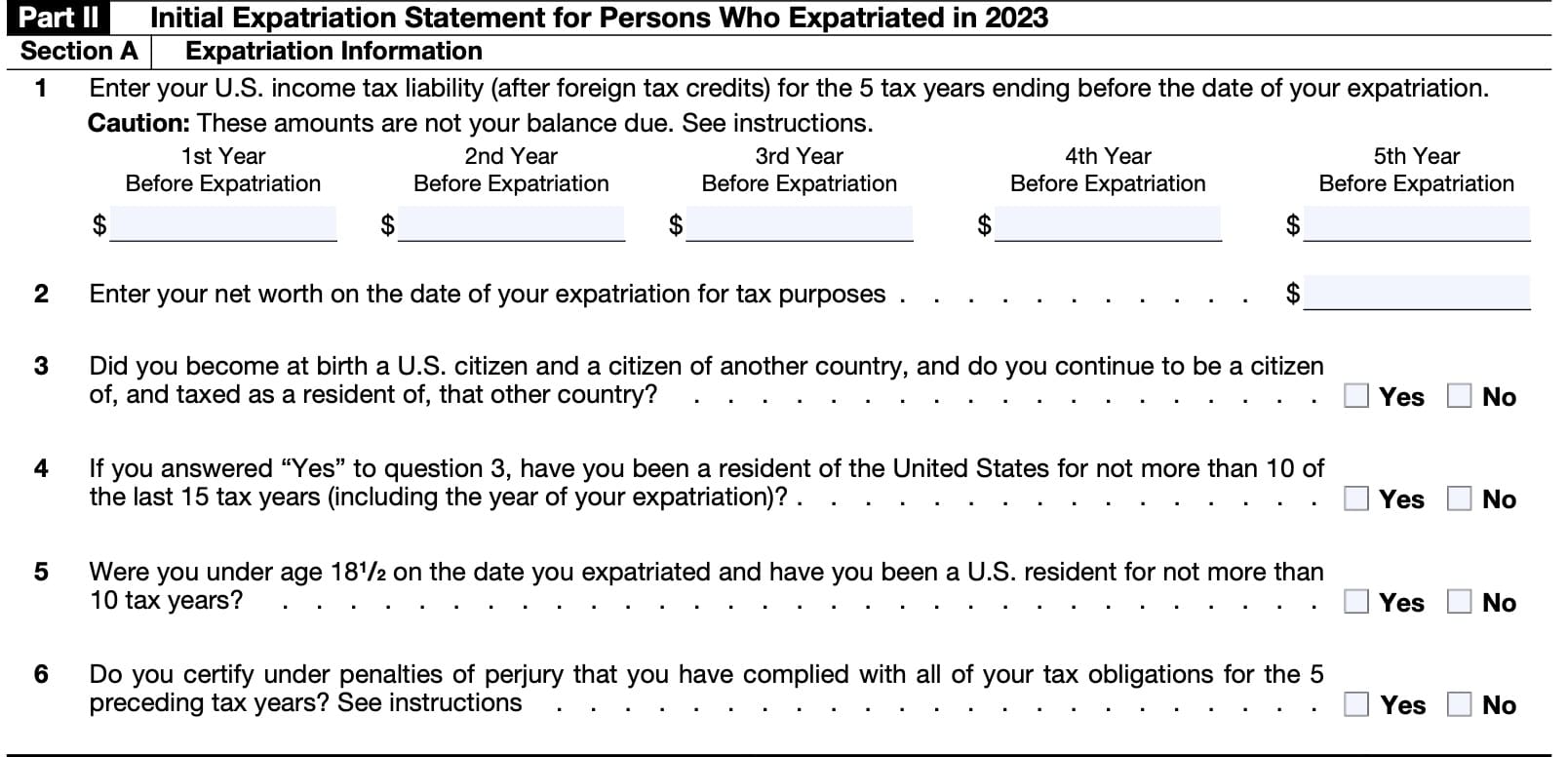

IRS Form 8854 Download Fillable PDF or Fill Online Initial and Annual

Form 8854 is usually due when you file your final form 1040 for the year you expatriated. Taxes, ensuring a smooth transition for expats. This form is critical for ensuring compliance with u.s. If you’re not filing a 1040 that year, you still need. Among these is the requirement to file irs form 8854 for expatriation and exit tax calculations.

