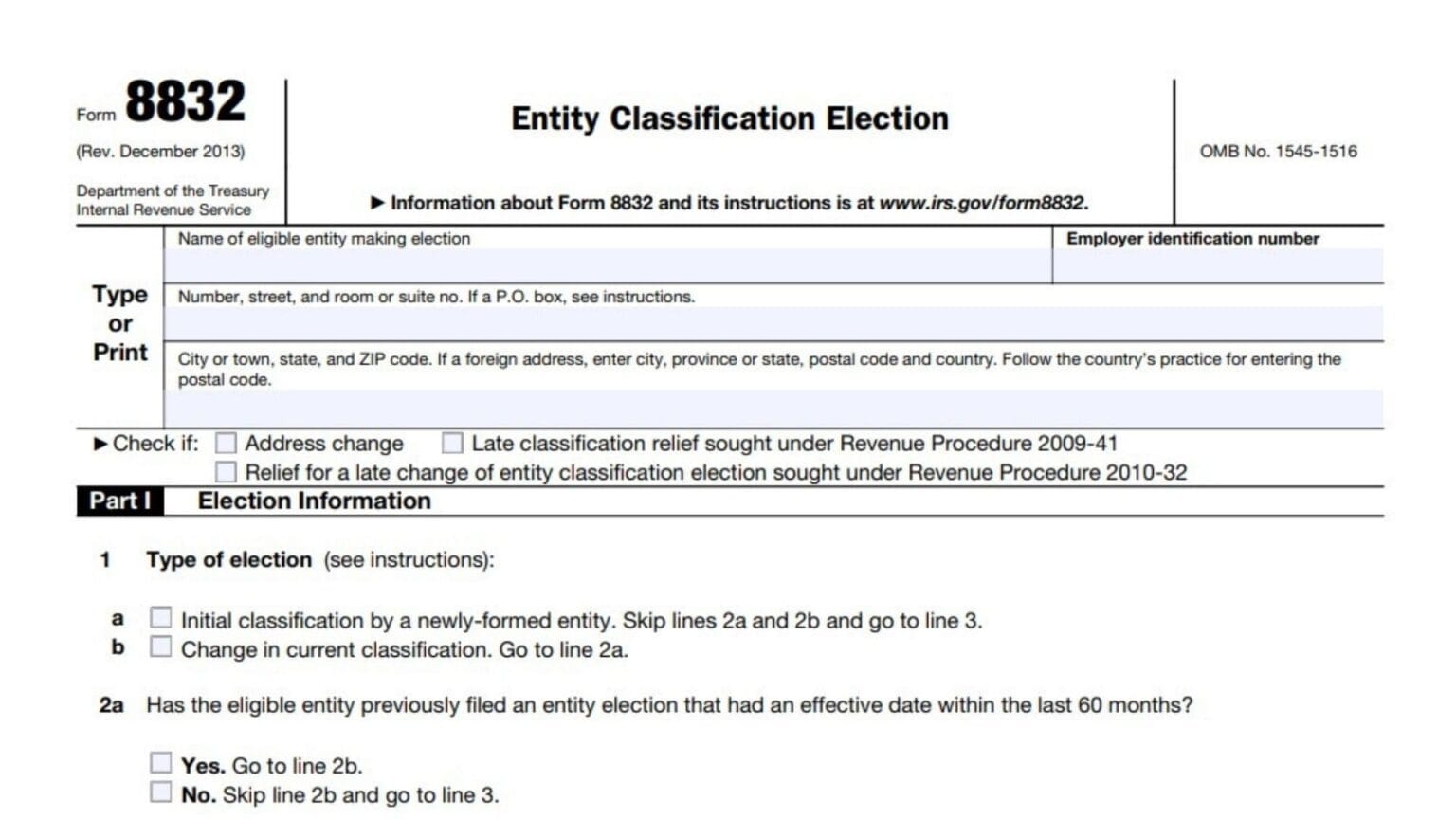

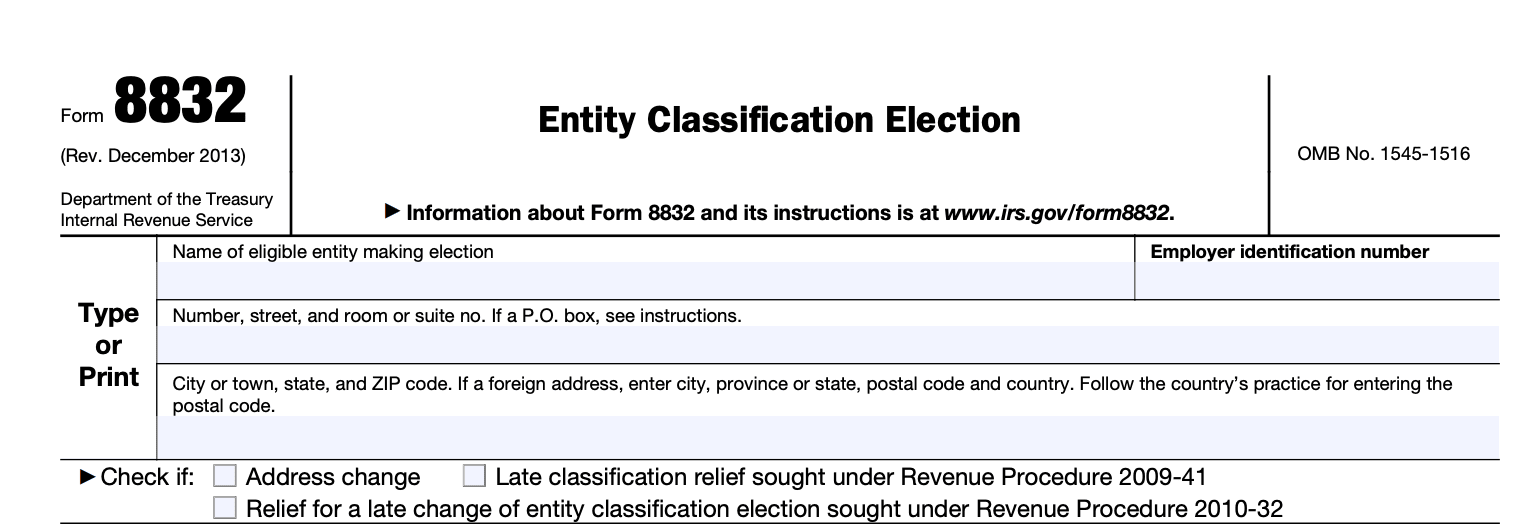

What Is Form 8832 - Irs form 8832, titled entity classification election, enables businesses—primarily limited. Eligible businesses use form 8832, entity classification election to declare themselves a corporation, partnership, or entity disregarded as. An eligible entity uses this form to elect how it will be classified for federal tax purposes, as: What is irs form 8832, and who should file it? Information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. This guide explains how us and foreign entities are. A corporation, a partnership, or an entity disregarded. Wondering what irs form 8832 is and whether it applies to your business?

Eligible businesses use form 8832, entity classification election to declare themselves a corporation, partnership, or entity disregarded as. An eligible entity uses this form to elect how it will be classified for federal tax purposes, as: Wondering what irs form 8832 is and whether it applies to your business? What is irs form 8832, and who should file it? Irs form 8832, titled entity classification election, enables businesses—primarily limited. A corporation, a partnership, or an entity disregarded. This guide explains how us and foreign entities are. Information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file.

What is irs form 8832, and who should file it? Eligible businesses use form 8832, entity classification election to declare themselves a corporation, partnership, or entity disregarded as. Wondering what irs form 8832 is and whether it applies to your business? An eligible entity uses this form to elect how it will be classified for federal tax purposes, as: A corporation, a partnership, or an entity disregarded. Information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. This guide explains how us and foreign entities are. Irs form 8832, titled entity classification election, enables businesses—primarily limited.

