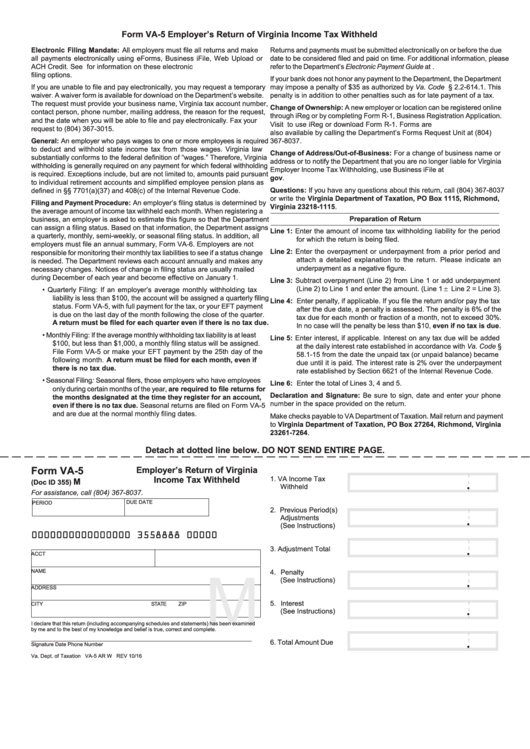

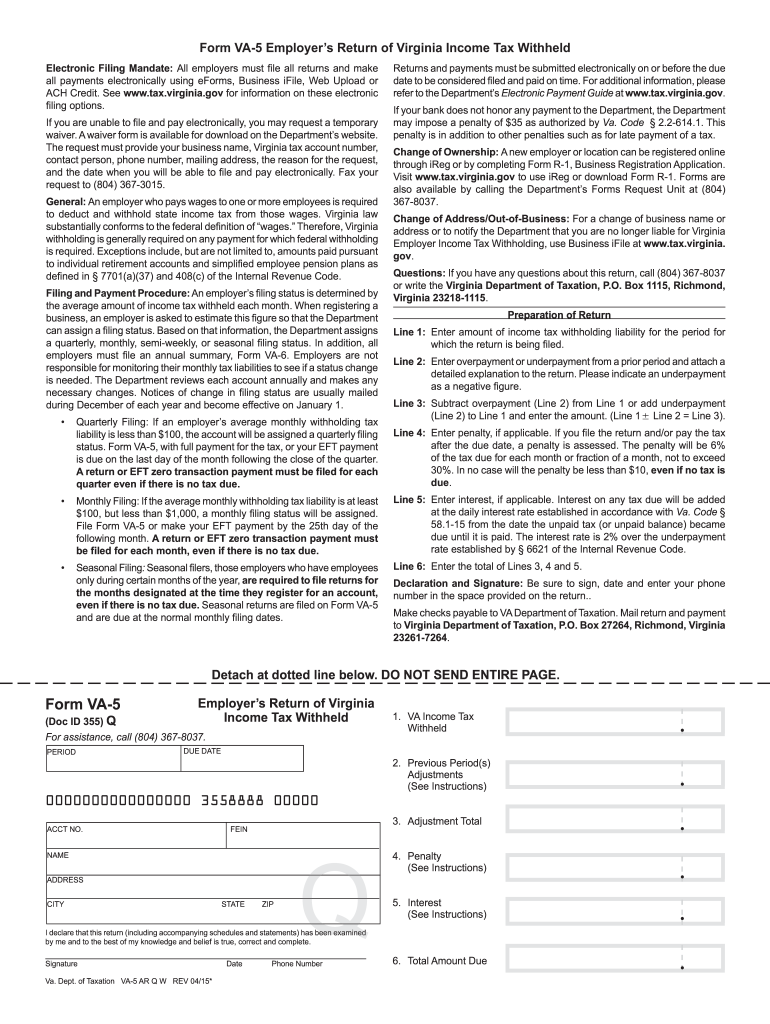

Va5 Form - The request must provide your business name, virginia tax account number, contact. Every virginia withholding tax filer is required to file all withholding tax returns and payments electronically. Form is available for download on the department’s website. An employer who pays wages to one or more employees is required to deduct. Federal banking regulations have imposed additional reporting requirements on all electronic banking transactions that directly involve a financial. Employer’s return of virginia income tax withheld instructions general:

Employer’s return of virginia income tax withheld instructions general: Form is available for download on the department’s website. Federal banking regulations have imposed additional reporting requirements on all electronic banking transactions that directly involve a financial. Every virginia withholding tax filer is required to file all withholding tax returns and payments electronically. An employer who pays wages to one or more employees is required to deduct. The request must provide your business name, virginia tax account number, contact.

