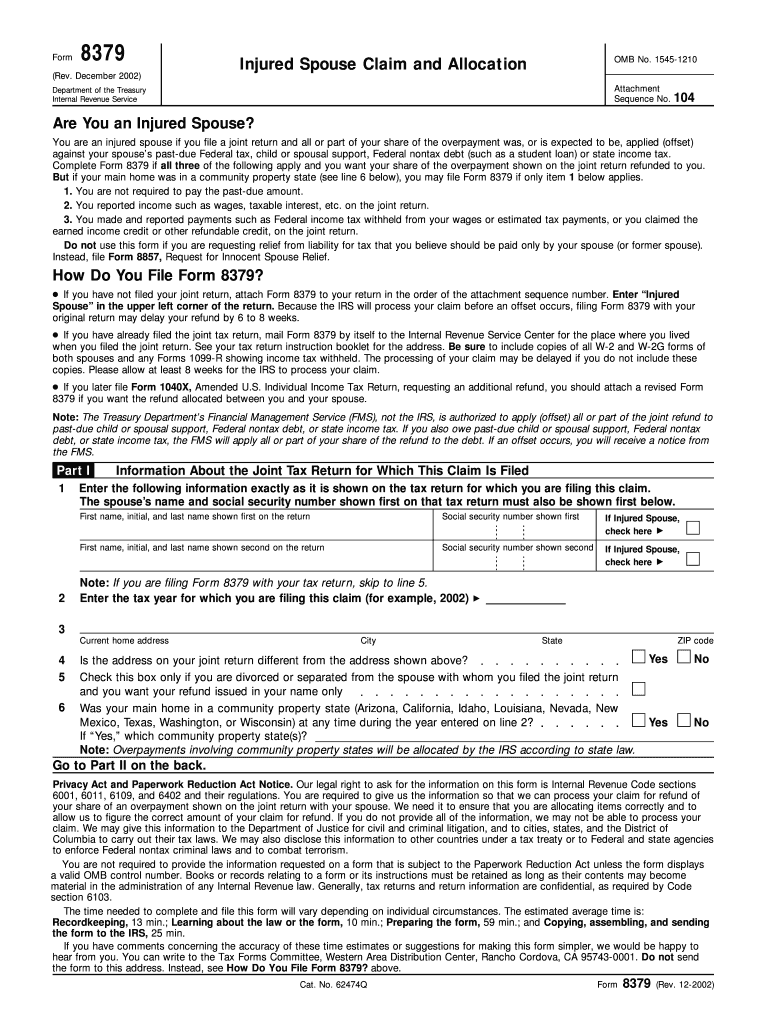

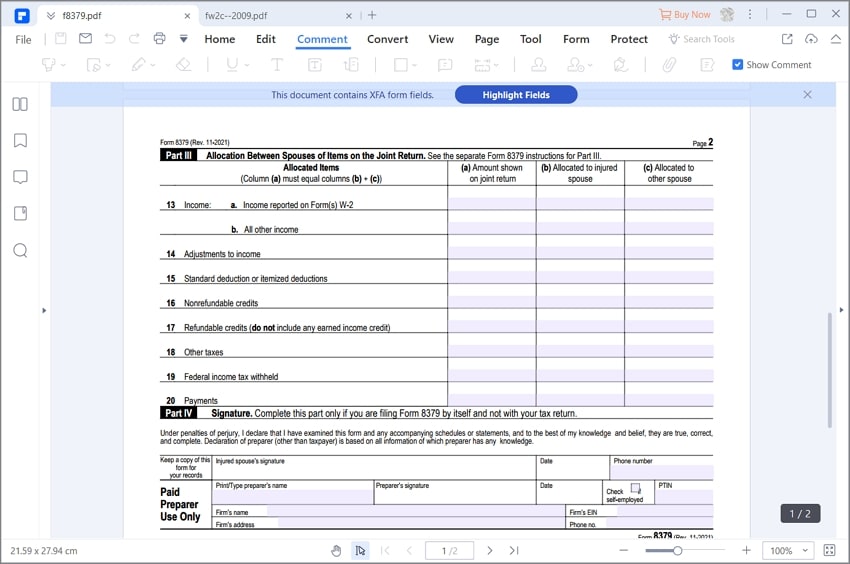

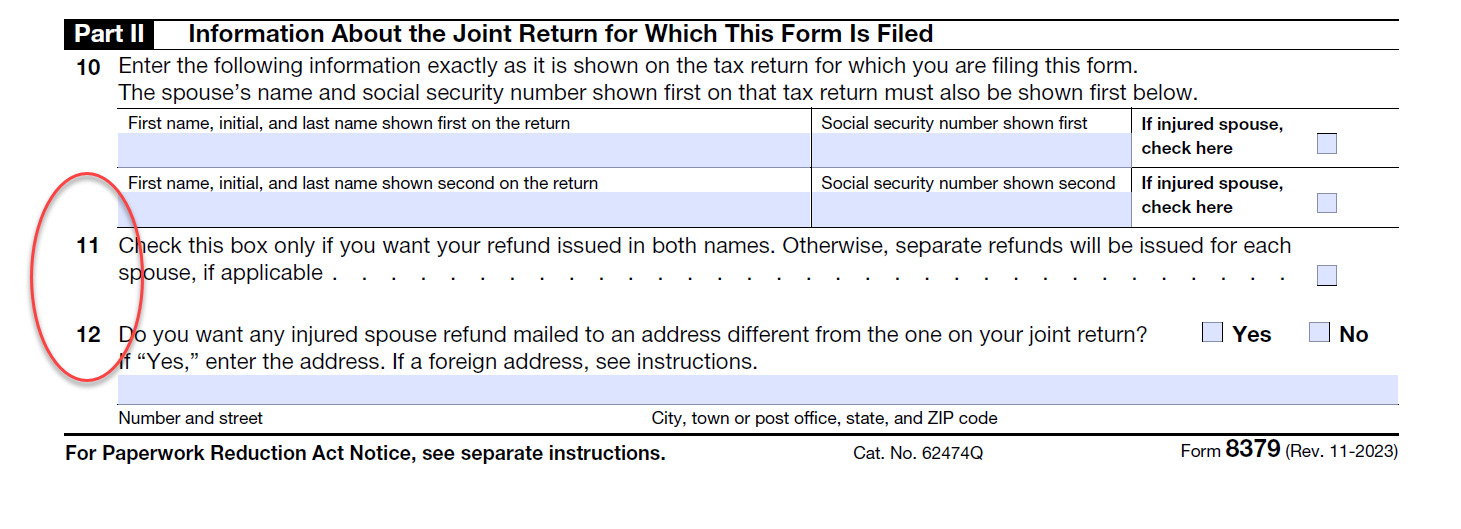

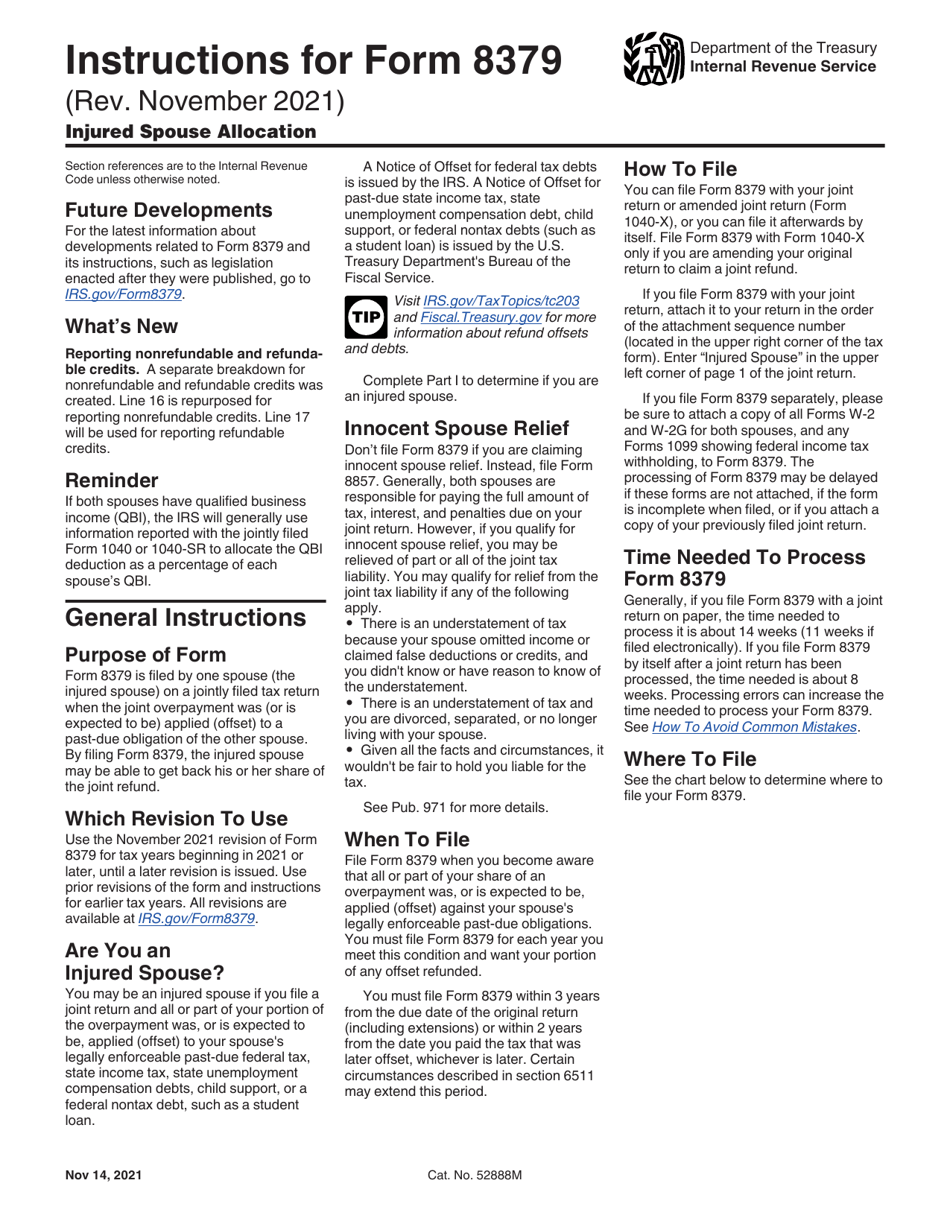

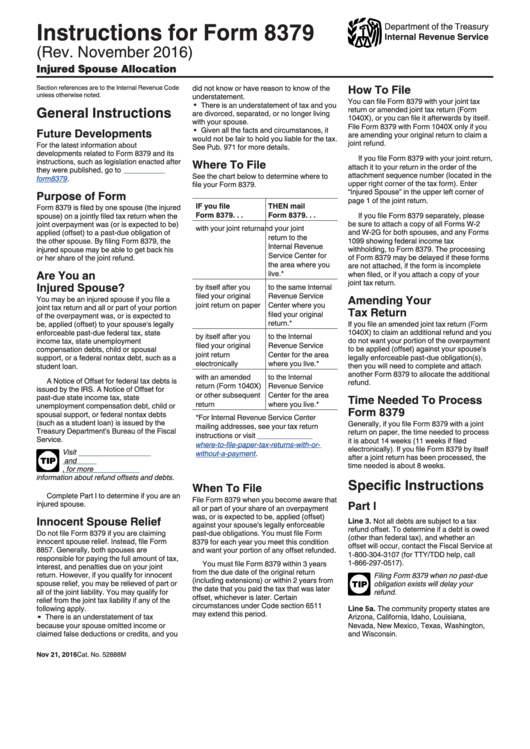

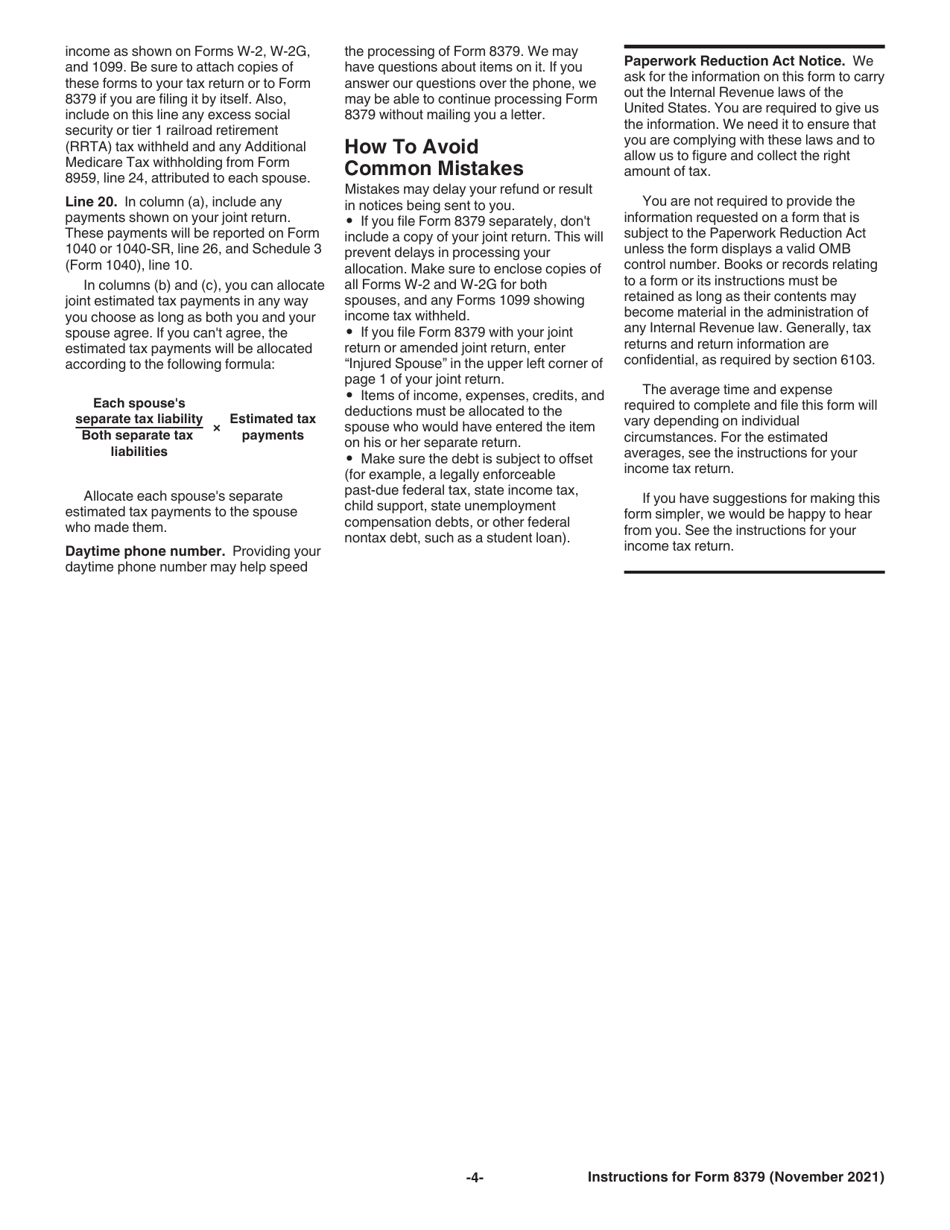

Tax Form 8379 - This is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. Fillable & printable formfillable pdf template Use prior revisions of the form. Use the november 2023 revision of form 8379 for tax years beginning in 2023 or later, until a later revision is issued. Under penalties of perjury, i declare that i have examined this form and any accompanying schedules or statements, and to the best of my. Follow the form 8379 instructions. Information about form 8857, request for innocent spouse relief, including recent updates, related forms, and instructions on how to file. Use this november 2024 revision of the instructions for form 8379 for tax years beginning in 2024 or later, until a later revision is issued. Fill in your taxpayer identification numbers in the same order as they appear on your joint tax return. Form 8379 is filed by one spouse (the injured spouse) on a jointly filed tax return when the joint overpayment was (or is expected to be) applied.

