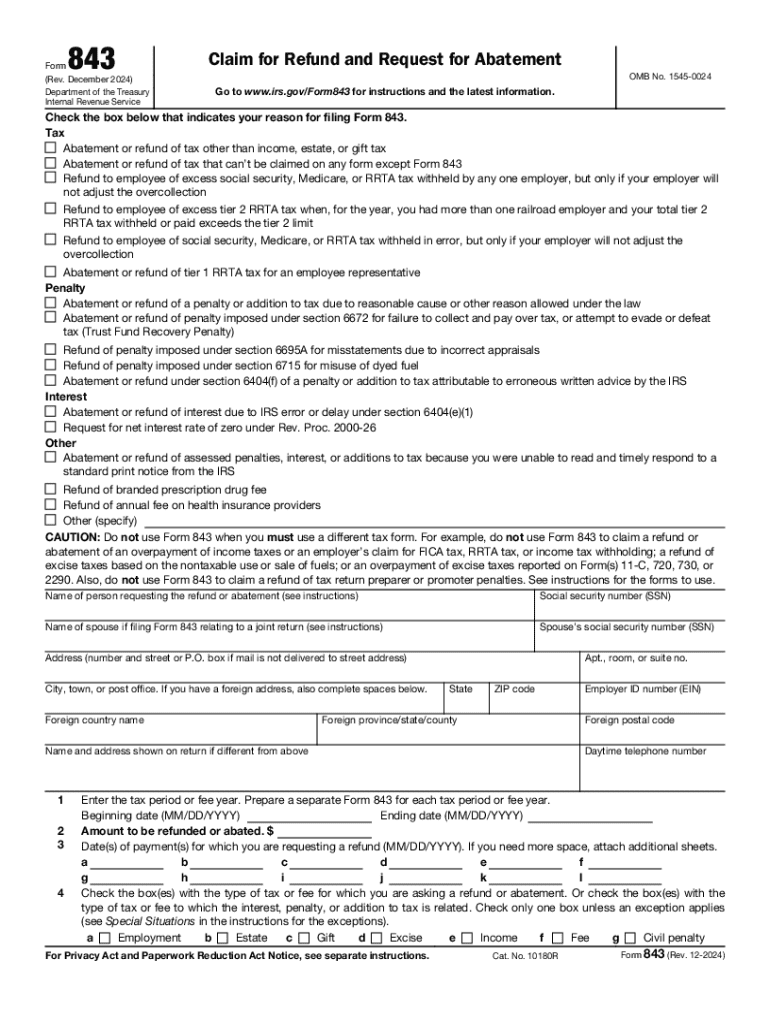

Tax Form 843 - I went to the local irs. I already sent by taxes into irs. To get a refund for the extra. Instead complete form 843 to obtain your refund for the overpayment of your social security and medicare tax by the same/one. Form 843 logistics my tax return (claiming refund) was rejected and i was assessed penalty charges for that. Simply multiply the amount in box 3 by a factor of 0.062 and enter that amount or 10,453.20 (whichever is less) in box 4. Is turbo tax able to fill out form 843, claim for refund and request for abatement? Form 843 and your tax return will be processed separately and any refund from the form 843 will come as a separate check so waiting to.

Simply multiply the amount in box 3 by a factor of 0.062 and enter that amount or 10,453.20 (whichever is less) in box 4. Form 843 logistics my tax return (claiming refund) was rejected and i was assessed penalty charges for that. Form 843 and your tax return will be processed separately and any refund from the form 843 will come as a separate check so waiting to. Instead complete form 843 to obtain your refund for the overpayment of your social security and medicare tax by the same/one. To get a refund for the extra. I already sent by taxes into irs. I went to the local irs. Is turbo tax able to fill out form 843, claim for refund and request for abatement?

I already sent by taxes into irs. To get a refund for the extra. Is turbo tax able to fill out form 843, claim for refund and request for abatement? Simply multiply the amount in box 3 by a factor of 0.062 and enter that amount or 10,453.20 (whichever is less) in box 4. Form 843 logistics my tax return (claiming refund) was rejected and i was assessed penalty charges for that. I went to the local irs. Instead complete form 843 to obtain your refund for the overpayment of your social security and medicare tax by the same/one. Form 843 and your tax return will be processed separately and any refund from the form 843 will come as a separate check so waiting to.

