Loan To Shareholder On Balance Sheet - Shareholder loans should appear in the liability section of the. These loans to shareholders are recorded as receivables on a company’s balance sheet. The irs mandates that taxpayers treat. A balance sheet shows assets, liability and owner’s equity. It must include detail disclosure for transparency as. Loans from shareholders or loans to shareholders go in the balance sheet as an asset or liability. The initial recognition of a shareholder loan involves recording it at its fair value on the company’s balance sheet. The loan to the shareholder must be recorded in a separate account and provide clear disclosure. The loan itself is not a deduction.

The loan to the shareholder must be recorded in a separate account and provide clear disclosure. The irs mandates that taxpayers treat. These loans to shareholders are recorded as receivables on a company’s balance sheet. A balance sheet shows assets, liability and owner’s equity. The loan itself is not a deduction. The initial recognition of a shareholder loan involves recording it at its fair value on the company’s balance sheet. It must include detail disclosure for transparency as. Shareholder loans should appear in the liability section of the. Loans from shareholders or loans to shareholders go in the balance sheet as an asset or liability.

The loan itself is not a deduction. The loan to the shareholder must be recorded in a separate account and provide clear disclosure. Loans from shareholders or loans to shareholders go in the balance sheet as an asset or liability. The initial recognition of a shareholder loan involves recording it at its fair value on the company’s balance sheet. The irs mandates that taxpayers treat. A balance sheet shows assets, liability and owner’s equity. Shareholder loans should appear in the liability section of the. It must include detail disclosure for transparency as. These loans to shareholders are recorded as receivables on a company’s balance sheet.

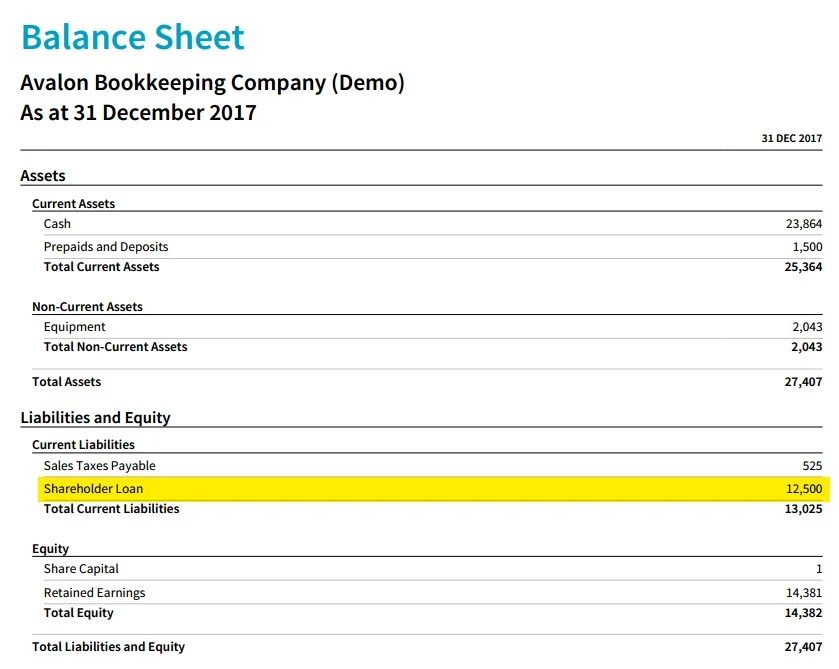

Shareholder Loan Understand it and Avoid Trouble with the CRA Blog

Shareholder loans should appear in the liability section of the. The loan to the shareholder must be recorded in a separate account and provide clear disclosure. The initial recognition of a shareholder loan involves recording it at its fair value on the company’s balance sheet. These loans to shareholders are recorded as receivables on a company’s balance sheet. The irs.

Irs Loans From Shareholders

The loan itself is not a deduction. Loans from shareholders or loans to shareholders go in the balance sheet as an asset or liability. A balance sheet shows assets, liability and owner’s equity. The irs mandates that taxpayers treat. The loan to the shareholder must be recorded in a separate account and provide clear disclosure.

