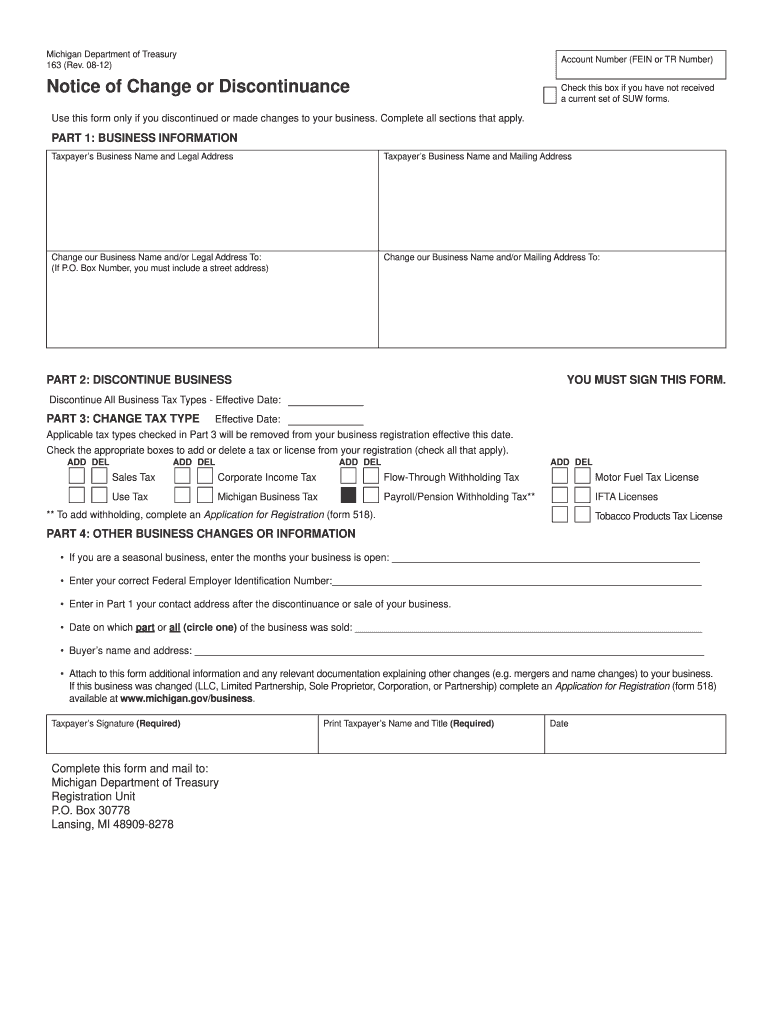

Mi Form 163 - Form 163 can also be submitted electronically on michigan treasury online at mto.treasury.michigan.gov. You must notify the registration section of the michigan department of treasury by completing a form 163 notice of change or discontinuance. Yes, form 163 notice of change or discontinuance is. Notice of change or discontinuance use this form only if you discontinued or made changes to your business. Complete all sections that apply. When discontinuing your business, please attach a copy of form 163, notice of change or discontinuance with your request for tax. Do i need to file anything else with form 5156 request for tax clearance application?

When discontinuing your business, please attach a copy of form 163, notice of change or discontinuance with your request for tax. Yes, form 163 notice of change or discontinuance is. Do i need to file anything else with form 5156 request for tax clearance application? Notice of change or discontinuance use this form only if you discontinued or made changes to your business. Complete all sections that apply. You must notify the registration section of the michigan department of treasury by completing a form 163 notice of change or discontinuance. Form 163 can also be submitted electronically on michigan treasury online at mto.treasury.michigan.gov.

Notice of change or discontinuance use this form only if you discontinued or made changes to your business. Form 163 can also be submitted electronically on michigan treasury online at mto.treasury.michigan.gov. You must notify the registration section of the michigan department of treasury by completing a form 163 notice of change or discontinuance. When discontinuing your business, please attach a copy of form 163, notice of change or discontinuance with your request for tax. Yes, form 163 notice of change or discontinuance is. Complete all sections that apply. Do i need to file anything else with form 5156 request for tax clearance application?