Revisiting the consequences of a “covered expatriate” for

If you’re not filing a 1040 that year, you still need. Your guide to a clean break. Taxes, ensuring a smooth transition for expats. Among these is the requirement to file irs form 8854 for expatriation and exit tax calculations. Information about form 8854, initial and annual expatriation statement, including recent updates, related forms, and instructions on how to.

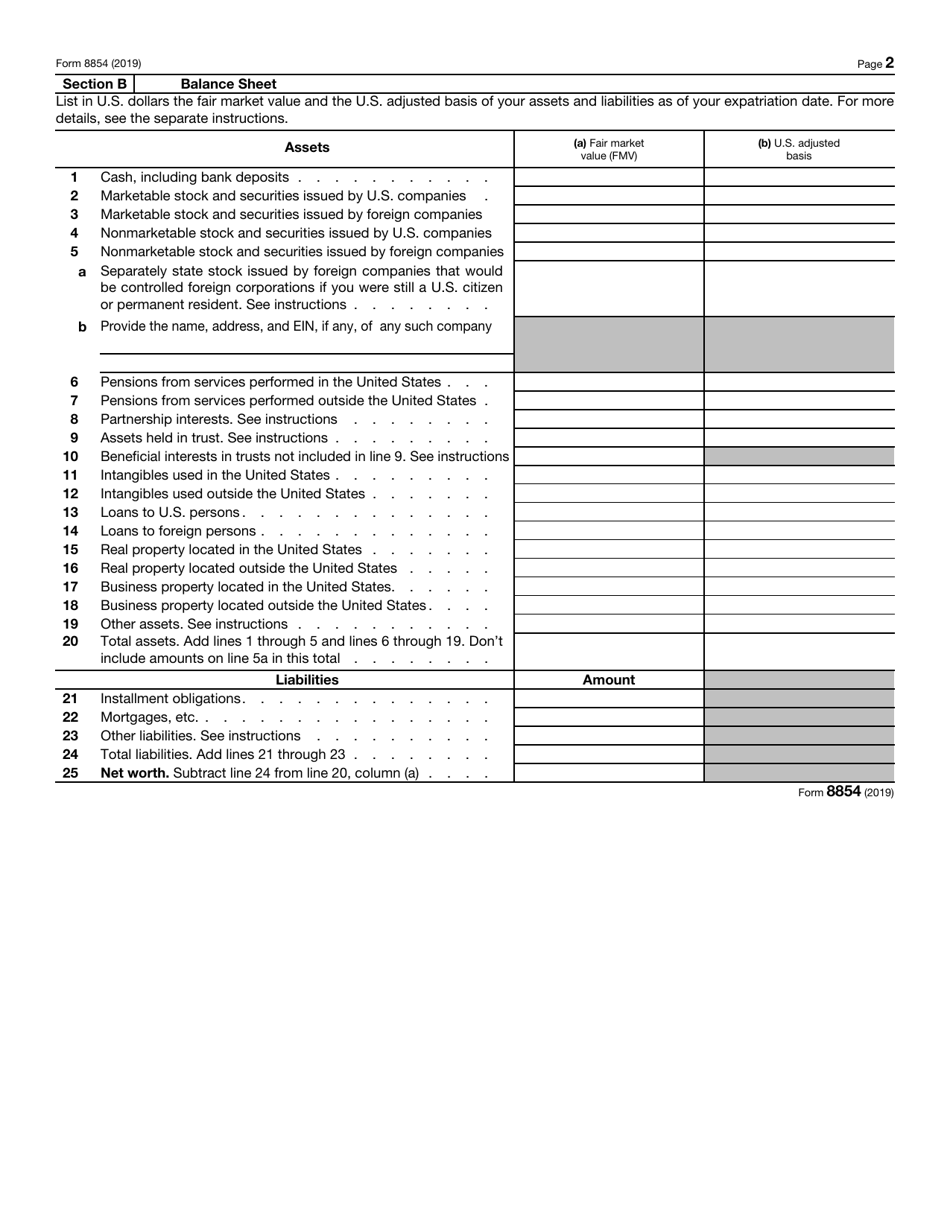

IRS Form 8854 2019 Fill Out, Sign Online and Download Fillable PDF

Form 8854 is usually due when you file your final form 1040 for the year you expatriated. Information about form 8854, initial and annual expatriation statement, including recent updates, related forms, and instructions on how to. This form is critical for ensuring compliance with u.s. Discover how form 8854 finalizes your exit from u.s. Taxes, ensuring a smooth transition for.