Federal banking regulations have imposed additional reporting requirements on all electronic banking transactions that directly involve a financial. The request must provide your business name, virginia tax account number, contact. Every virginia withholding tax filer is required to file all withholding tax returns and payments electronically. An employer who pays wages to one or more employees is required to deduct. Form is available for download on the department’s website. Employer’s return of virginia income tax withheld instructions general:

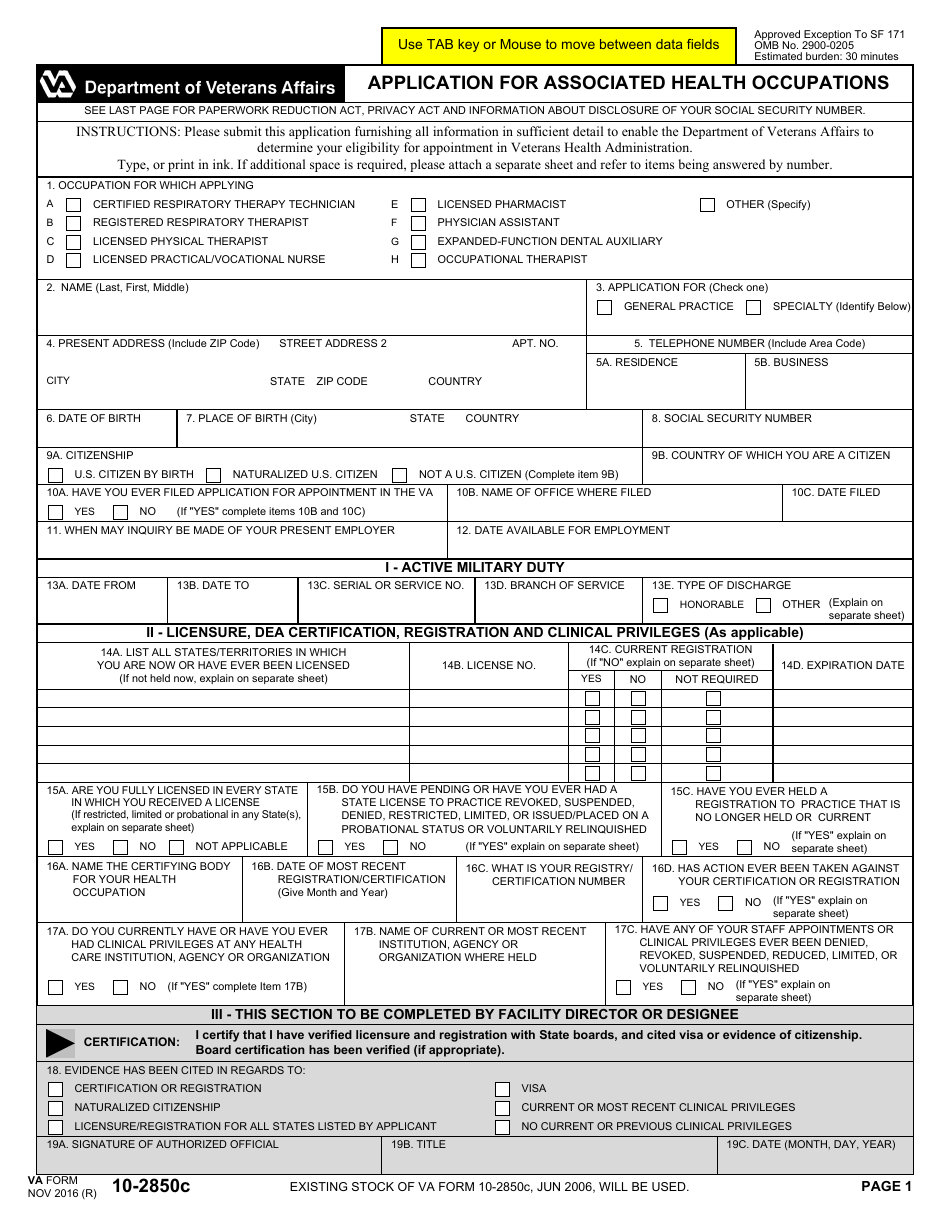

Fillable PDF Military Form Templates by PDF Guru.