Use this november 2024 revision of the instructions for form 8379 for tax years beginning in 2024 or later, until a later revision is issued. Follow the form 8379 instructions. Fillable & printable formfillable pdf template Use this november 2024 revision of the instructions for form 8379 for tax years beginning in 2024 or later, until a later revision is issued. Information about form 8379, injured spouse allocation, including recent updates, related forms, and instructions on how to file. Under penalties of perjury, i declare that i have examined this form and any accompanying schedules or statements, and to the best of my. Information about form 8857, request for innocent spouse relief, including recent updates, related forms, and instructions on how to file. If you’re an injured spouse, you must file a form 8379, injured spouse allocation, to let the irs know. Use prior revisions of the form. Use the november 2023 revision of form 8379 for tax years beginning in 2023 or later, until a later revision is issued.

Follow the form 8379 instructions. Use prior revisions of the form. Information about form 8379, injured spouse allocation, including recent updates, related forms, and instructions on how to file. Form 8379 is filed by one spouse (the injured spouse) on a jointly filed tax return when the joint overpayment was (or is expected to be) applied. Under penalties of perjury, i declare that i have examined this form and any accompanying schedules or statements, and to the best of my. Use this november 2024 revision of the instructions for form 8379 for tax years beginning in 2024 or later, until a later revision is issued. Use the november 2023 revision of form 8379 for tax years beginning in 2023 or later, until a later revision is issued. Information about form 8857, request for innocent spouse relief, including recent updates, related forms, and instructions on how to file. Fillable & printable formfillable pdf template Use this november 2024 revision of the instructions for form 8379 for tax years beginning in 2024 or later, until a later revision is issued.