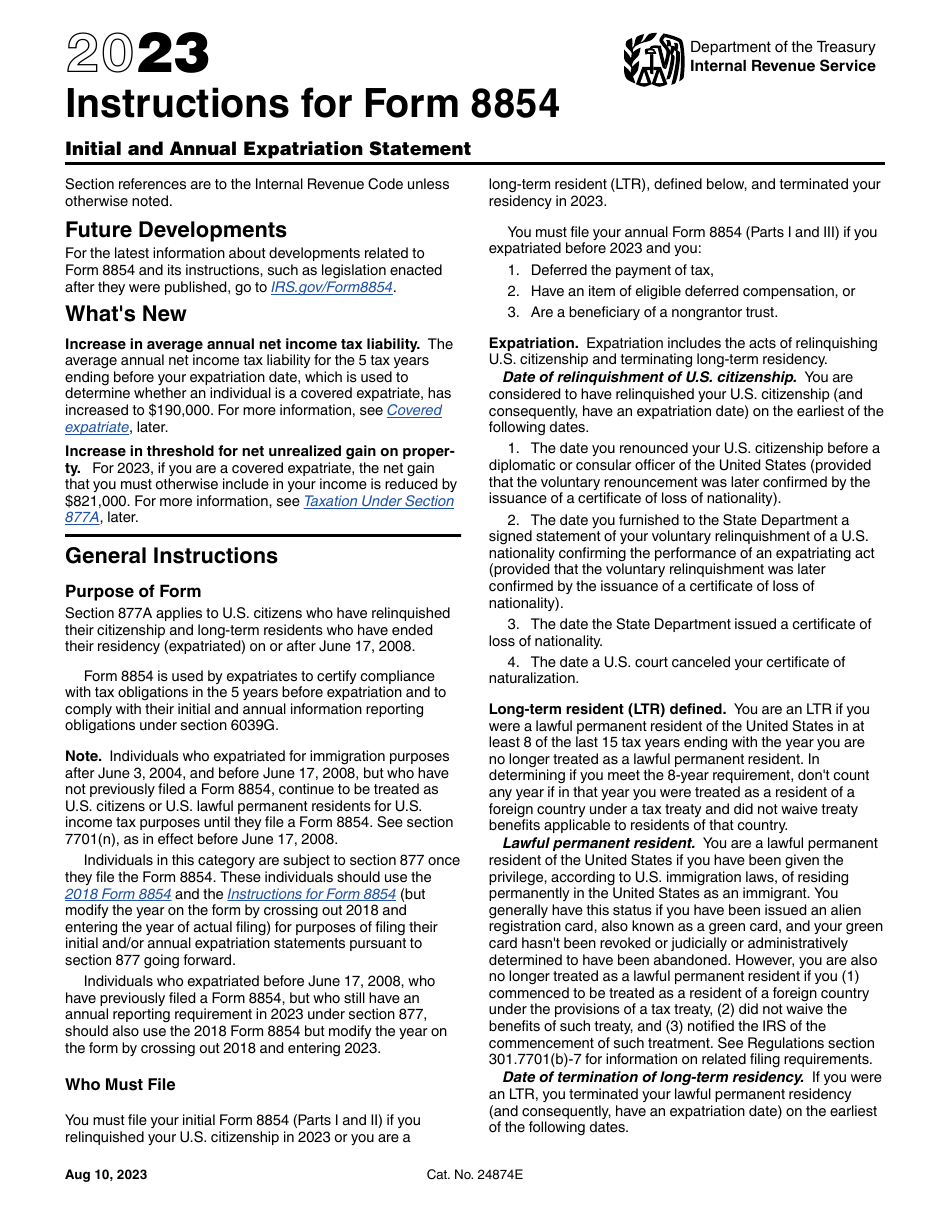

IRS Form 8854 Instructions

Your guide to a clean break. Form 8854 is usually due when you file your final form 1040 for the year you expatriated. Discover how form 8854 finalizes your exit from u.s. Taxes, ensuring a smooth transition for expats. This form is critical for ensuring compliance with u.s.

Download Instructions for IRS Form 8854 Initial and Annual Expatriation

Your guide to a clean break. Taxes, ensuring a smooth transition for expats. Form 8854 is usually due when you file your final form 1040 for the year you expatriated. Discover how form 8854 finalizes your exit from u.s. Information about form 8854, initial and annual expatriation statement, including recent updates, related forms, and instructions on how to.

2023 Form IRS 8854 Instructions Fill Online, Printable, Fillable

Taxes, ensuring a smooth transition for expats. Discover how form 8854 finalizes your exit from u.s. Your guide to a clean break. If you’re not filing a 1040 that year, you still need. This form is critical for ensuring compliance with u.s.

Form 8854 ≡ Fill Out Printable PDF Forms Online

Information about form 8854, initial and annual expatriation statement, including recent updates, related forms, and instructions on how to. Your guide to a clean break. Taxes, ensuring a smooth transition for expats. This form is critical for ensuring compliance with u.s. Discover how form 8854 finalizes your exit from u.s.

Form 8854 Understanding IRS Form 8854 Expatriation Statement and Exit