Claim Refund Complete with ease airSlate SignNow

Is turbo tax able to fill out form 843, claim for refund and request for abatement? I already sent by taxes into irs. Form 843 logistics my tax return (claiming refund) was rejected and i was assessed penalty charges for that. To get a refund for the extra. Simply multiply the amount in box 3 by a factor of 0.062.

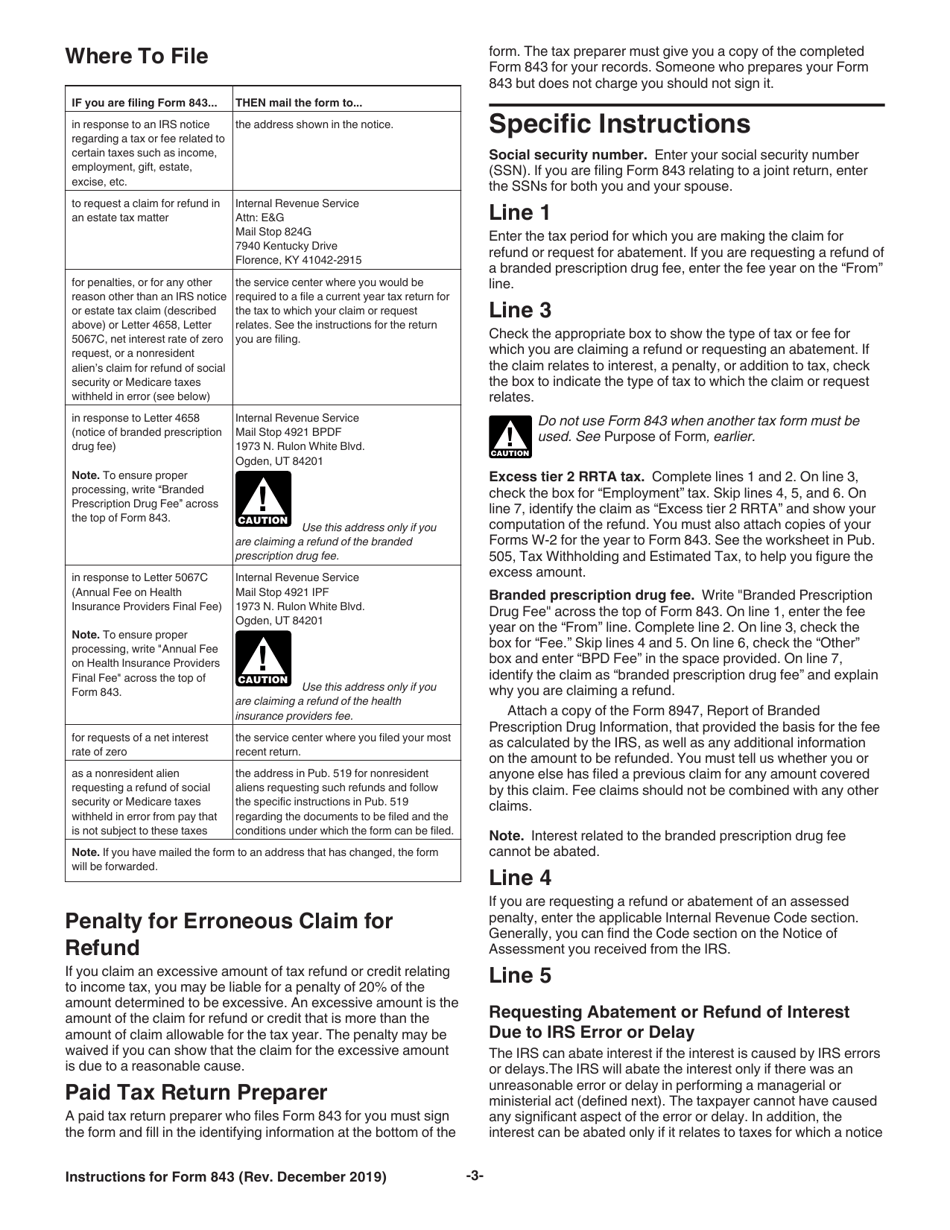

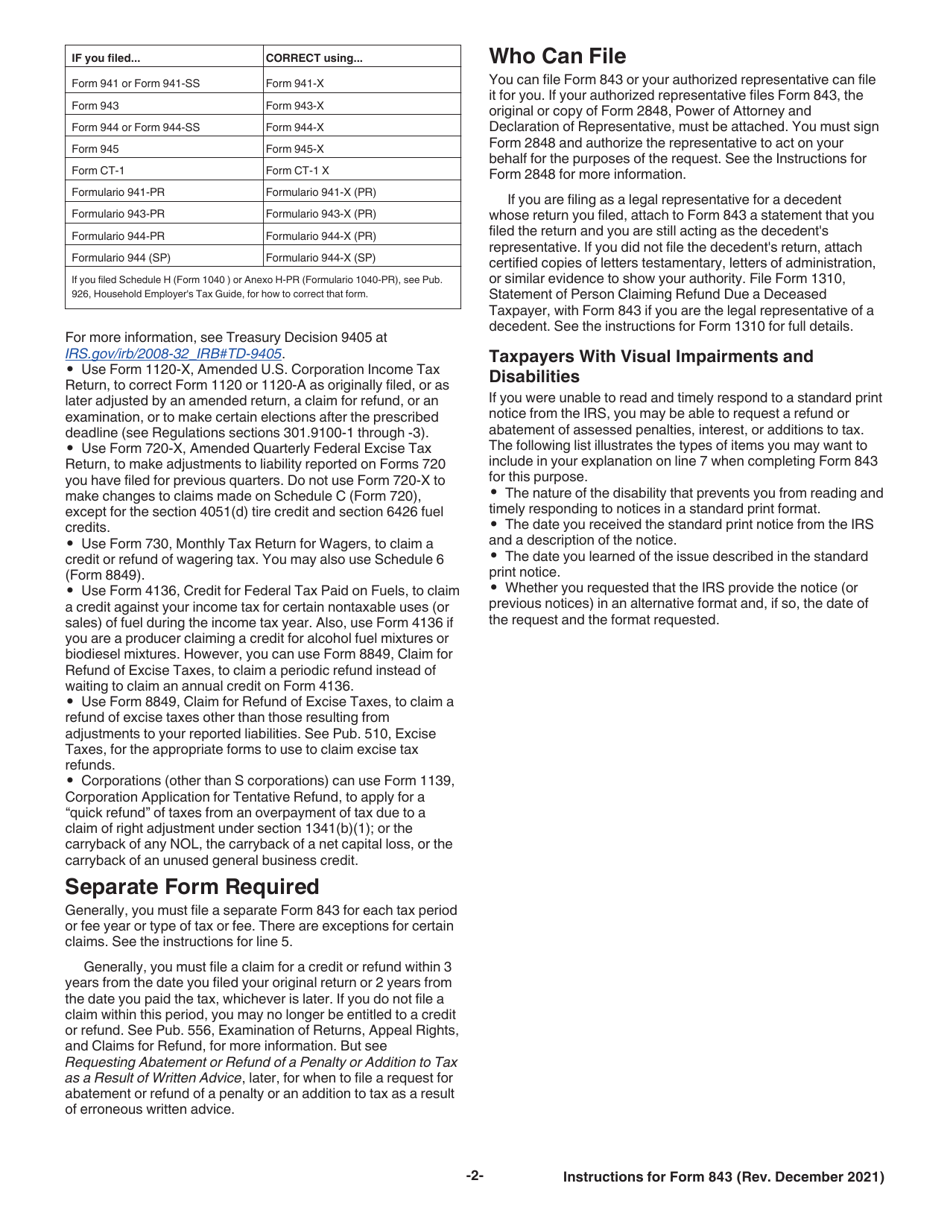

Download Instructions for IRS Form 843 Claim for Refund and Request for

I already sent by taxes into irs. Form 843 logistics my tax return (claiming refund) was rejected and i was assessed penalty charges for that. Instead complete form 843 to obtain your refund for the overpayment of your social security and medicare tax by the same/one. Is turbo tax able to fill out form 843, claim for refund and request.

Irs Form 843 Printable

Instead complete form 843 to obtain your refund for the overpayment of your social security and medicare tax by the same/one. Is turbo tax able to fill out form 843, claim for refund and request for abatement? I went to the local irs. Form 843 logistics my tax return (claiming refund) was rejected and i was assessed penalty charges for.