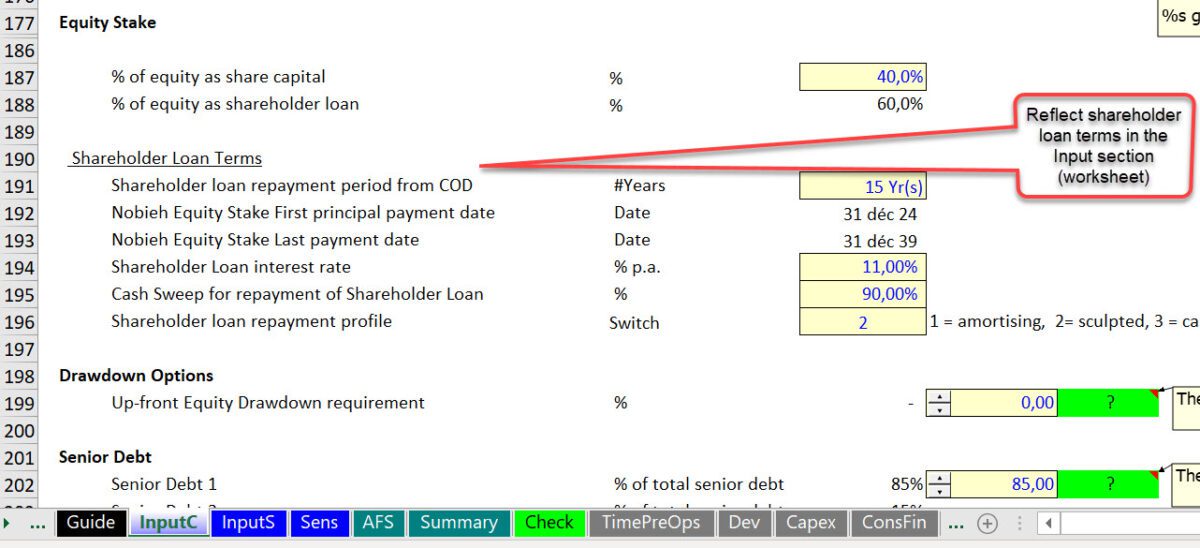

Forms of Equity Contributions in a Project Finance Structure

The irs mandates that taxpayers treat. Loans from shareholders or loans to shareholders go in the balance sheet as an asset or liability. A balance sheet shows assets, liability and owner’s equity. It must include detail disclosure for transparency as. The loan to the shareholder must be recorded in a separate account and provide clear disclosure.

Answered Given the following Year 9 selected… bartleby

A balance sheet shows assets, liability and owner’s equity. The loan itself is not a deduction. These loans to shareholders are recorded as receivables on a company’s balance sheet. The irs mandates that taxpayers treat. Shareholder loans should appear in the liability section of the.