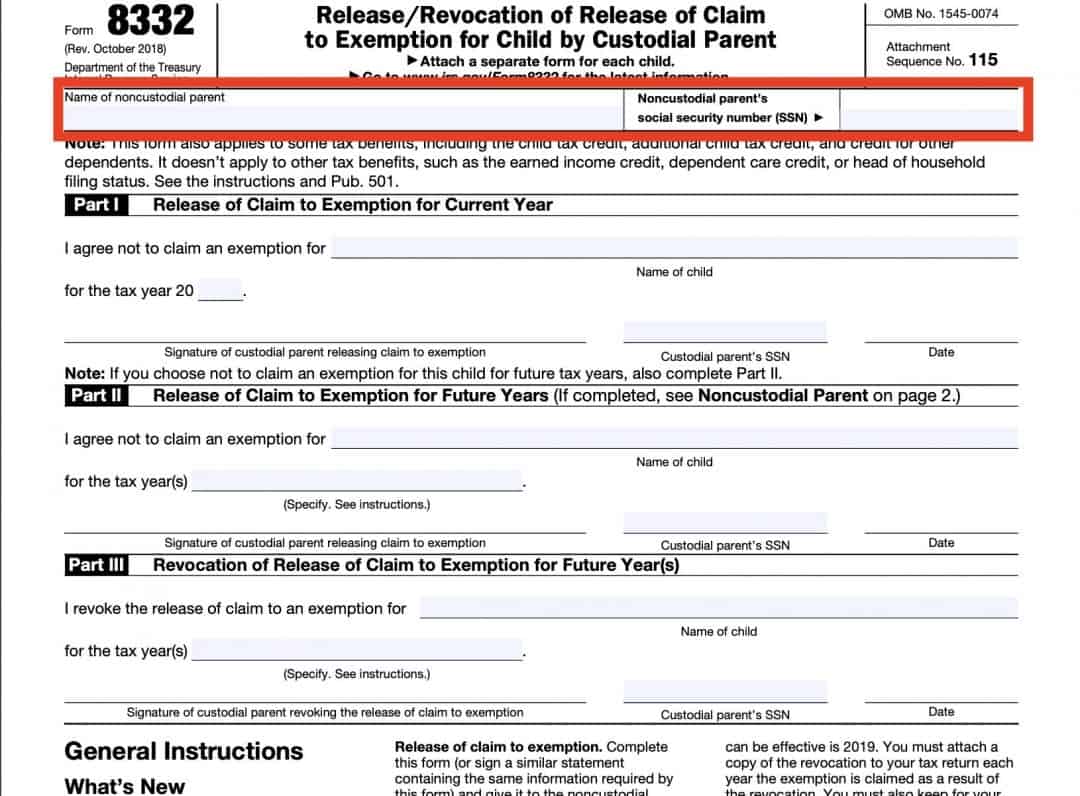

IRS Form 8332 A Guide for Custodial Parents

Wondering what irs form 8832 is and whether it applies to your business? Eligible businesses use form 8832, entity classification election to declare themselves a corporation, partnership, or entity disregarded as. This guide explains how us and foreign entities are. What is irs form 8832, and who should file it? A corporation, a partnership, or an entity disregarded.