Download Instructions for IRS Form 843 Claim for Refund and Request for

Is turbo tax able to fill out form 843, claim for refund and request for abatement? Form 843 logistics my tax return (claiming refund) was rejected and i was assessed penalty charges for that. Simply multiply the amount in box 3 by a factor of 0.062 and enter that amount or 10,453.20 (whichever is less) in box 4. I already.

Requesting a Refund or Abatement from the IRS When Can You Use Form 843?

I already sent by taxes into irs. Form 843 logistics my tax return (claiming refund) was rejected and i was assessed penalty charges for that. Form 843 and your tax return will be processed separately and any refund from the form 843 will come as a separate check so waiting to. To get a refund for the extra. Is turbo.

IRS Form 843. Claim for Refund and Request for Abatement Forms Docs

To get a refund for the extra. I already sent by taxes into irs. Form 843 logistics my tax return (claiming refund) was rejected and i was assessed penalty charges for that. Is turbo tax able to fill out form 843, claim for refund and request for abatement? I went to the local irs.

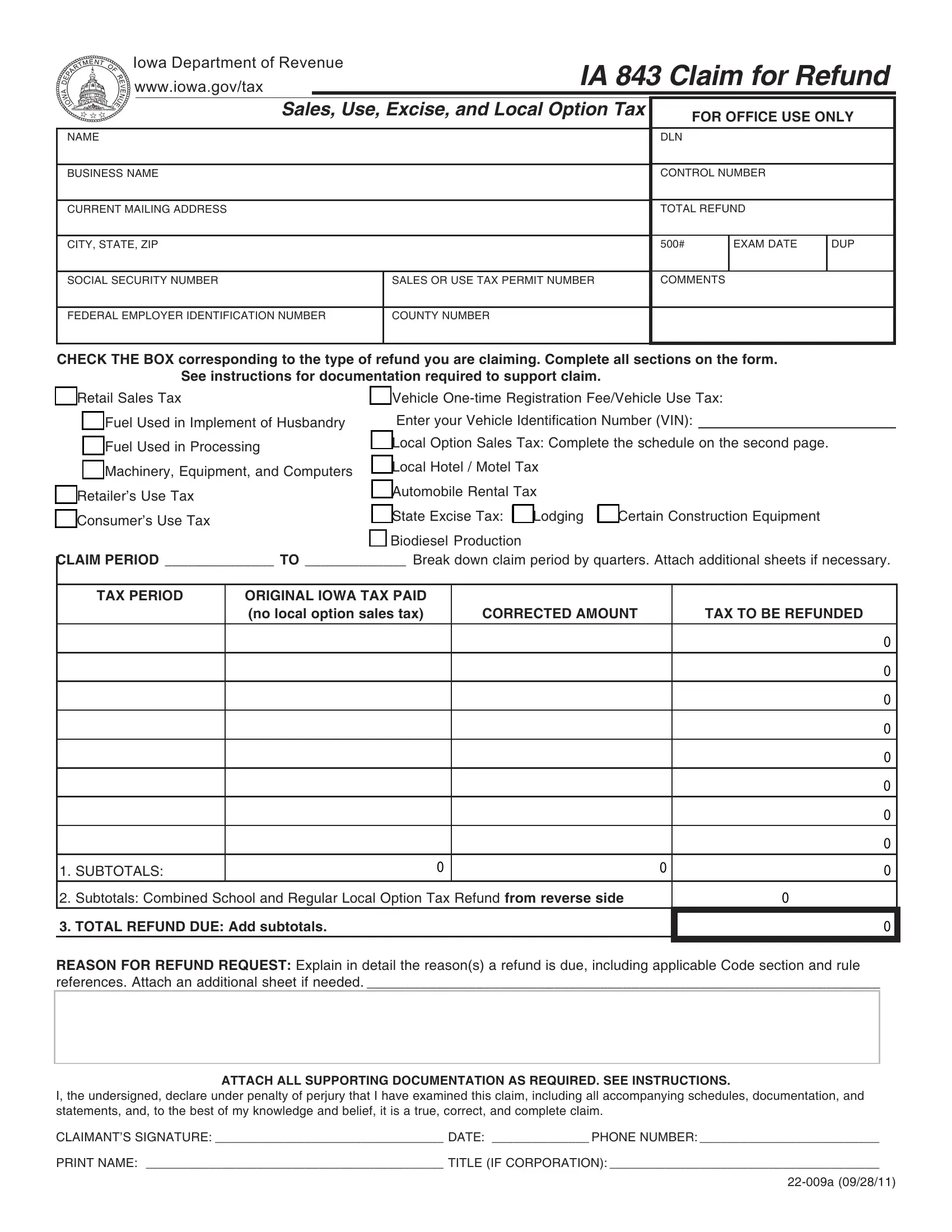

Ia 843 Form ≡ Fill Out Printable PDF Forms Online

Simply multiply the amount in box 3 by a factor of 0.062 and enter that amount or 10,453.20 (whichever is less) in box 4. Form 843 and your tax return will be processed separately and any refund from the form 843 will come as a separate check so waiting to. Instead complete form 843 to obtain your refund for the.

IRS Form 843 Instructions

