What Is A Tax Form 5498 - Sign in or create an online account. Find the 2025 tax rates (for money you earn in 2025). File at an irs partner site with the irs free file program or use free file. Find irs forms and answers to tax questions. Review the amount you owe, balance for each tax year, payment history, tax records and more. We help you understand and meet your federal tax. Prepare and file your federal income tax return online for free. See current federal tax brackets and rates based on your income and filing status. Access irs forms, instructions and publications in electronic and print media.

Find the 2025 tax rates (for money you earn in 2025). Review the amount you owe, balance for each tax year, payment history, tax records and more. Find irs forms and answers to tax questions. File at an irs partner site with the irs free file program or use free file. Prepare and file your federal income tax return online for free. We help you understand and meet your federal tax. Access irs forms, instructions and publications in electronic and print media. Sign in or create an online account. See current federal tax brackets and rates based on your income and filing status.

Prepare and file your federal income tax return online for free. File at an irs partner site with the irs free file program or use free file. We help you understand and meet your federal tax. Sign in or create an online account. Review the amount you owe, balance for each tax year, payment history, tax records and more. Find the 2025 tax rates (for money you earn in 2025). Access irs forms, instructions and publications in electronic and print media. Find irs forms and answers to tax questions. See current federal tax brackets and rates based on your income and filing status.

Individual Retirement Account

Access irs forms, instructions and publications in electronic and print media. See current federal tax brackets and rates based on your income and filing status. File at an irs partner site with the irs free file program or use free file. We help you understand and meet your federal tax. Prepare and file your federal income tax return online for.