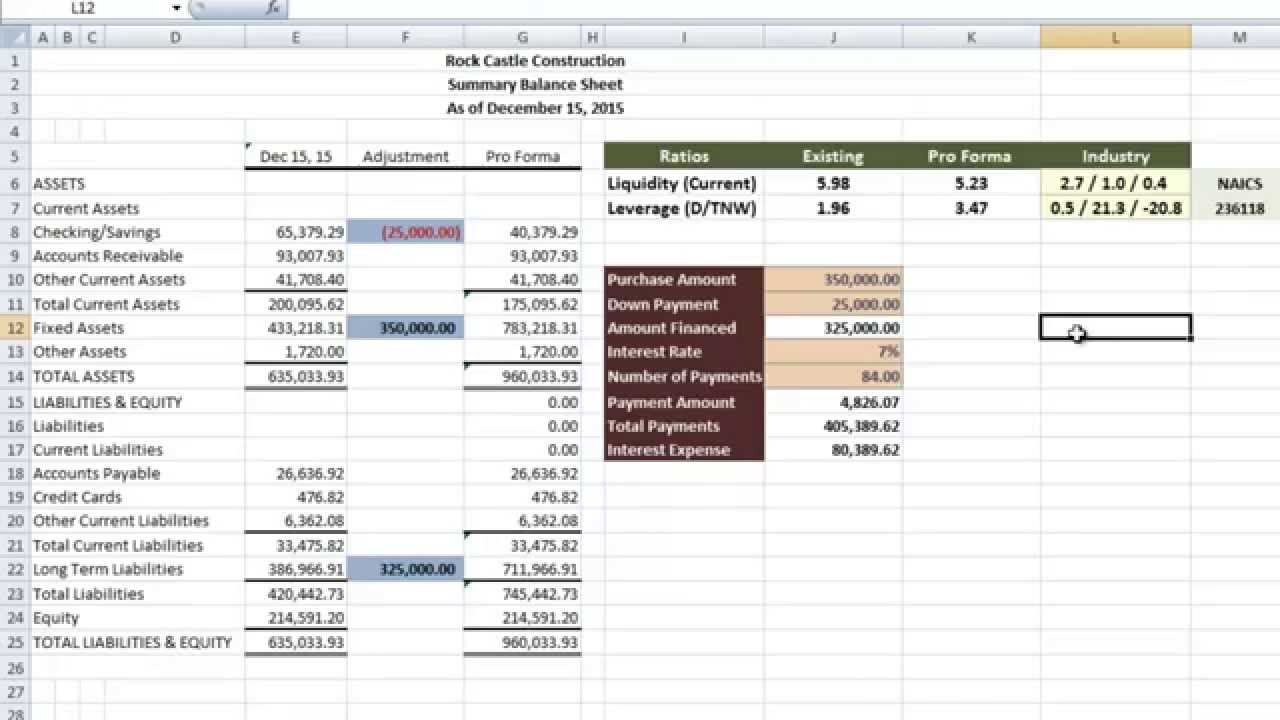

MANAGERIAL ACCOUNTING Eighth Canadian Edition GARRISON, CHESLEY

The irs mandates that taxpayers treat. The initial recognition of a shareholder loan involves recording it at its fair value on the company’s balance sheet. Shareholder loans should appear in the liability section of the. Loans from shareholders or loans to shareholders go in the balance sheet as an asset or liability. It must include detail disclosure for transparency as.

Project Finance Funding with Shareholder Loan and Capitalised Interest

A balance sheet shows assets, liability and owner’s equity. Loans from shareholders or loans to shareholders go in the balance sheet as an asset or liability. The irs mandates that taxpayers treat. The loan to the shareholder must be recorded in a separate account and provide clear disclosure. The loan itself is not a deduction.