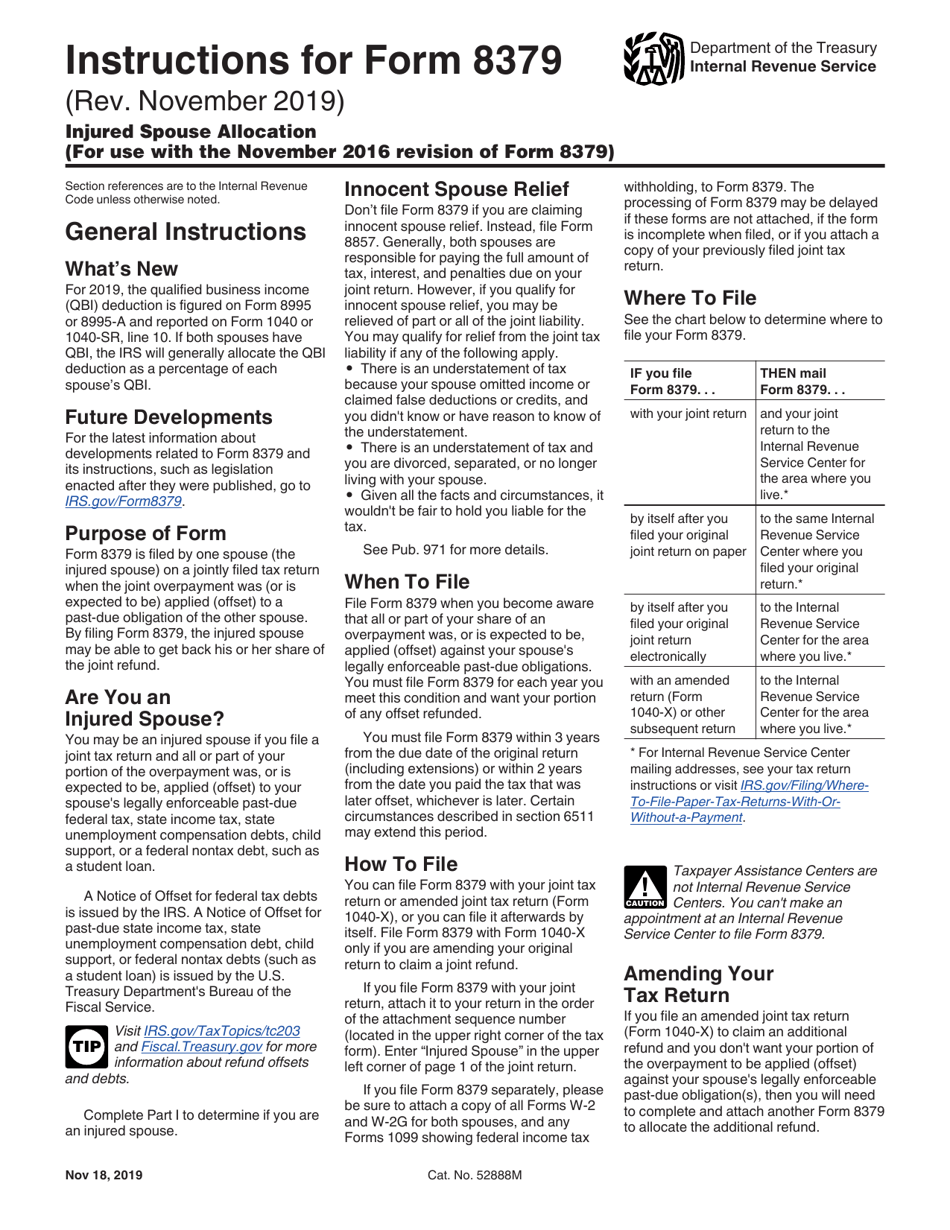

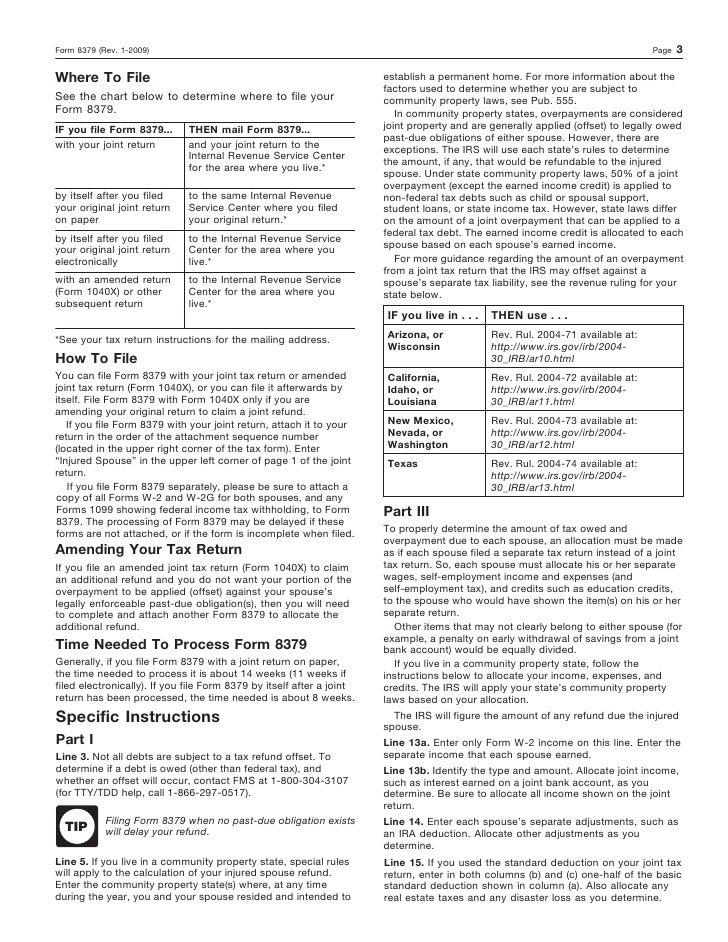

Instructions For Form 8379 Injured Spouse Allocation printable pdf

Under penalties of perjury, i declare that i have examined this form and any accompanying schedules or statements, and to the best of my. Use this november 2024 revision of the instructions for form 8379 for tax years beginning in 2024 or later, until a later revision is issued. Use prior revisions of the form. Use this november 2024 revision.