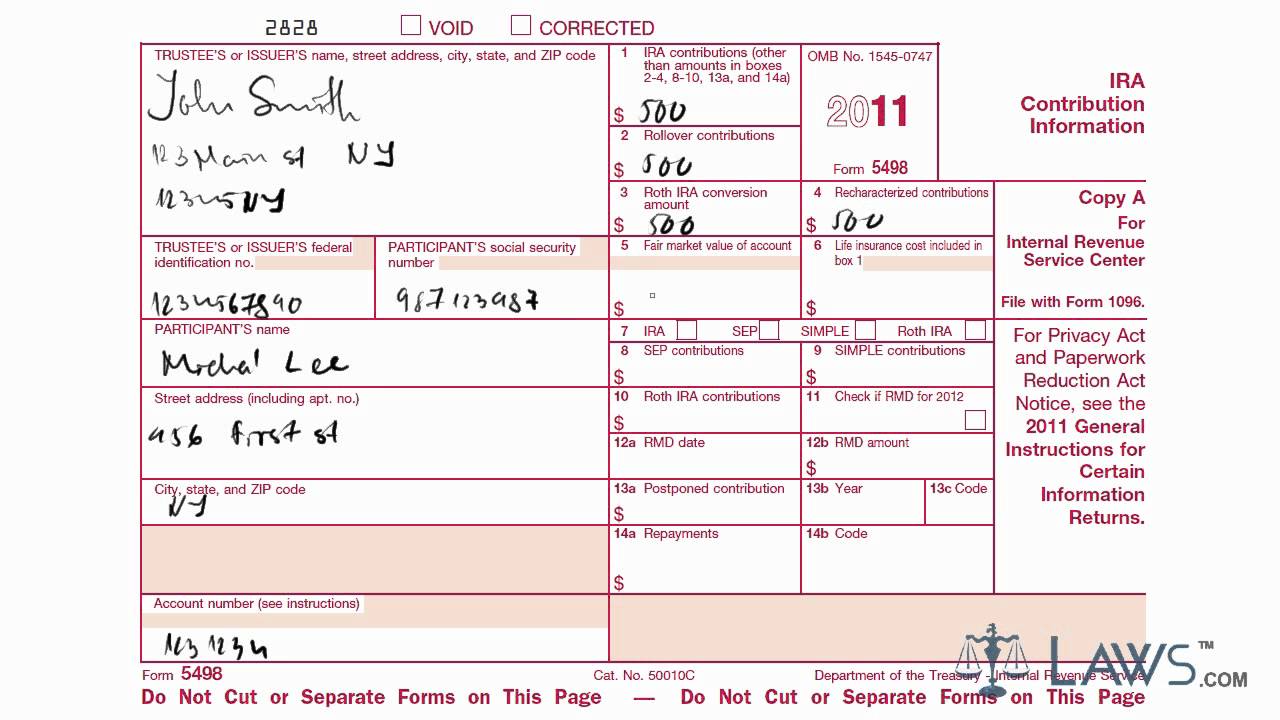

All About IRS Tax Form 5498 for 2020 IRA for individuals

Find the 2025 tax rates (for money you earn in 2025). File at an irs partner site with the irs free file program or use free file. See current federal tax brackets and rates based on your income and filing status. We help you understand and meet your federal tax. Access irs forms, instructions and publications in electronic and print.