The request must provide your business name, virginia tax account number, contact. Every virginia withholding tax filer is required to file all withholding tax returns and payments electronically. An employer who pays wages to one or more employees is required to deduct. Employer’s return of virginia income tax withheld instructions general: Federal banking regulations have imposed additional reporting requirements on.

Va form 4659 pdf Fill out & sign online DocHub

Every virginia withholding tax filer is required to file all withholding tax returns and payments electronically. Form is available for download on the department’s website. Federal banking regulations have imposed additional reporting requirements on all electronic banking transactions that directly involve a financial. The request must provide your business name, virginia tax account number, contact. Employer’s return of virginia income.

Fillable Form Va5 Employer'S Return Of Virginia Tax Withheld

Employer’s return of virginia income tax withheld instructions general: Federal banking regulations have imposed additional reporting requirements on all electronic banking transactions that directly involve a financial. Every virginia withholding tax filer is required to file all withholding tax returns and payments electronically. An employer who pays wages to one or more employees is required to deduct. Form is available.

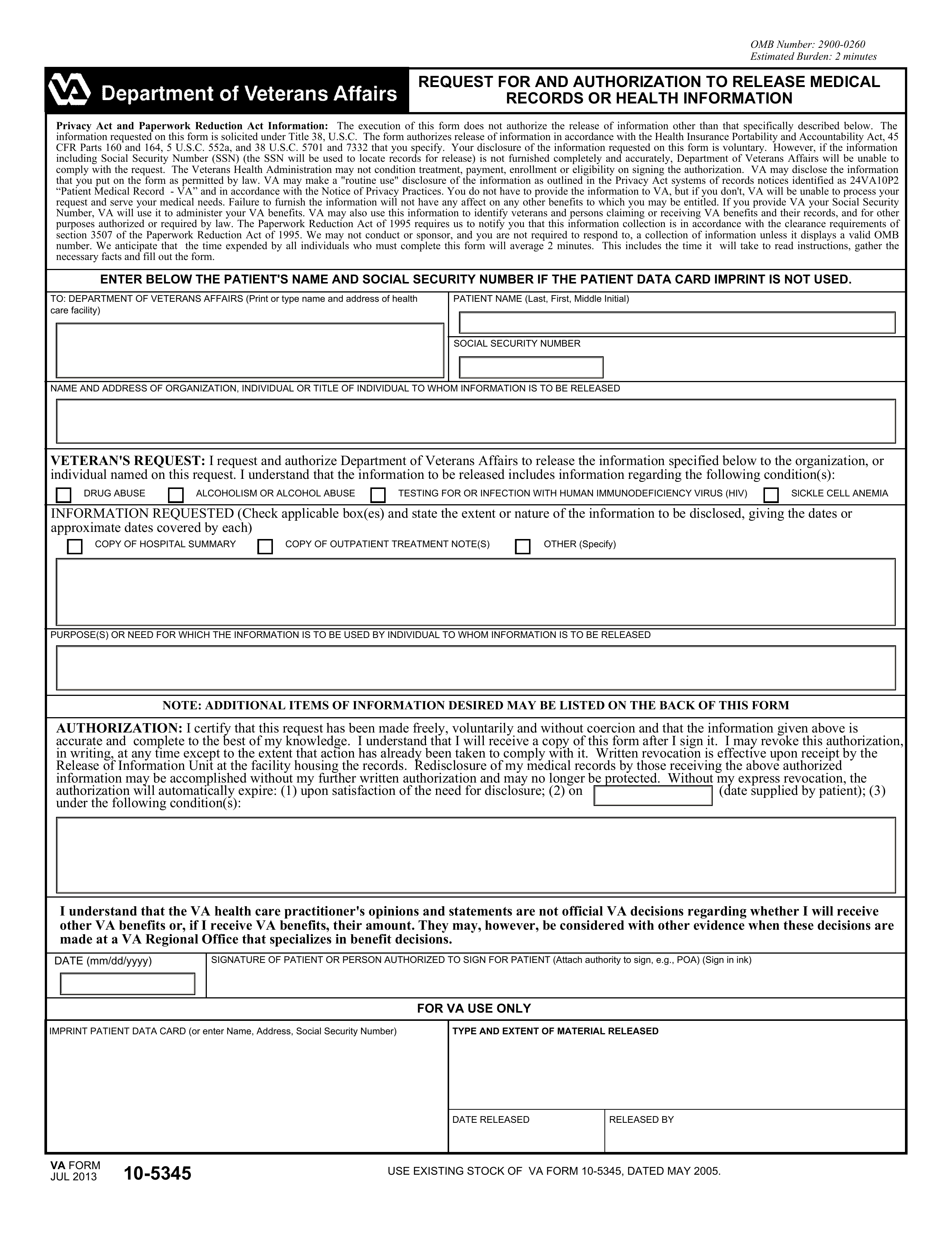

Free Veterans Affairs Request for and Authorization to Release Medical

The request must provide your business name, virginia tax account number, contact. Every virginia withholding tax filer is required to file all withholding tax returns and payments electronically. Form is available for download on the department’s website. Employer’s return of virginia income tax withheld instructions general: An employer who pays wages to one or more employees is required to deduct.

Virginia Health Form Fillable Online Printable Forms Free Online

Employer’s return of virginia income tax withheld instructions general: An employer who pays wages to one or more employees is required to deduct. The request must provide your business name, virginia tax account number, contact. Every virginia withholding tax filer is required to file all withholding tax returns and payments electronically. Form is available for download on the department’s website.

VA Intent to File Your Top 5 Questions Answered

Federal banking regulations have imposed additional reporting requirements on all electronic banking transactions that directly involve a financial. Employer’s return of virginia income tax withheld instructions general: The request must provide your business name, virginia tax account number, contact. An employer who pays wages to one or more employees is required to deduct. Form is available for download on the.