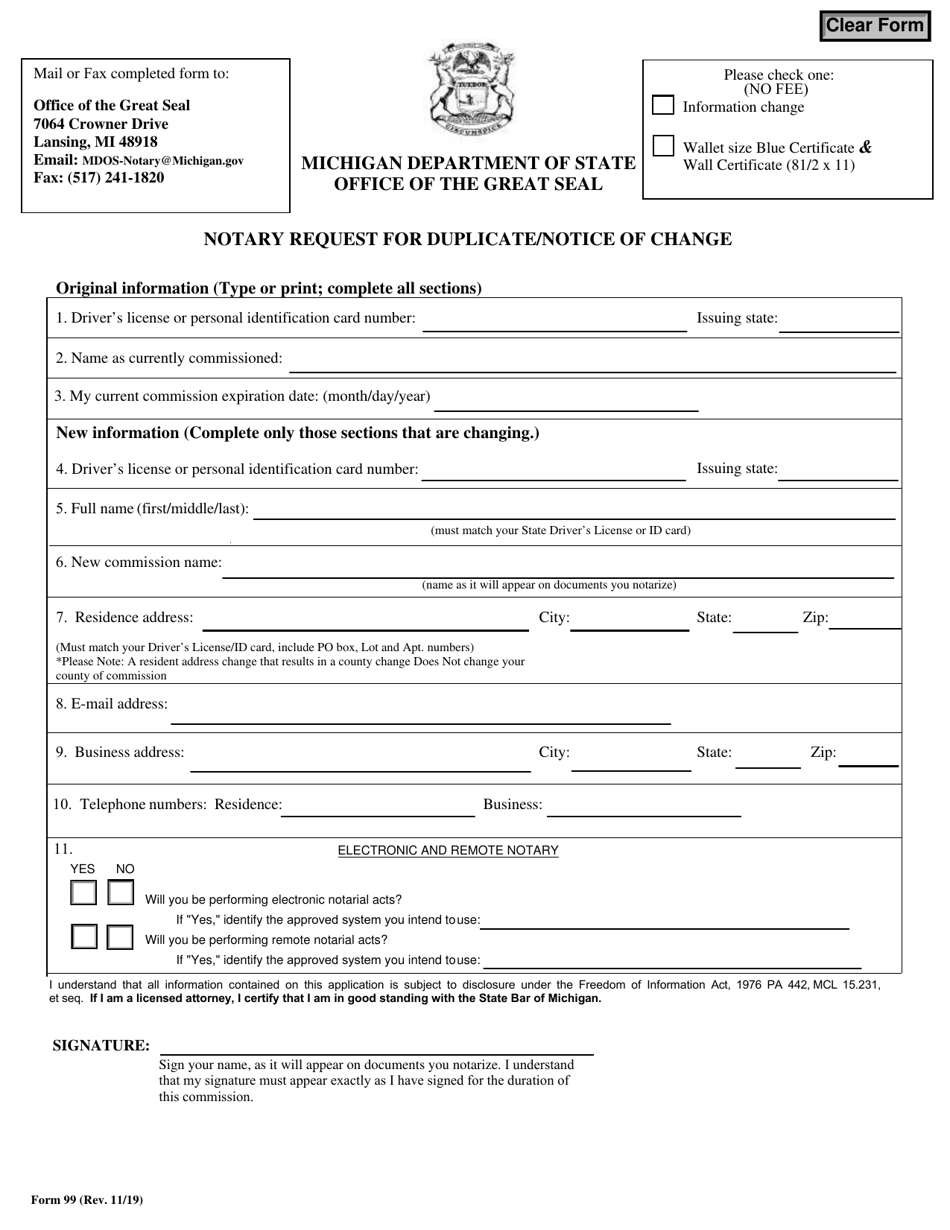

Form 99 Fill Out, Sign Online and Download Fillable PDF, Michigan

When discontinuing your business, please attach a copy of form 163, notice of change or discontinuance with your request for tax. Do i need to file anything else with form 5156 request for tax clearance application? Notice of change or discontinuance use this form only if you discontinued or made changes to your business. Complete all sections that apply. You.

