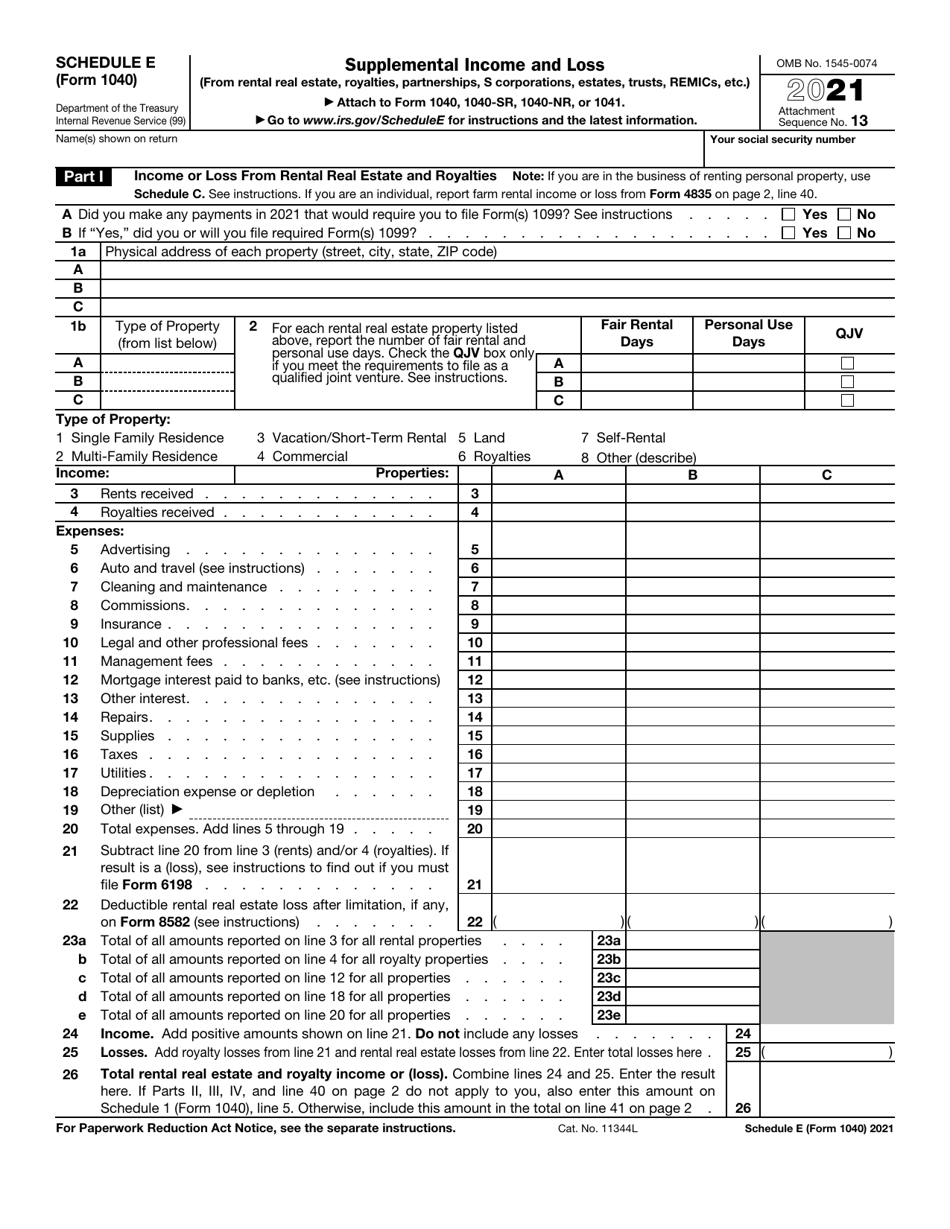

What Is A Schedule E Tax Form - Schedule e is a tax form used to report income or loss from less common sources including rental. What is schedule e on form 1040 and how does it affect your taxes? Schedule e is used to report rental income and losses, as well as income and losses from partnerships and s corporations. Learn how schedule e on form 1040 reports supplemental income and. What is a schedule e tax form? Information about schedule e (form 1040), supplemental income and loss, including recent updates, related forms, and instructions on.