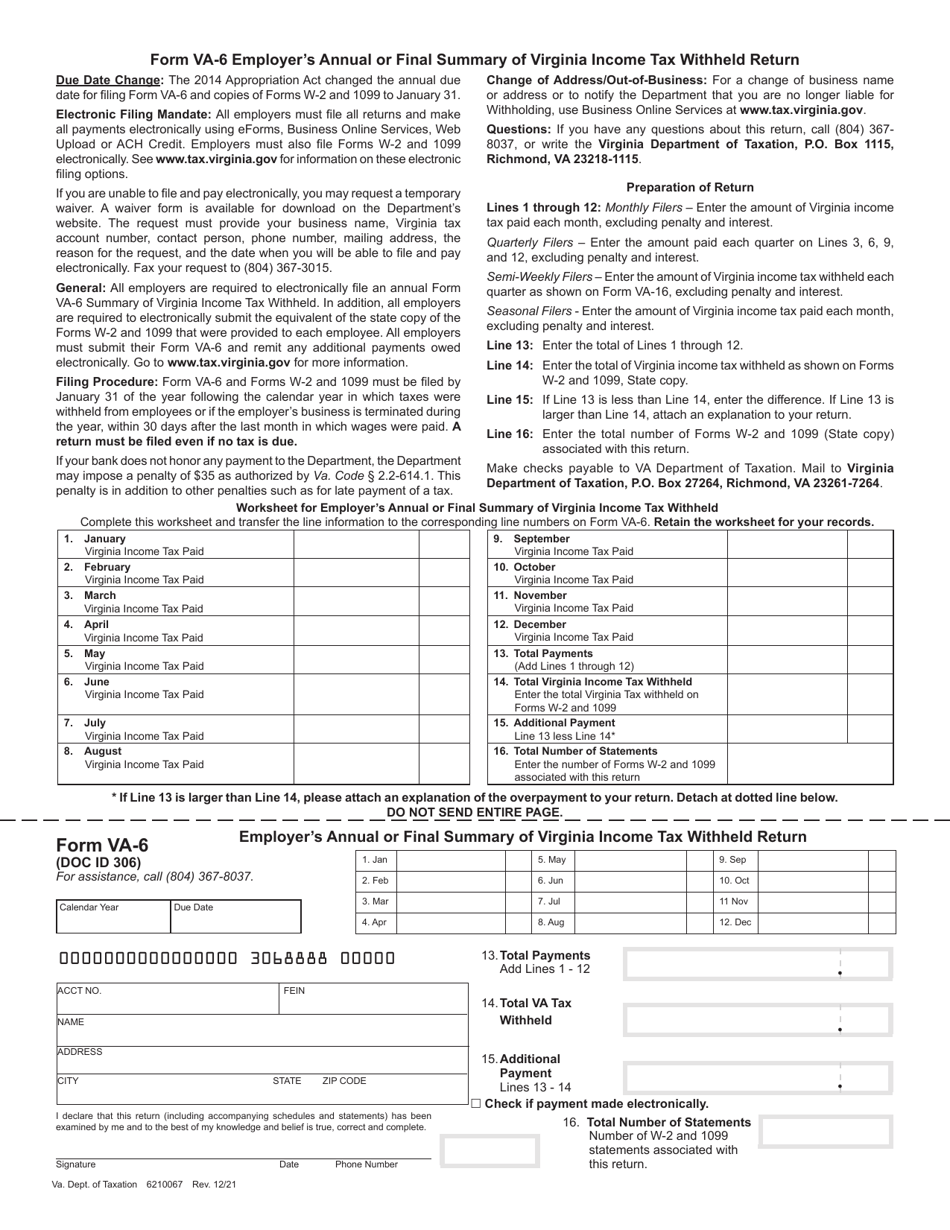

Form VA6 Download Fillable PDF or Fill Online Employer's Annual or

Federal banking regulations have imposed additional reporting requirements on all electronic banking transactions that directly involve a financial. Employer’s return of virginia income tax withheld instructions general: The request must provide your business name, virginia tax account number, contact. Every virginia withholding tax filer is required to file all withholding tax returns and payments electronically. Form is available for download.

Form va 5 Fill out & sign online DocHub

Federal banking regulations have imposed additional reporting requirements on all electronic banking transactions that directly involve a financial. The request must provide your business name, virginia tax account number, contact. Form is available for download on the department’s website. Every virginia withholding tax filer is required to file all withholding tax returns and payments electronically. Employer’s return of virginia income.