2011 Form MI DoT 163 Fill Online, Printable, Fillable, Blank pdfFiller

Notice of change or discontinuance use this form only if you discontinued or made changes to your business. Complete all sections that apply. Do i need to file anything else with form 5156 request for tax clearance application? When discontinuing your business, please attach a copy of form 163, notice of change or discontinuance with your request for tax. You.

Mi Form 163 Complete with ease airSlate SignNow

When discontinuing your business, please attach a copy of form 163, notice of change or discontinuance with your request for tax. Form 163 can also be submitted electronically on michigan treasury online at mto.treasury.michigan.gov. Notice of change or discontinuance use this form only if you discontinued or made changes to your business. Yes, form 163 notice of change or discontinuance.

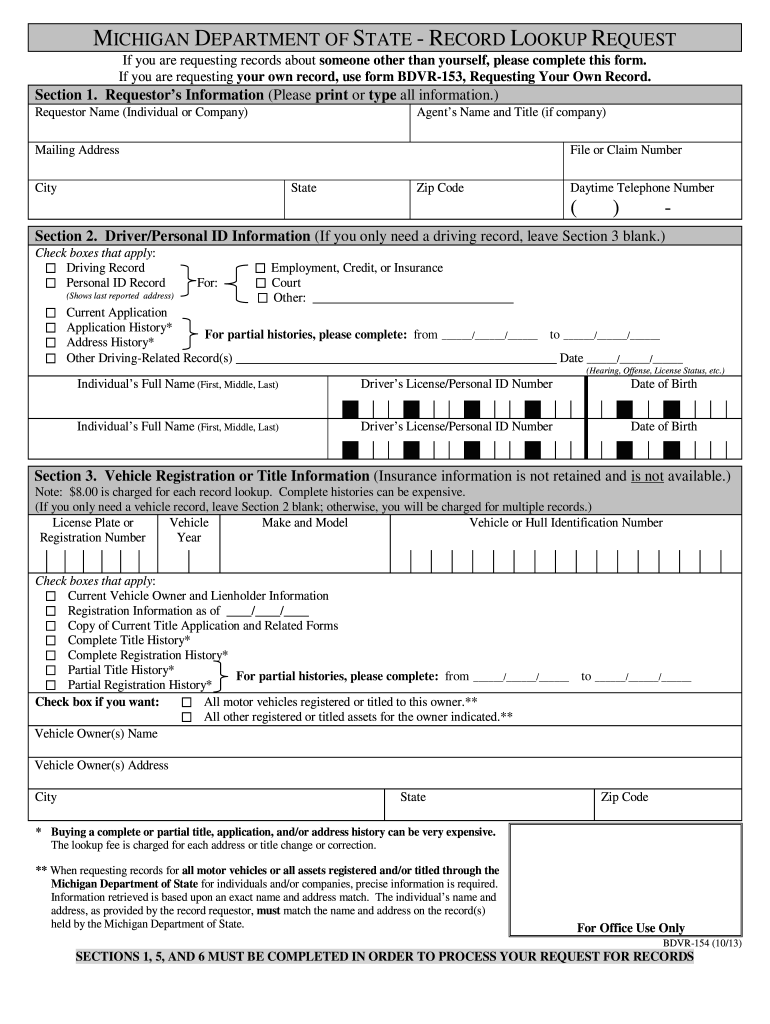

MI BDVR154 20132022 Fill and Sign Printable Template Online US

You must notify the registration section of the michigan department of treasury by completing a form 163 notice of change or discontinuance. Form 163 can also be submitted electronically on michigan treasury online at mto.treasury.michigan.gov. When discontinuing your business, please attach a copy of form 163, notice of change or discontinuance with your request for tax. Do i need to.