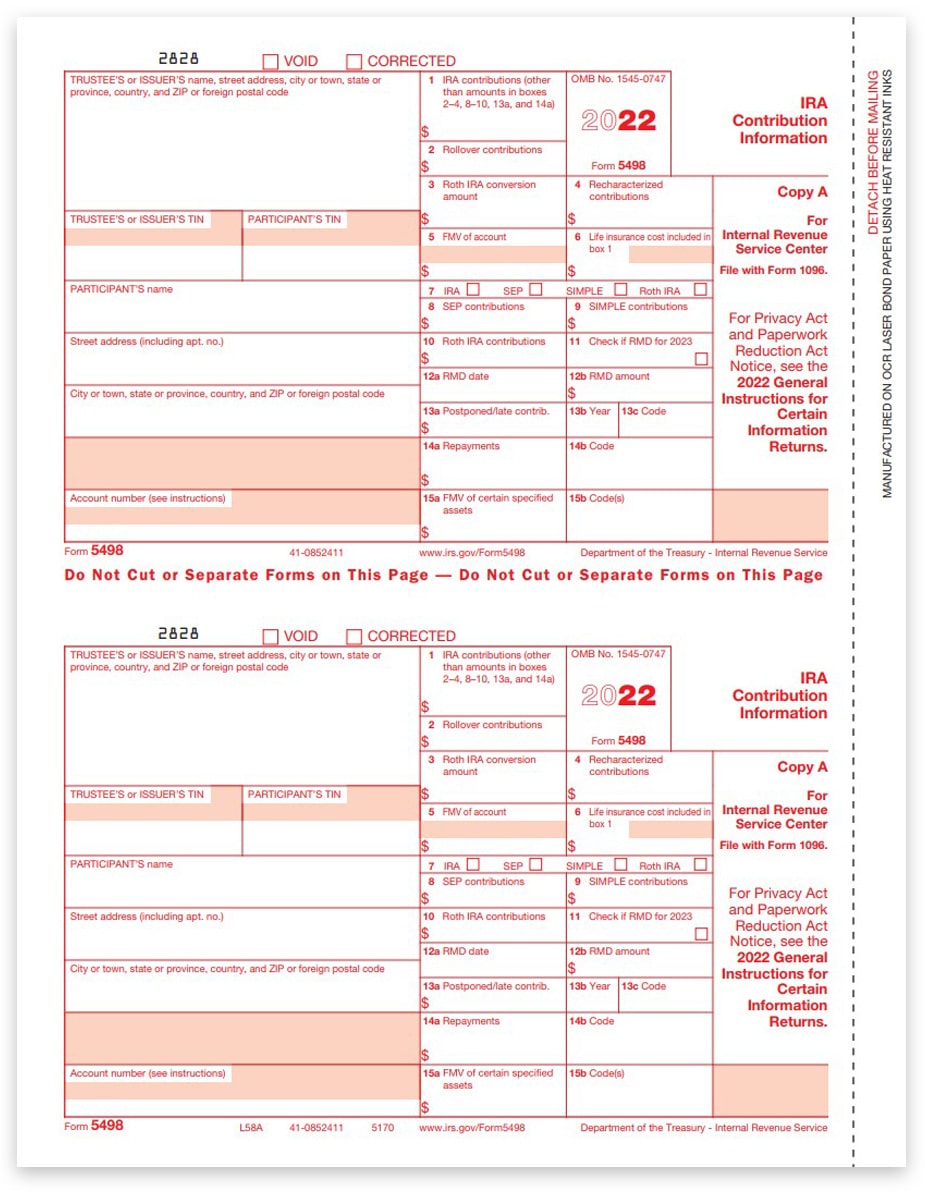

5498 Tax Forms for IRA Contributions, IRS Copy A

Find irs forms and answers to tax questions. See current federal tax brackets and rates based on your income and filing status. Review the amount you owe, balance for each tax year, payment history, tax records and more. Find the 2025 tax rates (for money you earn in 2025). Sign in or create an online account.

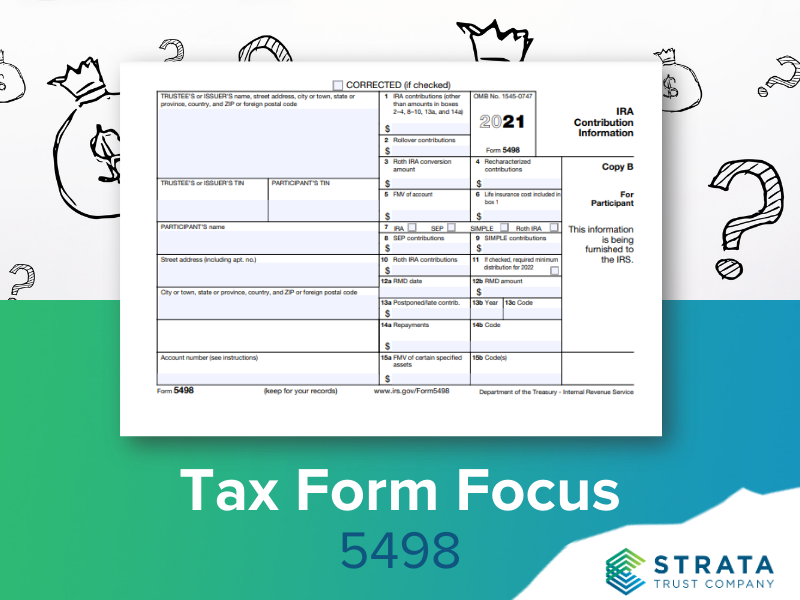

STRATA Trust Company SDIRA Services Alternative IRA Custodian

Prepare and file your federal income tax return online for free. We help you understand and meet your federal tax. File at an irs partner site with the irs free file program or use free file. Find irs forms and answers to tax questions. Sign in or create an online account.

IRS Form 5498 A Guide to IRA Contributions

Prepare and file your federal income tax return online for free. See current federal tax brackets and rates based on your income and filing status. Access irs forms, instructions and publications in electronic and print media. We help you understand and meet your federal tax. File at an irs partner site with the irs free file program or use free.