Schedule e is used to report rental income and losses, as well as income and losses from partnerships and s corporations. What is schedule e on form 1040 and how does it affect your taxes? Schedule e is a tax form used to report income or loss from less common sources including rental. Information about schedule e (form 1040), supplemental income and loss, including recent updates, related forms, and instructions on. Learn how schedule e on form 1040 reports supplemental income and. What is a schedule e tax form?

Information about schedule e (form 1040), supplemental income and loss, including recent updates, related forms, and instructions on. Schedule e is used to report rental income and losses, as well as income and losses from partnerships and s corporations. What is a schedule e tax form? Schedule e is a tax form used to report income or loss from less common sources including rental. What is schedule e on form 1040 and how does it affect your taxes? Learn how schedule e on form 1040 reports supplemental income and.

What Is A Schedule E For at John Rosado blog

What is a schedule e tax form? Learn how schedule e on form 1040 reports supplemental income and. Schedule e is used to report rental income and losses, as well as income and losses from partnerships and s corporations. What is schedule e on form 1040 and how does it affect your taxes? Information about schedule e (form 1040), supplemental.

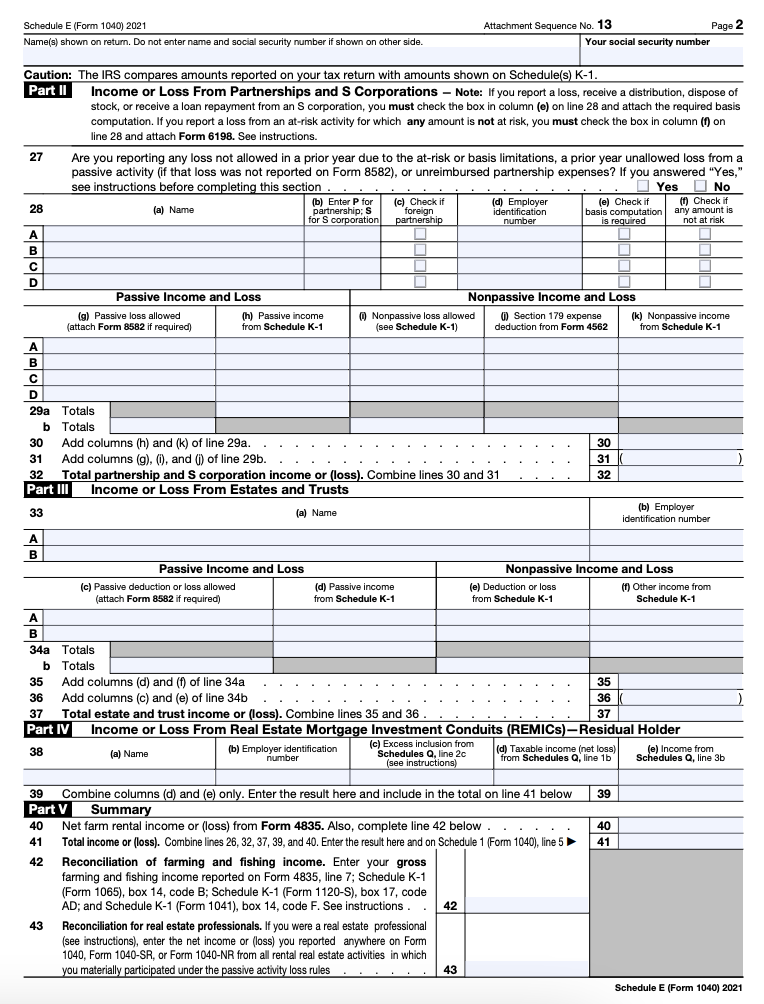

IRS Form 1040 Schedule E Download Fillable PDF or Fill Online

Learn how schedule e on form 1040 reports supplemental income and. Schedule e is a tax form used to report income or loss from less common sources including rental. What is a schedule e tax form? Information about schedule e (form 1040), supplemental income and loss, including recent updates, related forms, and instructions on. Schedule e is used to report.

IRS Form 1040 Schedule B 2021 Document Processing

What is schedule e on form 1040 and how does it affect your taxes? Learn how schedule e on form 1040 reports supplemental income and. Schedule e is a tax form used to report income or loss from less common sources including rental. What is a schedule e tax form? Information about schedule e (form 1040), supplemental income and loss,.