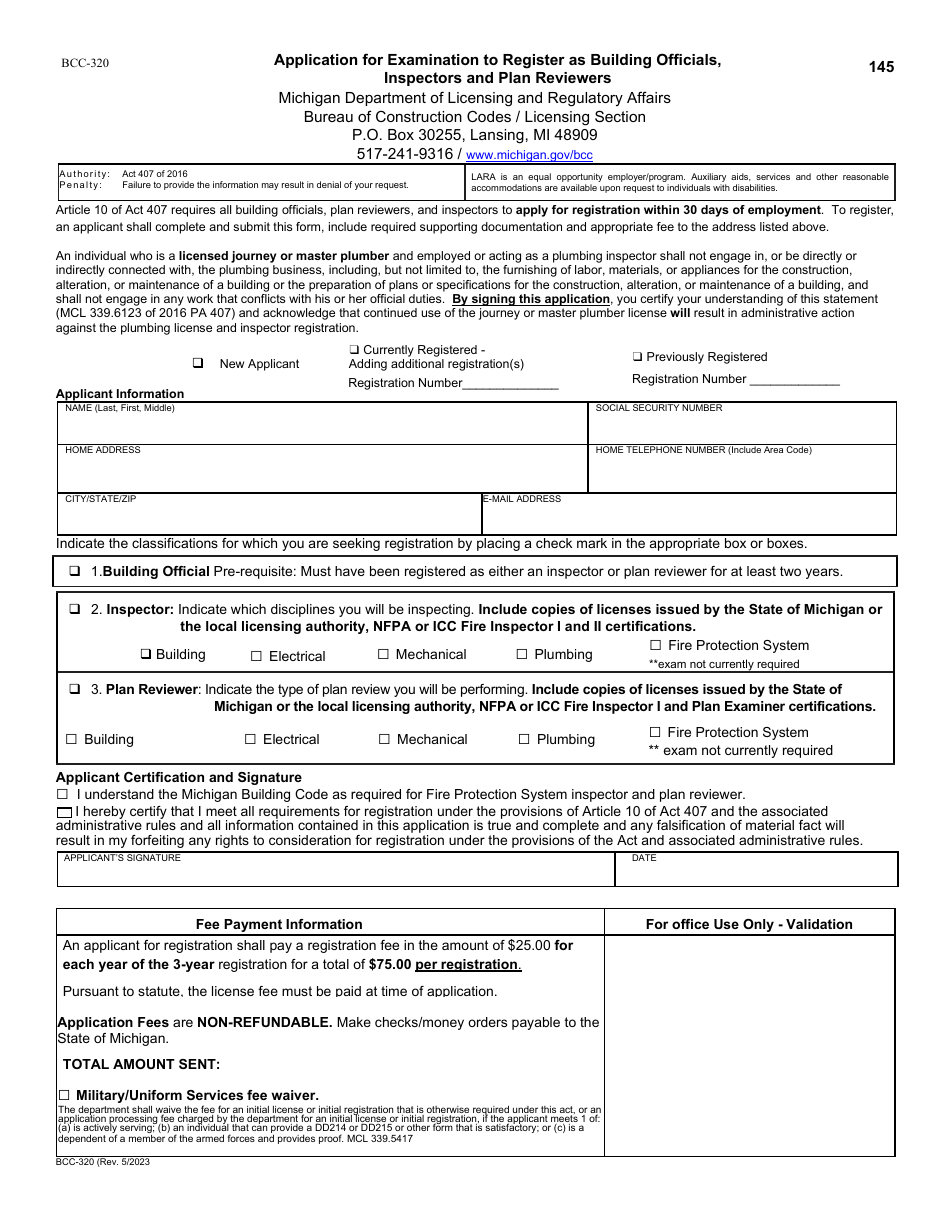

Form BCC320 Download Fillable PDF or Fill Online Application for

When discontinuing your business, please attach a copy of form 163, notice of change or discontinuance with your request for tax. Complete all sections that apply. You must notify the registration section of the michigan department of treasury by completing a form 163 notice of change or discontinuance. Form 163 can also be submitted electronically on michigan treasury online at.