Form 8854 is usually due when you file your final form 1040 for the year you expatriated. Information about form 8854, initial and annual expatriation statement, including recent updates, related forms, and instructions on how to. Among these is the requirement to file irs form 8854 for expatriation and exit tax calculations. Taxes, ensuring a smooth transition for expats. Your.

IRS Form 8854 Instructions

Among these is the requirement to file irs form 8854 for expatriation and exit tax calculations. Information about form 8854, initial and annual expatriation statement, including recent updates, related forms, and instructions on how to. Discover how form 8854 finalizes your exit from u.s. Your guide to a clean break. This form is critical for ensuring compliance with u.s.

IRS Form 8854 A Guide for U.S. Expatriates

Among these is the requirement to file irs form 8854 for expatriation and exit tax calculations. This form is critical for ensuring compliance with u.s. If you’re not filing a 1040 that year, you still need. Information about form 8854, initial and annual expatriation statement, including recent updates, related forms, and instructions on how to. Your guide to a clean.

This Form Is Critical For Ensuring Compliance With U.s.

Your guide to a clean break. Form 8854 is usually due when you file your final form 1040 for the year you expatriated. Information about form 8854, initial and annual expatriation statement, including recent updates, related forms, and instructions on how to. Among these is the requirement to file irs form 8854 for expatriation and exit tax calculations.

Discover How Form 8854 Finalizes Your Exit From U.s.

Taxes, ensuring a smooth transition for expats. If you’re not filing a 1040 that year, you still need.