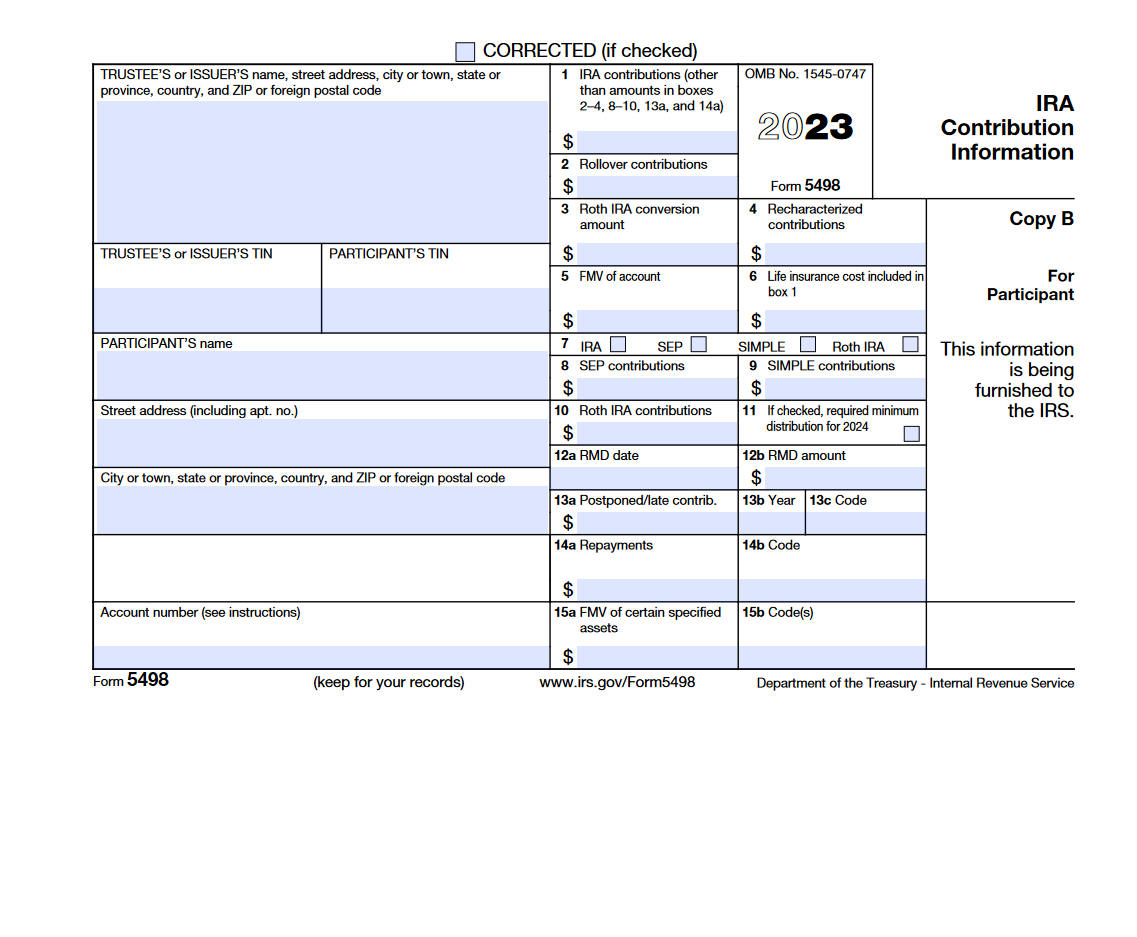

IRS Form 5498. IRA Contribution Information Forms Docs 2023

Find the 2025 tax rates (for money you earn in 2025). Prepare and file your federal income tax return online for free. Sign in or create an online account. Find irs forms and answers to tax questions. See current federal tax brackets and rates based on your income and filing status.

What is IRS Form 5498 IRA Contributions Information? Tax1099 Blog

Access irs forms, instructions and publications in electronic and print media. See current federal tax brackets and rates based on your income and filing status. Review the amount you owe, balance for each tax year, payment history, tax records and more. Prepare and file your federal income tax return online for free. Find irs forms and answers to tax questions.