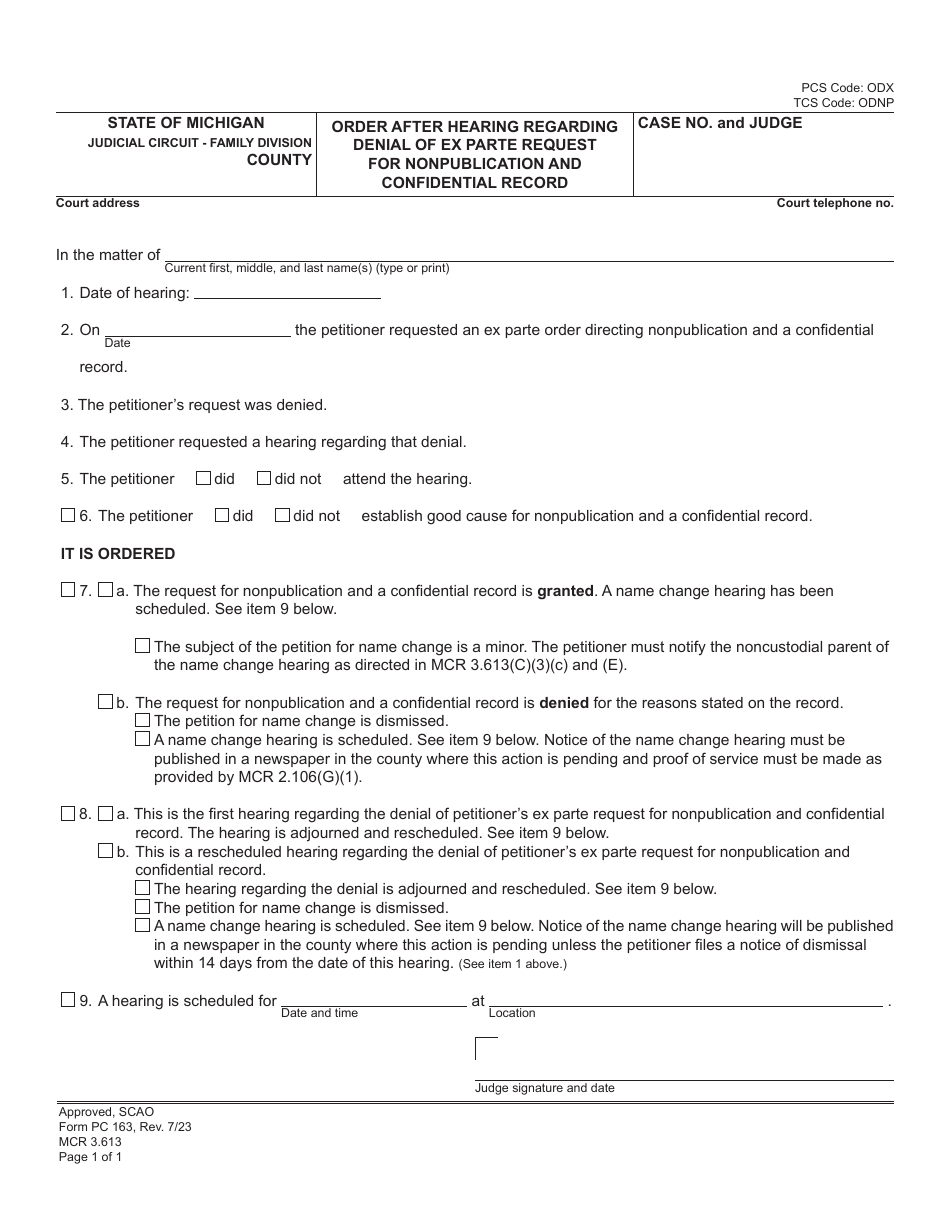

Form PC163 Fill Out, Sign Online and Download Fillable PDF, Michigan

When discontinuing your business, please attach a copy of form 163, notice of change or discontinuance with your request for tax. You must notify the registration section of the michigan department of treasury by completing a form 163 notice of change or discontinuance. Form 163 can also be submitted electronically on michigan treasury online at mto.treasury.michigan.gov. Yes, form 163 notice.