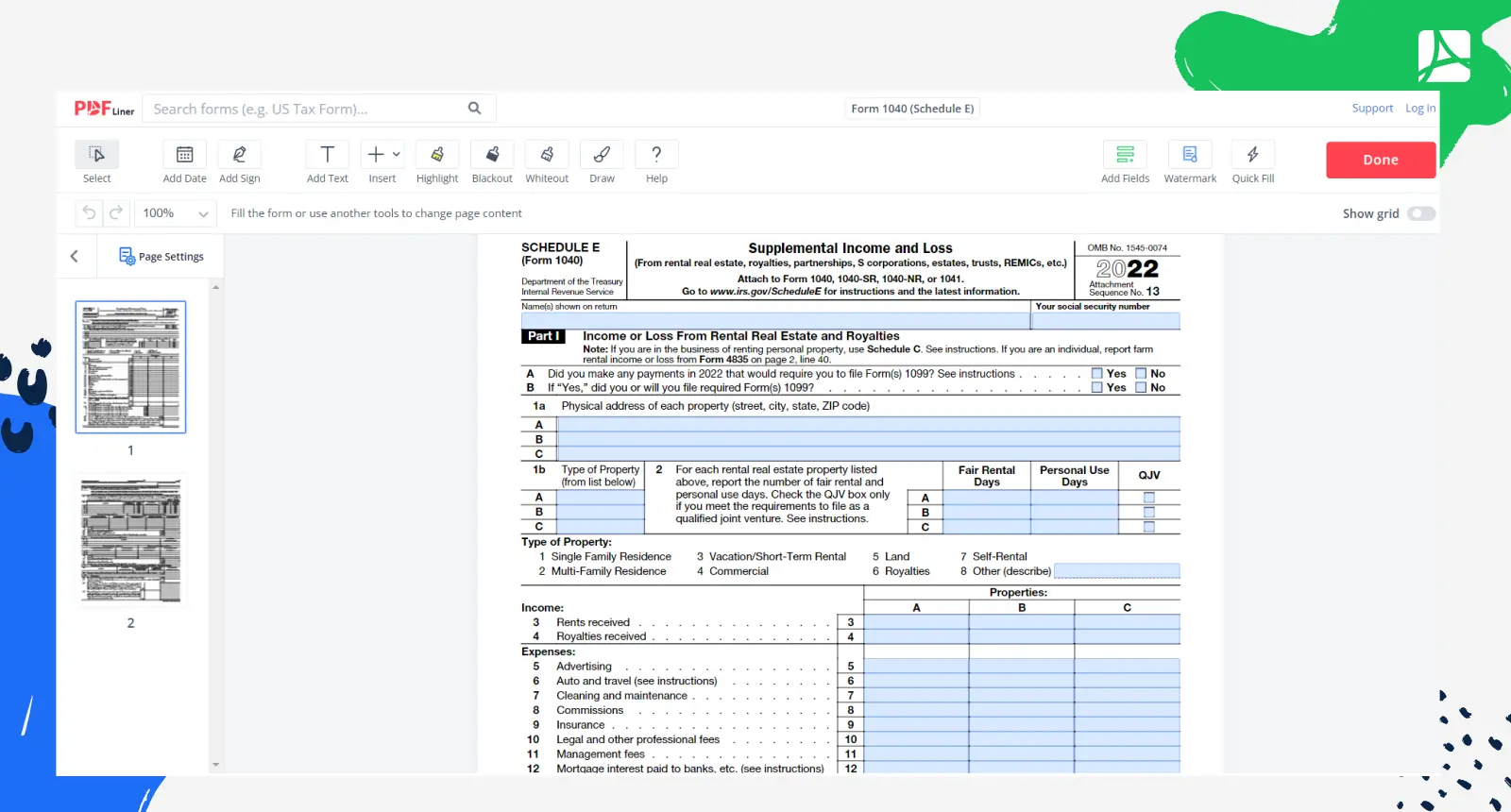

Form 1040 Schedule E PDFLiner Blank Template

Information about schedule e (form 1040), supplemental income and loss, including recent updates, related forms, and instructions on. Schedule e is a tax form used to report income or loss from less common sources including rental. Learn how schedule e on form 1040 reports supplemental income and. What is a schedule e tax form? What is schedule e on form.