I already sent by taxes into irs. Is turbo tax able to fill out form 843, claim for refund and request for abatement? Form 843 logistics my tax return (claiming refund) was rejected and i was assessed penalty charges for that. Simply multiply the amount in box 3 by a factor of 0.062 and enter that amount or 10,453.20 (whichever.

Form 843 IRS Claim For Refund And Request For Abatement

I went to the local irs. Form 843 logistics my tax return (claiming refund) was rejected and i was assessed penalty charges for that. Simply multiply the amount in box 3 by a factor of 0.062 and enter that amount or 10,453.20 (whichever is less) in box 4. To get a refund for the extra. Is turbo tax able to.

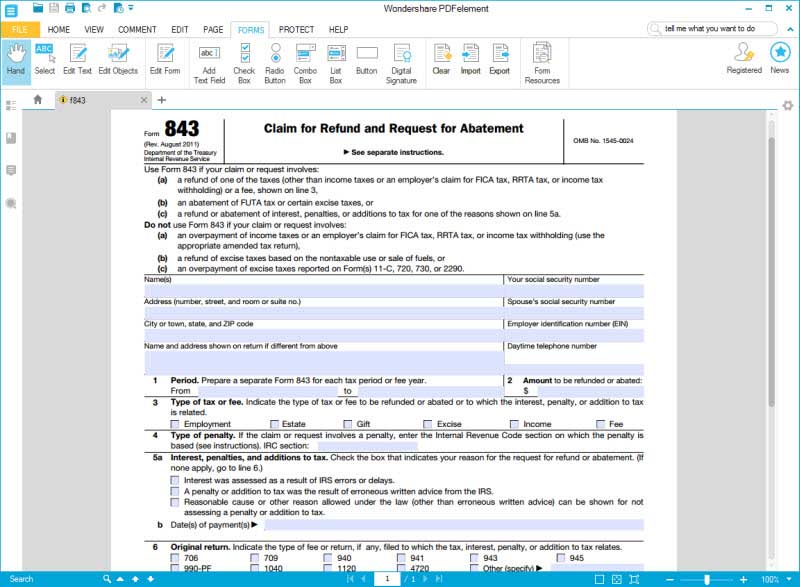

Form 843 Claim for Refund and Request for Abatement (2011) Free Download

Form 843 logistics my tax return (claiming refund) was rejected and i was assessed penalty charges for that. I went to the local irs. To get a refund for the extra. Simply multiply the amount in box 3 by a factor of 0.062 and enter that amount or 10,453.20 (whichever is less) in box 4. Form 843 and your tax.

Form 843 Logistics My Tax Return (Claiming Refund) Was Rejected And I Was Assessed Penalty Charges For That.

I went to the local irs. Is turbo tax able to fill out form 843, claim for refund and request for abatement? Form 843 and your tax return will be processed separately and any refund from the form 843 will come as a separate check so waiting to. I already sent by taxes into irs.

To Get A Refund For The Extra.

Simply multiply the amount in box 3 by a factor of 0.062 and enter that amount or 10,453.20 (whichever is less) in box 4. Instead complete form 843 to obtain your refund for the overpayment of your social security and medicare tax by the same/one.