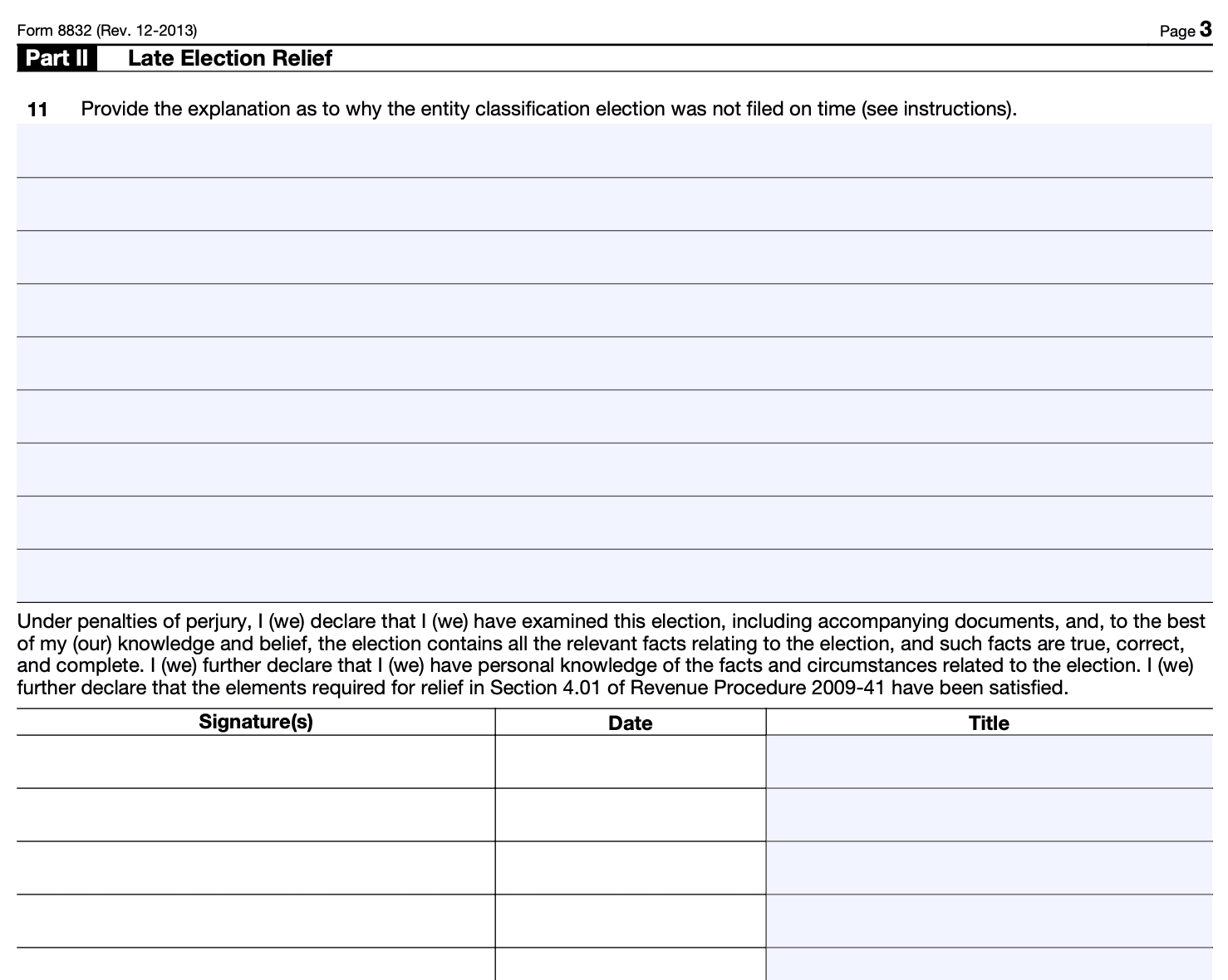

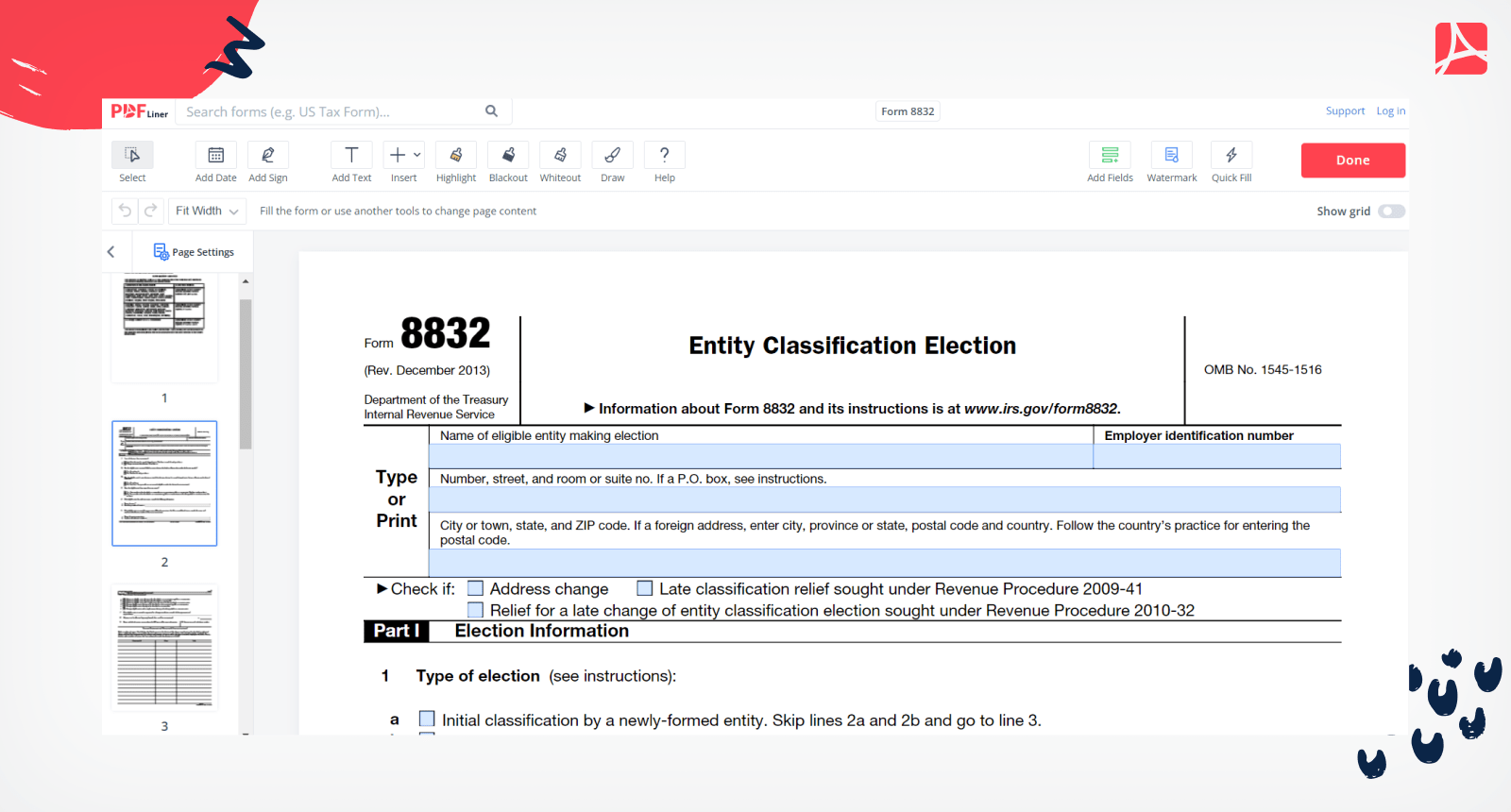

Form 8832 Instructions 2024 2025

Eligible businesses use form 8832, entity classification election to declare themselves a corporation, partnership, or entity disregarded as. This guide explains how us and foreign entities are. Irs form 8832, titled entity classification election, enables businesses—primarily limited. What is irs form 8832, and who should file it? An eligible entity uses this form to elect how it will be classified.

Electing C Corporation Tax Treatment for an LLC with IRS Form 8832

Eligible businesses use form 8832, entity classification election to declare themselves a corporation, partnership, or entity disregarded as. What is irs form 8832, and who should file it? Information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. Wondering what irs form 8832 is and whether it applies to your business? An.

Form 8832 Entity Classification Election

An eligible entity uses this form to elect how it will be classified for federal tax purposes, as: This guide explains how us and foreign entities are. What is irs form 8832, and who should file it? Information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. A corporation, a partnership, or.