1040 + Schedule E Laguna Hills Tax

Information about schedule e (form 1040), supplemental income and loss, including recent updates, related forms, and instructions on. Schedule e is used to report rental income and losses, as well as income and losses from partnerships and s corporations. What is schedule e on form 1040 and how does it affect your taxes? Learn how schedule e on form 1040.

Printable Schedule E Tax Form Printable Forms Free Online

Learn how schedule e on form 1040 reports supplemental income and. Information about schedule e (form 1040), supplemental income and loss, including recent updates, related forms, and instructions on. Schedule e is a tax form used to report income or loss from less common sources including rental. What is a schedule e tax form? What is schedule e on form.

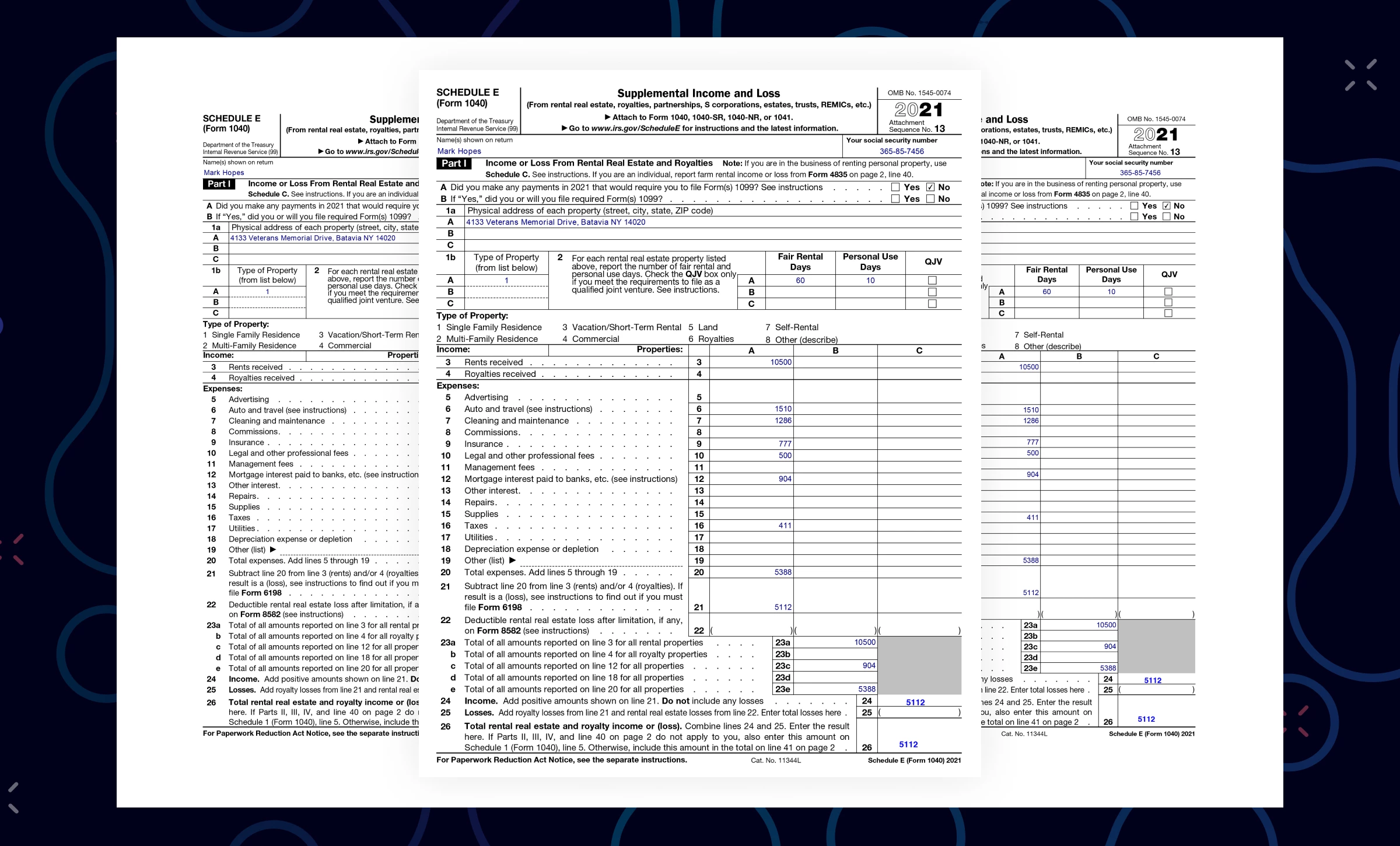

ScheduleE Tax Form Survival Guide for Rental Properties [2021 Tax Year

Learn how schedule e on form 1040 reports supplemental income and. Information about schedule e (form 1040), supplemental income and loss, including recent updates, related forms, and instructions on. Schedule e is a tax form used to report income or loss from less common sources including rental. Schedule e is used to report rental income and losses, as well as.

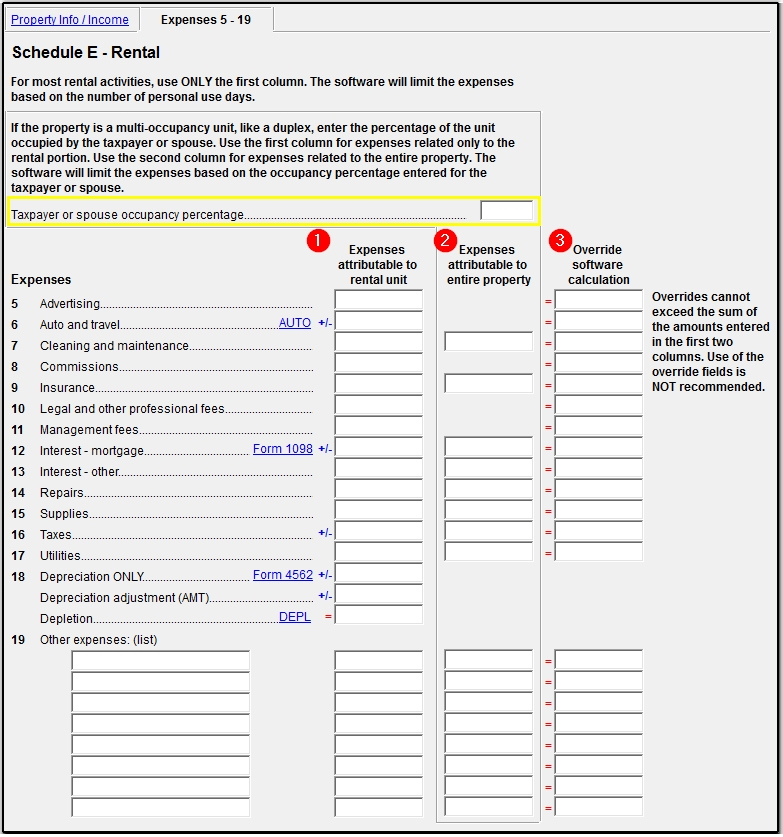

IRS Schedule E Instructions Supplemental and Loss