Download Instructions for IRS Form 8379 Injured Spouse Allocation PDF

If you’re an injured spouse, you must file a form 8379, injured spouse allocation, to let the irs know. Form 8379 is filed by one spouse (the injured spouse) on a jointly filed tax return when the joint overpayment was (or is expected to be) applied. Use this november 2024 revision of the instructions for form 8379 for tax years.

What Is Form 8379 Injured Spouse Allocation? Definition

Use this november 2024 revision of the instructions for form 8379 for tax years beginning in 2024 or later, until a later revision is issued. Follow the form 8379 instructions. This is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. Under penalties of perjury, i declare that i.

Injured Spouse Form Complete with ease airSlate SignNow

Under penalties of perjury, i declare that i have examined this form and any accompanying schedules or statements, and to the best of my. Use this november 2024 revision of the instructions for form 8379 for tax years beginning in 2024 or later, until a later revision is issued. Use prior revisions of the form. Follow the form 8379 instructions..

Form 8379 Instructions at tanmosheblog Blog

Use this november 2024 revision of the instructions for form 8379 for tax years beginning in 2024 or later, until a later revision is issued. Use this november 2024 revision of the instructions for form 8379 for tax years beginning in 2024 or later, until a later revision is issued. Form 8379 is filed by one spouse (the injured spouse).

Download Instructions for IRS Form 8379 Injured Spouse Allocation PDF

If you’re an injured spouse, you must file a form 8379, injured spouse allocation, to let the irs know. Under penalties of perjury, i declare that i have examined this form and any accompanying schedules or statements, and to the best of my. Use prior revisions of the form. Use the november 2023 revision of form 8379 for tax years.

Injured Spouse Taxpayer Advocate Service

Information about form 8379, injured spouse allocation, including recent updates, related forms, and instructions on how to file. This is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. Under penalties of perjury, i declare that i have examined this form and any accompanying schedules or statements, and to.

Form 8379 Injured Spouse Allocation DocumentsHelper

Use the november 2023 revision of form 8379 for tax years beginning in 2023 or later, until a later revision is issued. Use prior revisions of the form. Use this november 2024 revision of the instructions for form 8379 for tax years beginning in 2024 or later, until a later revision is issued. Use this november 2024 revision of the.

Form 8379Injured Spouse Claim and Allocation

Use this november 2024 revision of the instructions for form 8379 for tax years beginning in 2024 or later, until a later revision is issued. Under penalties of perjury, i declare that i have examined this form and any accompanying schedules or statements, and to the best of my. Use prior revisions of the form. If you’re an injured spouse,.

Download Instructions for IRS Form 8379 Injured Spouse Allocation PDF

This is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. Use this november 2024 revision of the instructions for form 8379 for tax years beginning in 2024 or later, until a later revision is issued. Use the november 2023 revision of form 8379 for tax years beginning in.

Use This November 2024 Revision Of The Instructions For Form 8379 For Tax Years Beginning In 2024 Or Later, Until A Later Revision Is Issued.

Use the november 2023 revision of form 8379 for tax years beginning in 2023 or later, until a later revision is issued. Form 8379 is filed by one spouse (the injured spouse) on a jointly filed tax return when the joint overpayment was (or is expected to be) applied. Use prior revisions of the form. Follow the form 8379 instructions.

Information About Form 8857, Request For Innocent Spouse Relief, Including Recent Updates, Related Forms, And Instructions On How To File.

Under penalties of perjury, i declare that i have examined this form and any accompanying schedules or statements, and to the best of my. If you’re an injured spouse, you must file a form 8379, injured spouse allocation, to let the irs know. This is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. Information about form 8379, injured spouse allocation, including recent updates, related forms, and instructions on how to file.

Use This November 2024 Revision Of The Instructions For Form 8379 For Tax Years Beginning In 2024 Or Later, Until A Later Revision Is Issued.

Fill in your taxpayer identification numbers in the same order as they appear on your joint tax return. Fillable & printable formfillable pdf template

:max_bytes(150000):strip_icc()/8379InjuredSpouseAllocation-1-03b68023b499432fabbad2fdc66b4b5e.png)