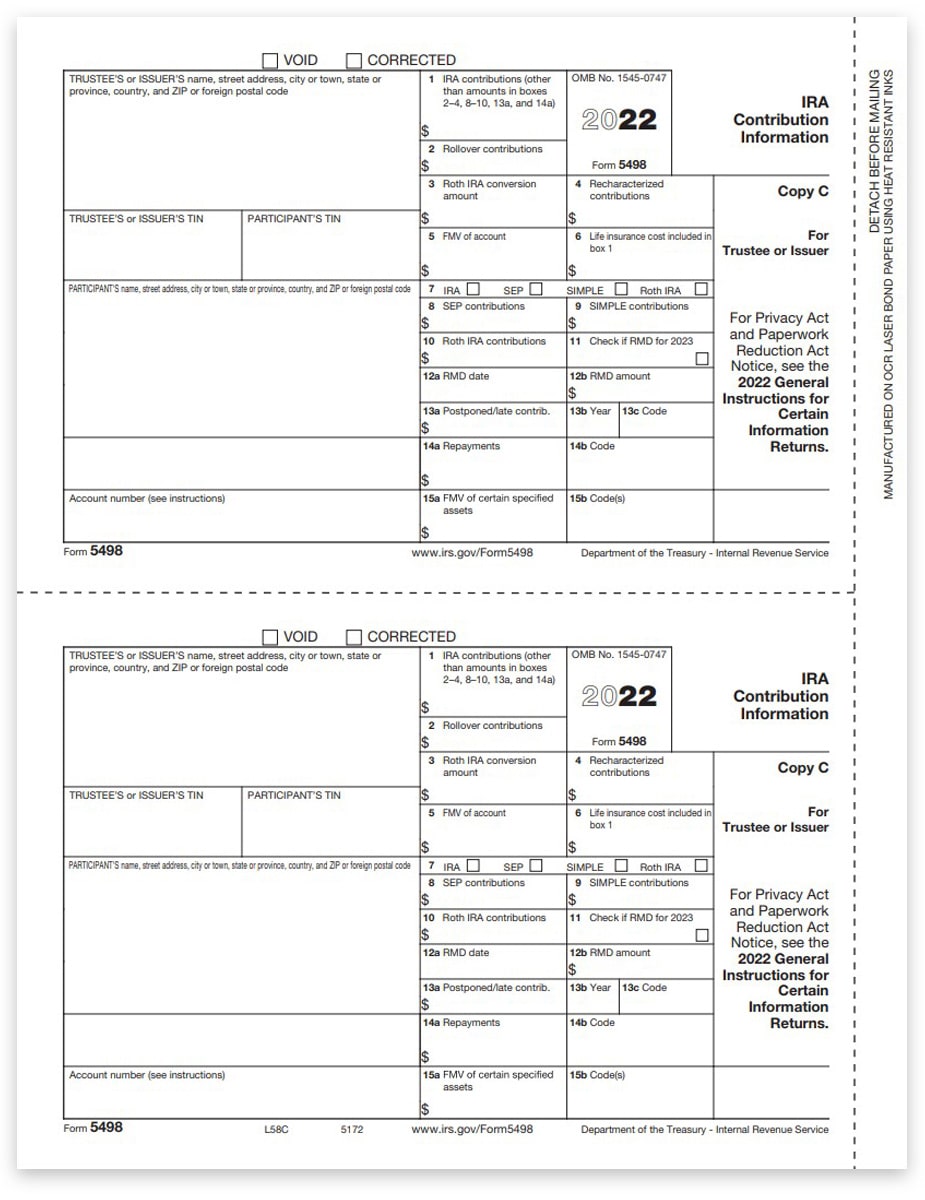

5498 Tax Forms for IRA Contributions, Issuer Copy C

Find the 2025 tax rates (for money you earn in 2025). We help you understand and meet your federal tax. File at an irs partner site with the irs free file program or use free file. See current federal tax brackets and rates based on your income and filing status. Review the amount you owe, balance for each tax year,.

The Purpose of IRS Form 5498

Find the 2025 tax rates (for money you earn in 2025). Review the amount you owe, balance for each tax year, payment history, tax records and more. Prepare and file your federal income tax return online for free. We help you understand and meet your federal tax. File at an irs partner site with the irs free file program or.

Demystifying IRS Form 5498 uDirect IRA Services, LLC

Sign in or create an online account. Review the amount you owe, balance for each tax year, payment history, tax records and more. Find irs forms and answers to tax questions. Find the 2025 tax rates (for money you earn in 2025). We help you understand and meet your federal tax.

Find The 2025 Tax Rates (For Money You Earn In 2025).

See current federal tax brackets and rates based on your income and filing status. Sign in or create an online account. File at an irs partner site with the irs free file program or use free file. Access irs forms, instructions and publications in electronic and print media.

We Help You Understand And Meet Your Federal Tax.

Review the amount you owe, balance for each tax year, payment history, tax records and more. Prepare and file your federal income tax return online for free. Find irs forms and answers to tax questions.

:max_bytes(150000):strip_icc()/ScreenShot2020-01-28at4.05.10PM-aaa74c7b441b4609ad379a16d4d624bf.png)