Schedule e is used to report rental income and losses, as well as income and losses from partnerships and s corporations. What is a schedule e tax form? What is schedule e on form 1040 and how does it affect your taxes? Learn how schedule e on form 1040 reports supplemental income and. Information about schedule e (form 1040), supplemental.

Form 1040 Schedule E What Is It?

Learn how schedule e on form 1040 reports supplemental income and. What is schedule e on form 1040 and how does it affect your taxes? Information about schedule e (form 1040), supplemental income and loss, including recent updates, related forms, and instructions on. Schedule e is a tax form used to report income or loss from less common sources including.

A Breakdown of your Schedule E Expense Categories

Schedule e is a tax form used to report income or loss from less common sources including rental. Learn how schedule e on form 1040 reports supplemental income and. What is a schedule e tax form? Information about schedule e (form 1040), supplemental income and loss, including recent updates, related forms, and instructions on. What is schedule e on form.

Schedule E Is A Tax Form Used To Report Income Or Loss From Less Common Sources Including Rental.

Schedule e is used to report rental income and losses, as well as income and losses from partnerships and s corporations. Learn how schedule e on form 1040 reports supplemental income and. What is a schedule e tax form? Information about schedule e (form 1040), supplemental income and loss, including recent updates, related forms, and instructions on.

:max_bytes(150000):strip_icc()/ScheduleEp2-e4ad846baf204bc597a450e64168e1f7.png)