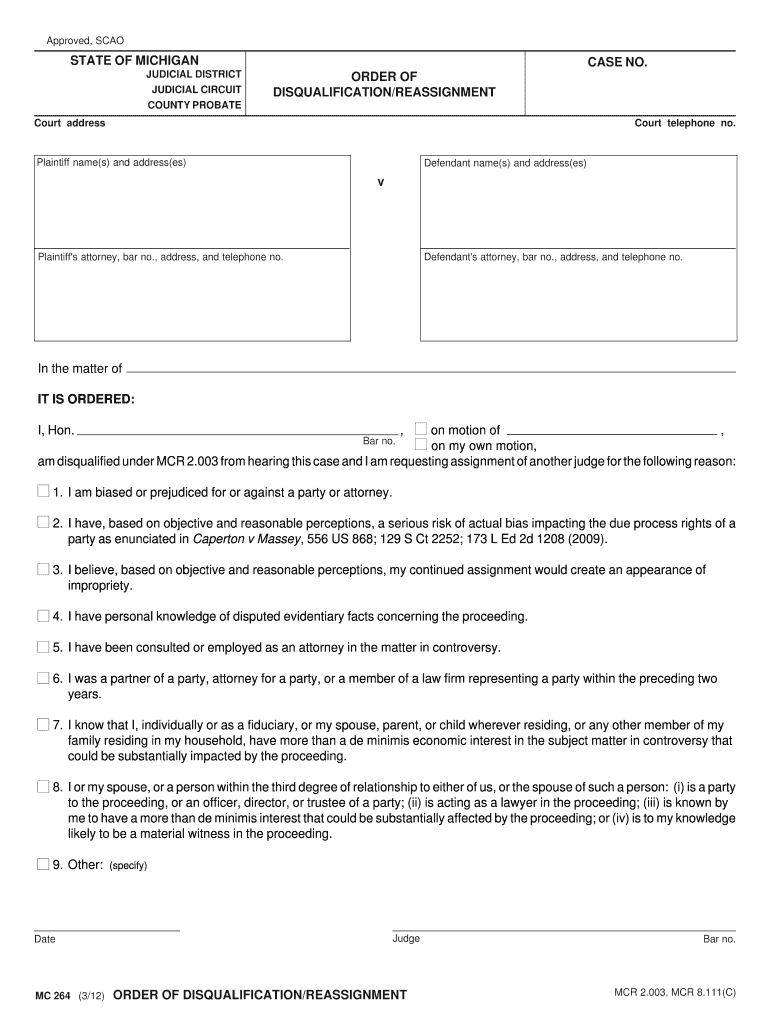

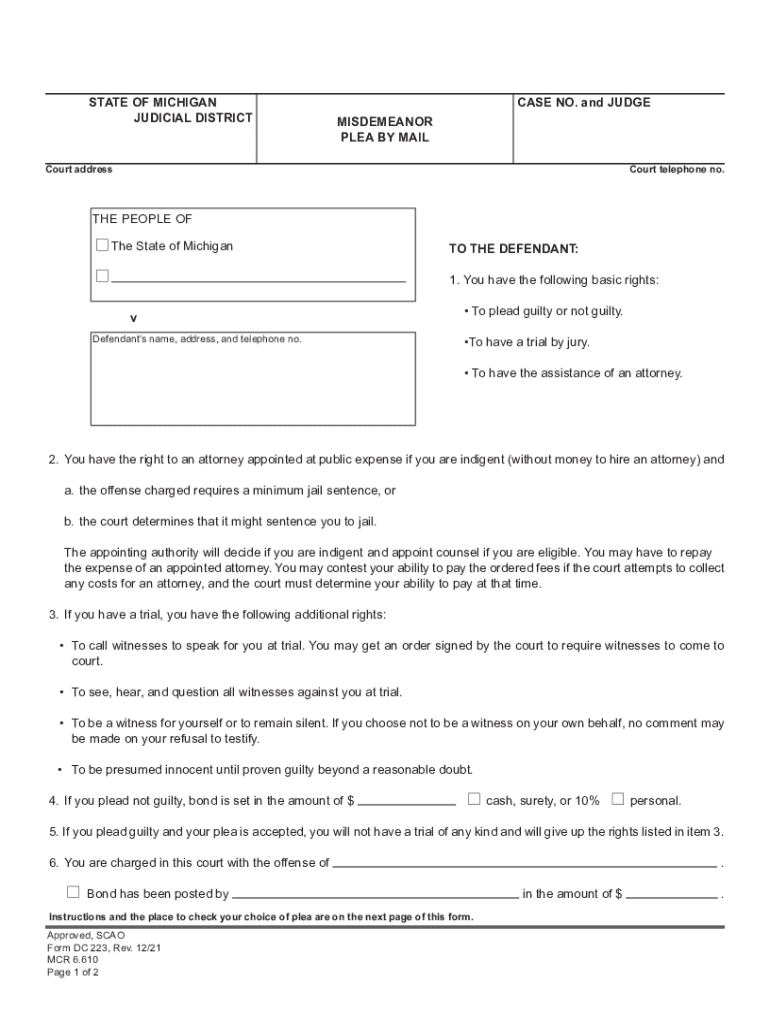

Approved, SCAO STATE of MICHIGAN CASE NO JUDICIAL DISTRICT Form Fill

Do i need to file anything else with form 5156 request for tax clearance application? Yes, form 163 notice of change or discontinuance is. Notice of change or discontinuance use this form only if you discontinued or made changes to your business. Complete all sections that apply. Form 163 can also be submitted electronically on michigan treasury online at mto.treasury.michigan.gov.

Mi 163 Form ≡ Fill Out Printable PDF Forms Online

Form 163 can also be submitted electronically on michigan treasury online at mto.treasury.michigan.gov. Yes, form 163 notice of change or discontinuance is. Do i need to file anything else with form 5156 request for tax clearance application? You must notify the registration section of the michigan department of treasury by completing a form 163 notice of change or discontinuance. When.

Michigan.govtaxes Form 163 Form Resume Examples EZVgZZxrYJ

Do i need to file anything else with form 5156 request for tax clearance application? You must notify the registration section of the michigan department of treasury by completing a form 163 notice of change or discontinuance. Notice of change or discontinuance use this form only if you discontinued or made changes to your business. Complete all sections that apply..

Fillable Online fill.ioSTATEOFMICHIGANCASENOandJUDGEFill Free

Complete all sections that apply. Form 163 can also be submitted electronically on michigan treasury online at mto.treasury.michigan.gov. Yes, form 163 notice of change or discontinuance is. Notice of change or discontinuance use this form only if you discontinued or made changes to your business. You must notify the registration section of the michigan department of treasury by completing a.

Form 163 Can Also Be Submitted Electronically On Michigan Treasury Online At Mto.treasury.michigan.gov.

Notice of change or discontinuance use this form only if you discontinued or made changes to your business. You must notify the registration section of the michigan department of treasury by completing a form 163 notice of change or discontinuance. When discontinuing your business, please attach a copy of form 163, notice of change or discontinuance with your request for tax. Complete all sections that apply.

Do I Need To File Anything Else With Form 5156 Request For Tax Clearance Application?

Yes, form 163 notice of change or discontinuance is.