IRS Form 8832 How to Fill it Right

An eligible entity uses this form to elect how it will be classified for federal tax purposes, as: This guide explains how us and foreign entities are. A corporation, a partnership, or an entity disregarded. Eligible businesses use form 8832, entity classification election to declare themselves a corporation, partnership, or entity disregarded as. What is irs form 8832, and who.

Form 8832 Entity Classification Election

Wondering what irs form 8832 is and whether it applies to your business? Irs form 8832, titled entity classification election, enables businesses—primarily limited. What is irs form 8832, and who should file it? Eligible businesses use form 8832, entity classification election to declare themselves a corporation, partnership, or entity disregarded as. Information about form 8832, entity classification election, including recent.

Understanding Form 8832 Entity Classification Election

Eligible businesses use form 8832, entity classification election to declare themselves a corporation, partnership, or entity disregarded as. An eligible entity uses this form to elect how it will be classified for federal tax purposes, as: This guide explains how us and foreign entities are. What is irs form 8832, and who should file it? A corporation, a partnership, or.

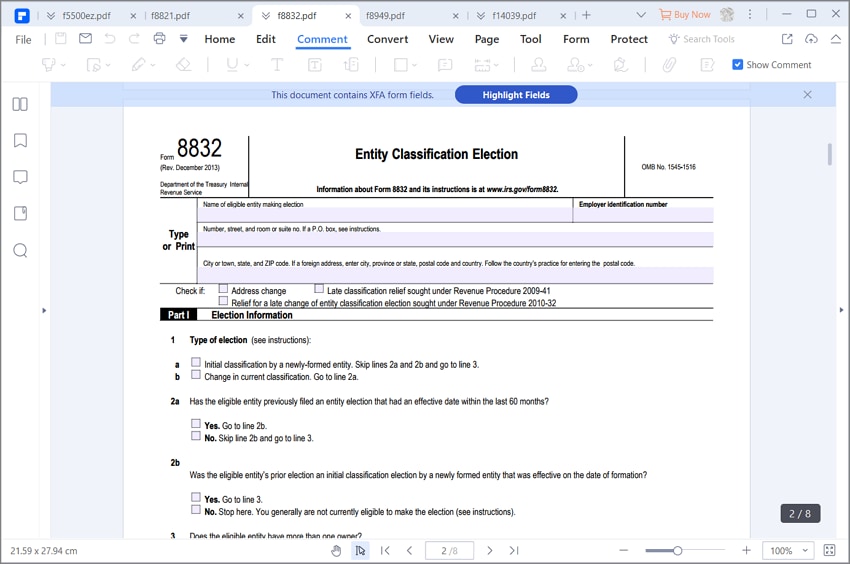

Form 8832 Fillable and Printable blank PDFline

Wondering what irs form 8832 is and whether it applies to your business? What is irs form 8832, and who should file it? Information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. A corporation, a partnership, or an entity disregarded. An eligible entity uses this form to elect how it will.

Irs Form 8832 Fillable Printable Forms Free Online

This guide explains how us and foreign entities are. Irs form 8832, titled entity classification election, enables businesses—primarily limited. Eligible businesses use form 8832, entity classification election to declare themselves a corporation, partnership, or entity disregarded as. Wondering what irs form 8832 is and whether it applies to your business? A corporation, a partnership, or an entity disregarded.

Form 8832 Instruction 2025 2026

Irs form 8832, titled entity classification election, enables businesses—primarily limited. Information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. Wondering what irs form 8832 is and whether it applies to your business? What is irs form 8832, and who should file it? An eligible entity uses this form to elect how.

Wondering What Irs Form 8832 Is And Whether It Applies To Your Business?

Eligible businesses use form 8832, entity classification election to declare themselves a corporation, partnership, or entity disregarded as. Irs form 8832, titled entity classification election, enables businesses—primarily limited. An eligible entity uses this form to elect how it will be classified for federal tax purposes, as: What is irs form 8832, and who should file it?

A Corporation, A Partnership, Or An Entity Disregarded.

This guide explains how us and foreign entities are. Information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file.