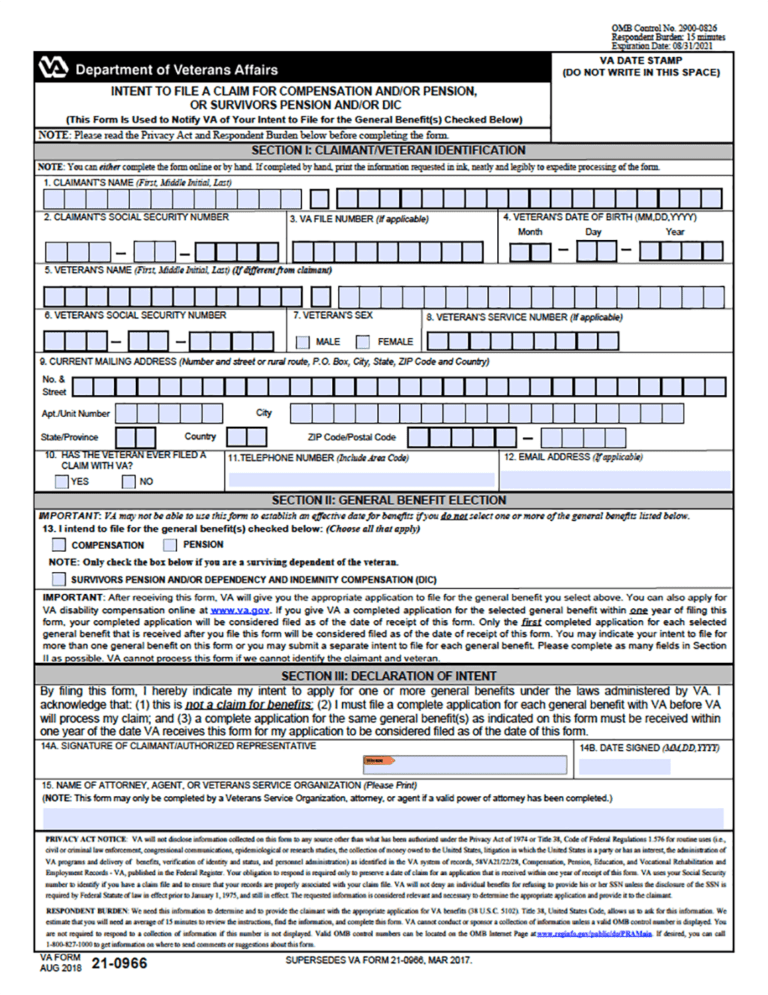

VA Form 21 0966 Printable VA Form

An employer who pays wages to one or more employees is required to deduct. Federal banking regulations have imposed additional reporting requirements on all electronic banking transactions that directly involve a financial. Every virginia withholding tax filer is required to file all withholding tax returns and payments electronically. The request must provide your business name, virginia tax account number, contact..

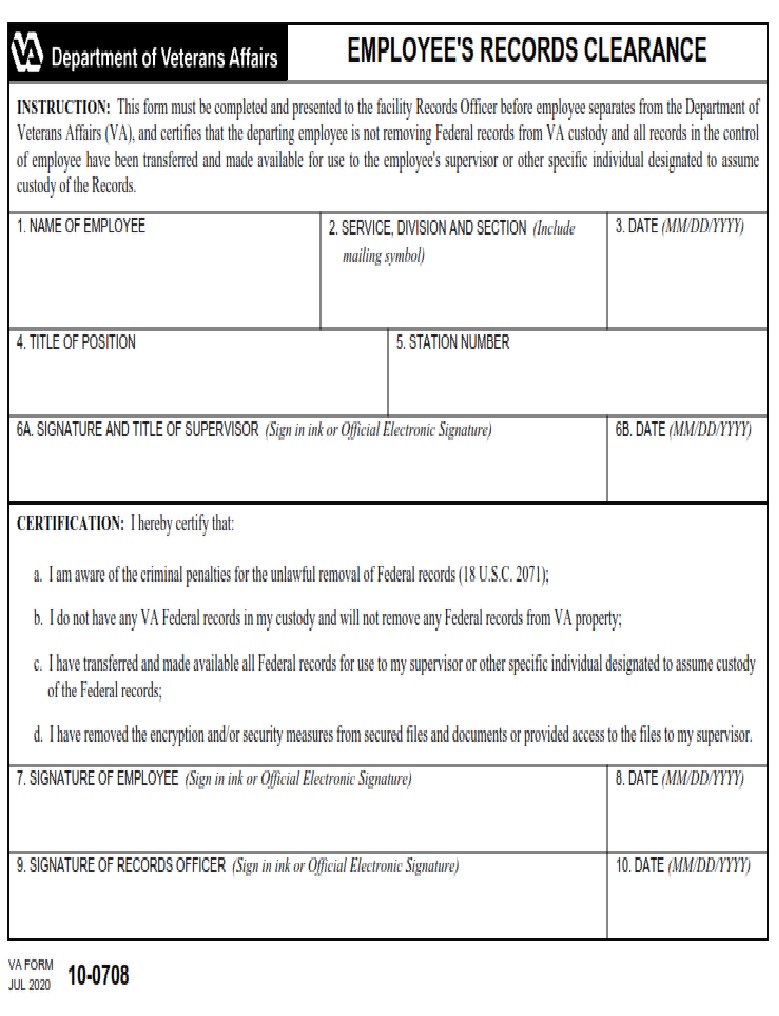

VA Form 100708 Employees Records Clearance VA Forms

Federal banking regulations have imposed additional reporting requirements on all electronic banking transactions that directly involve a financial. The request must provide your business name, virginia tax account number, contact. Every virginia withholding tax filer is required to file all withholding tax returns and payments electronically. Employer’s return of virginia income tax withheld instructions general: An employer who pays wages.

An Employer Who Pays Wages To One Or More Employees Is Required To Deduct.

Every virginia withholding tax filer is required to file all withholding tax returns and payments electronically. Form is available for download on the department’s website. The request must provide your business name, virginia tax account number, contact. Federal banking regulations have imposed additional reporting requirements on all electronic banking transactions that directly involve a financial.