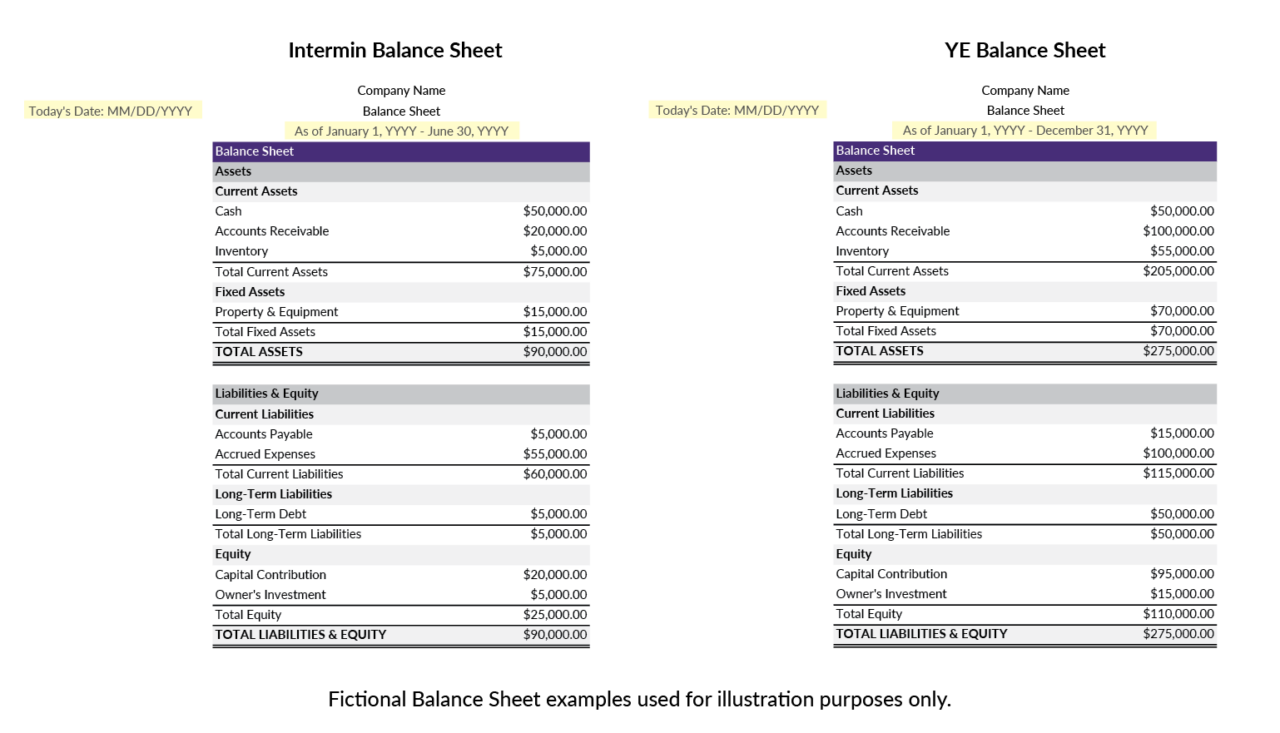

Tips for Preparing a Balance Sheet Lendistry

Shareholder loans should appear in the liability section of the. It must include detail disclosure for transparency as. The loan to the shareholder must be recorded in a separate account and provide clear disclosure. These loans to shareholders are recorded as receivables on a company’s balance sheet. Loans from shareholders or loans to shareholders go in the balance sheet as.

How To Show A Loan On A Balance Sheet Info Loans

The irs mandates that taxpayers treat. The initial recognition of a shareholder loan involves recording it at its fair value on the company’s balance sheet. The loan to the shareholder must be recorded in a separate account and provide clear disclosure. Loans from shareholders or loans to shareholders go in the balance sheet as an asset or liability. Shareholder loans.

Where Do Shareholder Distributions Go On Balance Sheet Info Loans

The loan to the shareholder must be recorded in a separate account and provide clear disclosure. The initial recognition of a shareholder loan involves recording it at its fair value on the company’s balance sheet. The loan itself is not a deduction. The irs mandates that taxpayers treat. Shareholder loans should appear in the liability section of the.

What Is a Balance Sheet? Complete Guide Pareto Labs

The loan to the shareholder must be recorded in a separate account and provide clear disclosure. The initial recognition of a shareholder loan involves recording it at its fair value on the company’s balance sheet. Loans from shareholders or loans to shareholders go in the balance sheet as an asset or liability. Shareholder loans should appear in the liability section.

Shareholder Loans Should Appear In The Liability Section Of The.

These loans to shareholders are recorded as receivables on a company’s balance sheet. The loan to the shareholder must be recorded in a separate account and provide clear disclosure. The irs mandates that taxpayers treat. The initial recognition of a shareholder loan involves recording it at its fair value on the company’s balance sheet.

It Must Include Detail Disclosure For Transparency As.

The loan itself is not a deduction. A balance sheet shows assets, liability and owner’s equity. Loans from shareholders or loans to shareholders go in the balance sheet as an asset or liability.